Analysis

Institutional Rotation Signals 40% Gains Ahead

Credit : coinpedia.org

The Ethereum worth prediction story for 2025 is changing into more and more bullish as 2026 is just some months away. This optimism is basically because of a major shift in institutional demand from Bitcoin to Ethereum. With Ethereum ETFs now surpassing Bitcoin ETFs in quarterly inflows and whale accumulation returning, ETH is exhibiting renewed momentum heading into the ultimate months of the 12 months.

Institutional rotation is redefining the ETF panorama

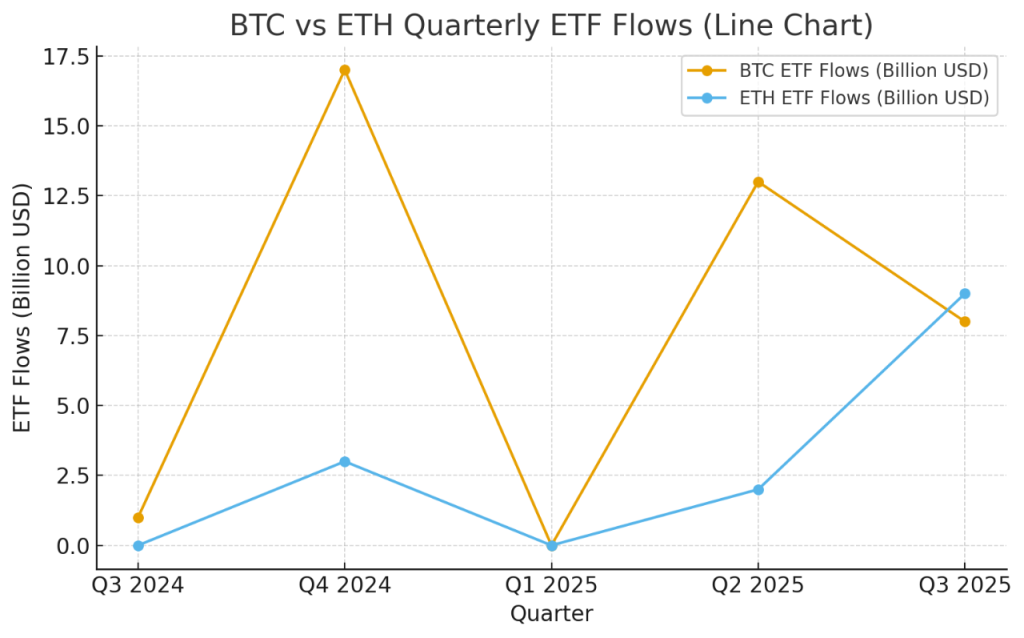

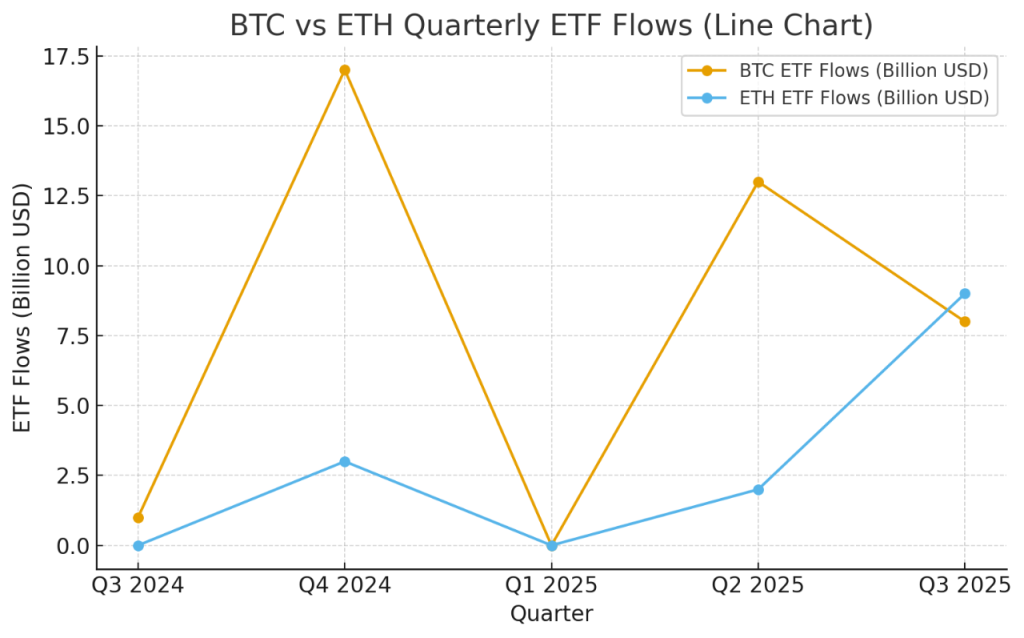

Within the $3.76 trillion international cryptocurrency sector, Bitcoin and Ethereum collectively account for greater than 70% of the market. Nonetheless, current ETF knowledge signifies a shift in institutional sentiment.

Bitcoin ETFs, which beforehand attracted greater than $30 billion between late 2024 and mid-2025, noticed inflows gradual to only $8 billion within the third quarter of 2025.

Ethereum ETFs, however, noticed a surge in reputation, reaching $9 billion in inflows in the identical quarter. That is their strongest quarter but and the primary time ETH has surpassed BTC in ETF demand.

Whereas it is too early to inform if this shift might sign a change in dominance, it is clear that Ethereum is evolving, however BTC nonetheless has the biggest share.

As well as, XWIN Analysis Japan marked this pattern in ETFs as a major shift in funding technique amongst institutional buyers. Additionally they talked about that the Ethereum fund’s property doubled in 2025, reaching 6.8 million ETH in October, confirming continued accumulation.

Even throughout market downturns, fund volumes have continued to develop, reflecting long-term confidence reasonably than short-term hypothesis.

Ethereum Features Floor Amid Bitcoin ETF Slowdown

Whereas Bitcoin ETFs dominated in early 2025, their inflows have turn out to be extra risky as establishments rebalance. Nonetheless, Ethereum ETF’s momentum underlines a structural shift as buyers now prioritize property that ship returns by way of dedication and publicity to on-chain innovation.

This shift indicators that skilled buyers are transferring from easy store-of-value methods to protocols with actual utility and revenue potential. If this sample continues into the fourth quarter of 2025, Ethereum might quickly redefine portfolio allocations within the digital asset market, establishing a brand new benchmark for institutional publicity.

Whales are returning as confidence within the chain will increase

Along with ETF inflows, Ethereum on-chain knowledge assign renewed accumulation by whales and sharks. After dumping round 1.36 million ETH between October 5 and 16, wallets holding between 100 and 10,000 ETH have began shopping for once more, accumulating round 218,470 ETH over the previous week.

This restoration of accumulation signifies a restoration of confidence among the many giant house owners. Traditionally, comparable patterns have preceded multi-month rallies, as these members have a tendency to purchase in periods of structural lows.

Ethereum Worth Prediction 2025 Technical Setup: ETH Expects $5,600 If Assist Holds

Technically the Ethereum worth chart helps the bullish case. Ethereum worth is buying and selling close to $3,950 immediately and stays robust above the help vary from $3,670 to $3,870, a zone that turned from resistance to key help within the final quarter of this 12 months.

This degree additionally corresponds to the centerline of a long-term ascending channel that has outlined ETH’s broader uptrend since 2023. If this help holds, the Ethereum worth forecast for 2025 expects a transfer in direction of $5,600, which can coincide with the higher channel resistance, implying a rise of just about 40% earlier than the tip of the 12 months.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We purpose to supply well timed updates on all the pieces crypto and blockchain, from startups to business majors.

Funding disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market situations. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts duty in your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our web site. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now