Altcoin

Investigate the likelihood of LINK’s price breaching $12 to reach a new high

Credit : ambcrypto.com

- LINK was displaying indicators of a potential breakout on the time of writing, supported by bullish technical indicators

- International trade reserves fell, whereas extended liquidations highlighted robust bullish sentiment

Chain hyperlink [LINK] has made important progress just lately attributable to technological improvements and notable enhancements in general market efficiency. Following the launch of CCIP Personal Transactions for banks and the combination with Bitcoin, Chainlink is positioning itself as a pacesetter in cross-chain tokenized asset settlements.

With ANZ’s pilot program and an AI-driven initiative to handle unstructured monetary information, LINK has registered a 4.46% worth improve prior to now 24 hours. LINK was buying and selling at $11.79 on the time of writing and seemed to be approaching a important resistance degree.

The query now could be: can this momentum push it to new highs?

Is LINK prepared for a breakout?

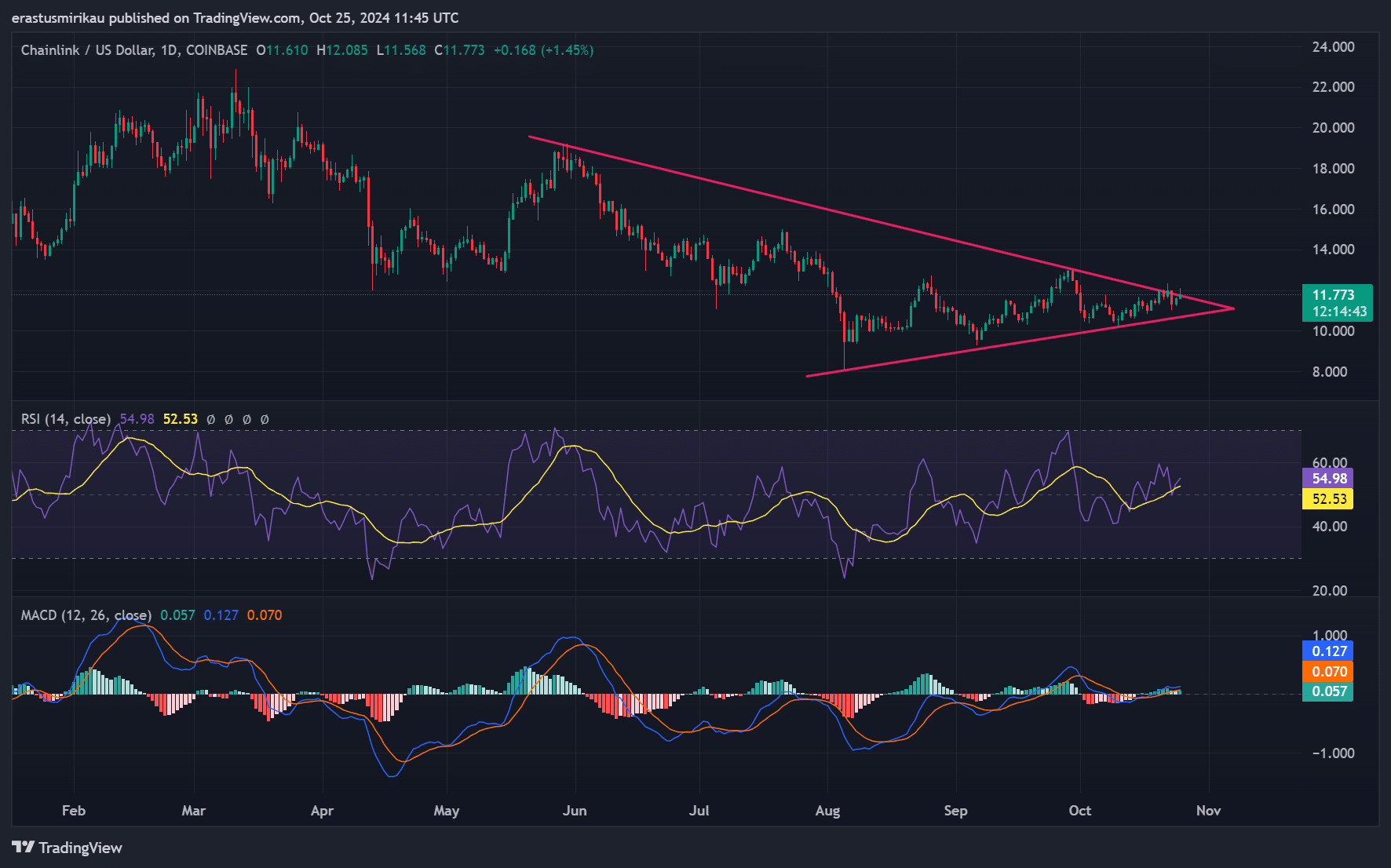

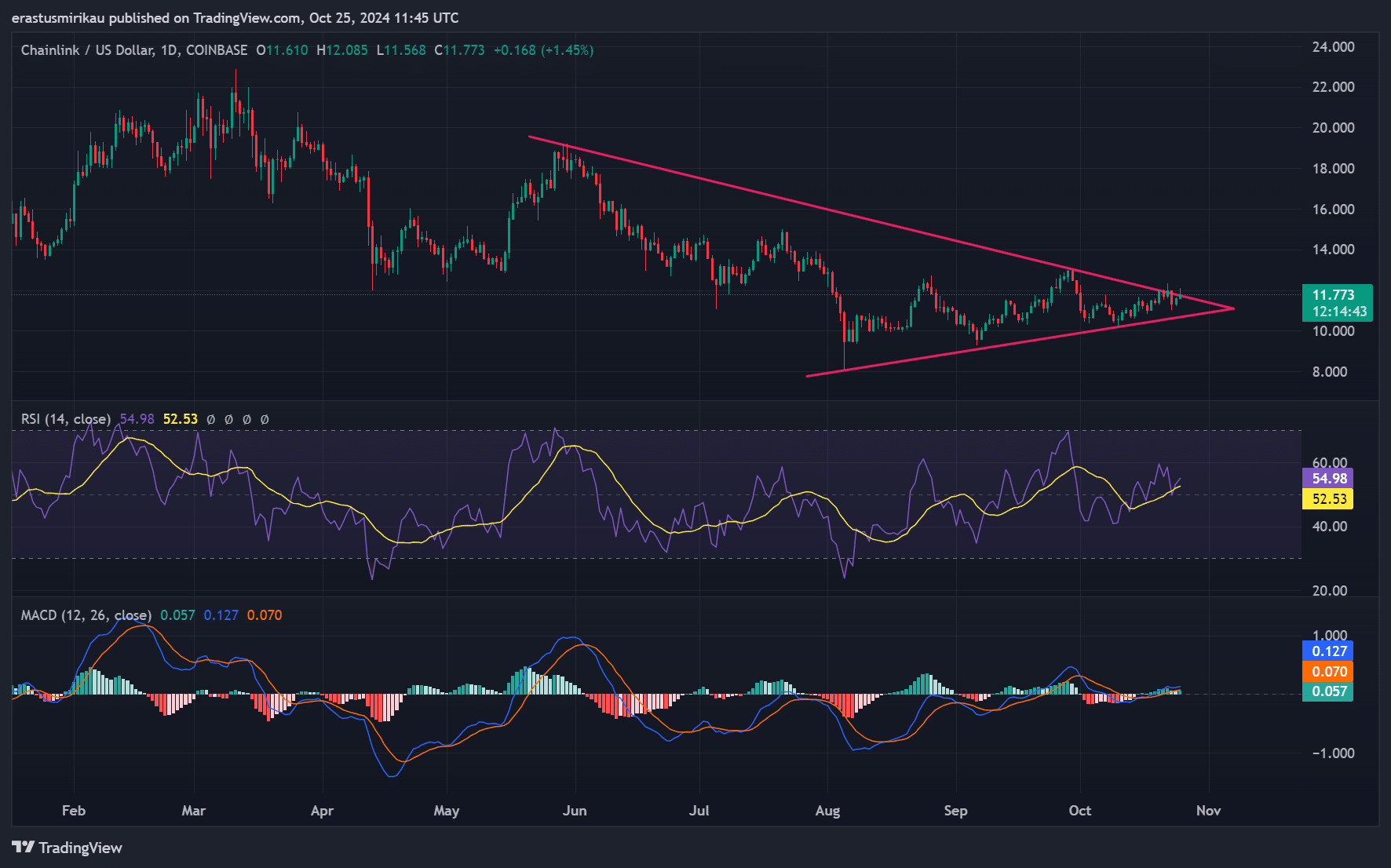

LINK’s chart confirmed a symmetrical triangle sample, a sample that has been tightening since mid-July. On the time of writing, LINK was buying and selling on the prime of this triangle, hovering at $11.77. Furthermore, the Relative Energy Index (RSI) stood at 54.98, indicating that LINK has a bullish edge.

Moreover, the Transferring Common Convergence Divergence (MACD) underlined a latest bullish crossover, which may very well be an indication of upside momentum. Subsequently, if LINK breaks out of the triangle, the subsequent goal may very well be the psychological degree of $13.

Supply: TradingView

Sturdy alerts within the chain point out elevated use

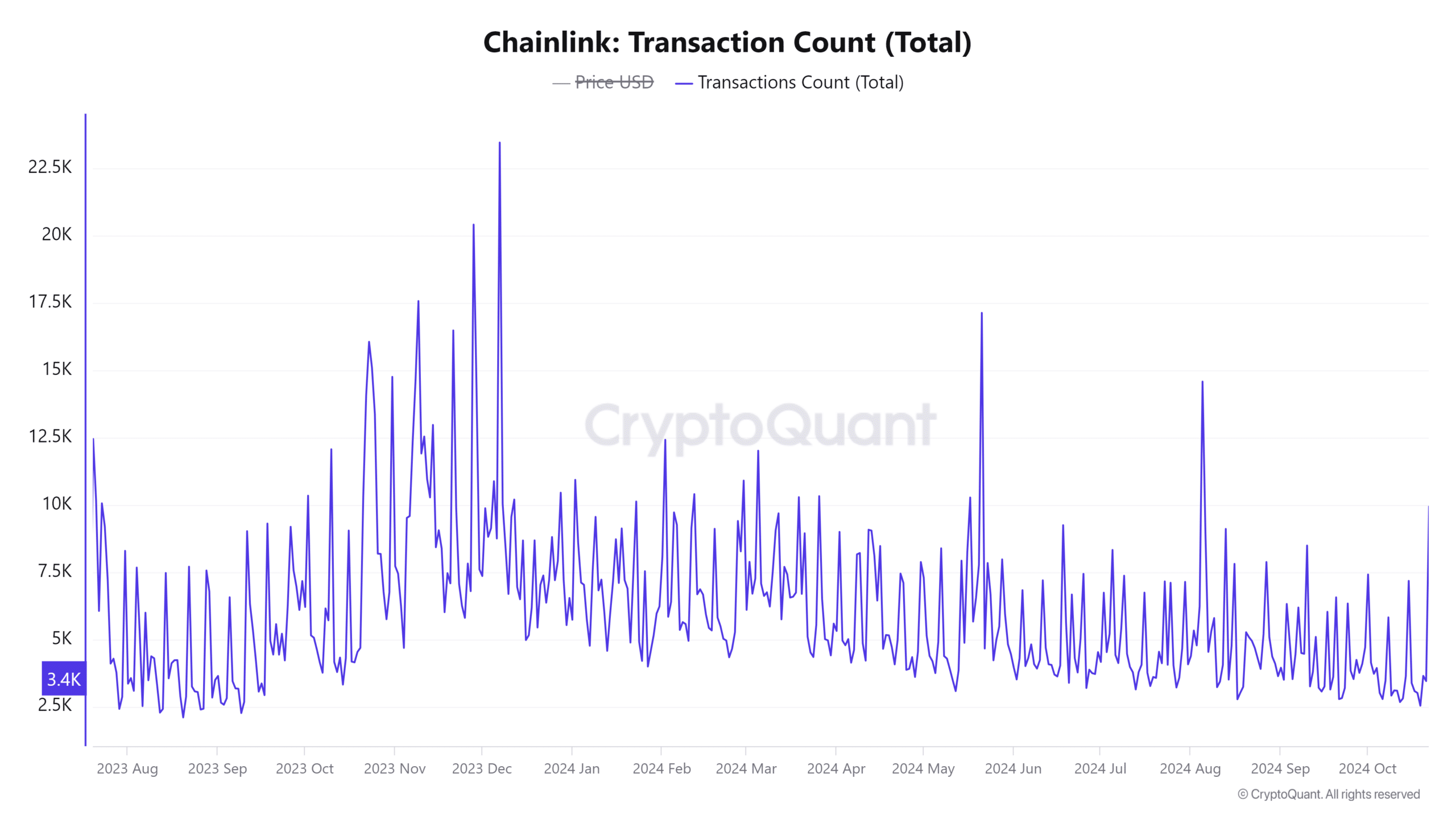

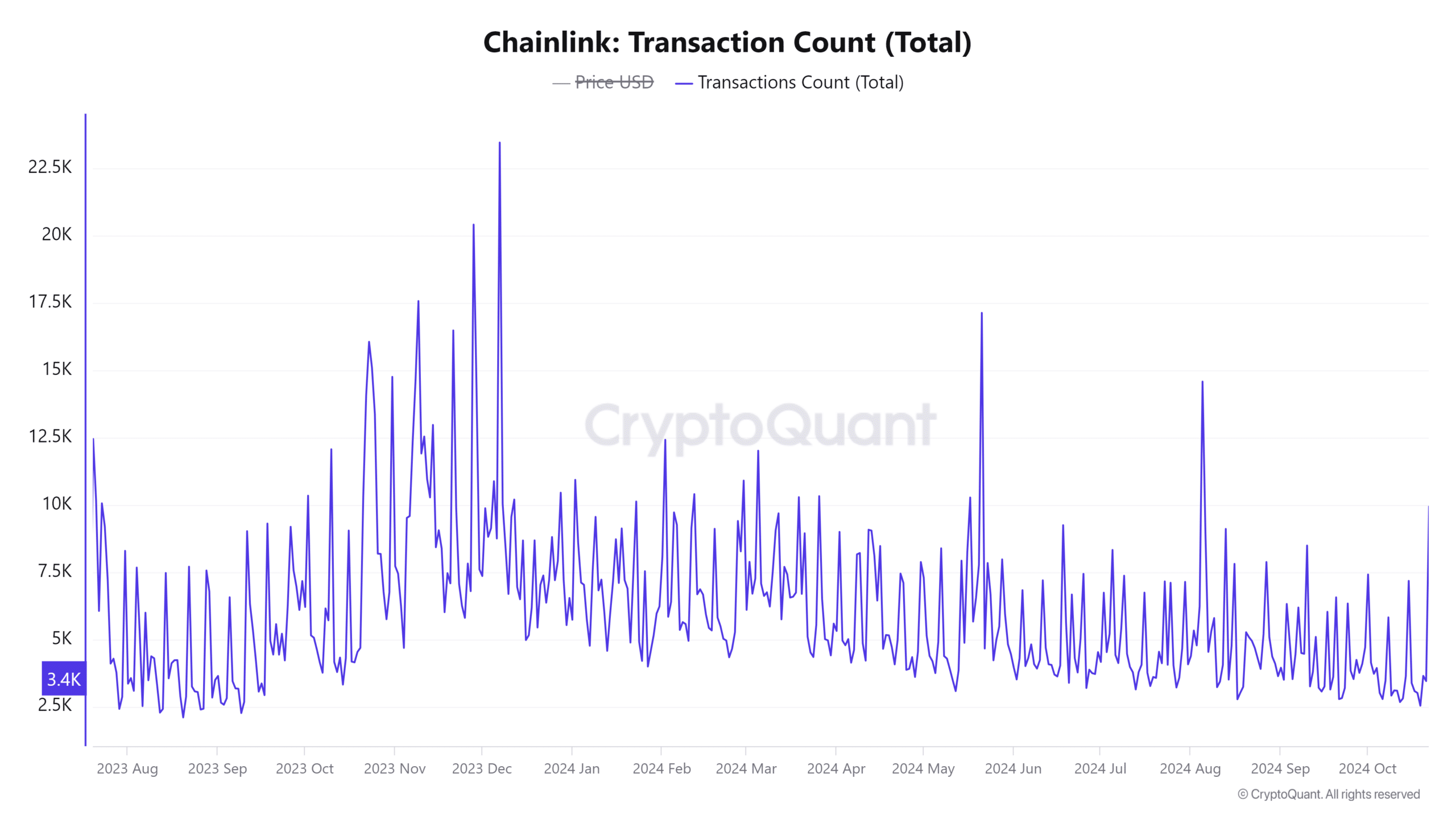

On-chain metrics painted a promising image for Chainlink. Lively addresses elevated by 1.11% prior to now 24 hours, to 176.45k. This may be interpreted as an indication of rising curiosity and exercise inside the Chainlink community.

Moreover, the variety of transactions elevated by 1.18%, reinforcing the concept extra customers are benefiting from the platform’s decentralized providers. Collectively, these alerts supported the bullish narrative, highlighting higher community engagement.

Supply: CryptoQuant

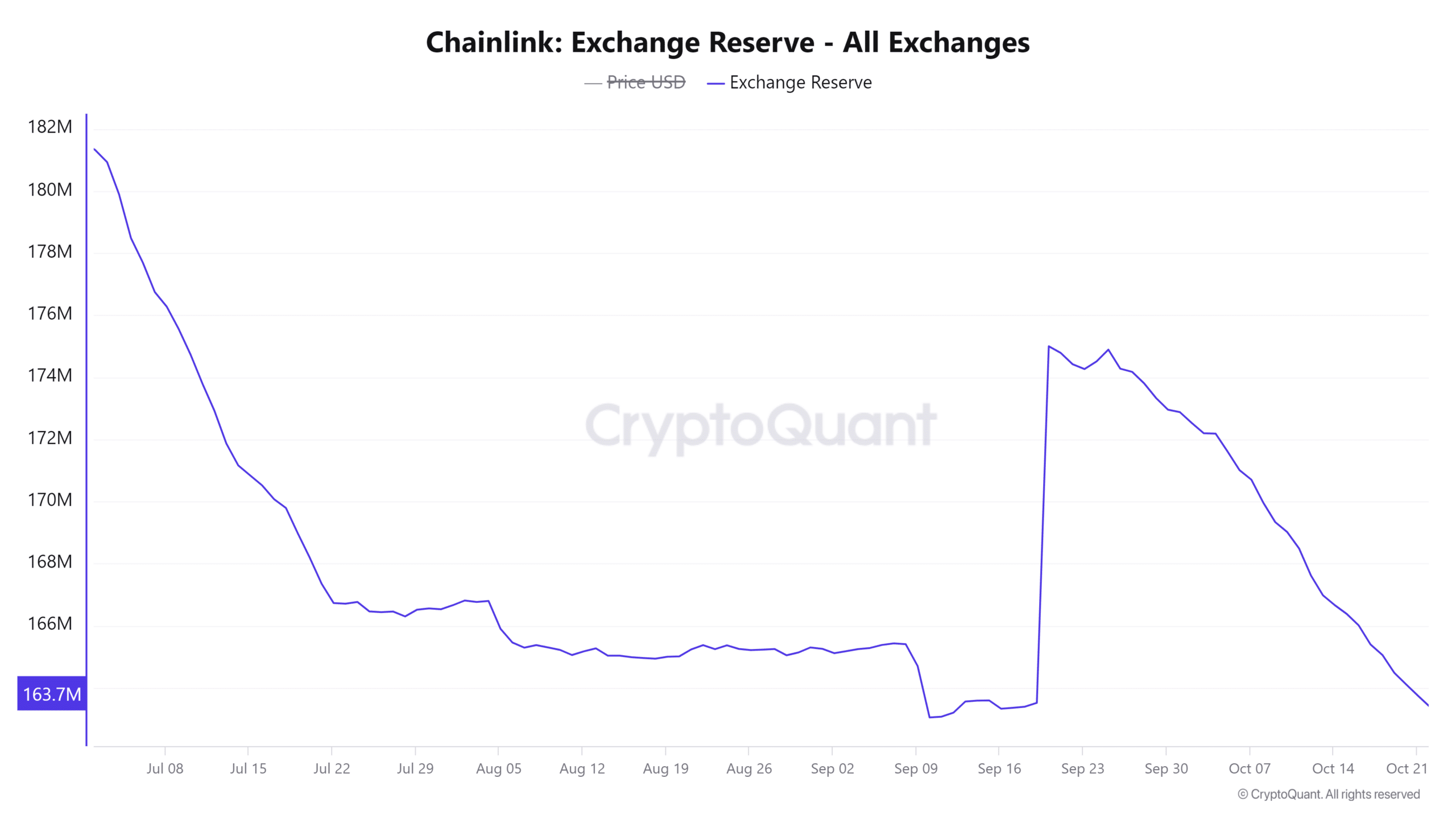

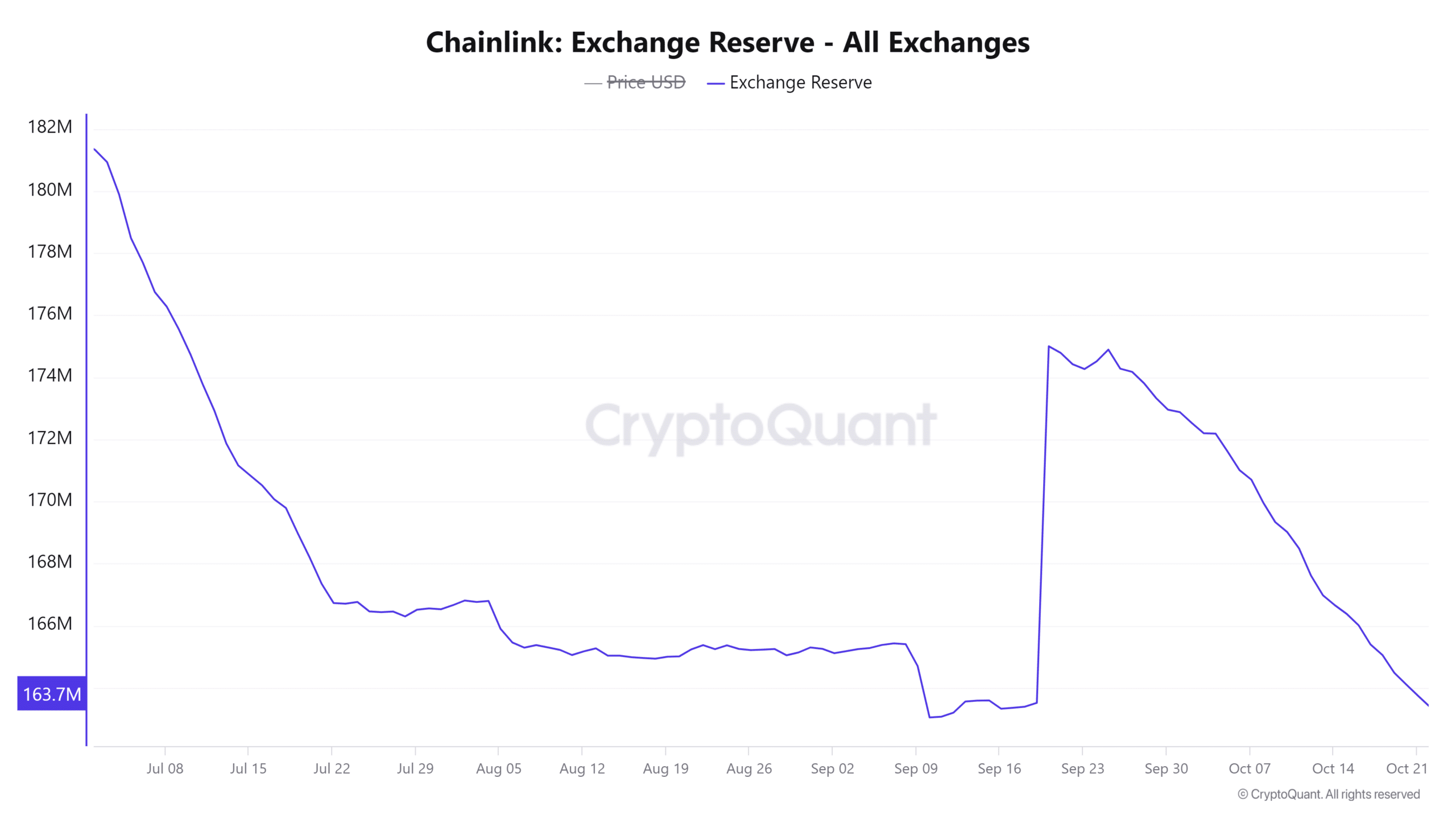

LINK international trade reserves are falling, indicating provide constraints

Curiously, foreign money reserves for LINK have fallen by 0.27% to 163.97 million tokens over the previous seven days. This drop instructed that traders are transferring their holdings from the inventory exchanges to personal wallets.

This may very well be an indication of decrease promoting strain, which may push the worth up additional if demand continues to rise.

Supply: CryptoQuant

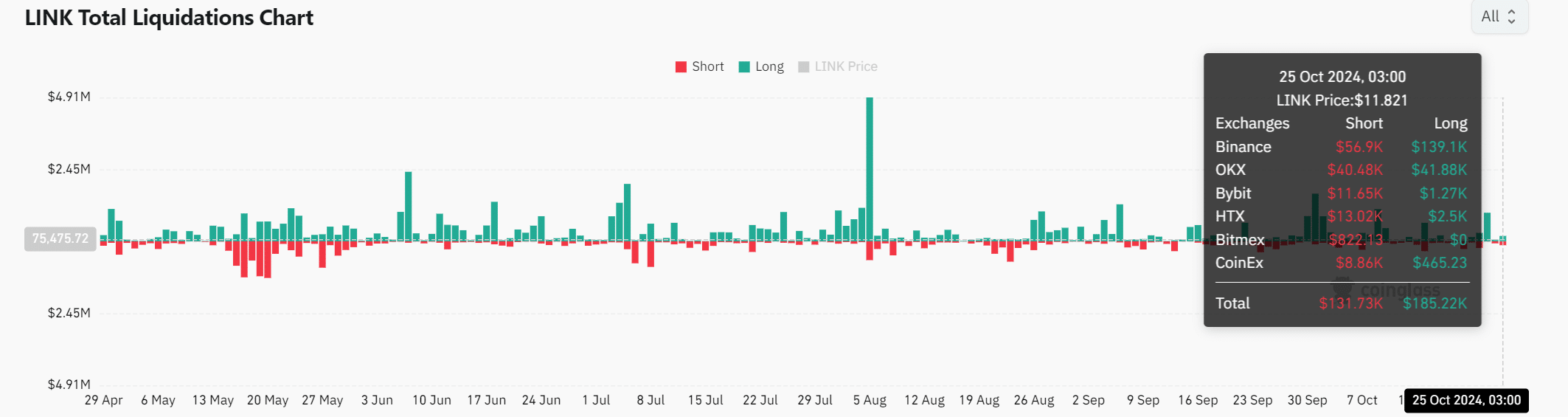

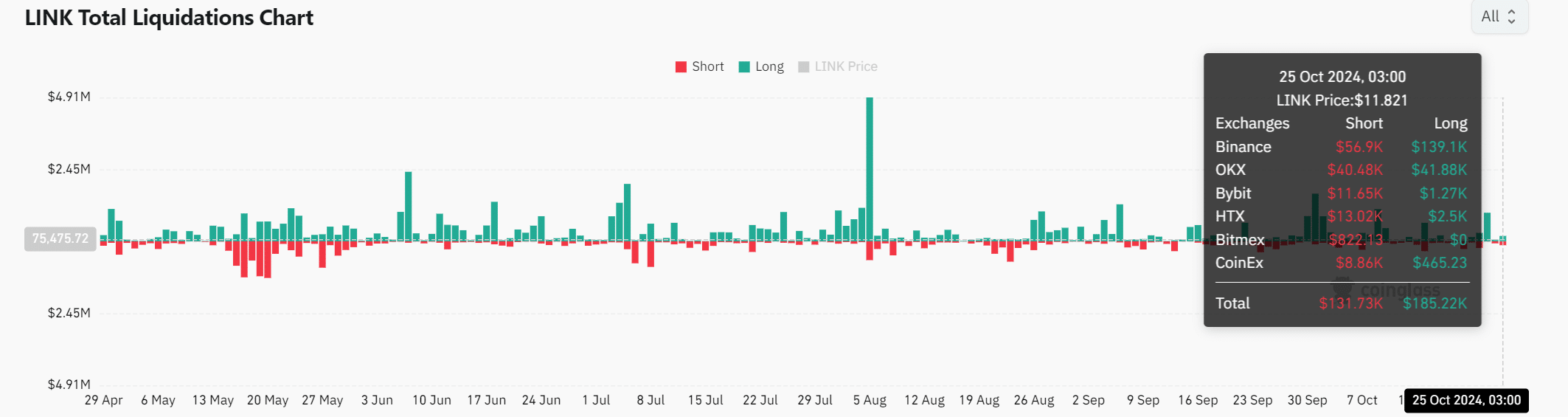

Lengthy liquidations add gas to the bullish fireplace

One other issue contributing to LINK’s potential rally is the imbalance between lengthy and brief liquidations.

Knowledge confirmed that $185.22k of lengthy positions have been liquidated, in comparison with $131.73k of shorts. This tendency in direction of lengthy liquidations underlined merchants’ confidence in a bullish transfer – accelerating LINK’s worth breakout.

Supply: Coinglass

Is your portfolio inexperienced? View the LINK Revenue Calculator

For the time being, Chainlink seems properly positioned for a breakout with rising community exercise, dwindling international trade reserves and bullish market sentiment.

If it efficiently breaks above $12, it may shortly goal increased resistance ranges. Nonetheless, merchants ought to stay cautious because the resistance at $12 may set off a pullback earlier than additional beneficial properties will be made.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024