Bitcoin

Is Bitcoin due for a pullback? – THESE key datasets suggest…

Credit : ambcrypto.com

- Bitcoin’s community ranking surpasses the exercise because the demand is weakened and the supply strain will increase.

- Alternate influx and detrimental DAA diversion counsel that gross sales dangers persist regardless of value stability.

Bitcoin’s [BTC] The market surroundings has change into more and more susceptible, with essential demand statistics that flip Bearish, whereas the alerts on the provision aspect intensify in several indicators.

On the time of writing, Bitcoin traded at $ 108.129.78, which displays a modest revenue of 0.68% within the final 24 hours.

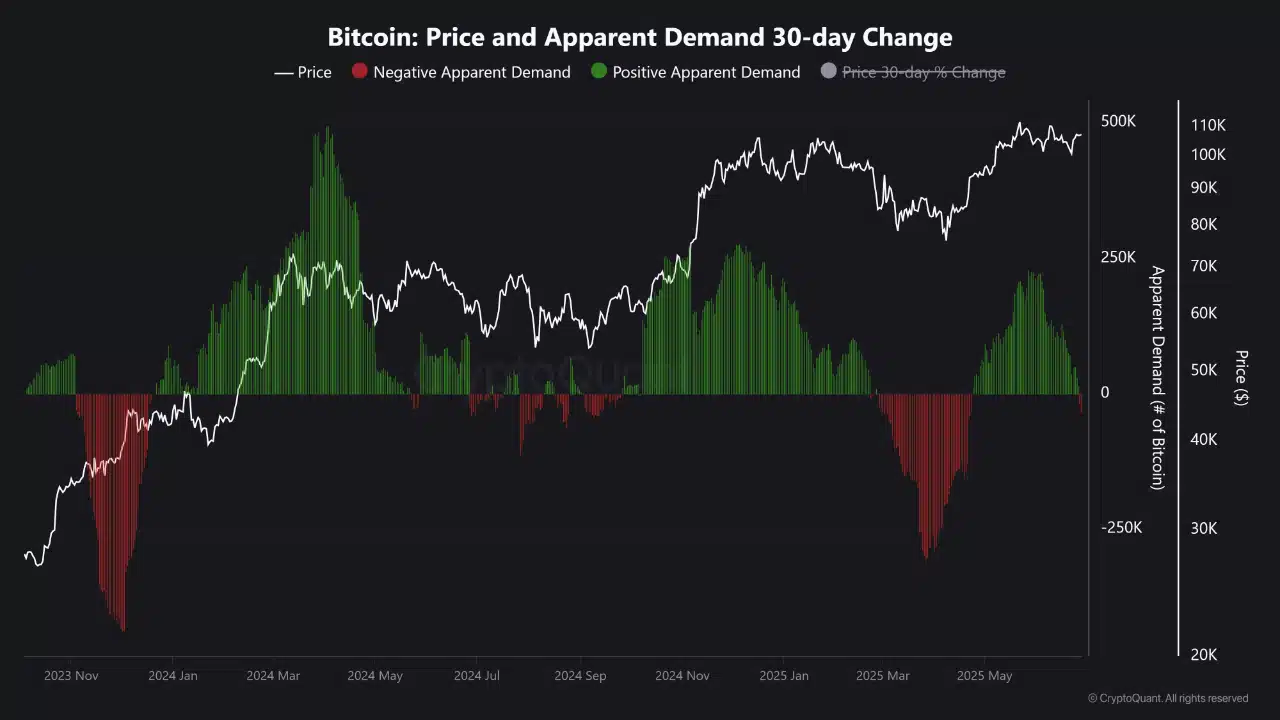

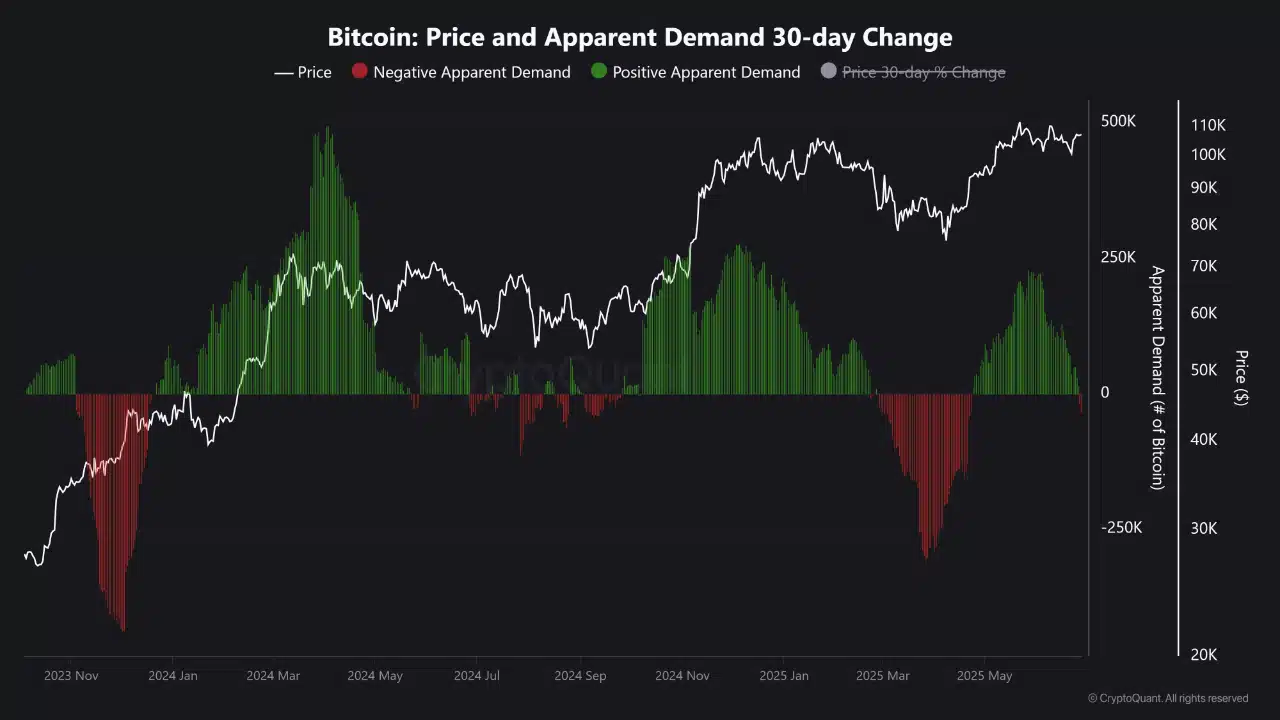

Nonetheless, this enhance contrasts sharply with underlying weak point on the chain. The obvious demand that measures the power of recent consumers to soak up the provision of miners and lengthy -term holders has once more change into detrimental.

This shift emphasizes the renewed distribution of skilled holders and miners, which uncovered Bitcoin to brief -term dangers within the midst of blurring natural demand and restricted new capital influx.

Supply: Cryptuquant

Do rising miner win and valuation statistics flash that early warning alerts?

On the time of writing, the Puell A number of skipped 25.73% to 1.26, indicating that miners are actually significantly extra worthwhile than regular, usually a precursor of elevated gross sales strain.

On the similar time, Bitcoin’s NVT ratio was additionally 84.17% to 55.17, which exhibits that market capitalization exceeds the transaction quantity. This can be a frequent sign of overvaluation.

Collectively these statistics counsel that, though the worth elevated, underlying community exercise and supply dynamics are incorrectly aligned.

Bitcoin may expose this imbalance to a withdrawal, particularly if the demand fails to soak up cash, miners will quickly have the ability to load the market. Warning is suggested within the midst of those rising warning alerts.

Supply: Cryptuquant

Does worthwhile holders scale back the possibility of robust assist?

From writing, greater than 98.82% of the Utxos was in revenue, whereas only one.17% was loss, indicating that almost all holders are on non -realized revenue.

Though this could counsel energy, this additionally implies that fewer market members are inspired to purchase the dip.

Furthermore, such a crooked revenue/loss distribution usually precedes native tops, whereby taking a revenue is broadly enhanced.

The shortage of loss -heavy holders additionally weakens the psychological assist zones, making value flooring much less dependable.

Are optimistic Netflows a warning sign for upcoming gross sales strain?

On the time of the press, BTC registered a internet influx of $ 57.5 million – the primary exceptional optimistic present in a sea.

Alternate Netflows Rotating Inexperienced Sign that buyers might put together themselves to promote, as a result of extra cash are deposited on festivals.

This shift in trade exercise might point out a reversal in market sentiment, whereby holders transfer from accumulation to distribution.

Given the background of weak demand and overhead alerts, rising trade deposits can exert further strain on the worth of BTC if the end result is because of elevated gross sales orders.

Can BTC gather whereas energetic handle progress stays Bearish?

Regardless of the worth of BTC that floats almost $ 108k, the DAA Divergence card stays deep purple.

This exhibits that the expansion in energetic addresses is lagging behind the worth promotion, which signifies that speculative value actions aren’t supported by actual consumer acceptance.

Traditionally, a detrimental DAA diversion has corrected properly, particularly when the worth climbing whereas the handle exercise stagnates or falls.

The present intensive purple zone in divergence evokes concern that the market energy is on the floor stage and is lacking elementary assist.

Can BTC retain its value with out a actual query?

Bitcoin continues to commerce above $ 108k, however a number of alerts on the chains point out the rising weak point below the floor.

Rising profitability of the miner, optimistic trade community flows and a rising NVT ratio point out growing sales-side strain and potential overvaluation.

Within the meantime, detrimental DAA -diversion and a excessive share of worthwhile Utxos are advised shopping for purchaser assist.

With no significant restoration of demand and community exercise, BTC may be confronted with elevated volatility and struggling to take care of its present place within the brief time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024