Ethereum

Is Ethereum Ready to Break $4,000? Key Metrics Suggest a Bull Run Is Building

Credit : ambcrypto.com

- Ethereum has risen nearly 20% in two weeks, with vital accumulation by traders.

- Key metrics resembling lively addresses and whale transactions point out potential for worth will increase.

Ethereum [ETH] has proven indicators of breaking out of the latest interval of stagnation and at last gearing up for what may very well be a serious bull rally. After months of underperformance in comparison with Bitcoin, Ethereum is at the moment buying and selling at $3,558.

This follows a 20% worth improve prior to now two weeks, signaling renewed curiosity from traders. Though ETH has fallen 1.4% over the previous day, it stays above the essential USD 3,500 assist degree, underscoring the market’s resilience.

Amid this worth motion, market analysts have finished simply that identified key traits that strengthen Ethereum’s potential for sustainable progress. A CryptoQuant analyst often known as TheKriptolik shared insights that make clear ETH’s enduring enchantment to main traders.

The analyst highlighted that regardless of Ethereum’s lower cost ranges in comparison with earlier highs, the ETH Trade Provide Ratio has fallen to ranges final seen in 2016. This decline signifies that traders are transferring their holdings from the inventory markets, indicating long-term accumulation.

At the same time as circulating provide has elevated, the decline in ETH holdings on the trade highlights that traders nonetheless view ETH as a protected haven.

Key numbers point out rising momentum for Ethereum

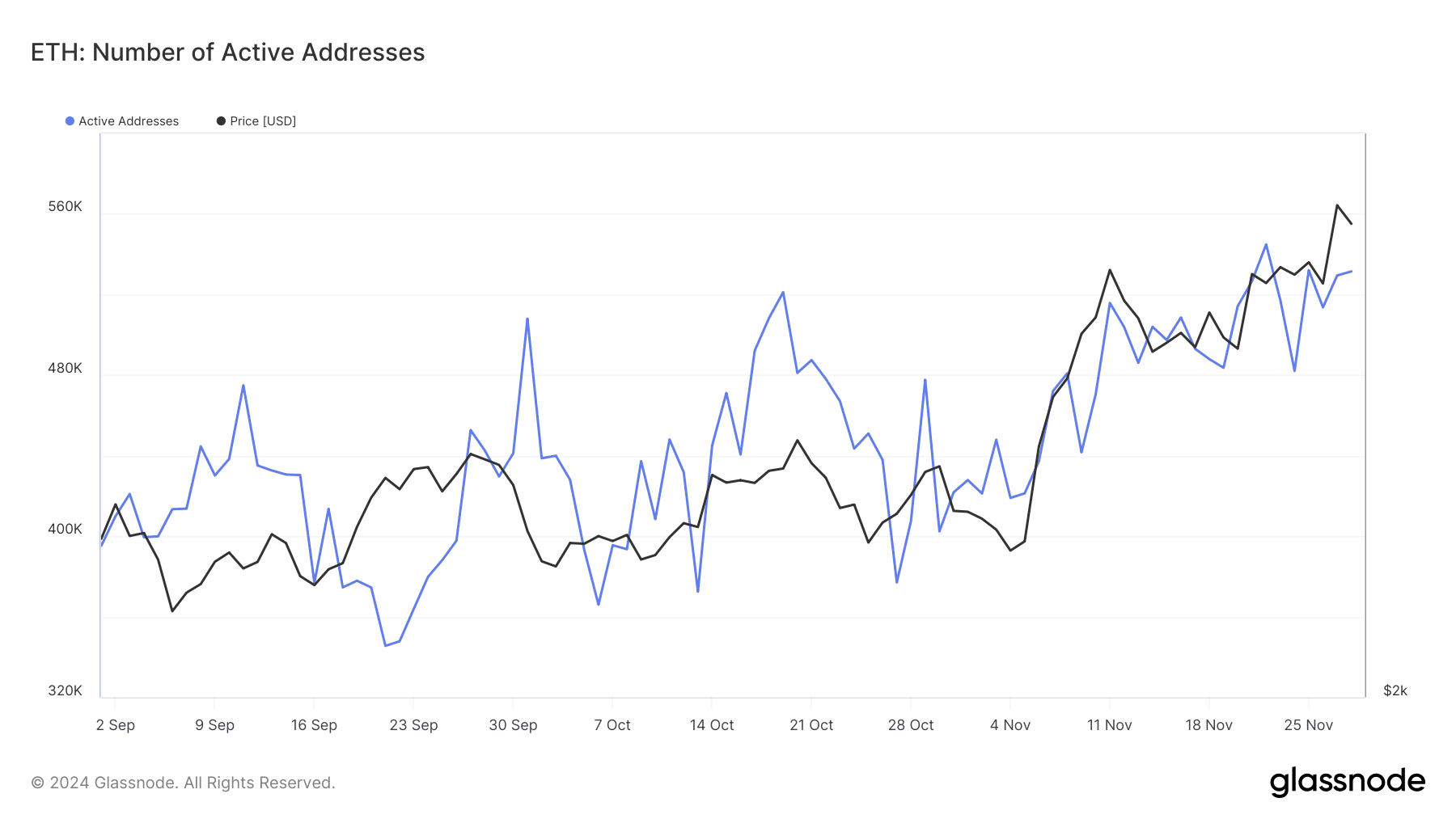

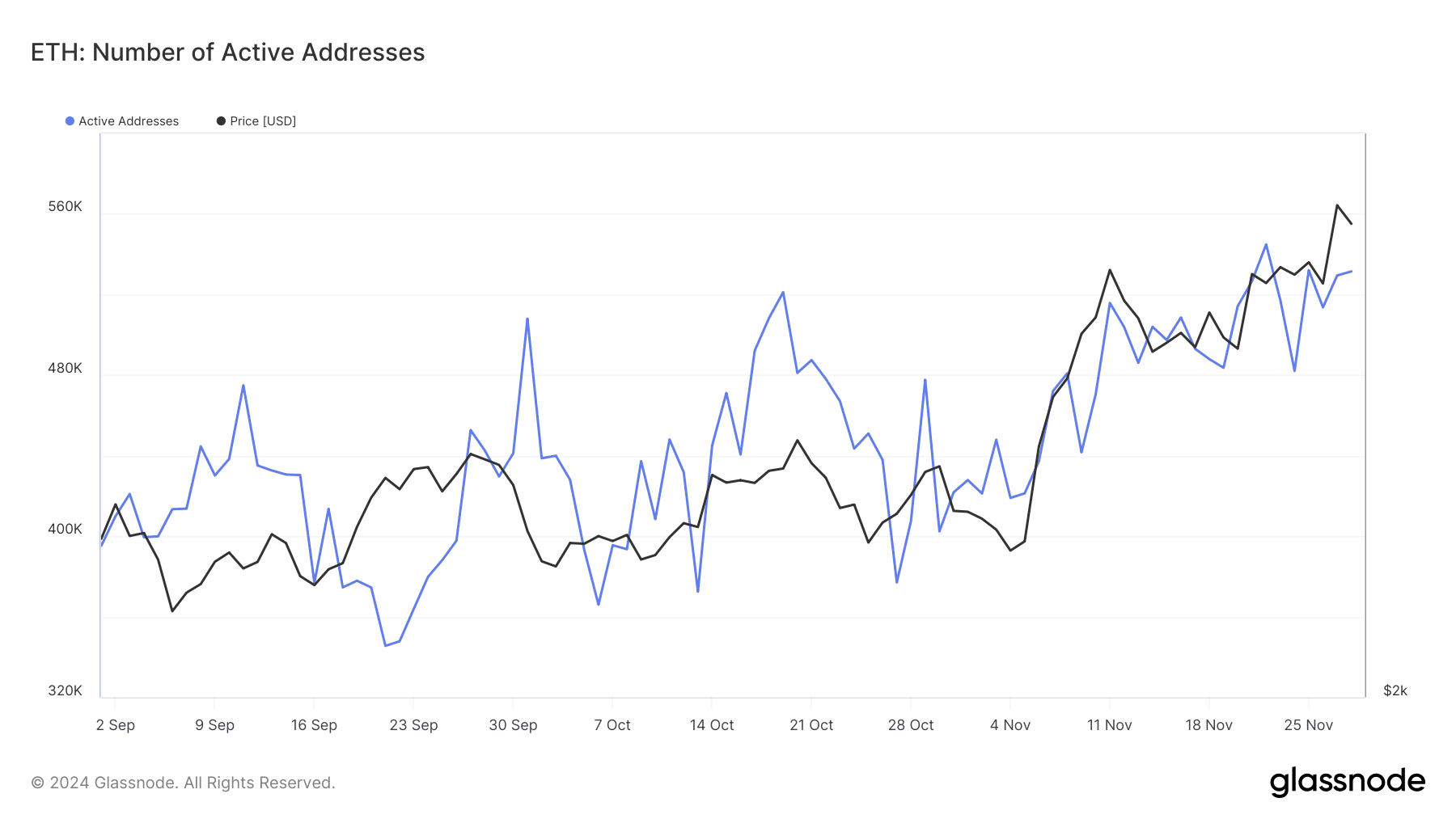

Analyzing Ethereum’s broader metrics reveals further insights into the asset’s efficiency and investor habits. One notable indicator is the expansion in Ethereum’s lively addresses, a metric typically related to retail investor curiosity.

Based on Glass junctionthe variety of lively Ethereum addresses has steadily elevated from lower than 500,000 in October to 531,000 on November 28.

Supply: Glassnode

This upward trajectory signifies elevated community exercise, which usually correlates with elevated demand and potential worth appreciation.

The rise in lively addresses signifies {that a} rising variety of contributors are partaking with the Ethereum ecosystem, whether or not by means of transactions, decentralized functions or staking, additional strengthening the foundations of the community.

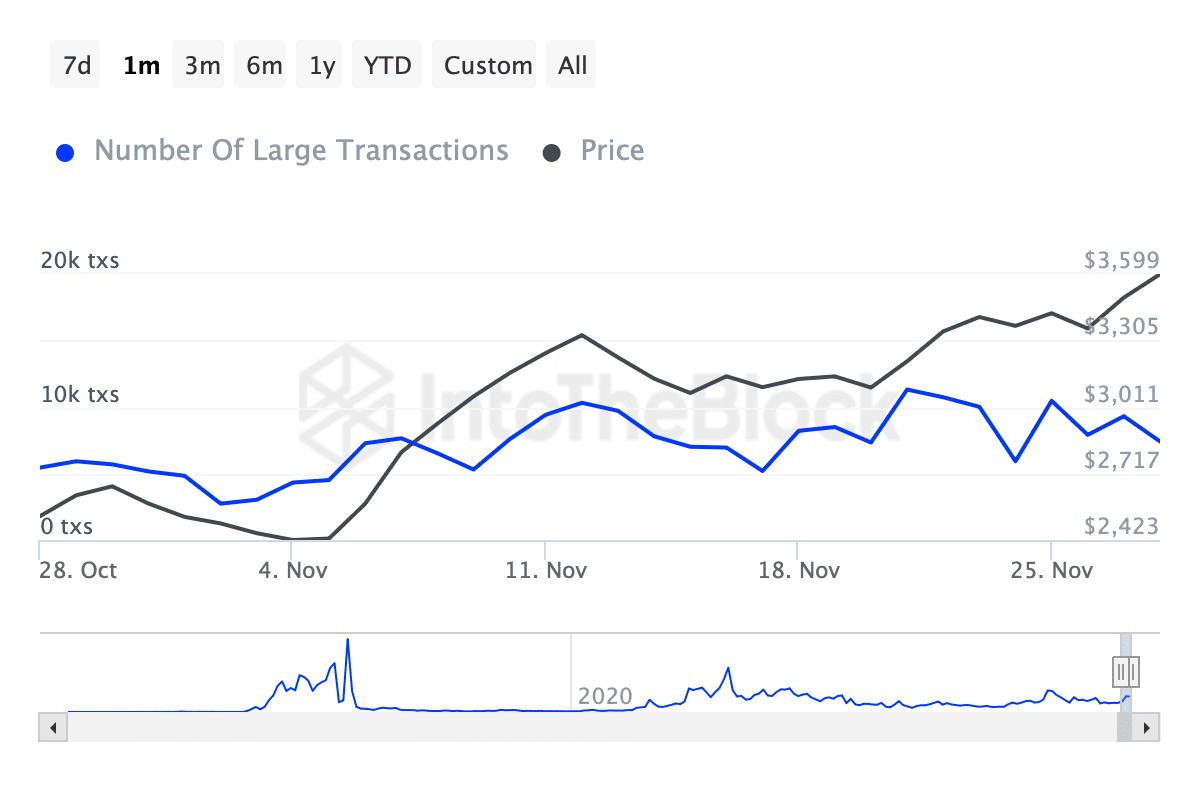

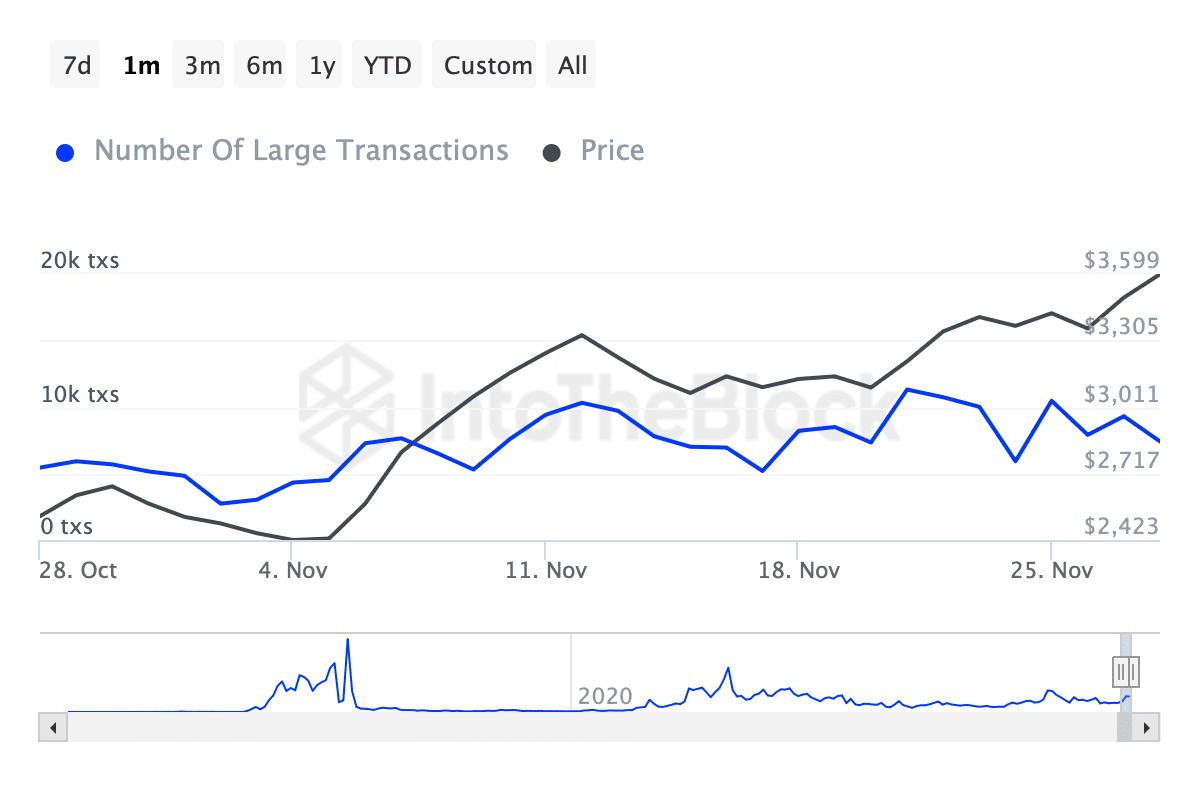

One other key metric is the exercise of Ethereum whales: traders executing trades over $100,000. Facts from IntoTheBlock reveals that whale transactions peaked at 11,210 earlier this month, reflecting elevated institutional exercise.

Nevertheless, this determine has fallen just lately, with Ethereum recording 7,410 whale transactions on November 28.

Supply: IntoTheBlock

Learn Ethereum [ETH] Worth forecast 2024-2025

Whereas the slight decline might point out short-term profit-taking, the continued exercise from large-scale traders indicators continued curiosity and confidence in Ethereum’s long-term worth proposition.

Sometimes, a rise in whale exercise can result in increased worth volatility, whereas a lower can point out consolidation or preparation for the subsequent market transfer.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now