Policy & Regulation

IRS secures first crypto tax fraud conviction, setting legal precedent

Credit : cryptonews.net

For the primary time, the IRS efficiently continued a case of tax fraud with solely crypto.

The American Inside Income Service has achieved an awesome victory, which is delivered a authorized precedent within the combat towards crypto-related tax fraud. In December 2024, Frank Richard Ahlgren III was sentenced to 2 years in jail and acquired $ 1.1 million a nice for avoiding taxes on his crypto gross sales. In a weblog put up of January 27, Blockchain Analytics agency chainalysis stated that the ruling marks the primary time that the tax watchdog has obtained a conviction for tax fraud, solely with digital property.

“After the IRS, the case additionally represents an necessary victory for the Ministry of Justice and Justice Ministries Worldwide.”

Chain salysis

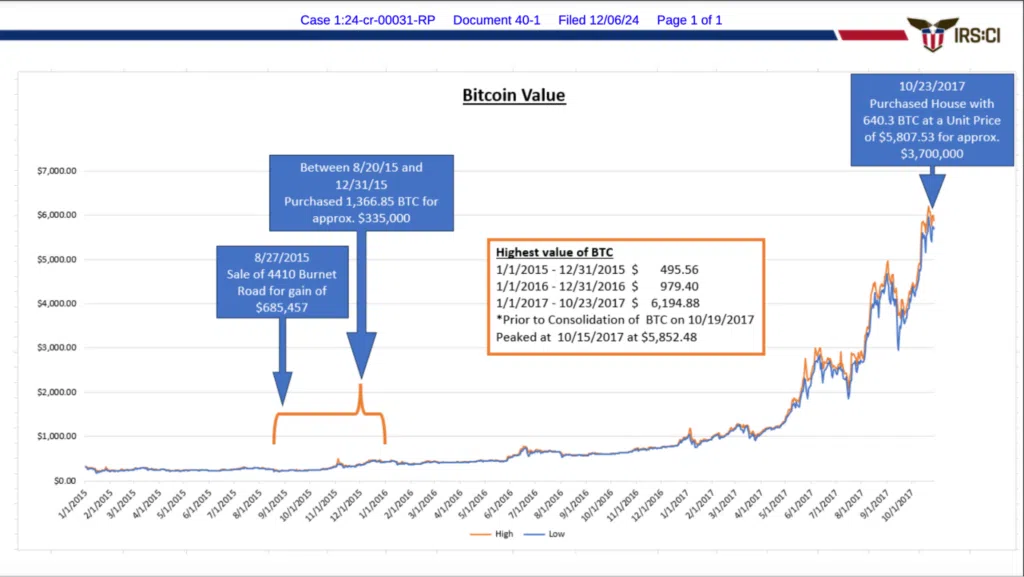

The case is linked to Ahlgren who buys a $ 4 million home in Park Metropolis, Utah, with the assistance of revenue from his Bitcoin (BTC) gross sales. The corporate thought of by the New York headquarters that Ahlgren’s strategies had been fairly in depth: he bought hundreds of thousands in BTC utilizing instruments similar to Coinjoin mixers, wasabi portion, peer-to-peer companies and even structured money depositos to the revenue to cover. He additionally adjusted his tax returns to point out a decrease worth for his crypto.

Perhaps you additionally prefer it: Detroit to just accept crypto funds for taxes and metropolis prices

The historical past of Ahlgren’s on-chain exercise versus Bitcoin worth Supply: chain evaluation

Nonetheless, researchers have nonetheless detected the crypto transactions of Ahlgren in a number of portfolios and gala’s. For every chain evaluation, his wealth of a purchase order of 2015 got here when he purchased 1,366 BTC for round $ 676,170.

“Though Ahlgren has thwarted the authorities for some time by performing some calculations, his conviction and conviction illustrate how tax evasion within the chain is traceable and has actual penalties.”

Chain salysis

Within the meantime, Senator Ted Cruz from Texas is on the brink of problem a brand new IRS -Crypto rule with the assistance of the Congressional Assessment Act. The rule forces decentralized crypto exchanges to gather buyer info, similar to names and addresses, and to ship tax types to customers.

As Crypto.information reported earlier, Cruz, along with senators Cynthia Lummis, Invoice Hagerty and Tim Sheehy, calls on what Republicans name the “midnight guidelines” of the Biden authorities. These laws had been accomplished on the finish of final yr and the CRA offers it congress till mid -Might to cancel them. The CRA grants resolutions to bypass senate filibusters and solely want majority votes in each rooms to cross.

Learn extra: Crypto taxes: What does laws appear like everywhere in the world?

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now