Bitcoin

Is Bitcoin quietly gearing up for a major breakout amid economic chaos?

Credit : ambcrypto.com

- Bitcoin beneficial properties the grip because the American financial uncertainty impacts report heights, rising the attraction of Secure Haven.

- Falling BTC influx to Binance sign lowered gross sales strain and rising long-term investor confidence.

As US financial instability will get deeper, Bitcoin [BTC] attracts consideration once more as a possible international protected haven.

With the belief of traders in conventional markets that hesitate, the flagship energetic of the crypto market reveals indicators of resilience.

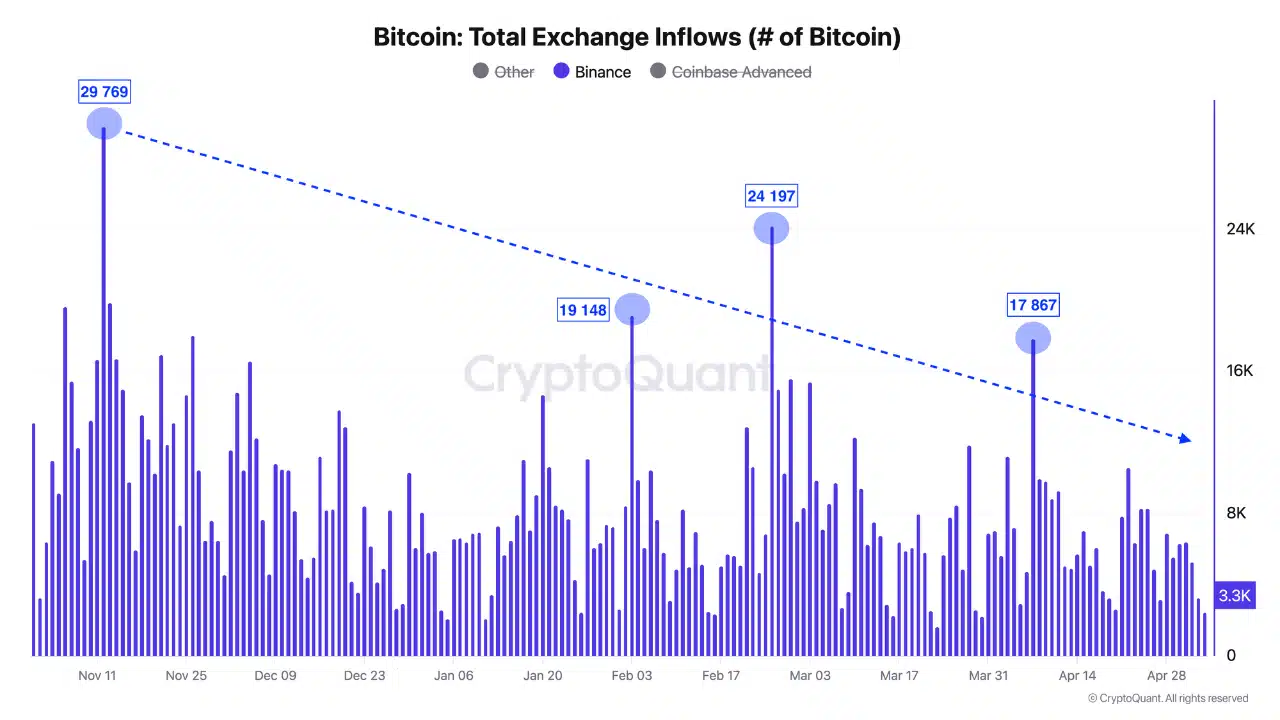

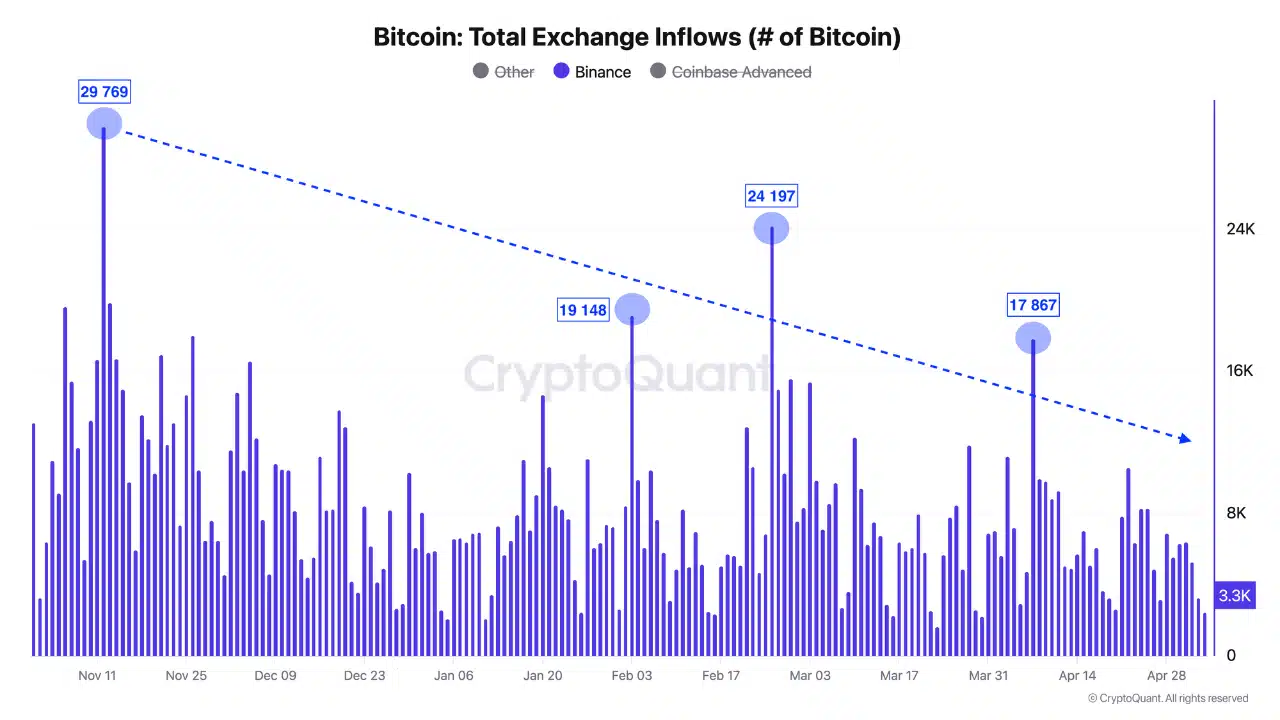

Specifically, BTC influx to Binance has fallen significantly, which signifies lowered strain on the gross sales facet and a shift to long-term possession.

These silent however significant indicators recommend that Bitcoin could concentrate on the subsequent main outbreak, which quietly positions itself, not solely as a hedge, however as a contest within the flight to security story.

Bitcoin rises within the midst of report -breaking financial turbulence

The US financial coverage safety index elevated to a report excessive in 2025.

The graph shown That each peak in uncertainty traditionally coincided with Bullish Momentum for Bitcoin – and the most recent Golf is probably the most excessive up to now.

Supply: Alfractaal

The tariff will increase of the second Trump administration, a recovered debt ceiling, the tied FED coverage and a credibility disaster for the US greenback have all fed investor worry.

Add the geopolitical dangers and authorized whiplash, the result’s a really unstable atmosphere for conventional markets.

Bitcoin, however, appears structural resistant to such chaos.

With confidence in Fiat -taking, BTC is more and more not thought-about speculative, however as a strategic hedge – one that may quietly introduce his subsequent battery part previous to a big outbreak.

BTC: Gross sales strain stress-free

Bitcoin -Influx to Binance has been fixed For the reason that finish of 2024, pointing to a discount of quick gross sales strain.

Though there have been a couple of outstanding peaks above 17,000 BTC, the pattern is evident: fewer cash are being moved to the trade for liquidation.

Supply: Cryptuquant

With macro dangers rising and investor confidence in Fiat methods which might be faltering, this could be a reflection of the rising conviction within the long-term position of Bitcoin as hedge.

Bitcoin’s value forecast

On the time of the press, BTC traded practically $ 94,000 and positioned a small withdrawal after testing the $ 96,000. The RSI is slipped from Overbought Territorium to round 58, indicating a cooling momentum with out pointing to overselling.

Supply: TradingView

Within the meantime, the MACD was near a bearish crossover; Potential consolidation or weak point within the quick time period. Nonetheless, the value construction remained intact above earlier resistance ranges and now acted as assist.

If the dip ft discover above $ 91,000 $ 92,000, Bulls might shortly regain management.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024