Ethereum

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum has skilled a a lot wanted enhance within the stage of $ 2,000, an essential psychological and technical determine that bulls have struggled since 10 March to reclaim again. This outbreak led to optimism available in the market, however the momentum was quick -lived, as a result of ETH shortly went under the extent and was unable to substantiate a strong maintain. Analysts usually agree {that a} sturdy and protracted motion above $ 2,000 is essential for Ethereum to provoke a broader restoration rally.

Associated lecture

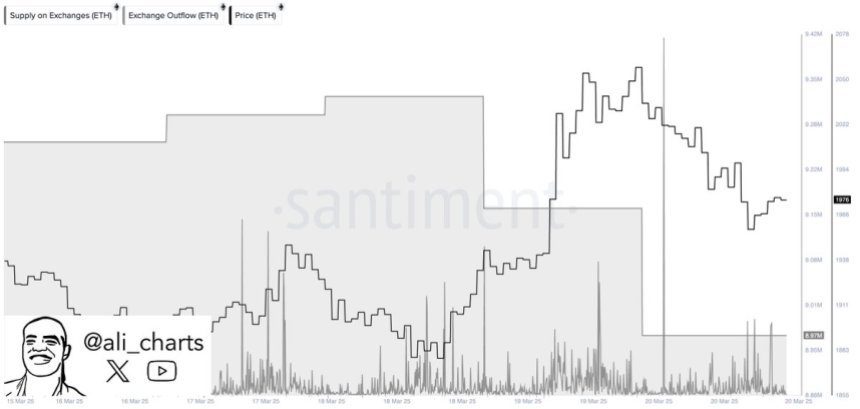

Regardless of the hesitation towards resistance, information on chains present indicators of rising investor confidence. Based on santiment, traders have withdrawn greater than 360,000 ETH from centralized exchanges within the final 48 hours. This shift is commonly interpreted as a bullish sign, which suggests that enormous holders transfer their belongings to personal portfolios, probably pending larger costs.

Within the meantime, the broader macro -economic panorama continues to exert stress. Commerce struggle tensions and unpredictable coverage choices from the US authorities have weighed closely on each crypto and conventional markets, which intensifies the volatility and uncertainty of traders. However, the most recent alternate outflow from Ethereum signifies a possible development shift – one that might favor accumulation and decide the stage for the subsequent massive motion, supplied that Bulls can reclaim and retain above $ 2K threshold.

Ethereum is confronted with essential check within the midst of alternate outflows

Ethereum has misplaced greater than 57% of its worth since mid -December and falls from a spotlight of round $ 4,100 to current lows close to $ 1,750. This sharp correction has created a difficult atmosphere for Bulls, who’ve repeatedly not recovered and had larger value ranges.

Now the $ 2,000 marking is a psychological and technical battlefield. If Ethereum can set up sturdy help above this stage, this may kind the premise for a restoration rally. Nevertheless, a failure to do that would most likely result in additional drawback and strengthen the bearish development.

Associated lecture

The present market panorama is fighting uncertainty. On the one hand, fixed macro -economic headwind – have prolonged commerce tensions, inflation issues and coverage shifts of the US authorities – weakens the boldness of traders and pushed volatility about danger belongings. However, there are indicators of potential restoration and accumulation.

High Crypto analyst Ali Martinez shared Data from SantimentMiserable that traders have withdrawn greater than 360,000 ETH from centralized gala’s within the final 48 hours. Traditionally, massive -scale recordings are thought-about a bullish sign, as a result of they recommend that traders transfer belongings to chilly storage for lengthy -term property as an alternative of making ready on the market.

This step may point out a rising belief in massive holders and point out the early levels of a brand new battery section – the imitated Ethereum can include greater than $ 2,000.

Value stays secure than $ 2,000

Ethereum is presently being traded at $ 1,960 After he briefly tried to reclaim the $ 2,000 marking in yesterday’s session. The psychological and technical resistance of $ 2,000 stays an important barrier which have to beat bulls to shift the market momentum to their benefit. Regardless of a small leap of current lows, Ethereum has hassle getting a grip within the midst of persistent market uncertainty.

Bulls should reclaim ETH above $ 2,000 and better ranges, reminiscent of $ 2,150 and $ 2,300 to substantiate the beginning of a restoration section. A protracted motion above these ranges wouldn’t solely point out a possible development removing, however also can pull offside traders again available on the market. Till that occurs, Ethereum stays susceptible for fixed shut stress.

Associated lecture

If bulls don’t break above the $ 2,000 resistance within the upcoming periods, Ethereum may lose help on the present stage and re -view the decrease demand zones round $ 1,850 and even $ 1,750. With the broader crypto market nonetheless beneath the affect of macro-economic volatility and weak sentiment, within the coming days are most likely essential for the course of ETH. A decisive motion above or under this key vary will most likely set the tone for the subsequent predominant prize promotion.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024