The value of Bitcoin (BTC) has fallen under an important psychological help stage of round $100,000. The flagship coin fell greater than 2% on Thursday, hitting a low of round $98.2k earlier than recovering to commerce round $98.4k in the course of the Central North American buying and selling session.

Why did the Bitcoin value fall at this time?

Continued sell-off by whale traders amid gold and inventory market restoration

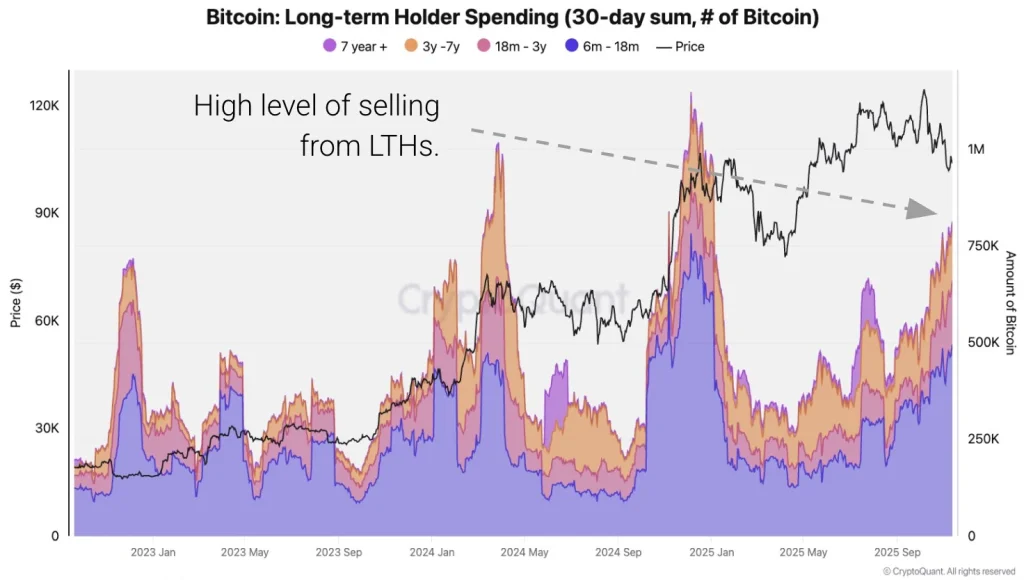

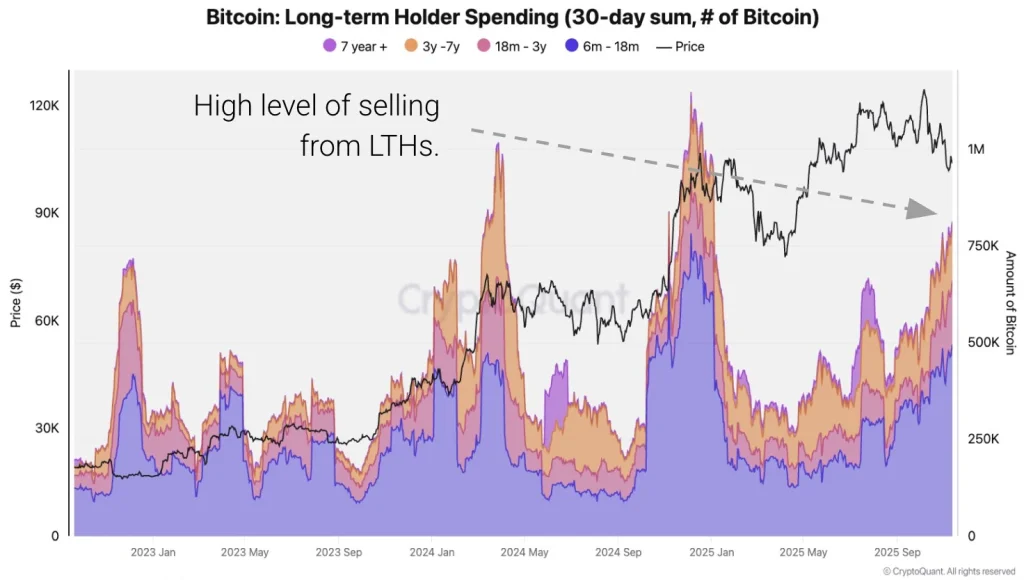

Bitcoin’s notable sell-off at this time was largely influenced by low demand from whale traders. In accordance with market knowledge evaluation from CryptoQuant, long-term holders of Bitcoin are aggressively deleveraging, just like the fourth quarter of 2024.

Supply: CryptoQuant

Precisely, long-term holders have offered 815,000 BTCs within the final 30 days. On-chain knowledge evaluation of Arkham revealed {that a} single whale offered Bitcoins value $290 million through Kraken on Thursday.

Amid the continued Bitcoin-led crypto sell-off, gold costs have risen. Regardless of the reopening of the US authorities, the move of capital into the crypto market has not but reached the capability to soak up the excessive promoting stress.

Heavy liquidation of lengthy merchants as a consequence of elevated concern of additional capitulation

Following the sudden Bitcoin-led crypto sell-off, greater than $647 million was liquidated from the leveraged crypto markets. In accordance with market knowledge evaluation of MintGlassGreater than $519 million concerned lengthy merchants, whereas Bitcoin accounted for greater than $234 million.

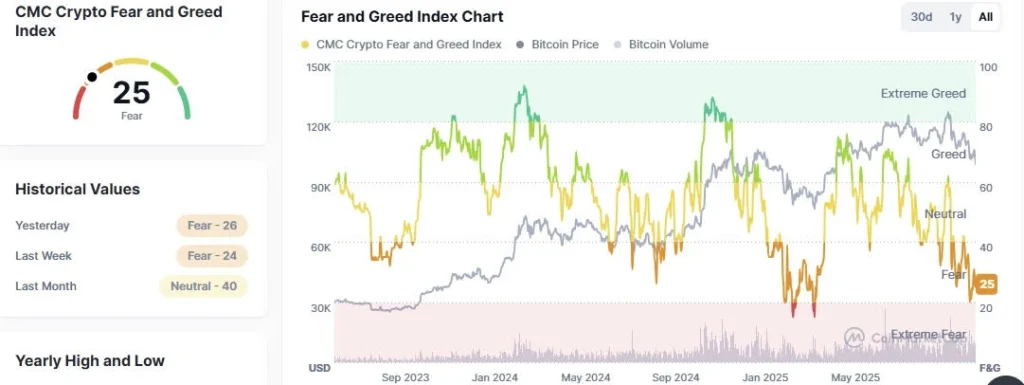

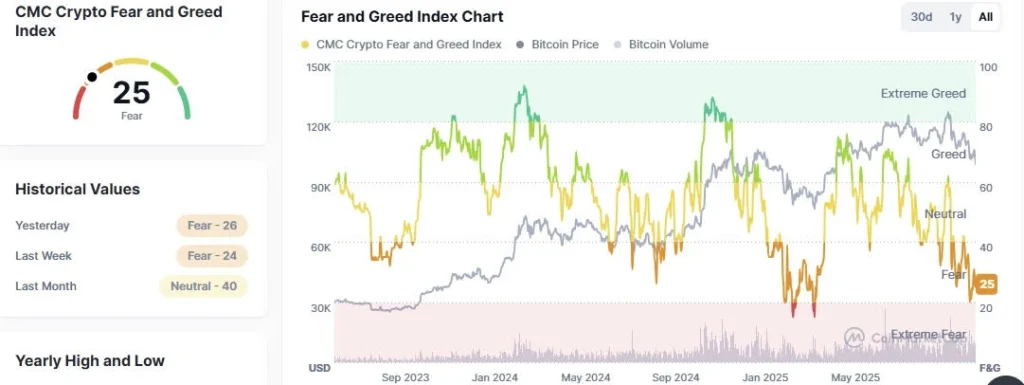

The heavy liquidation of lengthy merchants induced the impression of an extended squeeze, whereas rising fears of additional capitulation. Notably, the crypto concern and greed index has fallen to a multi-month low of round 25, indicating excessive concern of additional capitulation.

Supply: MuntMarketCap

Technical glitch: BTC value has fallen under bull market help

After the BTC value did not regain $107,000 as a help stage in latest days, the market’s reversal was confirmed. As such, the flagship coin is properly positioned to retest its multi-year rising logarithmic help trendline.

From a technical evaluation perspective, the value of BTC might fall as a lot as $92,000, leaving a CME hole unfilled.

What’s subsequent for the bull market?

All consideration has now shifted to the Federal Reserve, forward of the anticipated quantitative easing (QE) in December. As traders are anticipated to swap their gold positive factors for Bitcoin, a possible restoration is probably going within the coming weeks, with most Wall Avenue specialists predicting a parabolic rally quickly.