Altcoin

Investigating the latest liquidations of Ethereum and its value as an investment now

Credit : ambcrypto.com

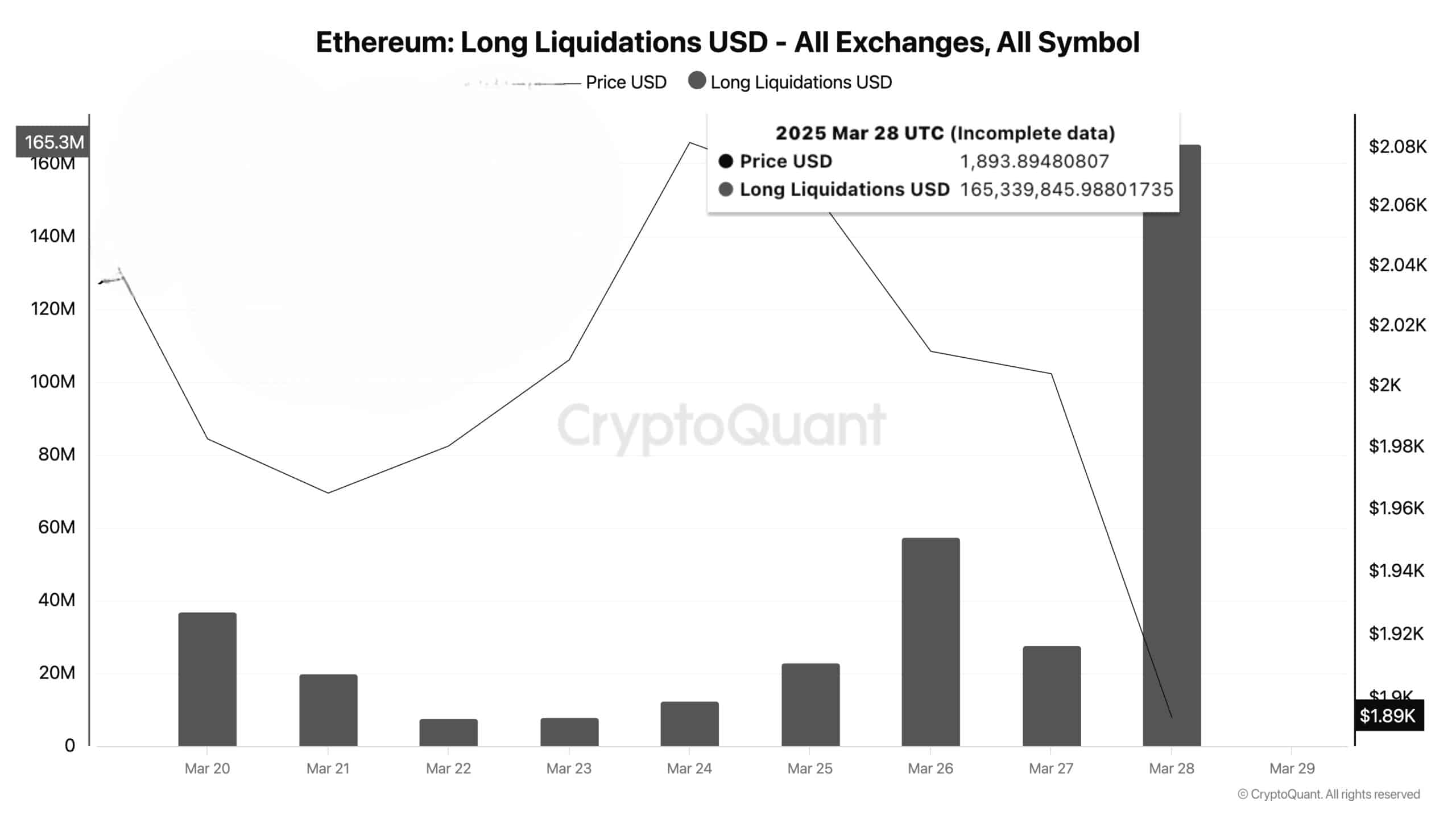

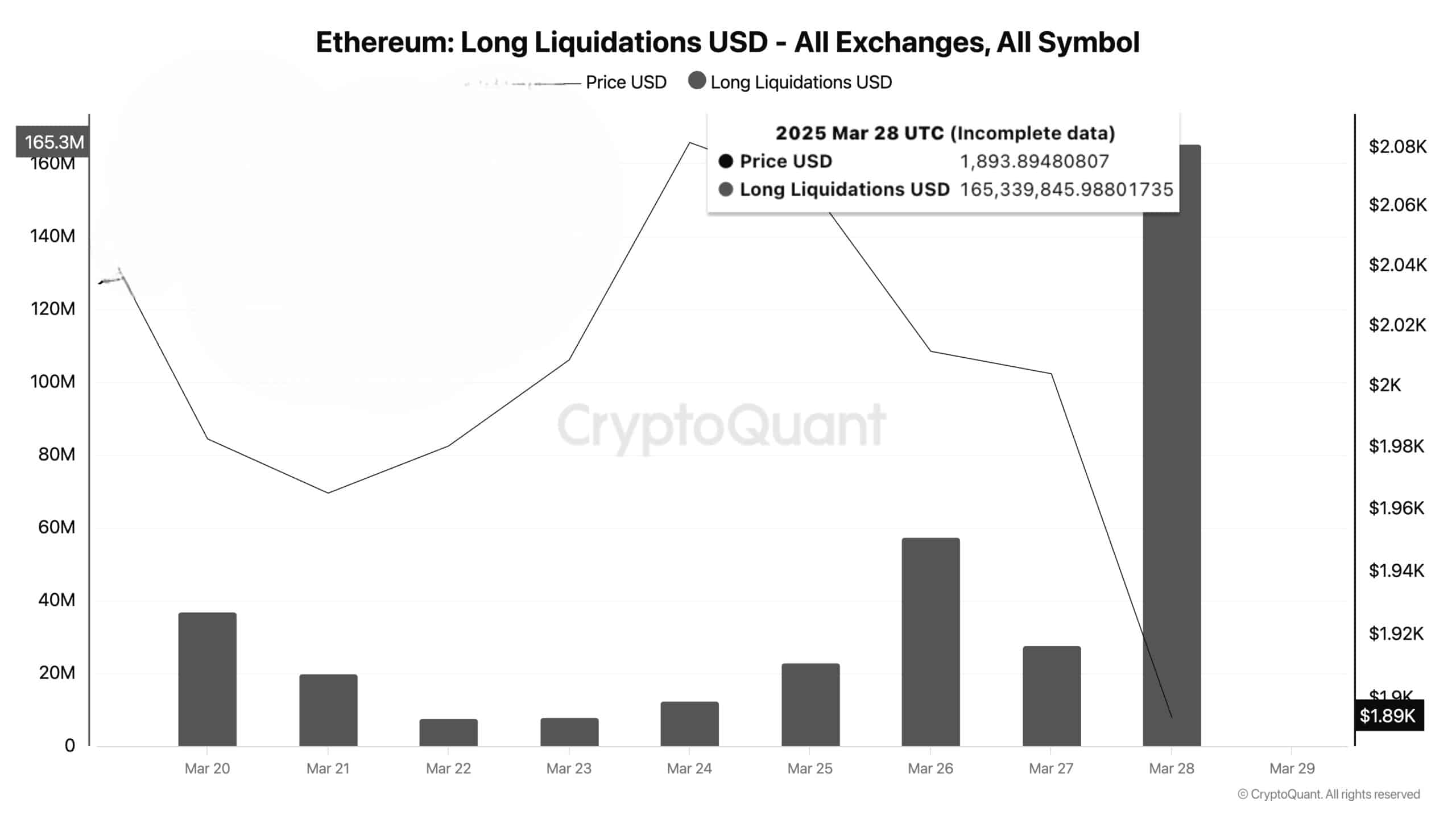

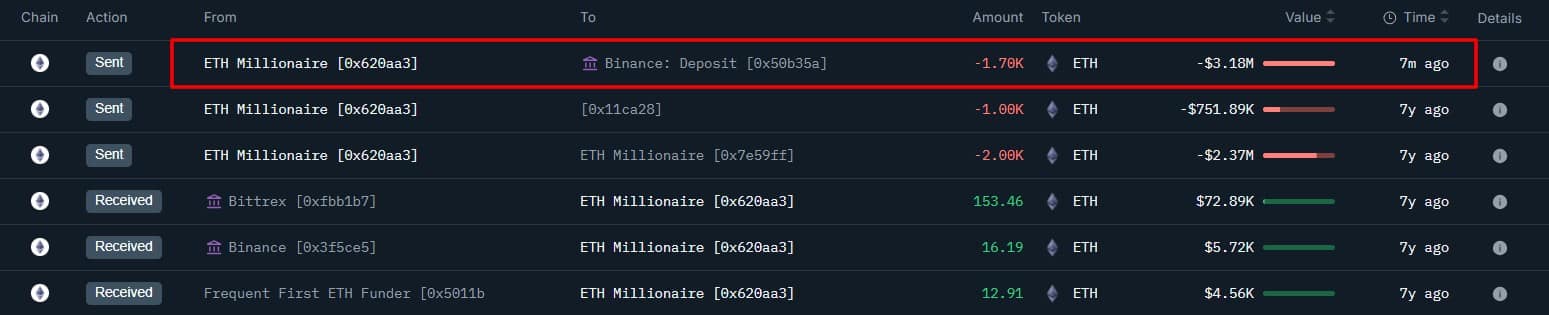

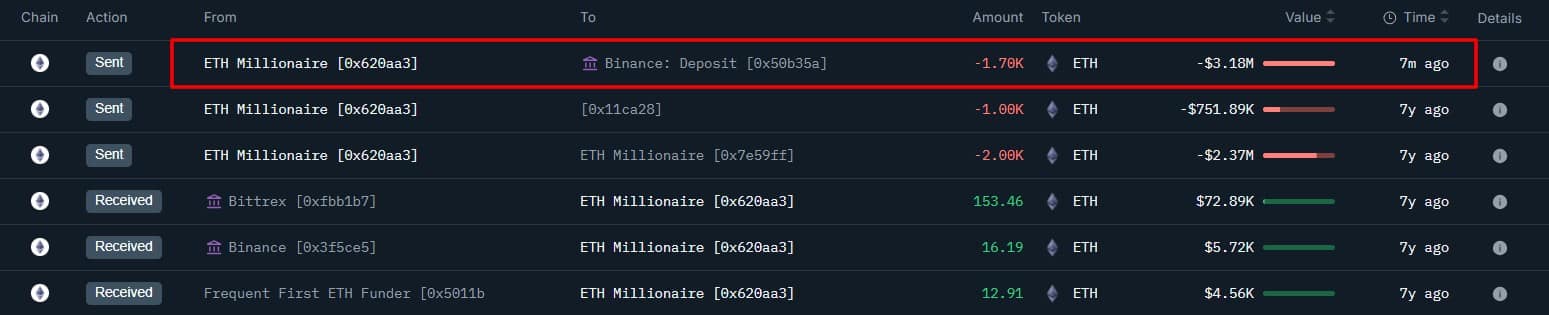

- Roughly $ 165 million in lengthy ETH positions had been liquidated when the ICO participant 1,700 ETH Terneertelslavenlagen price $ 3.18 million in Binance

- Regardless of the market capitalization of ETH, the community noticed a lower in transaction exercise, person development and reimbursements/earnings

Ethereum [ETH] has seen appreciable market correction these days. Because of the identical, merchants have needed to cope with losses of $ 165 million from liquidations with lengthy positions.

Giant -scale liquidations befell when the lever merchants skilled the surprising worth that many merchants fell to promote their property.

Top quality liquidity might proceed to push the value of ETH, which might result in bigger worth fluctuations within the charts.

Supply: Cryptuquant

These large liquidations for lengthy place are an indication that Bullish Energy has been weak, in order that future leverage is unlikely within the coming periods. The unfavourable market prints can’t have the ability to obtain vital help areas. This might feed an additional large sale that may prolong the downward development.

Nevertheless, that isn’t all like furthermore, an Ethereum ICO participant with out a current exercise in seven years despatched 1,700 ETH with a worth of $ 3.18 million to Binance.

The bizarre motion confirmed that the holder meant to promote his coins-one signal of gross sales stress.

Supply: Onchain -Lens

Whales generate market instability by shifting their present property, as a result of market speculators attempt to predict their goals. On this particular case, the deposited ETH can result in actual gross sales by buyers, in order that unfavorable market circumstances can come up for Ethereum.

Nevertheless, ETH has lately demonstrated minimal adjustments if the whales implement funding methods with their funds, as an alternative of performing gross sales actions.

Max Ache worth degree and community exercise

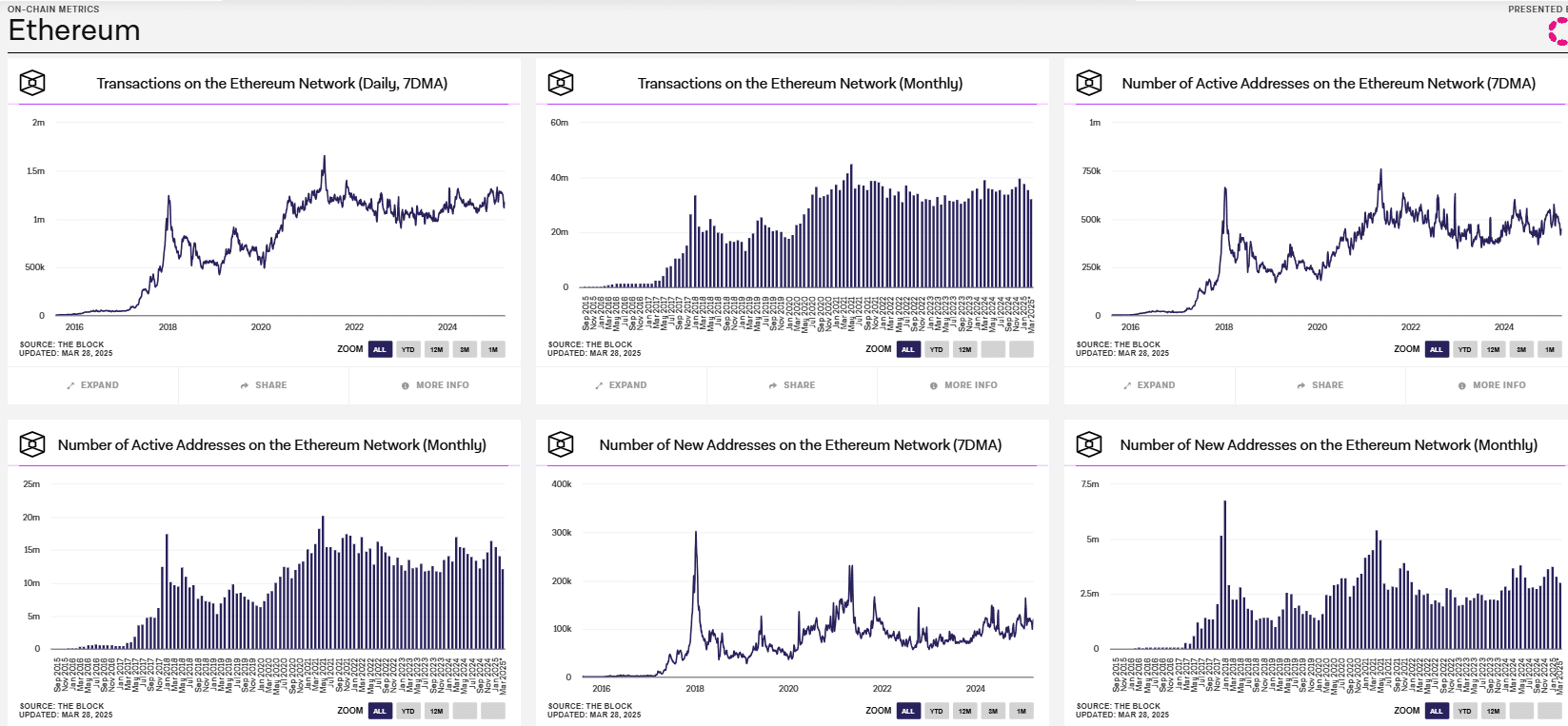

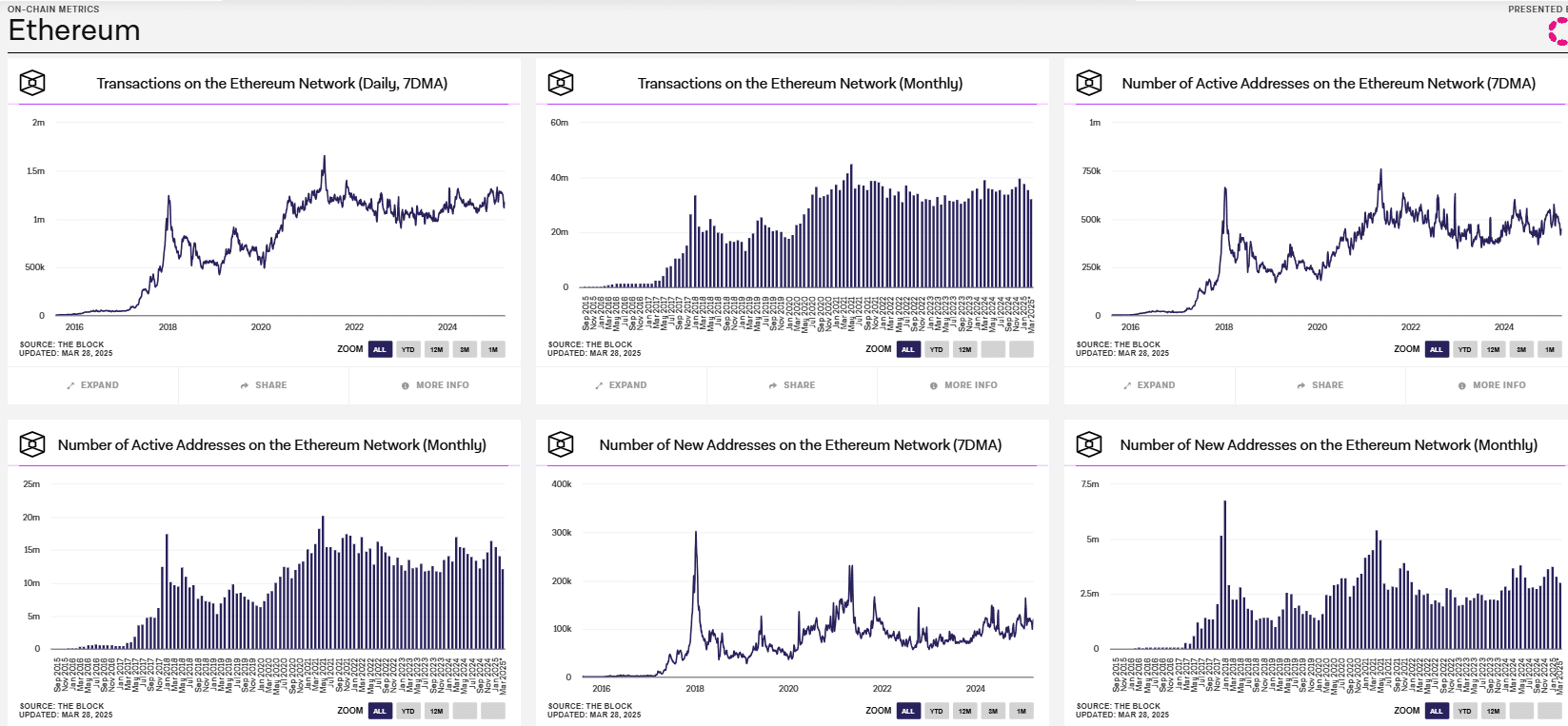

On the time of writing, Beerarish sentiment appeared to eliminate the Ethereum -Blockchain. For instance – the variety of day by day transactions remained round 1 million as a result of the use decreased steadily throughout the board.

Though the transaction frequency surpassed 40 m for a month, it was not potential to succeed in its peak numbers.

Lively addresses remained below 750K, as a result of the involvement of customers appeared to lower. And but the month-to-month energetic addresses amounted to greater than 10 million indicative for persistent person involvement in the long run.

Supply: X

New Ethereum Community addresses (7DMA) revealed falling statistics as a result of they fell to figures beneath 100k. The two.5 million month-to-month new addresses created much less most impression than beforehand recorded spikes of latest addresses.

For his half, the prize from Ethereum went till April Max Ache Level of $ 2,200 – a degree that has served traditionally as help.

Supply: X

What this implies is that extra drawback will be anticipated.

Is ETH good as an funding or as a utility community?

Ethereum can at present perform extra as a main utility system. Particularly because the information proposed customers help and transaction actions didn’t replicate the rising developments.

The career of Ethereum investments might lower, relying on the fixed adoption charges that stand nonetheless. The lower in community use, together with giant sale of whales and strolling in liquidations of lengthy positions, are all indicators of unfavourable sentiment. Lastly, the falling worth of ETH continues to doubt the power to function an funding energetic.

Merely put, the market setting for Ethereum is now unclear.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now