Analysis

Is Elon Musk’s Tesla Selling $760 Million of Bitcoin?

Credit : coinpedia.org

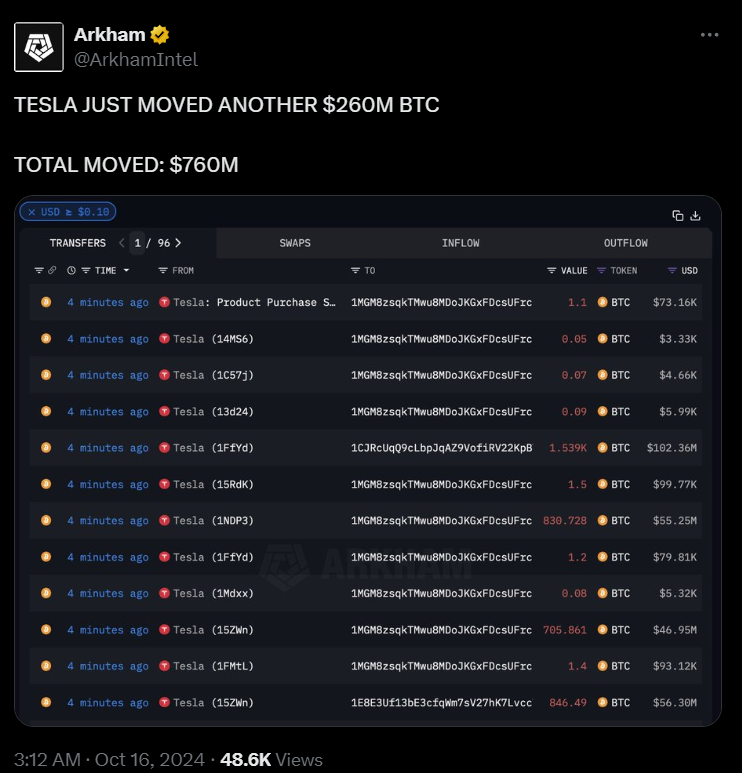

Amid the continuing value correction within the cryptocurrency market, Elon Musk’s Tesla simply moved a major quantity of Bitcoin (BTC) to an unknown pockets. On October 16, 2024, it made on-chain intelligence company Arkham posted on X (previously Twitter) that the large electrical automotive producer Tesla had simply moved 11,500 BTC value $760 million.

Is Tesla Promoting Its BTC Stakes?

This important BTC switch has raised considerations about whether or not Tesla is promoting its BTC holdings or what they plan to do subsequent. Nevertheless, that is the primary time prior to now two years that Tesla has moved its BTC holdings. In accordance with the information, Tesla is the fourth largest BTC holder, after MicroStrategy, mining firm Marathon Digital and Riot Platform.

After this essential BTC transaction, Tesla didn’t publish any feedback. Nevertheless, regardless of this outstanding BTC switch, asset costs remained steady and no main modifications have been noticed on the exchanges, nor was there any dumping of enormous whales.

BTC present value momentum

On the time of writing, BTC is buying and selling close to $66,880 and has skilled a modest value improve of over 1.35% over the previous 24 hours. Throughout the identical interval, buying and selling quantity elevated by 20%, indicating better participation from merchants and buyers.

Technical evaluation of Bitcoin, will the value fall?

In accordance with professional technical evaluation, BTC is at the moment going through sturdy resistance on the higher restrict of a descending channel sample. That is the sixth time since March 2024 that the world’s largest cryptocurrency has reached this stage.

Historic information reveals that when BTC reaches this stage, it experiences notable promoting strain and a value drop of greater than 20%.

This time, nonetheless, the sentiment may be very totally different as we method the presidential elections in america. Knowledge reveals that the crypto market has seen a outstanding rally over the last two elections in October main as much as the elections.

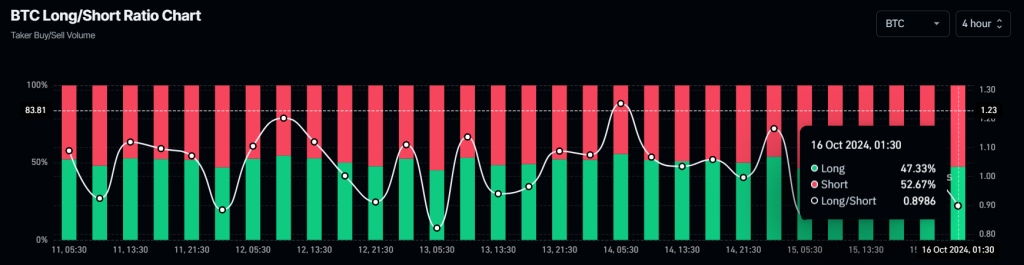

BTC’s bearish on-chain metrics

Moreover, on-chain analytics agency Coinglass signifies weak market sentiment amongst merchants over the previous 4 hours. In accordance with the information, BTC’s lengthy/quick ratio at the moment stands at 0.89, reflecting bearish sentiment.

At present, 52.7% of prime merchants have quick positions, whereas 47.3% have lengthy positions.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024