Adoption

Institutions like Strategy and Metaplanet now hold 12.3% of the total Bitcoin supply

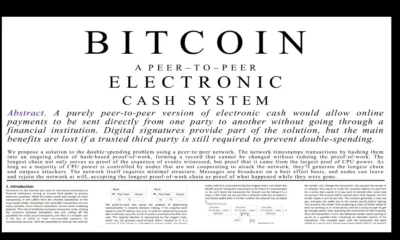

Credit : cryptoslate.com

Institutional cash, funds and public corporations proceed to extend their BTC corporations and at present verify 12.3% of all Bitcoin supply.

In response to Bitcoin Analytics platform, based on Ecoinometrics from Bitcoin Analytics Platform, this has elevated dramatically within the final 12 months. Institutional cash has added 5% to their mixed pursuits prior to now yr alone, in order that the value of Bitcoin was continued by extra 80% within the final 12 months.

Entities comparable to ETFs, sovereign funds and enterprise treasury now have billions of {dollars} on BTC, greater than 1,000,000 cash.

The rise of Bitcoin -Bitchist

The structural transformation of the market is recorded by the rise of Bitcoin Treasury corporations comparable to Technique and Metaplanet. Technique alone now restrains itself 638,400 BTCGreater than 3% of the whole circulating energy provide. On the similar time, the Japanese metaplanet surpassed 20,000 BTC and rapidly climb the ranks below enterprise Bitcoin treasure containers.

Their methods revolve round aggressive accumulation of the Bitcoin provide, coverage for issuing tailor -made shares to purchase extra Bitcoin and revolutionary steadiness administration to maximise publicity to BTC as a reserve firm.

The most important names of Wall Road additionally climb to deal with the brand new wave. JPMorgan began accepting Bitcoin ETFs shares in June 2025 as collateral for loans and collaborated with Coinbase to have Chase Credit Card Holders Crypto purchases finance straight.

This steady integration by means of loans, asset administration and direct buy exhibits the extent of standardization of Bitcoin in conventional funds, which spell a deeper liquidity for the complete ecosystem.

And with $ 7.5 trillion At the moment parked in cash market funds, solely on the lookout for a brand new home, the institutional accumulation of the Bitcoin provide will in all probability go up and on the proper.

Bitcoin supply shift from retail to settings

Maybe essentially the most hanging, the focus of Bitcoin provide shifts away from early holders and retail traders to funds and corporations.

Current on-chain facts Unveils a dramatic change in deal with distribution and alternate liters prior to now two years, and emphasizes how giant gamers consolidate their share within the finite vary of. Michael Saylor well-known because the founder and chairman of the technique warned:

“The digital gold rush ends ~ January 7, 2035. Get your bitcoin earlier than there isn’t any bitcoin for you.”

The accelerating institutional acceptance is the liquidity tightening, making Bitcoin more and more scarce and helps larger costs throughout each influx.

Revolutionary treasury methods of corporations comparable to Technique and Metaplanet set new requirements, whereas financial institution giants comparable to JPMorgan are actively supporting it extra lively than ever.

This steady consolidation might essentially change the story of Bitcoin, as a result of Bitcoin provide shifts from retail palms to institutional portfolios.

Institutional urge for food is now one of the vital highly effective forces that kind each volatility within the brief time period and the long-term vacation spot of the world’s largest crypto-currency.

State on this article

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now