Altcoin

Is $80,000 inevitable for BTC as investors flock to Bitcoin’s ‘safe haven’?

Credit : ambcrypto.com

- With main establishments betting on its future, Bitcoin is more and more seen as a retailer of worth

- Enormous quantities of USDT are flooding the market, indicating indicators of liquidity

Buyers switched from conventional shares to Bitcoin [BTC] as a result of they think about the latter as an asset with decrease threat and excessive potential.

The aforementioned pattern was highlighted by Bitcoin’s 10% acquire on the weekly charts, pushing it to a brand new all-time excessive of $77,000. That is in opposition to the backdrop of accelerating uncertainty about Trump’s fiscal coverage – particularly the Chinese language tariffs and rising nationwide debt.

With the brand new administration centered on positioning the USA as a crypto capital, Bitcoin’s place as a protected haven may very well be reconsidered.

Main establishments are betting on the way forward for Bitcoin

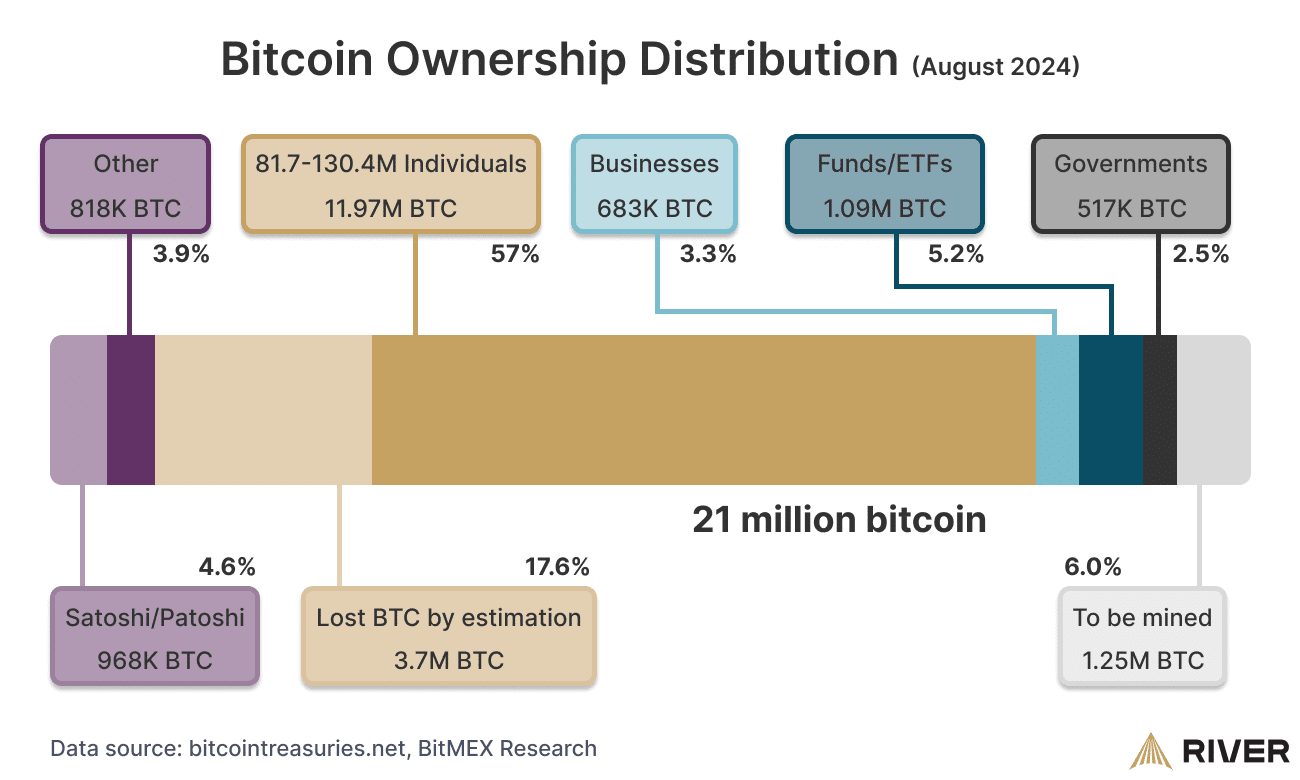

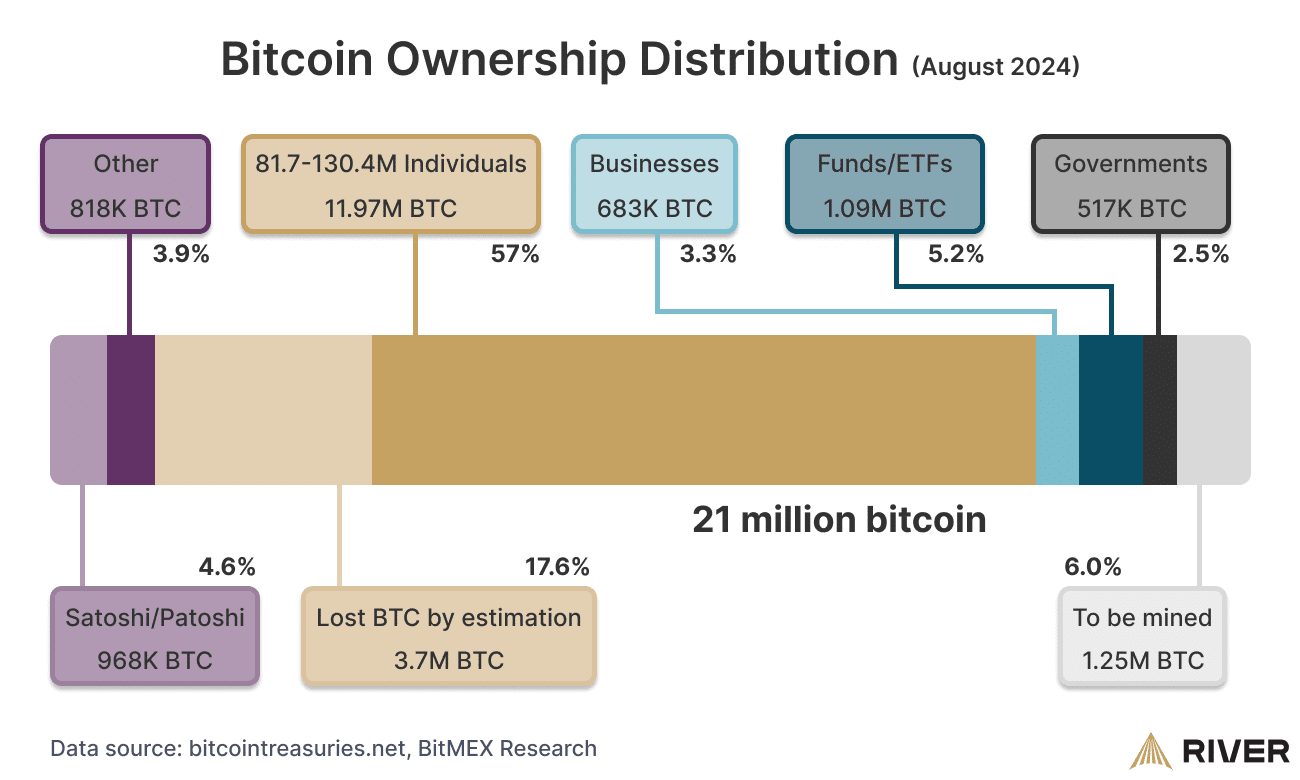

With Bitcoin’s mounted provide of 21 million cash, traders are more and more piling on BTC as a real retailer of worth. In truth one report from monetary intelligence company River highlighted BTC’s engagement with key stakeholders.

Supply: River

This assist was essential, particularly as derivatives markets have developed for the reason that final presidential election, with Open Curiosity (OI) reaching document lows. file $45 billion.

The rising institutional curiosity gives long-term certainty and helps to soak up speculative fluctuations. Because of this, there have been $36.28 million in liquidations within the final 24 hours occurredclosing $25.20 million briefly positions.

Furthermore, BTC ETFs have damaged data with large numbers inflowonly a day after the election outcomes. This has put retail traders in a robust place as they view the present value as a high-risk, high-reward dip.

If this momentum continues, BTC may attain $80,000 by the top of the final buying and selling days of November. This may also be confirmed by one other set of bullish elements.

There will likely be monumental liquidity, however…

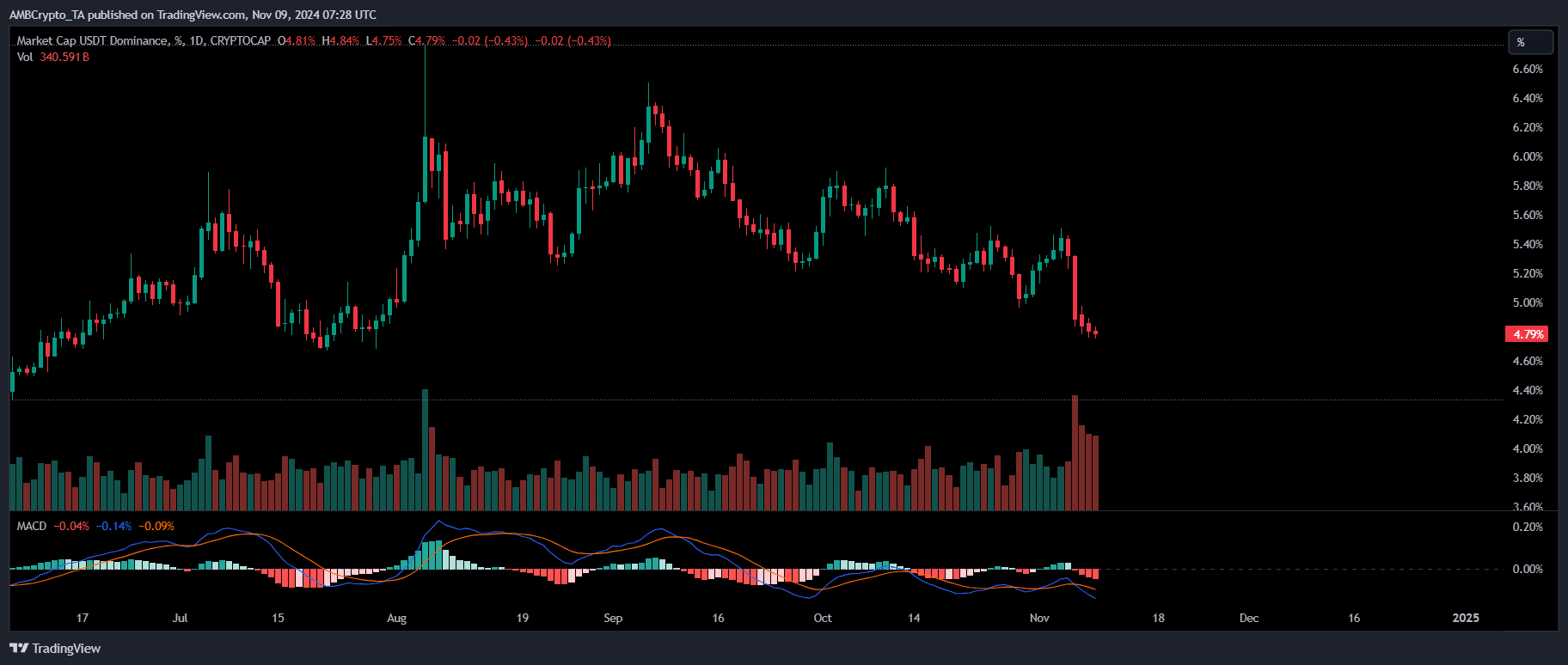

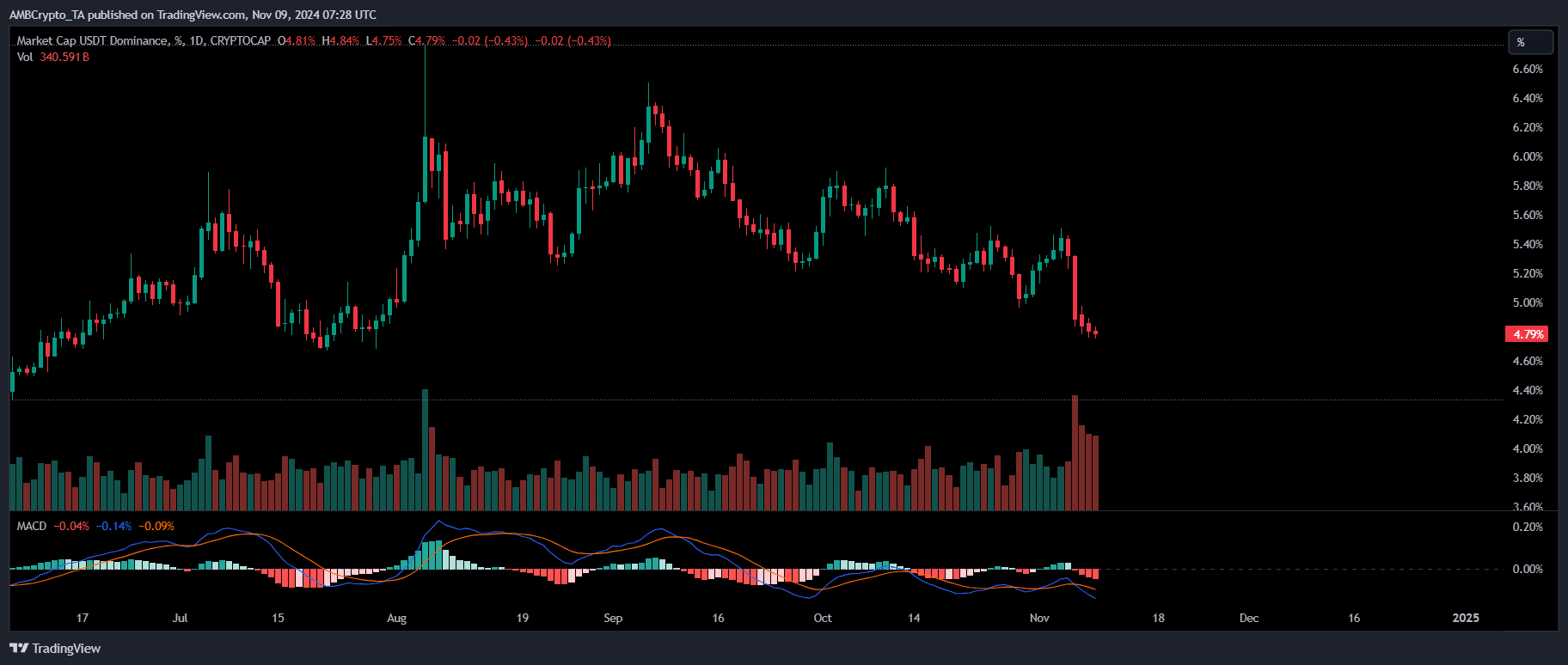

In contrast to earlier cycles the place USDT market dominance waned however rebounded, this time it has steadily declined. Regardless of getting into a threat zone, its dominance confirmed constant pink bands, reaching a every day low of 6% on Election Day.

Supply: TradingView

A low USDT market share usually signifies that BTC is nearing a market backside as traders transfer stablecoins again into belongings. They see the present value as a beautiful entry level.

Tether’s Treasury just lately minted 1 billion USDT tokens, given the present market circumstances the place Bitcoin emerged as a safer asset.

Regardless of bullish indicators, the market could now overheat. The RSI indicated an overbought situation, with value actions rising 74% over the previous two weeks.

Weak arms pays out, inflicting a small reversal. Monitoring giant addresses is subsequently important, as their assist will likely be essential in absorbing this stress. So Bitcoin was at a crossroads on the time of writing.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Quick-Time period Holders (STHs) may promote their beneficial properties, inflicting a small pullback. Nonetheless, total market sentiment nonetheless pointed to a rally to $80,000 earlier than the top of the month.

A significant factor supporting this pattern is the rising uncertainty surrounding “Trump transactions.” This makes Bitcoin a safer guess than shares, boosting institutional curiosity.

Whereas a small dip appeared potential, BTC’s bull rally regarded poised to proceed on the time of writing.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now