Bitcoin

Is A Bitcoin Supercycle Imminent?

Credit : bitcoinmagazine.com

Bitcoin rises in 2025 and ignites hypothesis a few historic Bitcoin -Supercycle. After a fleeting begin of the yr, renewed momentum, recovering sentiment and bullish statistics, analysts have those that ask: are we a few Bitcoin Bull Run repeat 2017? This Bitcoin worth evaluation investigates cycle comparisons, investor habits and long-term traits to evaluate the likelihood of an explosive part on this market cycle of this cryptocurrency.

How the Bitcoin cycle of 2025 pertains to previous bull runs

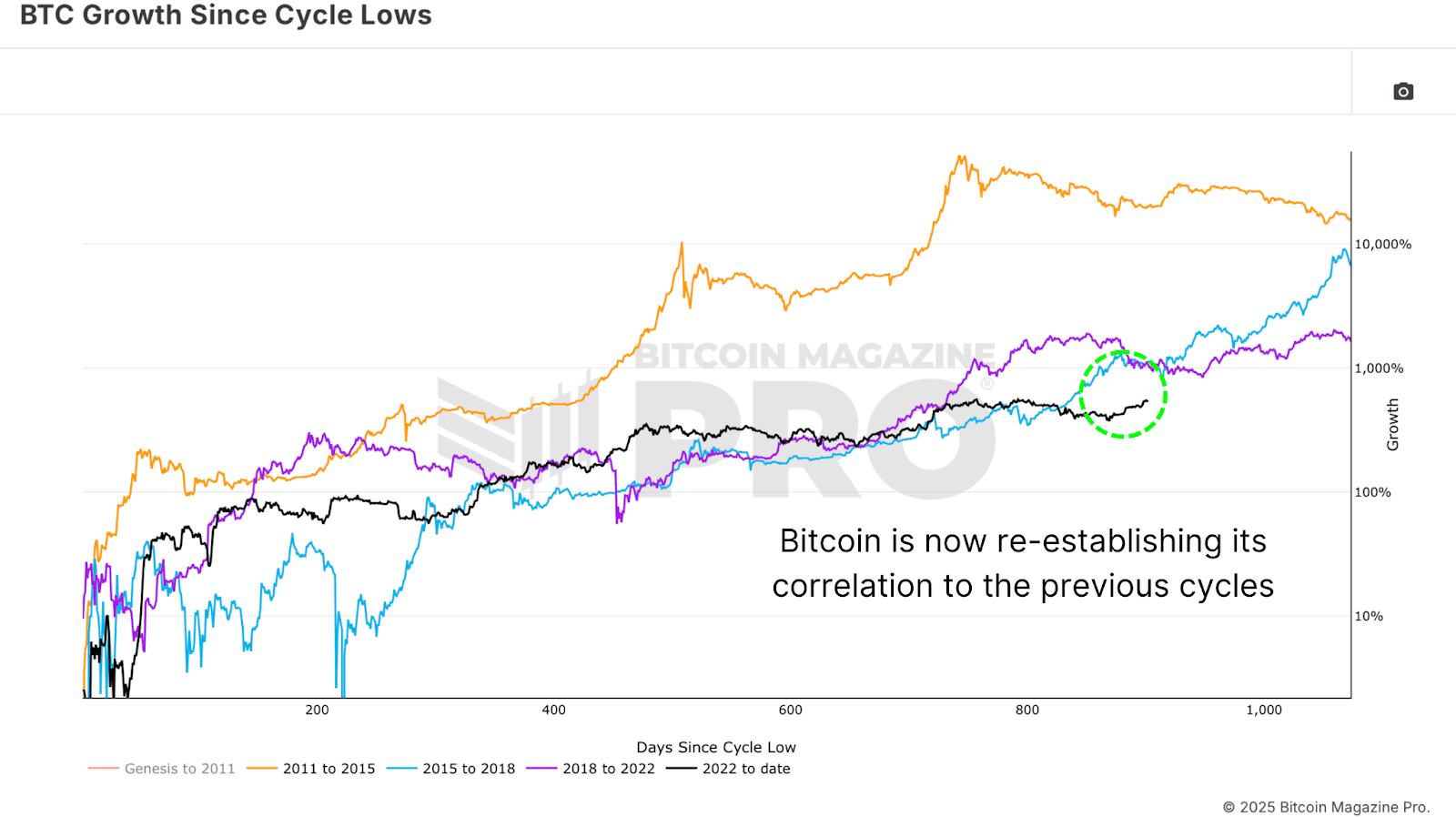

The most recent Bitcoin worth has reset expectations. In keeping with the BTC growth since cycle low Graphics, Bitcoin’s course of arrives carefully with the cycles of 2016-2017 and 2020-2021, regardless of macro challenges and drawings.

Traditionally, Bitcoin Market Cycli peaks for about 1,100 days from their lows. After about 900 days after the present cycle, a whole lot of days may be left for potential explosive Bitcoin worth development. However do investor habits and market mechanics help a Bitcoin SuperCycle 2025?

Bitcoin Investor Conduct: Echoes van de Bull Run 2017

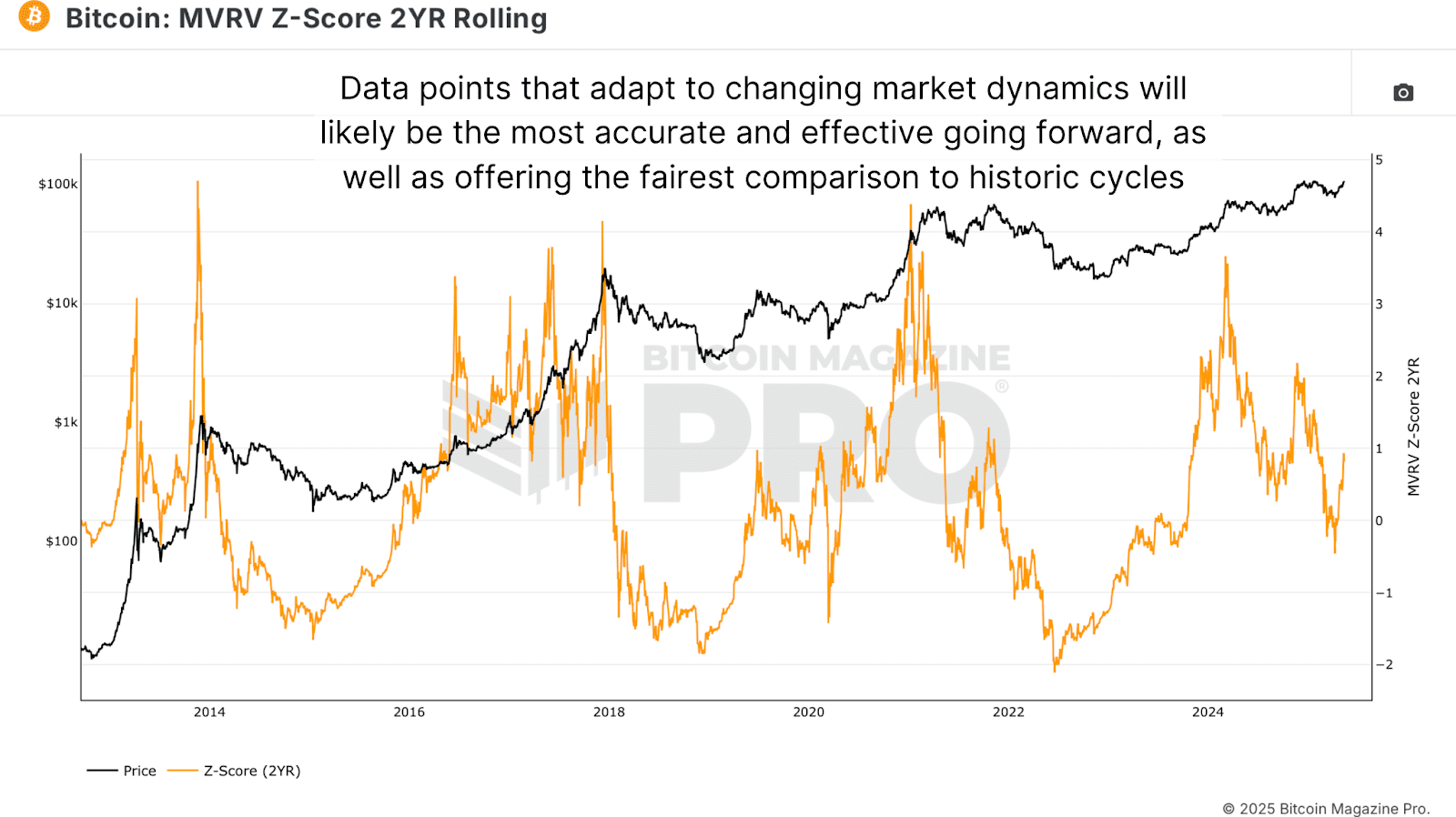

To gauge the psychology of cryptocurrency buyers, the 2-year-old rolling MVRV-Z-score Affords important insights. This superior metriek is sweet for misplaced cash, illiquid supply, rising ETF and institutional corporations and altering long-term Bitcoin holders habits.

Final yr, when Bitcoin Value ~ $ 73,000 reached, the MVRV-Z-score reached 3.39-a excessive however not unprecedented degree. Retracements adopted, reflective consolidations from the mid -cycle that may be seen in 2017. The 2017 cycle particularly contained a number of high-score peaks earlier than the final parabolic bitcoin rally.

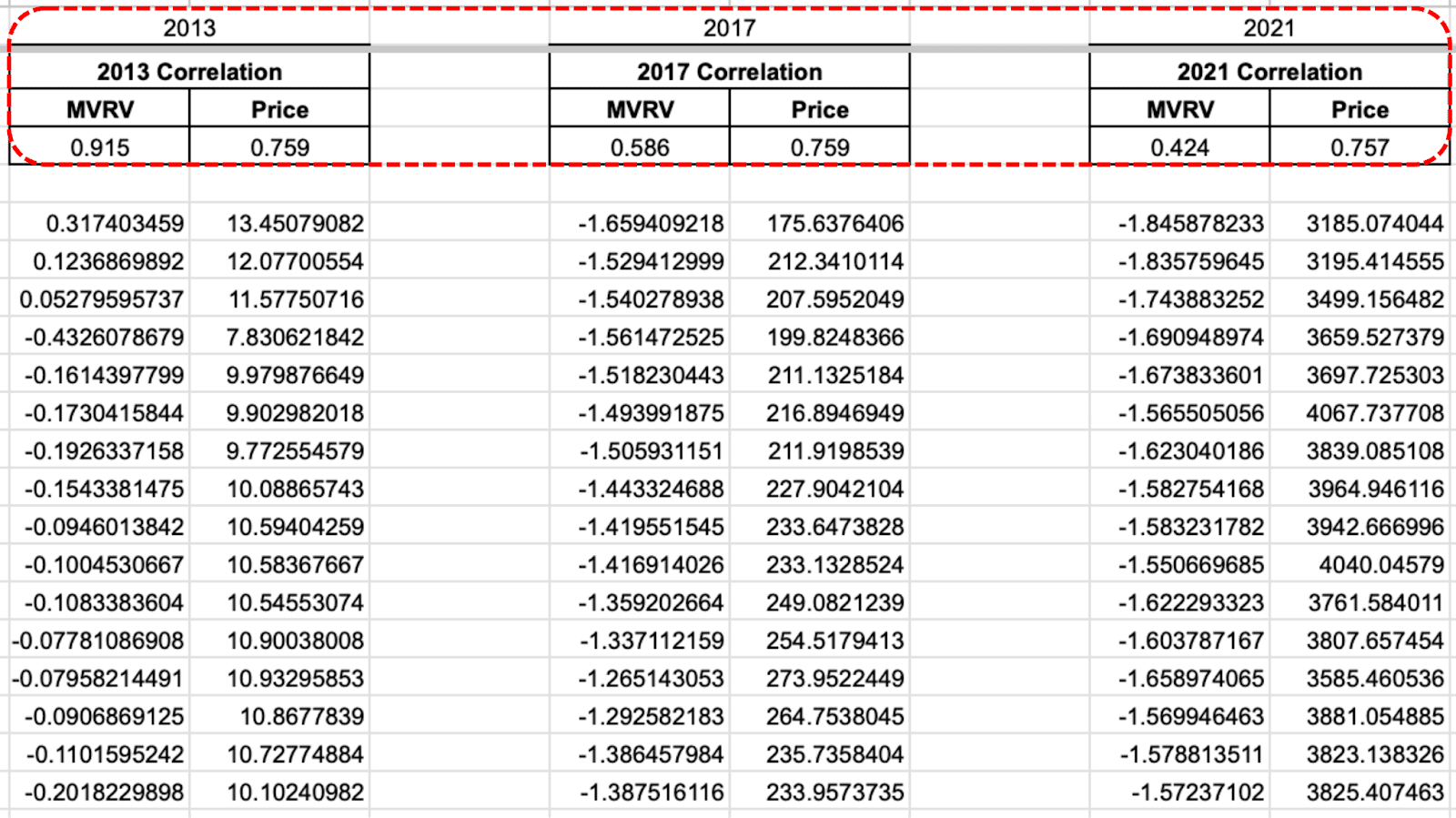

Use of the Bitcoin Magazine Pro APIA Cross-Cycle Bitcoin evaluation unveils a placing 91.5% behavioral correlation with the double peak cycle of 2013. With two giant tops all pre-destroying ($ 74k) and one post-lighting ($ 100k+)-would be capable to mark a 3rd of all time of a possible of a possible darbully of plenty of threefold. Bitcoin-SuperCycle.

The 2017 cycle reveals a correlation of 58.6%, whereas the investor habits of 2021 is much less comparable, though the Bitcoin worth promotion correlates with ~ 75%.

Lengthy-term Bitcoin holders sign sturdy belief

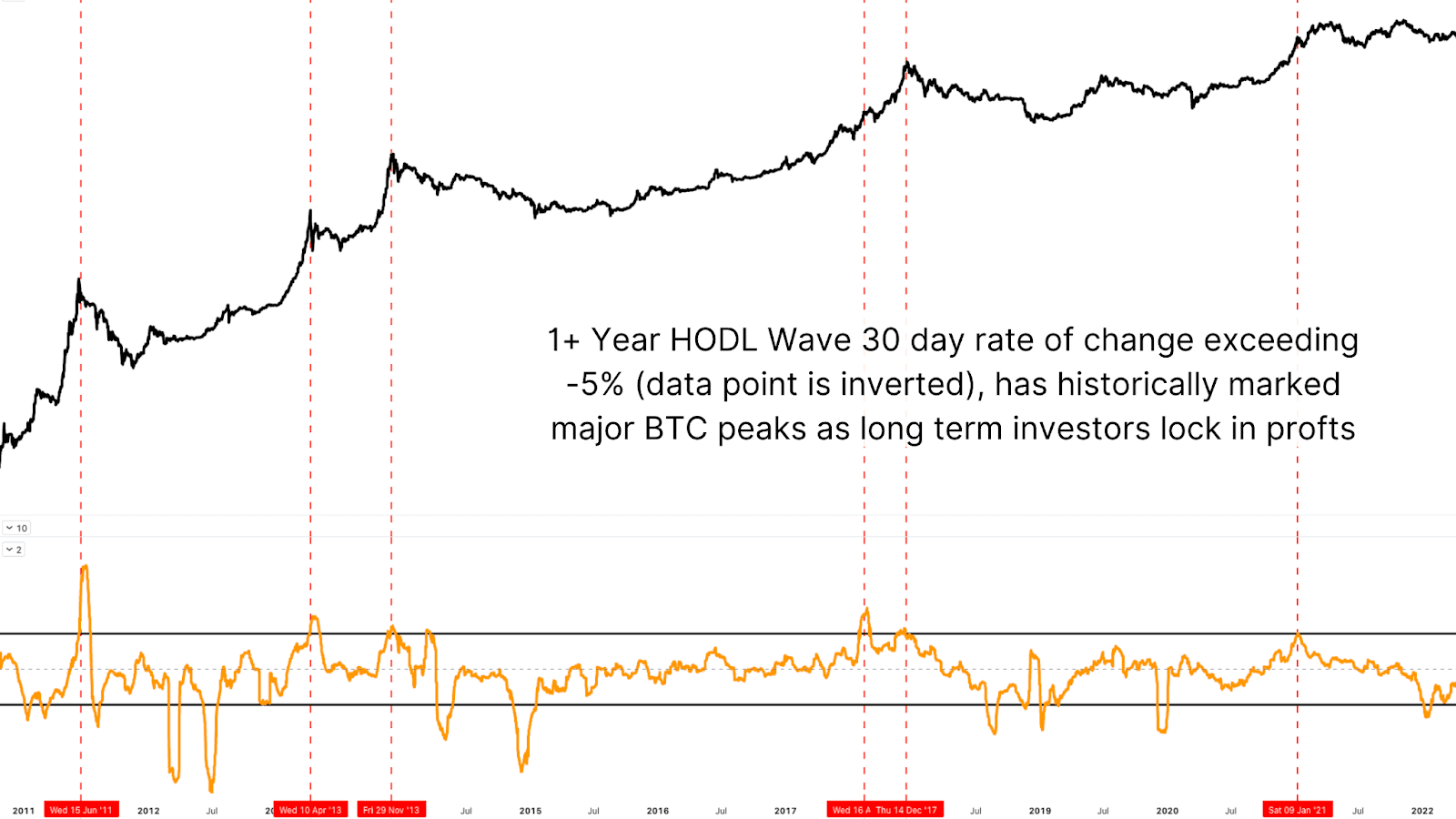

The 1+ year Hodl Wave Reveals the proportion of BTC that is still unmoved for a yr or extra, even when costs rise-a uncommon development in bull markets that replicate a robust long-term conviction.

Traditionally, sharp will increase within the HODL -Wave’s pace of change indicators principal bottoms, whereas Sharp is reducing the tops of the marker lower. At the moment, the metric is at a impartial bending level, removed from peak distribution, indicating that Bitcoin buyers anticipate significantly increased costs in the long run.

Bitcoin SuperCycle or extra consolidation?

Can Bitcoin replicate the euphoric parabolic rally of 2017? It’s doable, however this cycle can minimize a singular path and mix historic patterns with trendy cryptocurrency market dynamics.

We might method a 3rd main peak inside this cycle – a primary within the historical past of Bitcoin. Whether or not this causes a full bitcoin-supercycle-melt-up stays unsure, however necessary statistics counsel that BTC is much from topping. The provision is tight, long-term holders stay steadfast and demand rises, pushed by the expansion of the stablecoin, institutional bitcoin investments and ETF streams.

Conclusion: Is a Bitcoin rally of $ 150k in sight?

Drawing direct parallels till 2017 or 2013 is seductive, however Bitcoin is not a peripheral gear. As an grownup, institutionalized market, the habits evolves, however the potential for explosive bitcoin development continues to exist.

Historic Bitcoin cycle correlations stay excessive, the habits of buyers is wholesome and technical indicators sign area for strolling. With out main indicators of capitulation, worthwhile or macro depletion, the stage is ready for sustainable Bitcoin worth growth. Whether or not it is a rally of $ 150k or afterwards, the Bitcoin Bull Run of 2025 could possibly be one for the historical past books.

Go to a go to to a bigger research, technical indicators, actual -time market warnings and entry to a rising group of analysts Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your personal analysis earlier than you make funding choices.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now