Bitcoin

Is Bitcoin nearing a rebound? – THESE metrics say ‘yes’

Credit : ambcrypto.com

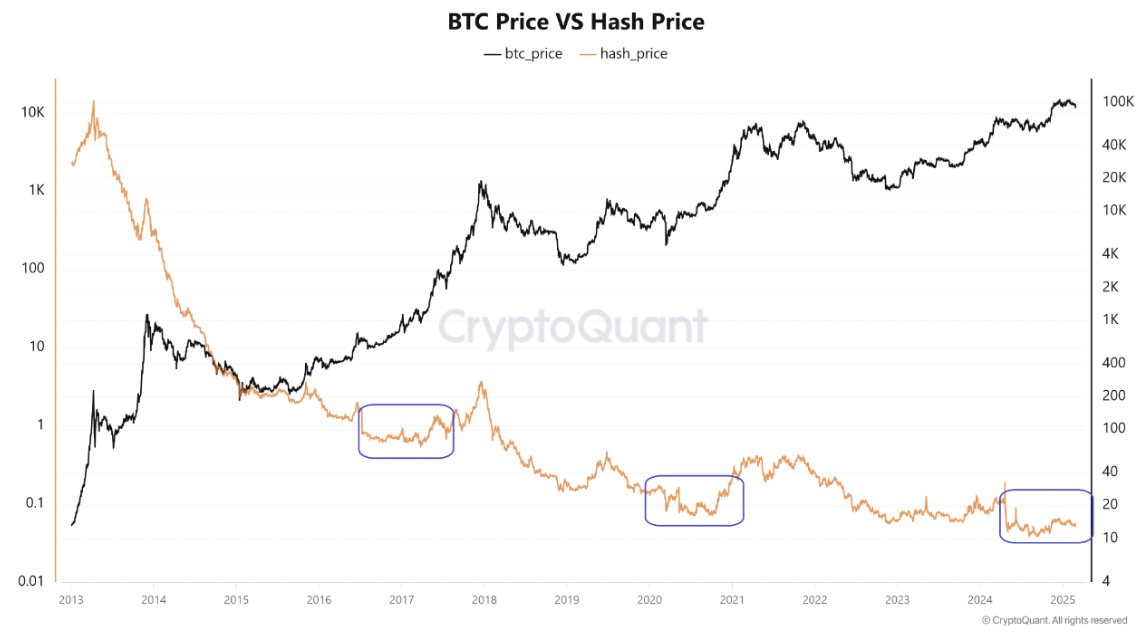

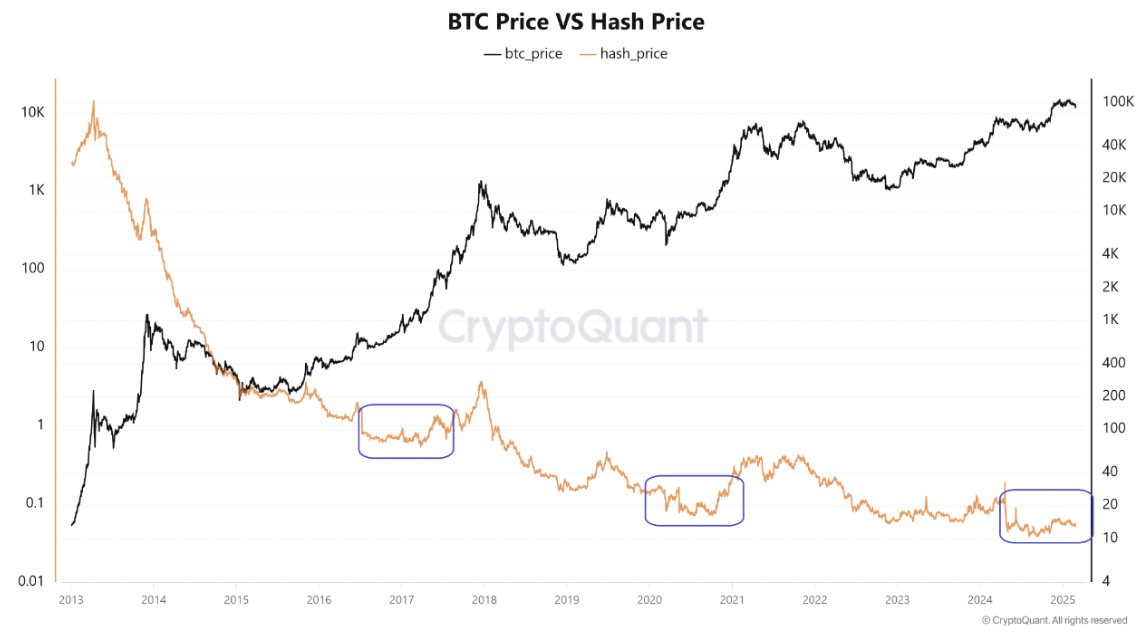

- Bitcoin’s decrease hash value advised that it could method a value base, which can point out a rebound.

- Growing energetic addresses and rising stock-flow ratio pointed to rising market confidence and shortage.

Bitcoin [BTC]S Current actions in Hashprijs tailor-made to patterns from the previous, which means that the cryptocurrency might method a backside. On the time of the press, Bitcoin traded at $ 80,101.35, with 7.67% within the final 24 hours.

Traditionally, decrease hash -pricing durations agreed to meet Bitcoin’s value that’s on the underside, indicating {that a} potential rebound may very well be on the horizon.

Whereas BTC assessments these key ranges, it raises the query – can this be an excellent accumulation part earlier than the subsequent bullrun is?

Supply: Cryptuquant

Bitcoin’s in/out of the cash graph reveals fascinating insights into the present market sentiment. A big a part of BTC, round 75.30% (14.95 million BTC), stays “within the cash”, which reveals that the majority buyers are nonetheless in revenue.

Nevertheless, 23.23% (4.61 million BTC) Bitcoin addresses are “exterior the cash”. This reveals that though most Bitcoin holders stay worthwhile, the market will not be with out challenges.

BTC: The rising exercise on the blockchain suggests …

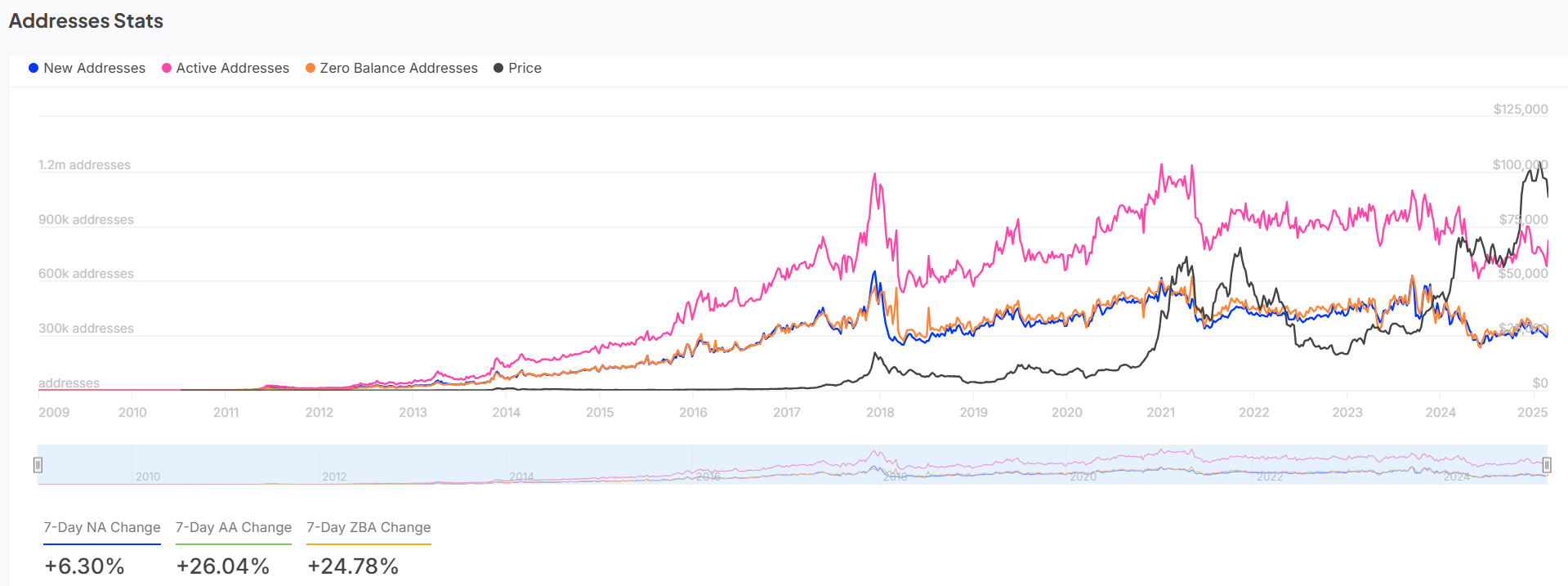

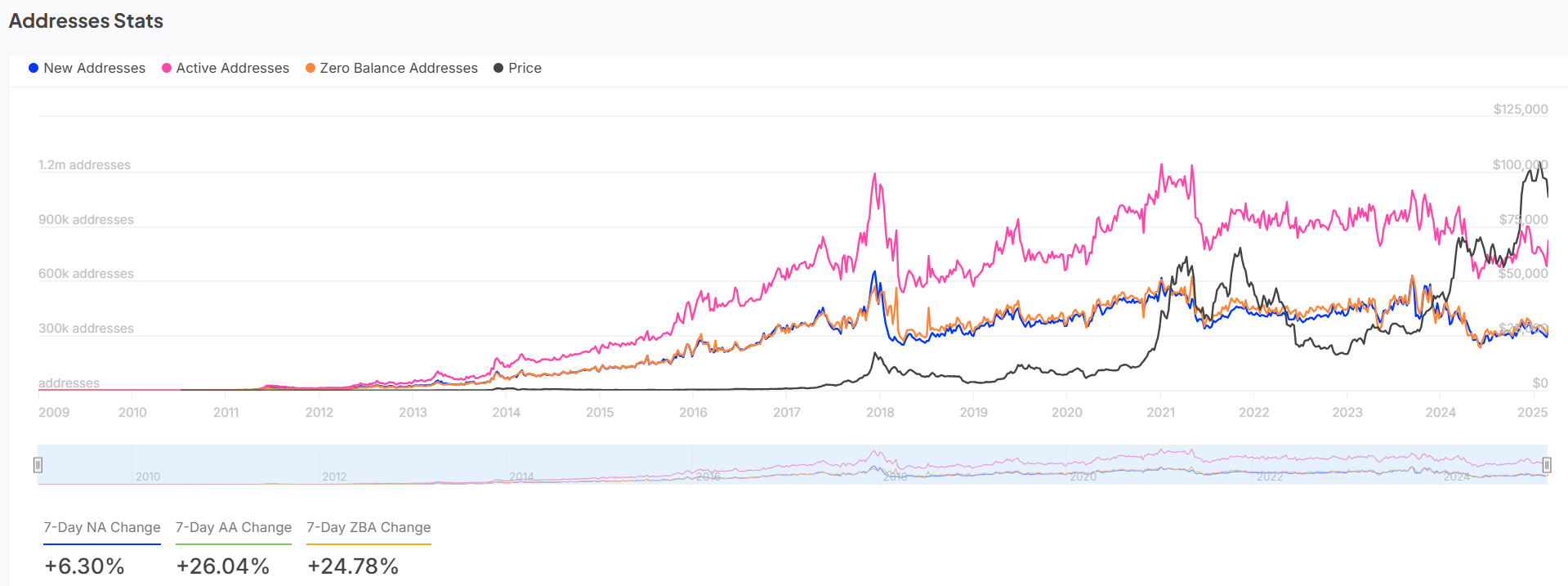

The tackle statistics of Bitcoin provide additional insights within the route of the market. Lively addresses have elevated by 6.30% within the final 7 days, which displays the rising participation within the Bitcoin community.

The pink line, which represents energetic addresses, reveals a gentle enhance that carefully displays the value actions of Bitcoin. Within the meantime, the variety of zero steadiness addresses has risen by 24.78%, indicating that many new customers hold Bitcoin energetic or buying and selling as an alternative of leaving their wallets.

This enhance in exercise, particularly with the rise in new addresses (26.04% previously week), means that market confidence is rising. This may result in a value rebound if BTC continues to realize energy.

Supply: Intotheblock

Breakout Vooruit? Present technical indicators …

The technical evaluation of Bitcoin reveals essential help and resistance ranges.

On the time of writing, BTC examined help at round $ 80.216, a degree that beforehand seen earlier value reactions. Nevertheless, the downward development line and the demolition of necessary help ranges recommend that BTC is underneath stress.

As well as, the stochastic RSI lecture of two.23 signifies a bought -over state, which frequently precedes a value reverse. The Bollinger tires additionally level to a tightening sample, indicating that volatility can enhance quickly.

These technical indicators recommend that BTC or this help degree might bounce or additional break down, relying on future market developments.

Supply: TradingView

BTC shares-to-flow ratio: growing shortage of fuels …

Bitcoin’s stock-flow ratio has risen by 100% over the previous 24 hours and reached to 2,1152 m. This means a rise in Bitcoin’s shortage, as a result of the velocity of latest supply continues to fall.

The rising stock-flow ratio means that, though BTC is confronted with short-term value volatility, the long-term proposal stays intact.

Whereas fewer BTC cash are launched over time, the shortage will increase the query and presumably push costs greater.

Supply: Cryptuquant

Does Bitcoin put together for a rebound?

Bitcoin is approaching a possible soil primarily based on present evaluation. The decrease hash value, mixed with growing energetic addresses, signifies a possible value popularity.

Though technical indicators such because the stochastic RSI point out a bought -up state, Bitcoin will in all probability expertise an elevated buy exercise. Shortage continues to stimulate worth.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024