Analysis

Institutional Investors Dump $50,780,000,000 in Stocks in Just One Month Amid US Bond Rating Downgrade and Trump Trade War: S&P Global

Credit : dailyhodl.com

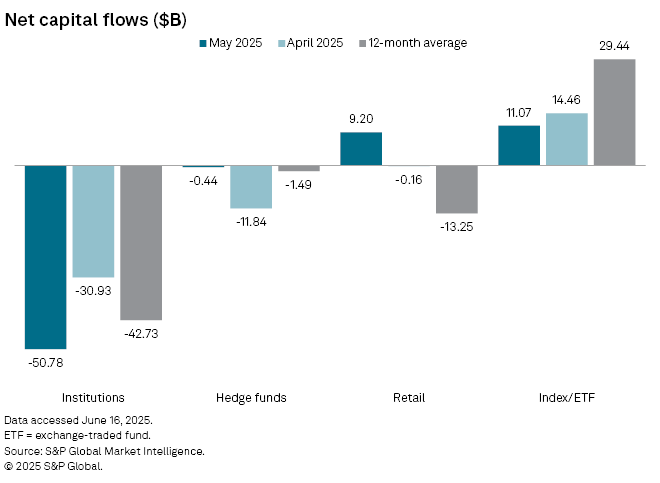

Institutional traders dumped a web $ 50.78 billion in shares in Might, in keeping with Market Intelligence of S&P International.

That quantity surpassed the web $ 30.93 billion in shares that have been launched by establishments in April and is above the web month-to-month common previously yr of $ 42.73 billion.

S&P International Notes that establishments dumped shares in Might due to the priority about commerce and the choice of Moody to downgrade the creditworthiness of america from AAA to AA1.

Explains Thomas McNamara, an S&P International Director of Market Intelligence,

“Establishments nonetheless don’t really feel that we’re out of the forest in relation to charges, recession and common international uncertainty.”

Conversely, the index and exchange-related fund traders spent a web $ 11.07 billion in shares final month and $ 14.46 billion in April. Nevertheless, each figures are significantly lower than the common of 12 months of $ 29.44 billion.

McNamara says that it’s “by no means zero-sum” by way of inventory gross sales.

“There are a lot of elements that go into this on a common foundation, however this month was a fundamental board of inventory shopping for. This will also be a purpose why the market returned because it did with none lengthy -term conviction.”

The S&P 500 has risen by 0.25percentpreviously month, and the Nasdaq composite has risen virtually 1.6%, though the economic common of Dow Jones is falling by virtually 1.4%.

Comply with us on X” Facebook And Telegram

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Examine worth promotion

Surf the Day by day Hodl -Combine

Generated picture: midjourney

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024