Ethereum

Identifying how ETH can outshine BTC in 2025

Credit : ambcrypto.com

ETH surpasses BTC

An in-depth evaluation by AMBCrypto discovered that the share of ETH holders who stored their property for greater than a 12 months elevated from 59% in January 2024 to 75% in December 2024, in response to InTheBlok information.

This was in stark distinction to Bitcoin, the place the share of long-term holders fell from 70% to 62.3% over the identical interval.

Supply: IntoTheBlock

The rising retention price for Ethereum indicated larger confidence amongst buyers, pushed by expectations of future community upgrades and broader usability.

In the meantime, the decline within the variety of long-term Bitcoin holders could replicate profit-taking or diversification methods, signaling a possible shift in market sentiment as buyers prioritize ETH heading into 2025.

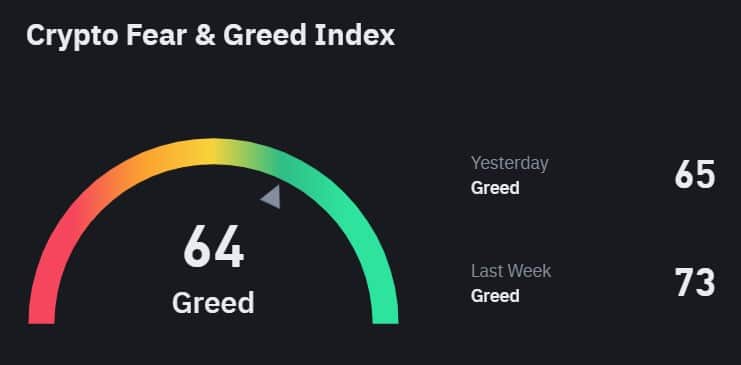

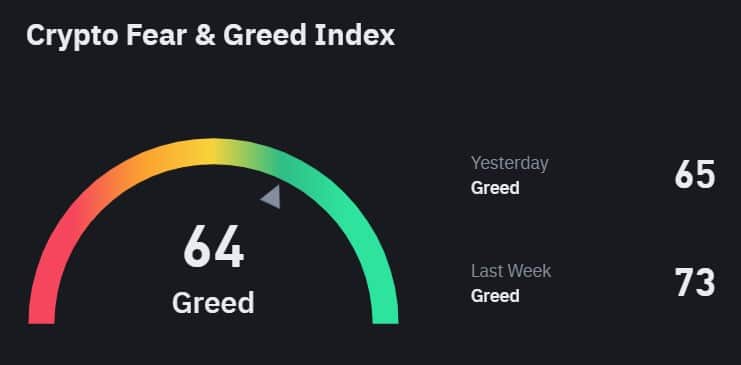

The Worry and Greed Index falls to a two-month low

Notably, dropping HODLers was not the one drawback the king coin confronted. The Crypto Worry and Greed Index fell to 64 on December 31, the bottom degree since October 15.

This decline mirrored declining market optimism as Bitcoin plunged greater than 12% over the previous two weeks to commerce close to $93,000.

Supply: Binance Sq.

After peaking at 94 in November – pushed by pleasure surrounding the pro-crypto election ends in the US, the index remained above 70 for a lot of December earlier than the latest pullback. The decline marked a shift from excessive greed to extra cautious sentiment amongst buyers.

Whereas greed nonetheless dominated, the decline highlighted issues about short-term market volatility as merchants reacted to Bitcoin’s worth actions and the combined indicators from the broader market.

Learn Ethereum [ETH] Worth forecast 2025-2026

BTC in an accumulation section?

Regardless of the dip, investor James Williams believes Bitcoin is getting into an important accumulation section. In his newest X-post (previously Twitter), Williams described present situations as a chance for long-term positioning.

Williams predicted a interval of consolidation within the coming weeks, doubtlessly setting the stage for a big breakout. Williams is assured in Bitcoin’s long-term trajectory and views the present worth motion as a part of a pure market cycle. He predicts a worth of $131,500 or larger within the first quarter of 2025, calling such ranges “inevitable.”

He emphasised that being affected person in periods of consolidation typically rewards buyers, as such phases have traditionally preceded substantial upward strikes in Bitcoin’s worth.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024