Ethereum

Is Ethereum staking enough to counter ETH’s struggles against Bitcoin?

Credit : ambcrypto.com

- Ethereum continued to commerce within the $3,000 value zone.

- Nonetheless, the ETH/BTC pair broke help for the primary time since 2016.

Ethereums [ETH] ongoing battle towards Bitcoin [BTC] continues to dominate market discussions because the ETH/BTC pair finds itself in a precarious place.

Current knowledge confirmed Ethereum’s native token, ETH, hovering round crucial help ranges towards Bitcoin, whereas staking tendencies confirmed continued inflows.

This is what the charts inform us about Ethereum’s trajectory and the well being of the market.

Ethereum assessments main resistance

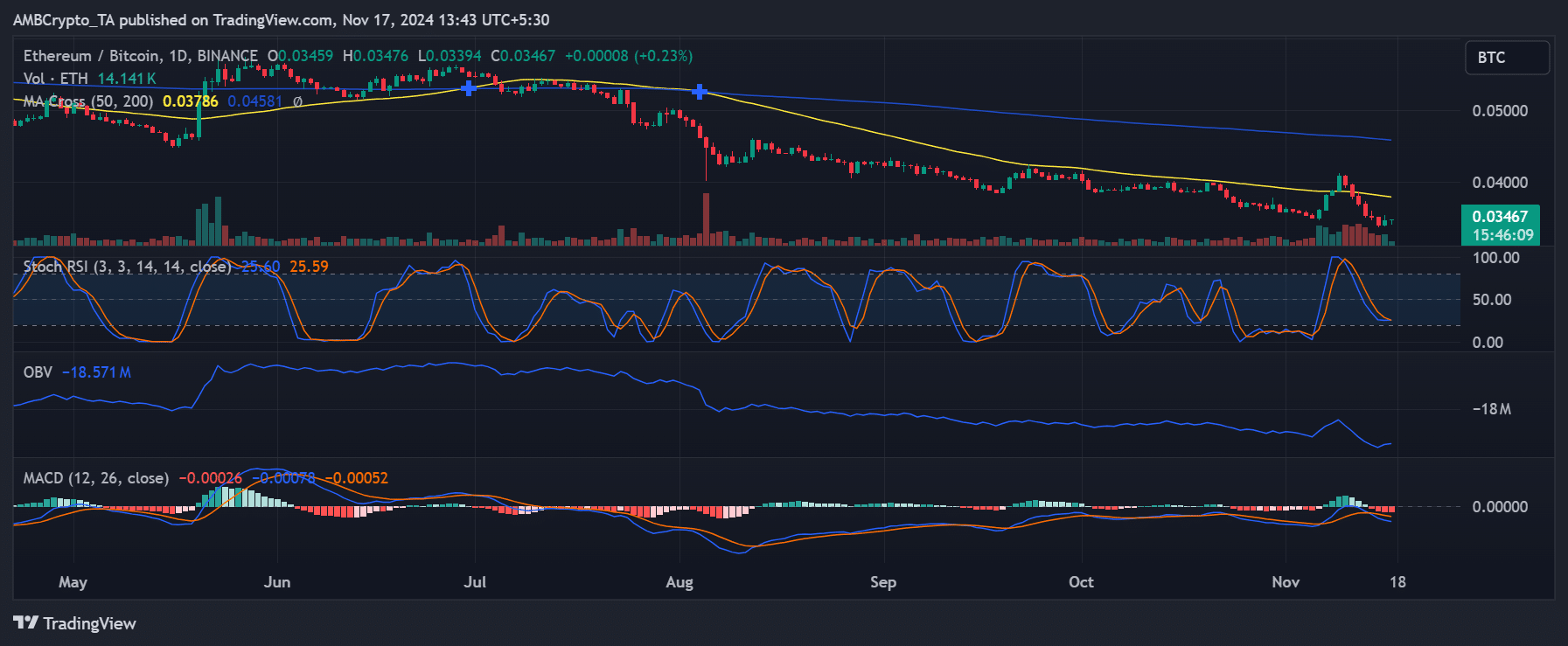

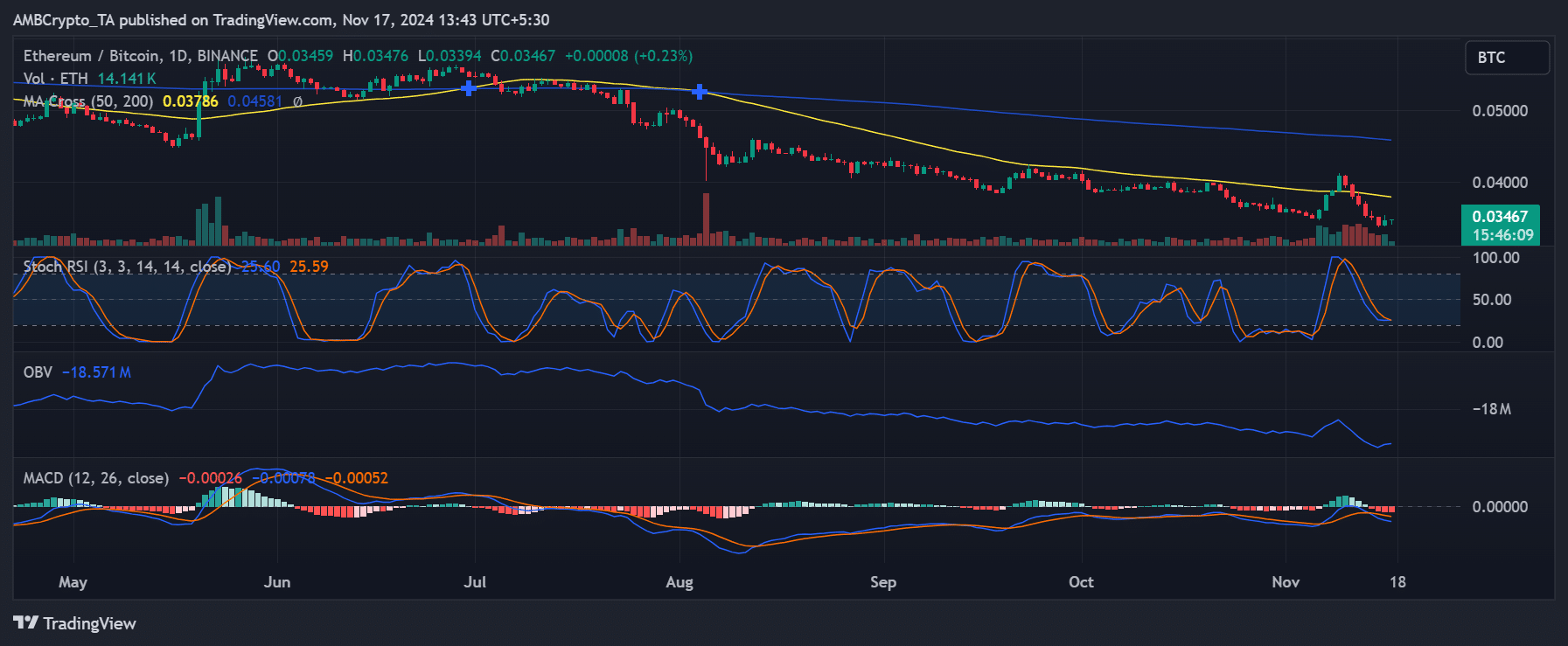

Ethereum’s ETH/BTC pair has seen a modest restoration from the current dip, buying and selling at 0.03469 BTC on the time of writing.

This adopted a major decline that noticed ETH breach the 50 and 200 day shifting averages earlier this 12 months, reinforcing a bearish crossover.

Nonetheless, the current rebound has taken the worth again above 0.034, however the 200-day MA, which stood at 0.0459 BTC on the time of writing, loomed as a formidable resistance stage.

Supply: TradingView

Indicators such because the MACD confirmed a bearish development, with the sign line nonetheless under zero, whereas the Stochastic RSI pointed to oversold circumstances, indicating attainable aid rallies.

The OBV (On-Stability Quantity) recommended muted momentum, additional reinforcing the concept that ETH faces important challenges in regaining dominance towards Bitcoin.

ETH/USD development: bullish momentum

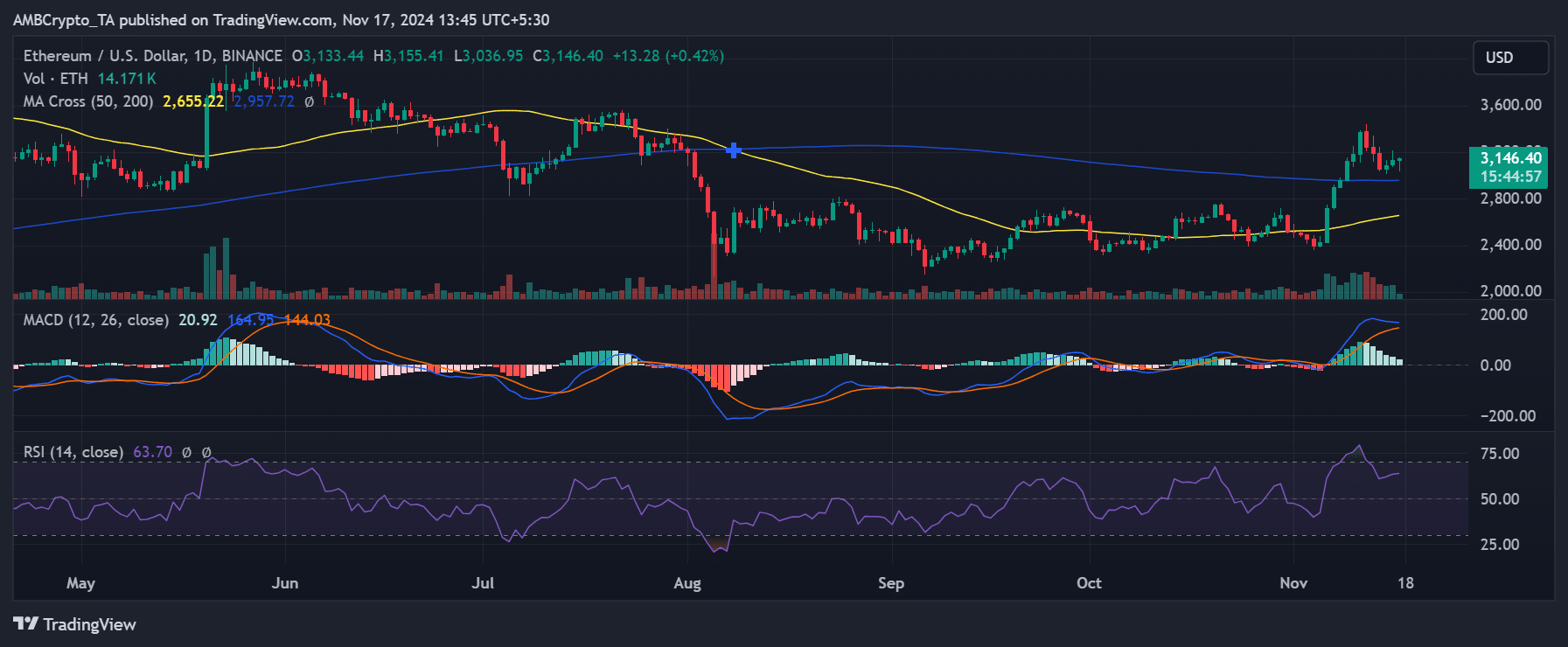

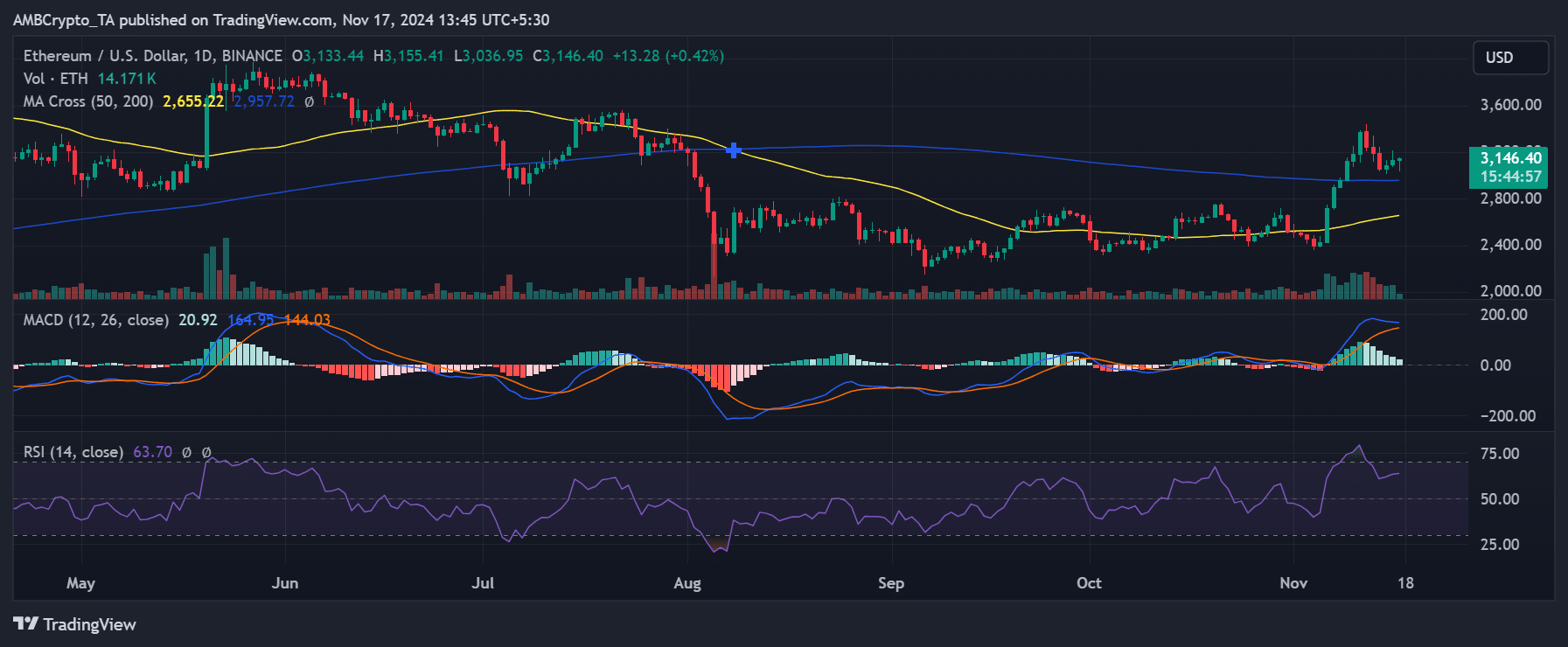

In distinction to the battle towards Bitcoin, ETH/USD painted a extra optimistic image. Ethereum was buying and selling at $3,147 on the time of writing, having reclaimed the 200-day shifting common at $2,955.

The current bullish crossover between the 50-day and 200-day MAs indicated a possible shift in momentum, with key resistance ranges round $3,200 being carefully watched.

The RSI hovered round 71, indicating a barely overbought surroundings, whereas the MACD remained in bullish territory, indicating room for additional upside potential.

Ethereum’s capacity to maintain above $3,000 will probably be essential to persevering with its upward trajectory within the coming weeks.

Supply: TradingView

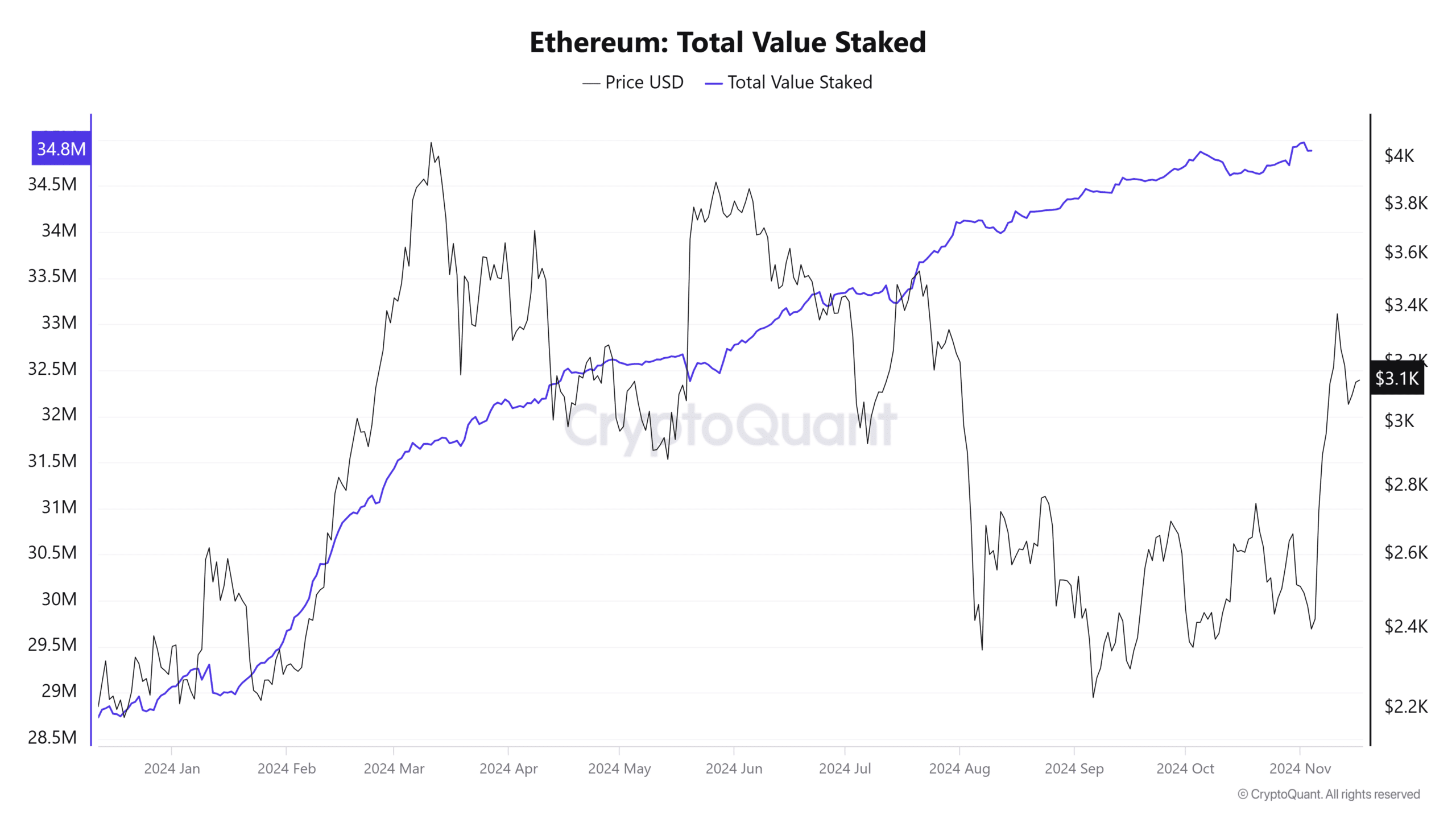

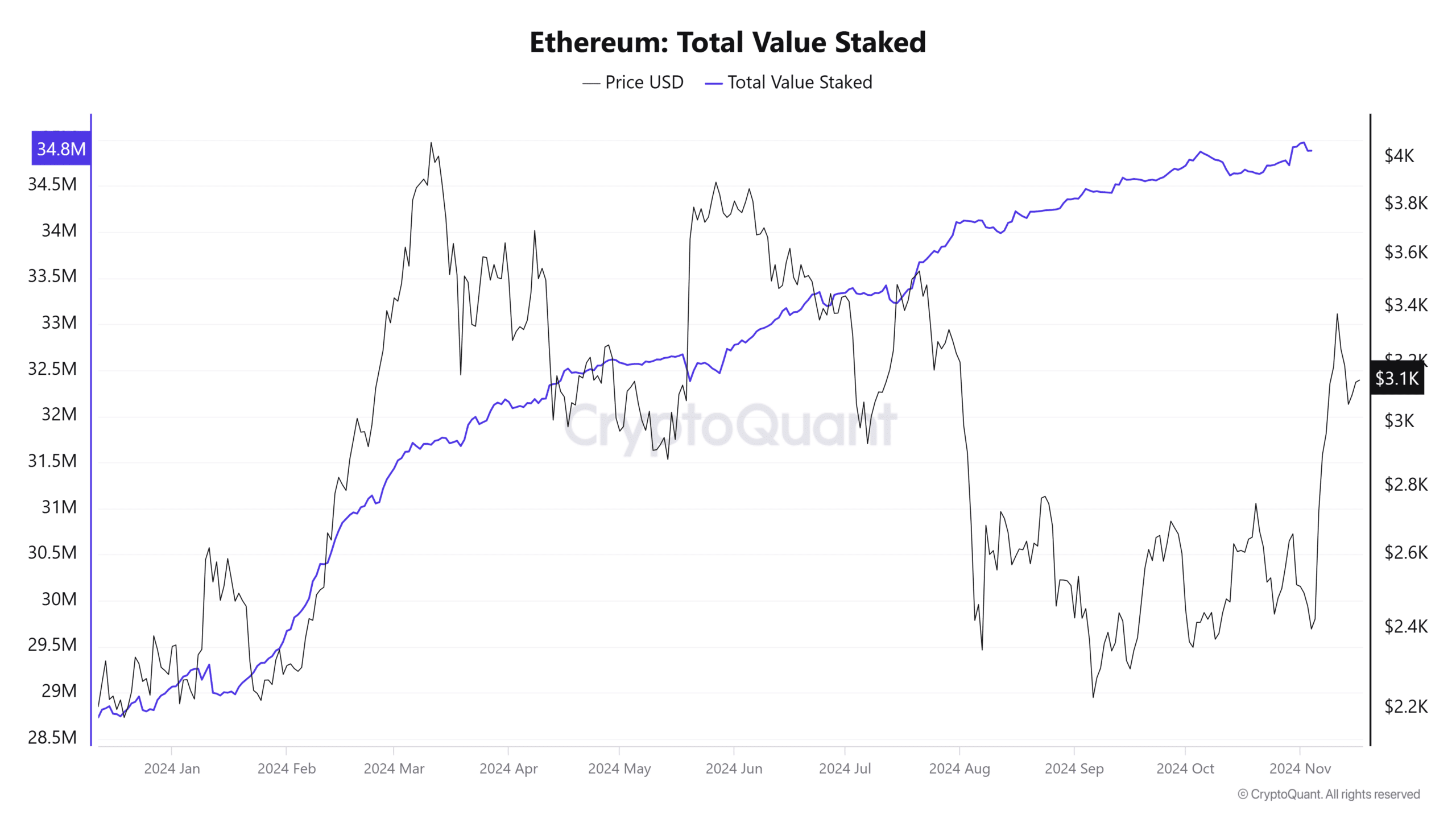

Ethereum’s TVL stays vivid

When it comes to stakes, Ethereum’s fundamentals remained sturdy. The overall worth staked in Ethereum’s community has reached an all-time excessive of 34.8 million ETH, underscoring the robust confidence amongst holders.

This metric, mixed with Ethereum’s press-time value of $3,100, highlighted a gradual enhance in staking participation regardless of its lackluster efficiency towards Bitcoin.

Supply: CryptoQuant

CryptoQuant’s chart exhibits that ETH stakes have grown constantly over the previous 12 months, at the same time as Ethereum’s value skilled volatility.

This resilience might point out bullish sentiment for the community long term, even when the ETH/BTC pair falters within the brief time period.

What’s subsequent for Ethereum?

The broader market sentiment round Ethereum is combined. Whereas the rising whole worth staked paints an image of investor confidence, the lack of the ETH/BTC pair to carry important ranges raises issues.

ETH’s path ahead relies upon closely on its capacity to achieve power towards Bitcoin, particularly as Bitcoin’s dominance continues to rise.

To get Ethereum again on its ft, a break above the resistance at 0.045 BTC is important. In the meantime, the help at 0.033 BTC stays essential to keep watch over in case of additional declines.

Learn Ethereum’s [ETH] Value forecast 2024-25

Ethereum’s rapid prospects stay clouded by the battle towards Bitcoin, however its betting numbers and broader community fundamentals stay strong.

With the market eyeing a attainable reversal within the ETH/BTC pair, Ethereum’s robust participation and bullish USD efficiency might function lifelines, making certain its long-term viability even in occasions of volatility on the brief time period.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now