Altcoin

Is AAVE’s rise to $400 sustainable? This is why key statistics point to caution

Credit : ambcrypto.com

- The worth of AAVE has elevated by 18% within the final 24 hours.

- Promoting stress on the token elevated, indicating a slight worth correction.

AAVE has delivered a stellar efficiency up to now 24 hours with double-digit worth positive factors. This latest uptrend might push the token additional above $400 as predicted by a preferred analyst.

That is why AMBCrypto assessed its metrics to search out out if the street forward is evident.

AAVE bulls are on the transfer

AAVE has damaged away from the highest cryptos because it registered an 18% worth improve within the final 24 hours. On the time of writing, it was buying and selling at $378 with a market cap of over $5.6 billion.

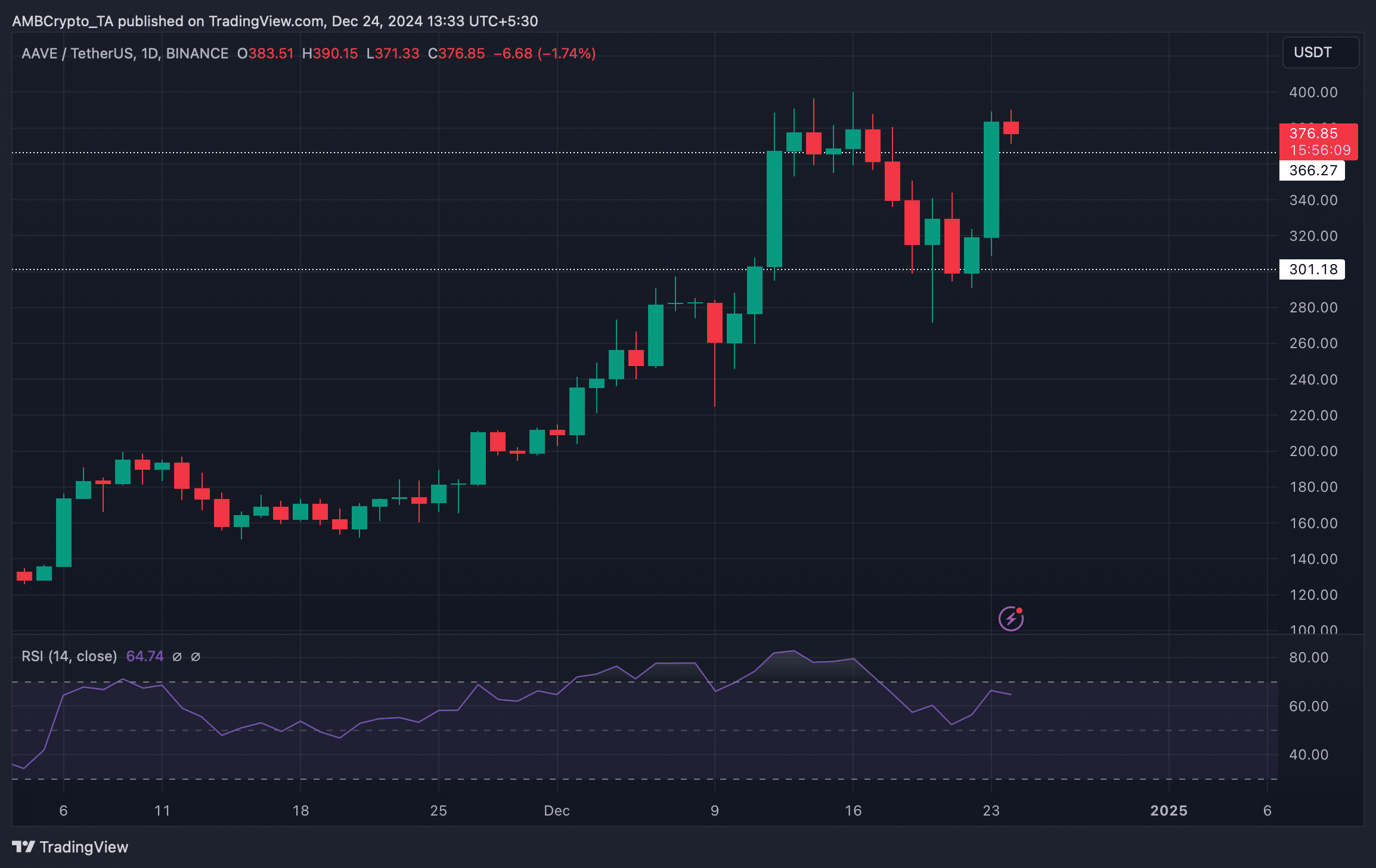

Ali Martinez, a preferred crypto analyst, posted one tweet that indicated comparable progress when one situation was met. In response to the tweet, an Adam and Eve sample fashioned on the token’s map. Within the occasion of a profitable breakout above the USD 342 resistance zone, the token might quickly cross USD 400.

Particularly, Martinez mentioned a breakout might lead to a 19% worth improve. Fortuitously, the token managed to interrupt out efficiently, and on the time of writing, it was marching in direction of the $400 mark.

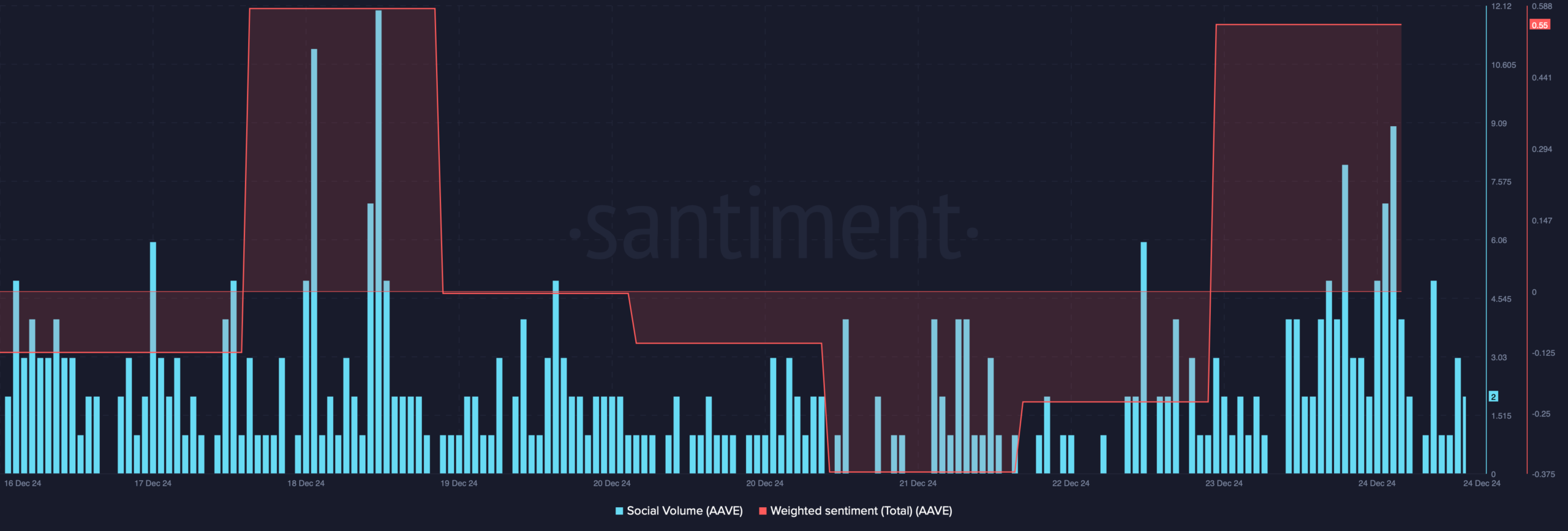

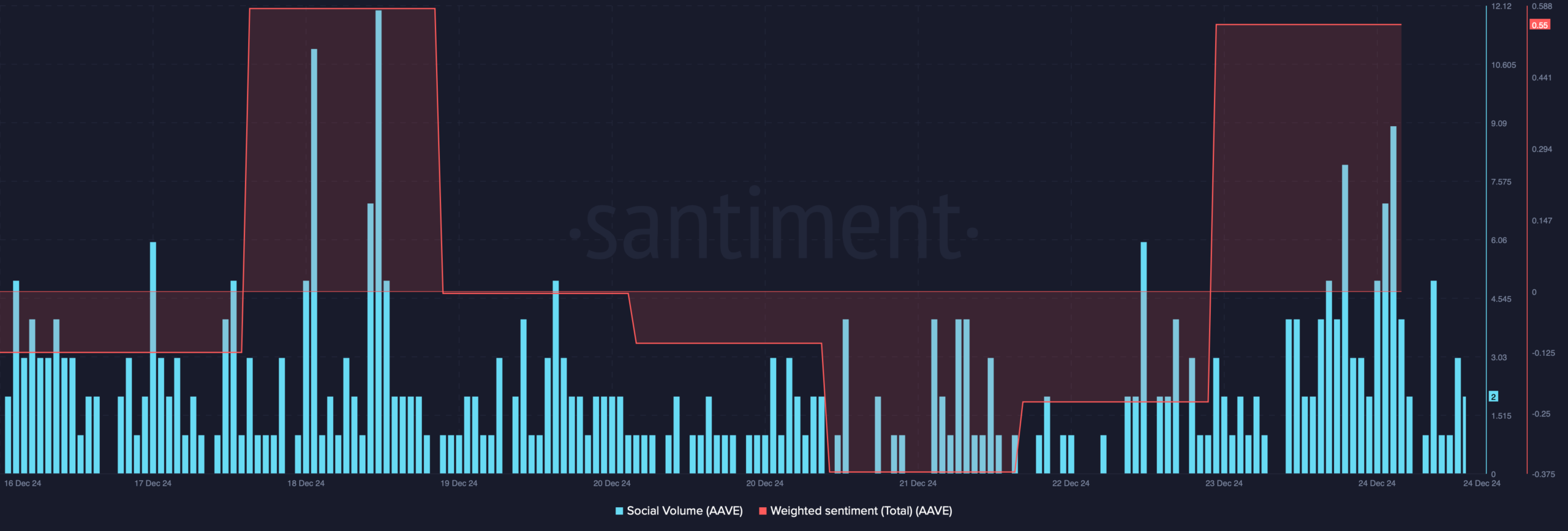

This latest worth improve additionally had a optimistic influence on the token’s social metrics. For instance, weighted sentiment ended up within the optimistic zone, that means bullish sentiment round AAVE rose.

Its social quantity additionally elevated – a transparent signal of the coin’s recognition within the crypto market.

Supply: Santiment

Probability that AAVE will keep the pump

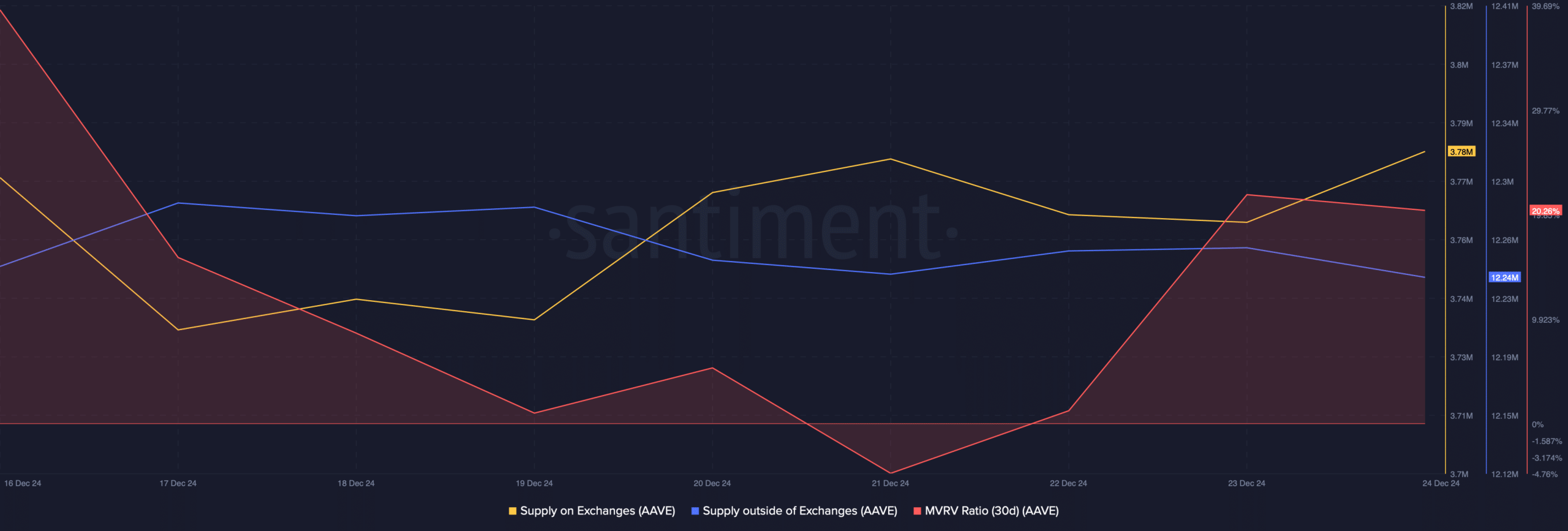

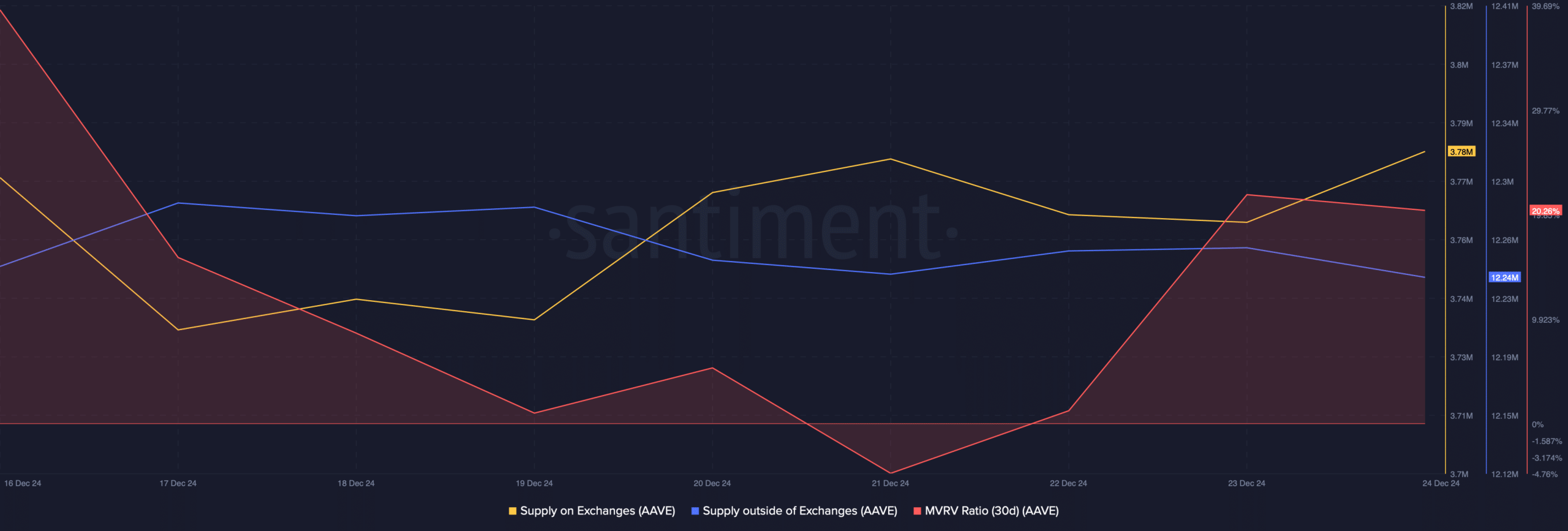

AMBrypto then seemed on the token’s on-chain knowledge to search out out if this bull run will proceed. The evaluation reveals that promoting stress seems to have elevated within the latest previous.

The provision of AAVE on the exchanges elevated, whereas the availability exterior the exchanges decreased. Each time that occurs throughout a bull rally, it signifies that traders are cashing out to make a revenue, typically leading to worth corrections.

One other bearish measure was the MVRV ratio, which fell barely after a promising rise on December 23.

Supply: Santiment

Just like the above statistics, Coinglass’ facts revealed that there have been extra brief positions available in the market than lengthy positions because the token’s lengthy/brief ratio (4 hours) fell over the previous 24 hours.

Learn From Aave [AAVE] Value prediction 2024-25

If a worth correction happens, will probably be essential for AAVE to check its help at $366 to renew a rally in direction of $400 within the coming days.

But when the token slips under help, the value might fall once more to $301.

Supply: TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024