Bitcoin

Is Bitcoin’s $105K chop a strategic trap? – Here’s what might be happening

Credit : ambcrypto.com

- The latest Retracement from Bitcoin led to a cautious bouncing and invited Shorts to extend their bets.

- May this break really be a strategic association?

Bitcoin [BTC] was slipped again in his traditional “wait -and -see” mode.

After a textbook racement to the psychological degree of $ 100k, you’ll anticipate that bulls will come and cost with conviction. However as an alternative, the Bounce Underwhelming has been. No explosive comply with -up, no parabolic restoration.

That hesitation? It will get opportunistic shorts a gap and so they have arrived. Binance’s BTC/USDT permanently Now present virtually 60% brief bias and confirmed that many merchants lean at a drawback.

What if this subdued break will not be an indication of weak point, however a deliberate strategic consolidation? A calculated set -up that lays the groundwork for an outbreak with excessive volatility?

Shorts technique to make the most of Bull Heseling

At present, 96.6% of Bitcoin’s vary is in non -realized revenue. Add the truth that the brief -term holder (StH) delivery Has introduced itself again to ranges of November 2024.

Within the meantime, the retail commerce stays on the sidelines, and with the development of macro tickles for the FOMC, Capital has been was shares, leaving BTC’s Momentum within the stability.

On this context, the rising brief bias doesn’t appear reckless; It appears earlier, calculated as a brief -leners eye, which appears like a clear reversing association.

However what gas provides to their conviction is the shortage of directional momentum.

Merely put, with bulls that present hesitation and no outbreak in sight, no one actually has management now. That lack of clear path exhibits the door huge open for a withdrawal, and shorts realize it.

Supply: Hyblock Capital

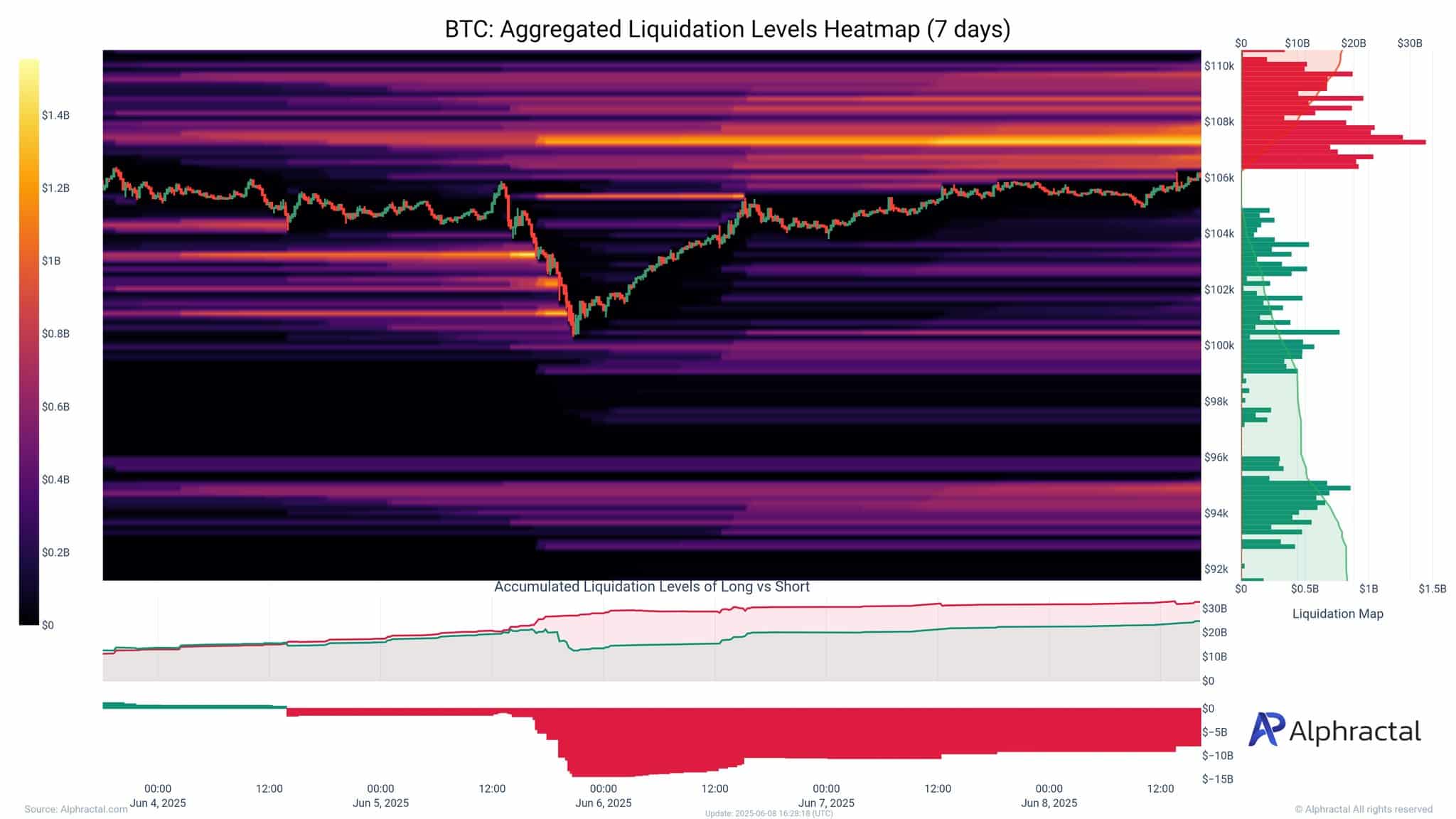

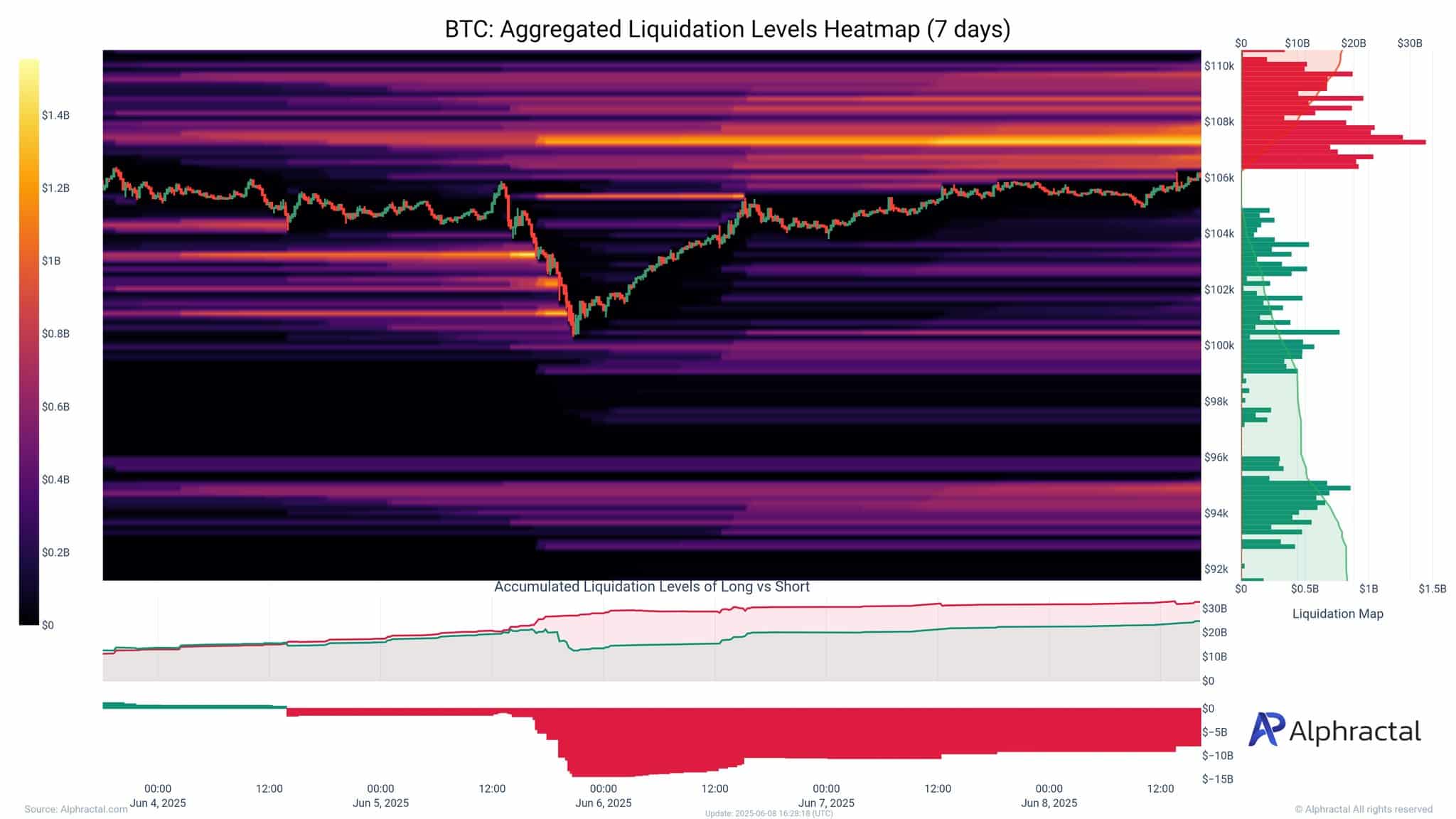

As illustrated within the graph above, Bitcoin’s weekly aggregated liquidation -Delta exhibits a transparent purple dominance, indicating that lengthy positions are aggressively liquidated.

Consequently, this dynamic feeds a speculative bubble. Each time BTC withdraws, pressured liquidations destroy merchants betting on a bullish rally. As a result of Financing percentages prefer lungsLiquidations stream rapidly in bigger sale.

It’s no shock that Binance sees a heavy temporary bias. As talked about earlier, we profit from short-sellers on Bull Heseling, making it a wonderful technique for an excessive amount of return.

Market voltage peaks as Bitcoin -eyes an enormous brief cluster

Bitcoin has now spent greater than every week consolidating below $ 106k – $ 107k zone, which boosts it as a key resistance ceiling.

In consequence, lungs are at all times washed away, and with out giant Institutional money When you take a step again, shorts turn out to be extra assured {that a} correction is on the deck.

However right here is the factor – each time somebody provides to a brief wager, in addition they put the stage for a pinch. That’s the reason the longer BTC consolidates with out breaking down, the extra explosive the outbreak may very well be.

And with greater than $ 1 billion in shorts that’s stacked simply above $ 107k, that degree may work as a launch path like Bulls determine to push by.

Supply: Coinglass

Fascinating is that Michael Saylor appears to place for precisely that, double Whereas reserves proceed to shrink between inventory markets whereas buyers go for chilly storage.

Robust hodling conduct, confirmed by chain statisticsMoreover, underlines the story of the availability.

Put all of it collectively and the present consolidation of BTC doesn’t seem to be indecision. As a substitute, it appears like a fall set. One that might lure in additional shorts earlier than he unlocking a squeeze and better objectives.

In the intervening time, Hodling is maybe the neatest step on the board.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now