Altcoin

Is AVAX Poised for a 12% Rally? 74% of traders think so, because…

Credit : ambcrypto.com

- AVAX might rise 12% to succeed in $28.50 if it holds itself above the $24.50 degree

- On-chain statistics and technical evaluation urged that bulls have been dominating the asset

AVAX market sentiment and worth motion have usually been vital to the altcoin’s destiny. For instance, over the previous two days, broader sentiment within the crypto market has been fairly unfavorable. Nonetheless, it seems to be like AVAX is prepared for an additional rally.

AVAX technical evaluation and key ranges

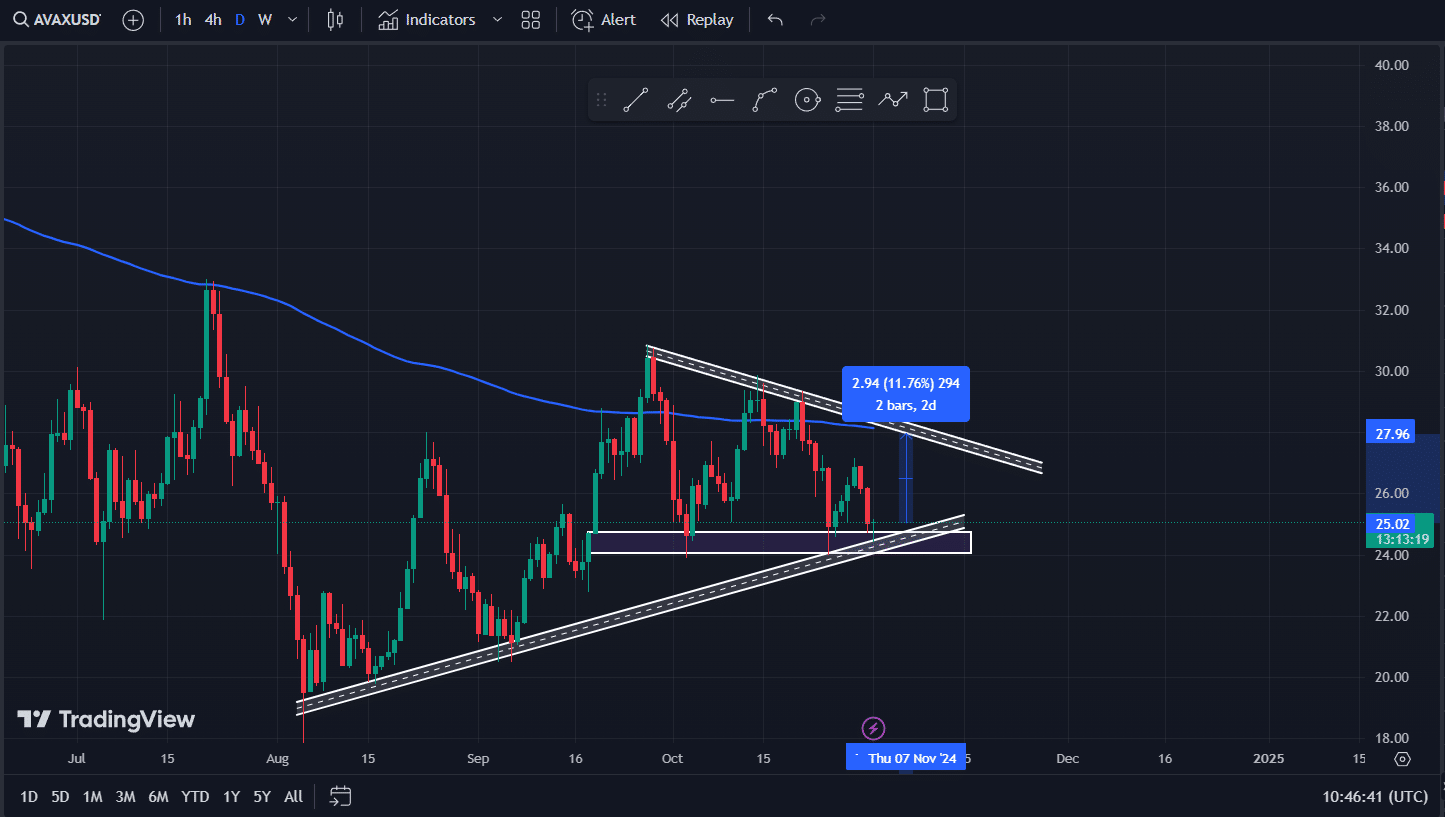

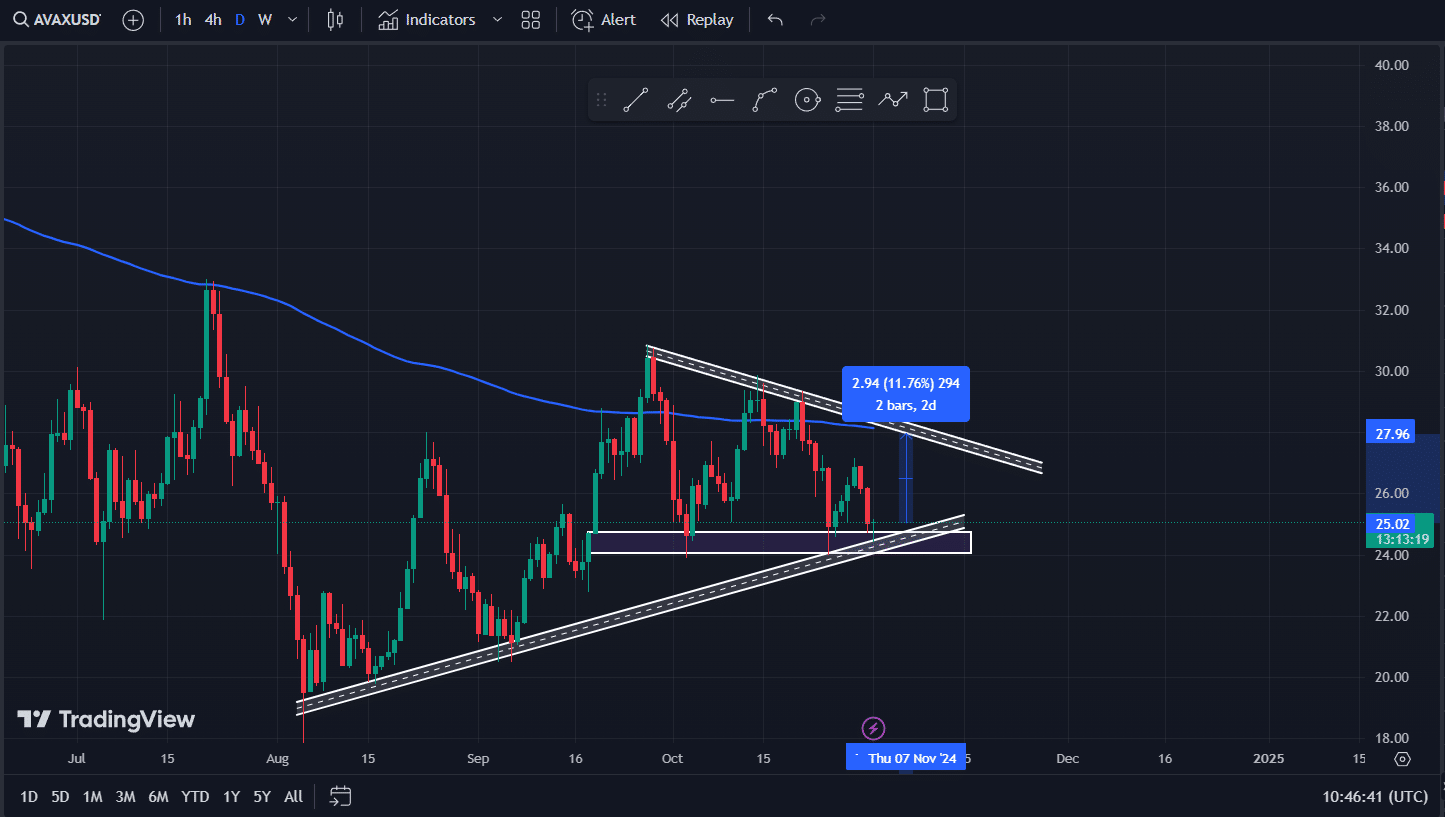

In line with AMBCrypto’s technical evaluation, AVAX stays fairly bullish and will rise 12% to succeed in the $28.50 degree within the coming days.

In reality, the latest worth motion confirmed that because the asset’s worth approaches the $24.50 assist degree, there’s some shopping for stress and a worth reversal.

Supply: TradingView

Aside from this horizontal assist degree, AVAX was supported by an upward trendline on the time of this writing, which has been in place since early August 2024. As with the horizontal assist degree, each time the asset’s worth reaches this trendline, it tends to stage a notable upward rally.

On the time of writing, AVAX gave the impression to be buying and selling under the 200 Exponential Transferring Common (EMA) each day, indicating an upward development. In the meantime, the Relative Power Index (RSI) urged a attainable upside rally because it was in oversold territory.

AVAX’s bullish thesis will solely maintain if it stays above the $24.50 degree. In any other case it would fail.

Bullish statistics within the chain

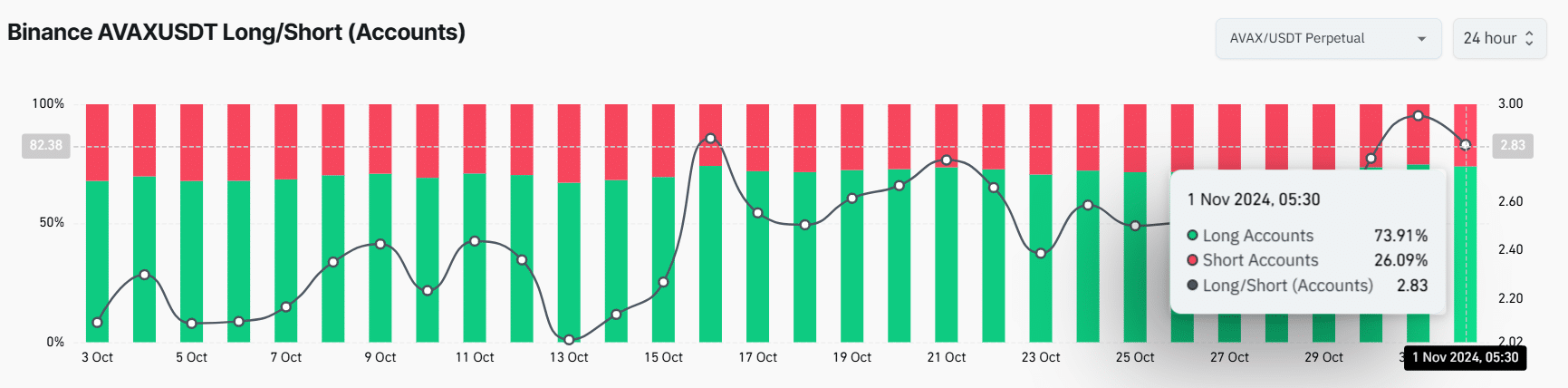

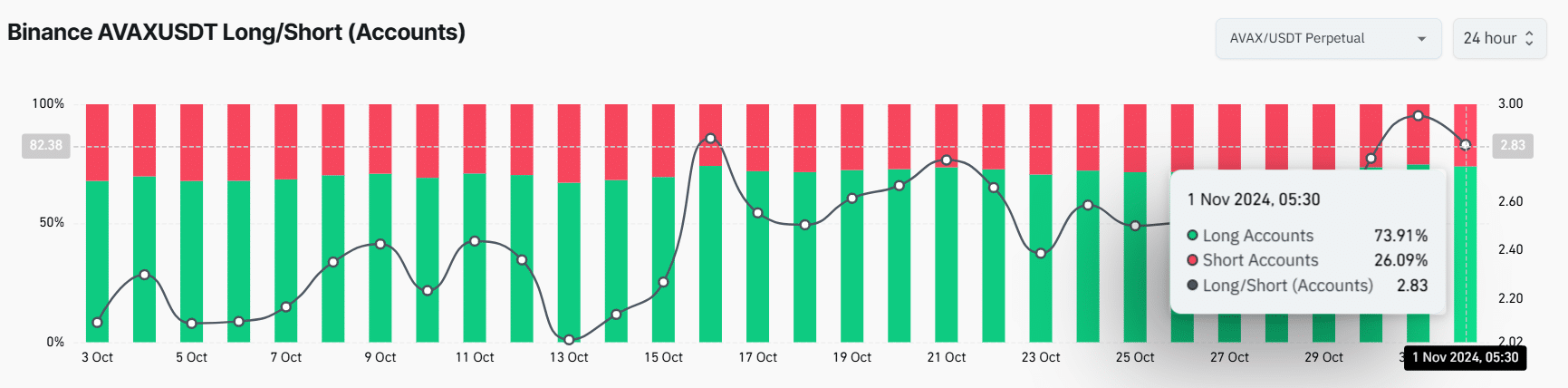

Along with this optimistic technical evaluation, on-chain metrics similar to key liquidation ranges and the Lengthy/Quick ratio additional supported this bullish outlook. For instance, based on on-chain analytics agency CoinGlass, Binance’s AVAX Lengthy/Quick ratio had a worth of two.83 on the time of writing.

Supply: Coinglass

This discovering hinted at robust bullish sentiment amongst merchants. Furthermore, 73.91% of the highest merchants on Binance appeared to have lengthy positions, whereas 26.09% of them had brief positions.

Excessive liquidation ranges

Presently, the important thing liquidation ranges are at $24.35 on the draw back and $25.45 on the upside, with merchants at these ranges being over-leveraged, based on Coinglass.

If sentiment stays bullish and the worth rises to the $25.45 degree, brief positions price almost $875,300 shall be liquidated. Conversely, if sentiment adjustments and the worth falls to the $24.35 degree, lengthy positions price roughly $2.94 million shall be liquidated.

The mix of those on-chain metrics with technical evaluation urged that AVAX bulls are at present dominating the asset base and will assist an upcoming rally.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now