Ethereum

Institution offloads $23.5 mln of Ethereum, But bullish signs persist

Credit : ambcrypto.com

- Hong Kong-based Metalpha has transferred greater than 33,589 ETH price $77.55 million to Binance up to now 4 days.

- Primarily based on the historic value momentum, there’s a good probability that ETH may rise 23% to the $2,700 stage.

Regardless of the continued market restoration, it seems that Ethereum [ETH] is prepared for a major value drop. Presently, each traders and establishments are bearish as they proceed to dump ETH on exchanges.

Institutional promoting frenzy

On September 10, evaluation firm on the chain Look at chain famous on X (previously Twitter) that Metalpha, a Hong Kong asset administration large, had dumped 10,000 Ether price $23.45 million to Binance [BNB].

The corporate has transferred greater than 33,589 ETH price $77.55 million to Binance up to now 4 days.

However regardless of the notable dump, the asset supervisor nonetheless held a major 51,300 ETH price $120 million on the time of writing.

Are whales transferring away from ETH?

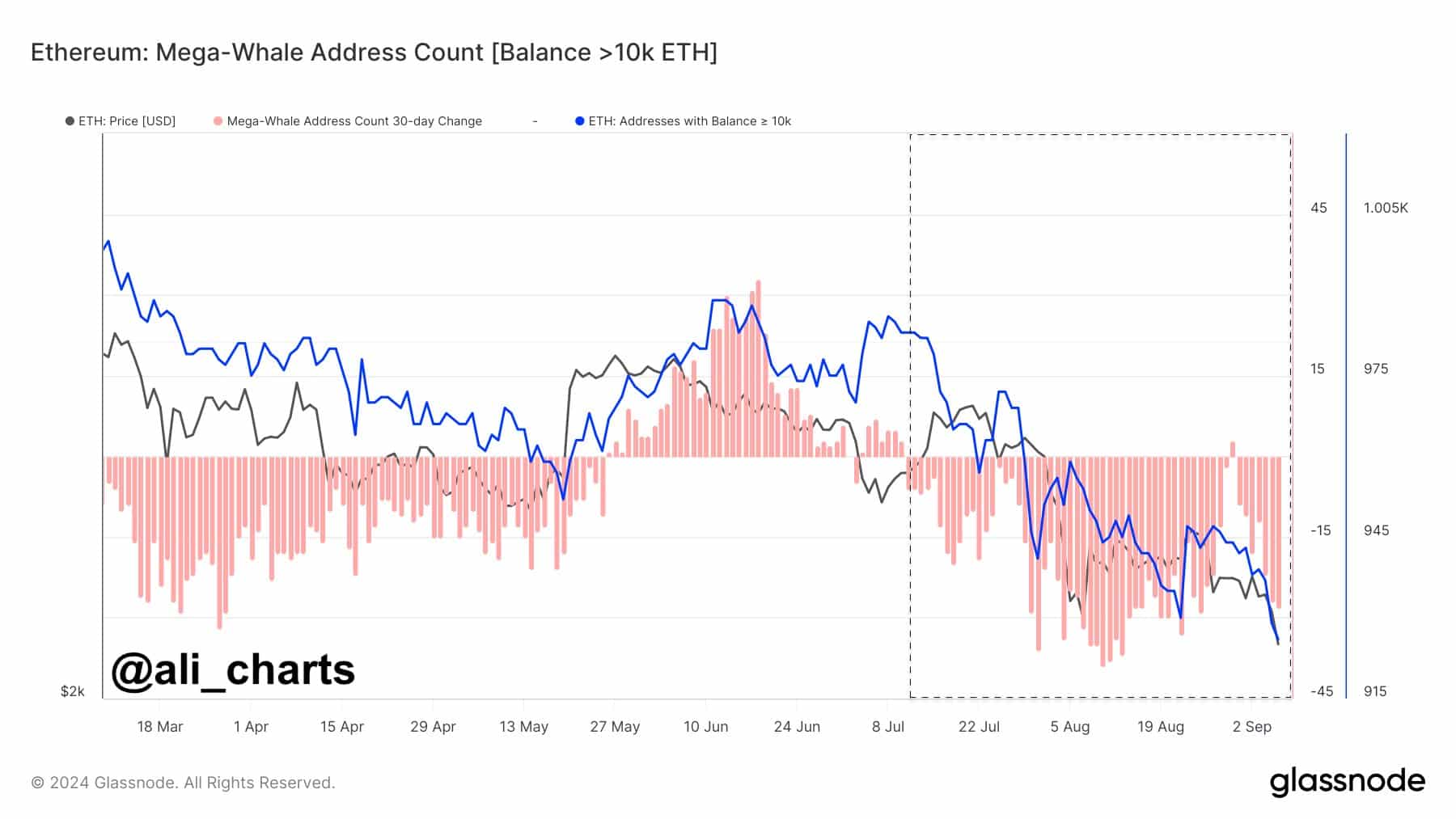

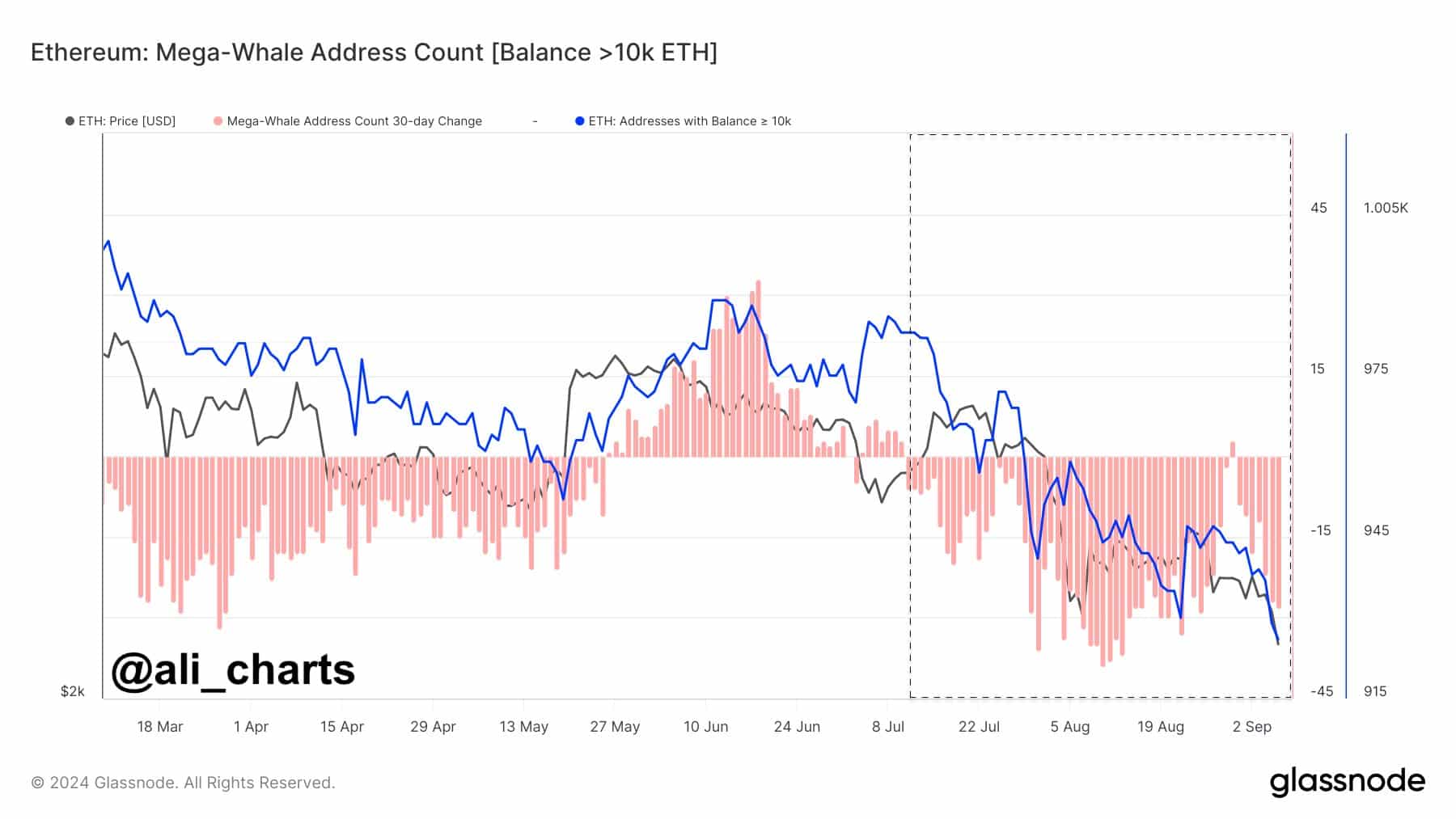

Just lately, a outstanding crypto professional posted on X stating that Ethereum whales have stopped accumulating ETH since early July. As a substitute, they bought or redistributed their ETH holdings.

This means an absence of curiosity from traders and whales in current weeks.

Supply:

Nonetheless, if whales and establishments proceed with important ETH dumps, there’s a good probability that it could lead on to an enormous sell-off within the coming days.

Vital ranges to concentrate to

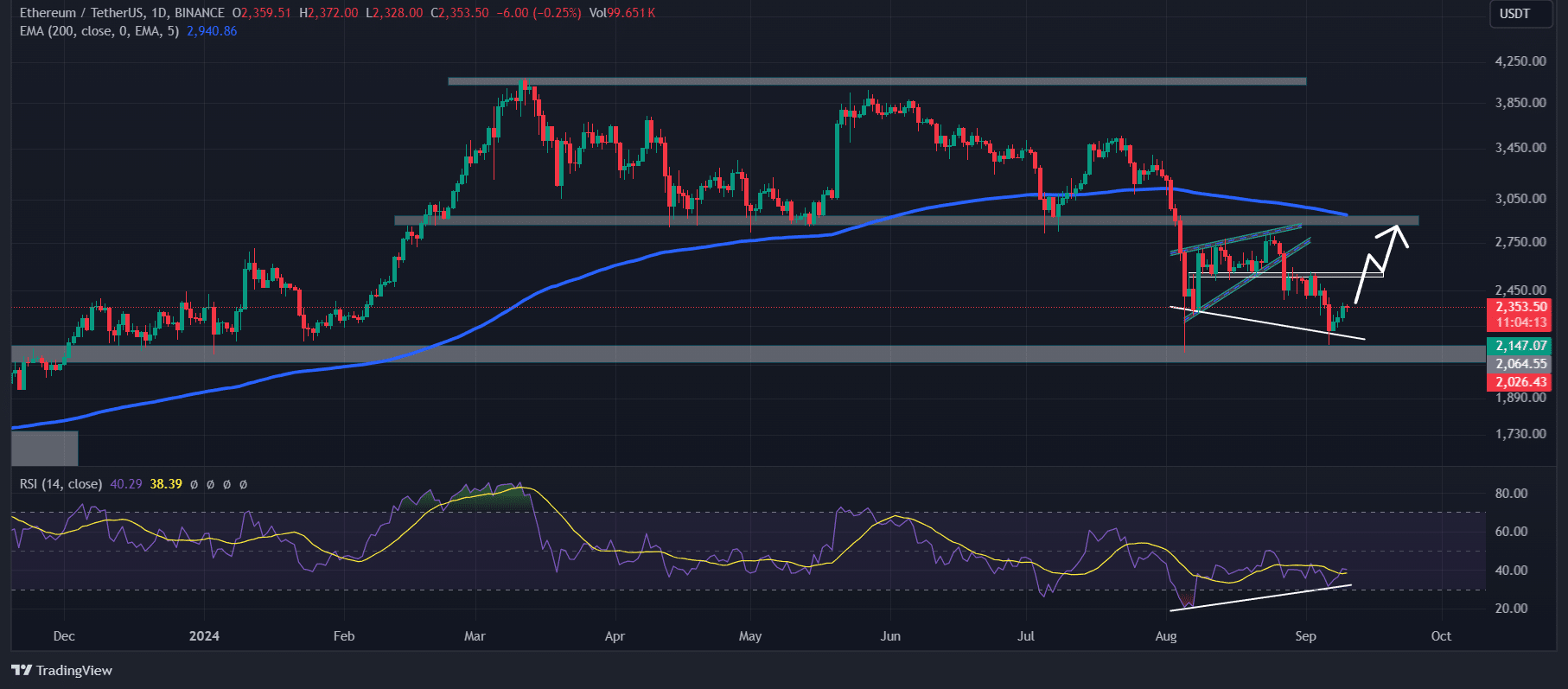

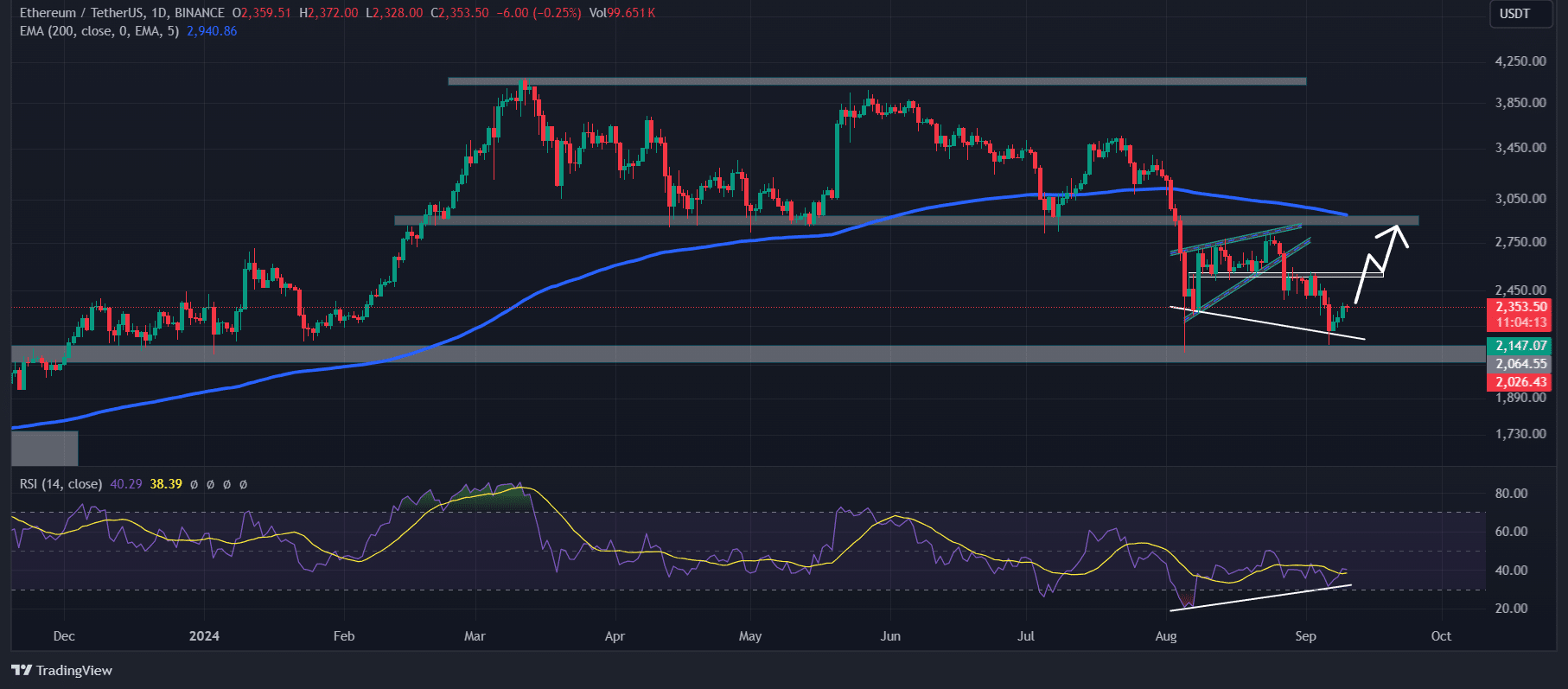

AMBCrypto’s have a look at Ethereum confirmed encouraging indicators.

Notably, the king of altcoins may see an upward rally as a result of present bullish divergence on its Relative Power Index (RSI). Furthermore, it has discovered assist on the essential USD 2,150 stage.

Supply: TradingView

Primarily based on historic value momentum, when the worth of ETH reaches this assist stage, it at all times tends to expertise an enormous value enhance of greater than 23%. This time there’s a comparable expectation that ETH may rise to $2,700.

Nonetheless, this bullish view will solely work till ETH holds itself above the essential USD 2,150 assist stage.

Bullish knowledge on the chain

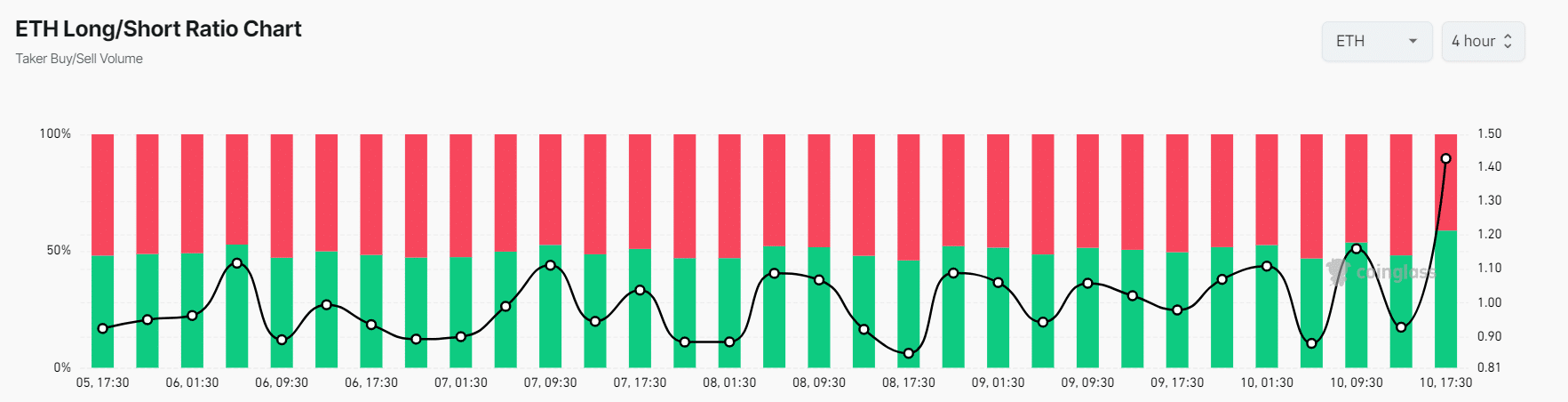

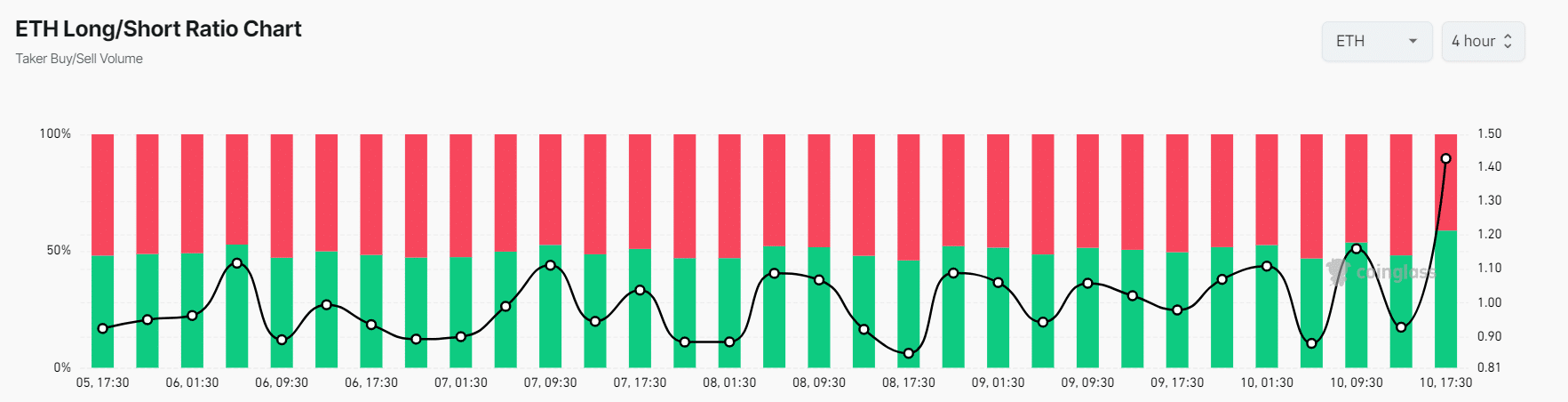

On-chain knowledge additionally supported the bullish outlook. Coinglass’ ETH Lengthy/Quick Ratio chart on the time of writing was at +1,424, its highest stage up to now week, indicating merchants’ bullish sentiment.

Moreover, ETH Futures Open Curiosity rose 2.5%, indicating merchants could also be betting extra on lengthy positions.

Supply: Coinglass

A optimistic Lengthy/Quick ratio and better Open Curiosity point out potential shopping for alternatives. On the time of writing, 58.75% of the highest ETH merchants had lengthy positions, whereas 41.25% had quick positions.

This advised that bulls dominated the property and had the potential to liquidate quick positions.

Learn Ethereum’s [ETH] Value forecast 2024–2025

On the time of writing, ETH was buying and selling across the $2,350 stage, having risen greater than 2.35% up to now 24 hours.

Buying and selling quantity elevated by a modest 14% over the identical interval, indicating higher dealer participation through the market restoration.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now