Ethereum

Is Ethereum’s price bottom in sight? Key data points to…

Credit : ambcrypto.com

- The worth of ETH tapped its realized value, which raised the hope for a possible soil.

- Weak demand for spot -ETFs and flat community development might derail such a consequence

Ethereum’s [ETH] The worth is within the information after it has affected an vital stage that marked earlier lengthy -term market soils, which elevated the hope for potential reversal for the Altcoin.

In accordance with Cryptoquant analyst Kriptolik, ETH fell beneath the ‘realized value’, the typical price -based foundation for many consumers. This stage usually marks a possible market shift. The analyst claimed”

“These intervals are constantly adopted by sturdy recovery-value. They’re strategic accumulation factors for long-term buyers.”

Supply: Cryptuquant

The connected graph additionally revealed that the realized price-saw market rebounds in 2018-2020.

Nonetheless, the extent might additionally act as a brief -term resistance when the ETH value falls beneath. In such a case, the analyst warned {that a} stroll in Panic Sale of ETH might in all probability be within the brief time period.

What’s the subsequent step for ETH?

However, US shares and crypto, together with ETH, responded as risk-on belongings on Trump price updates. As such, a possible soil can solely be accelerated by a optimistic macro fencing.

Even institutional buyers even left the Altcoin for six consecutive weeks, as evidenced by the constant outskirts of US Spot ETTFs.

Supply: SOSO worth

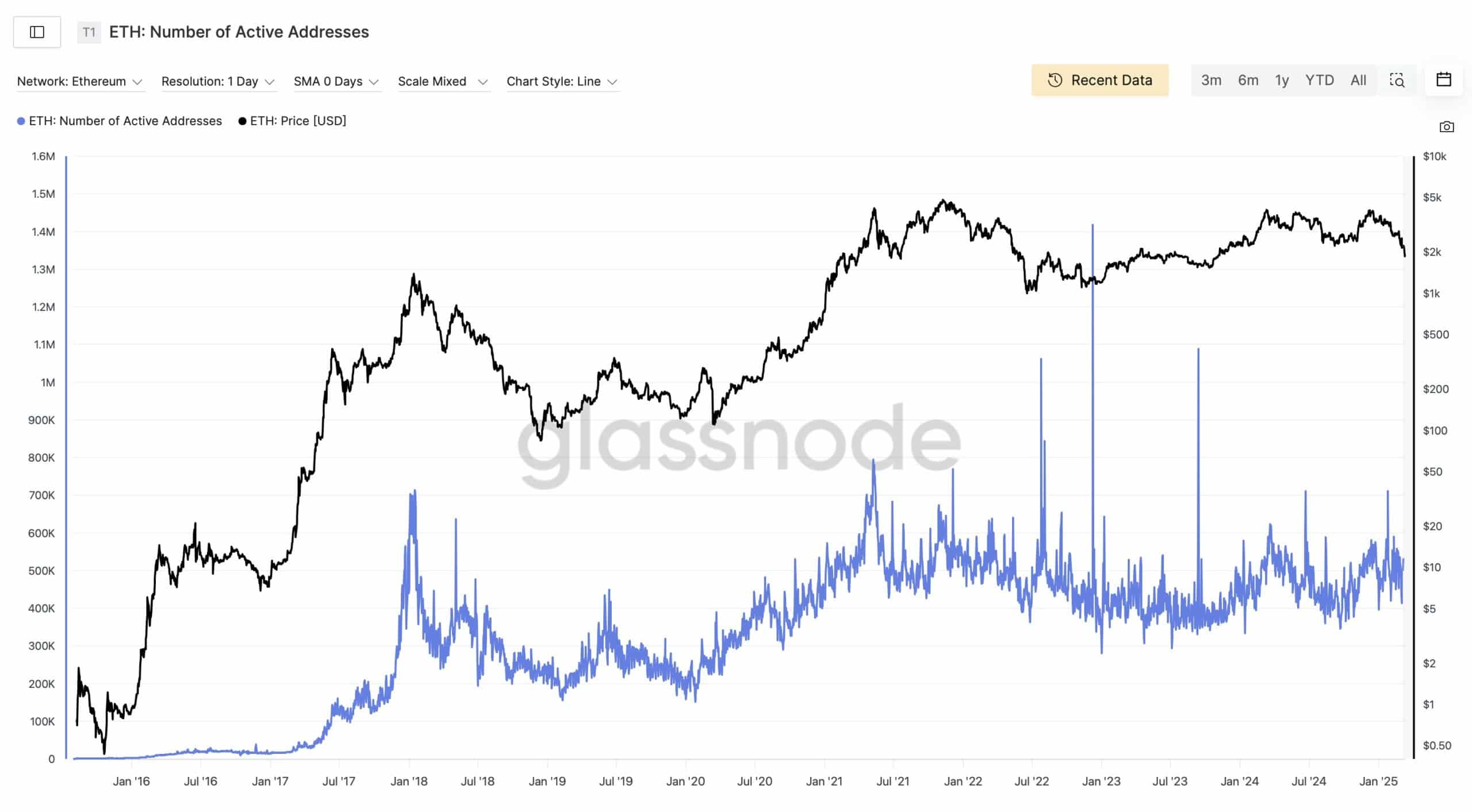

One other rigorously facts Level, in line with analyst Stacy Wall, is stagnating lively customers. She famous that Ethereum has been flat addresses for 4 years.

Though some critics have argued that customers have been migrating to L2S, stagnant community development could possibly be the restoration views of ETH CAP.

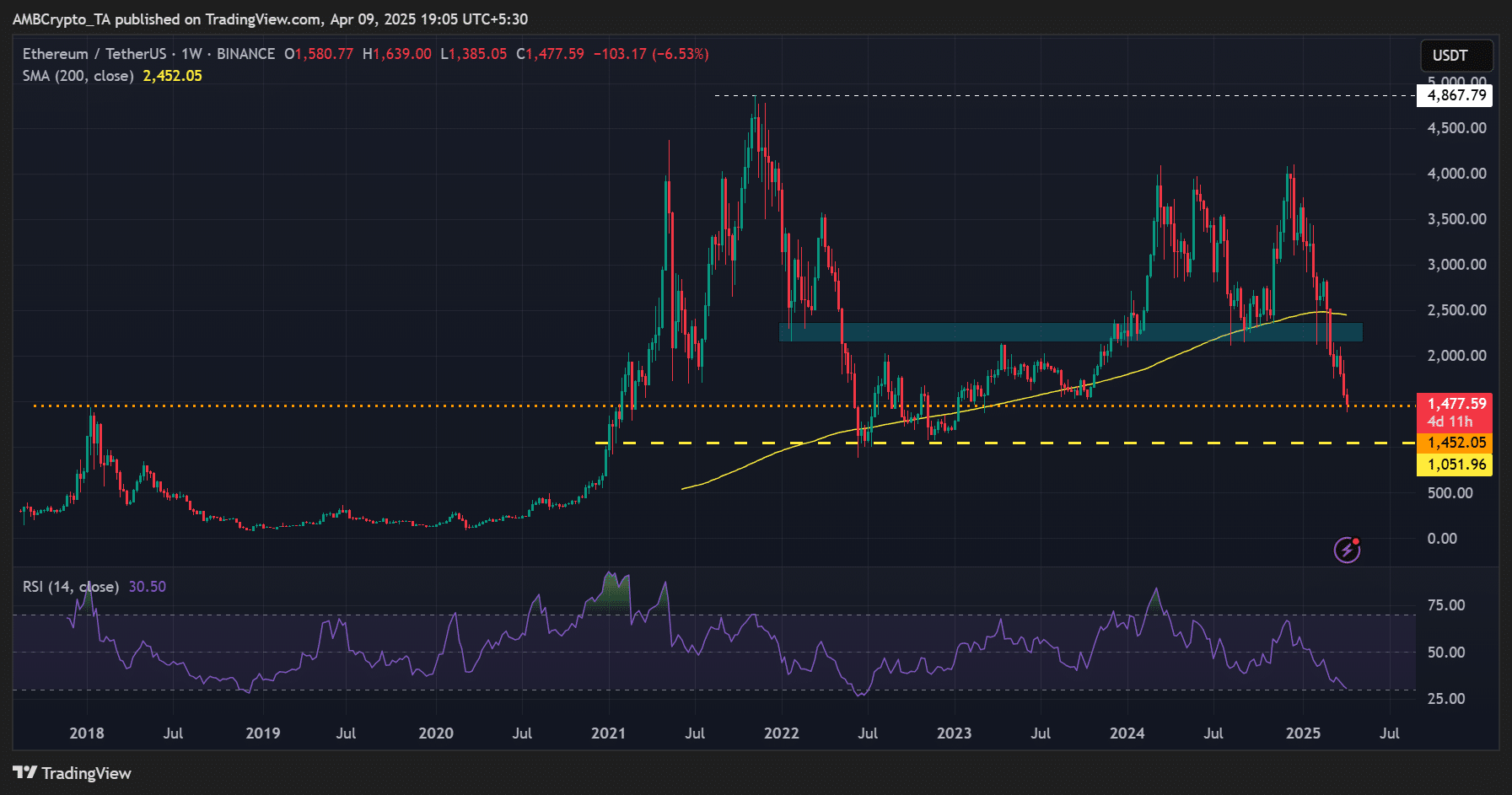

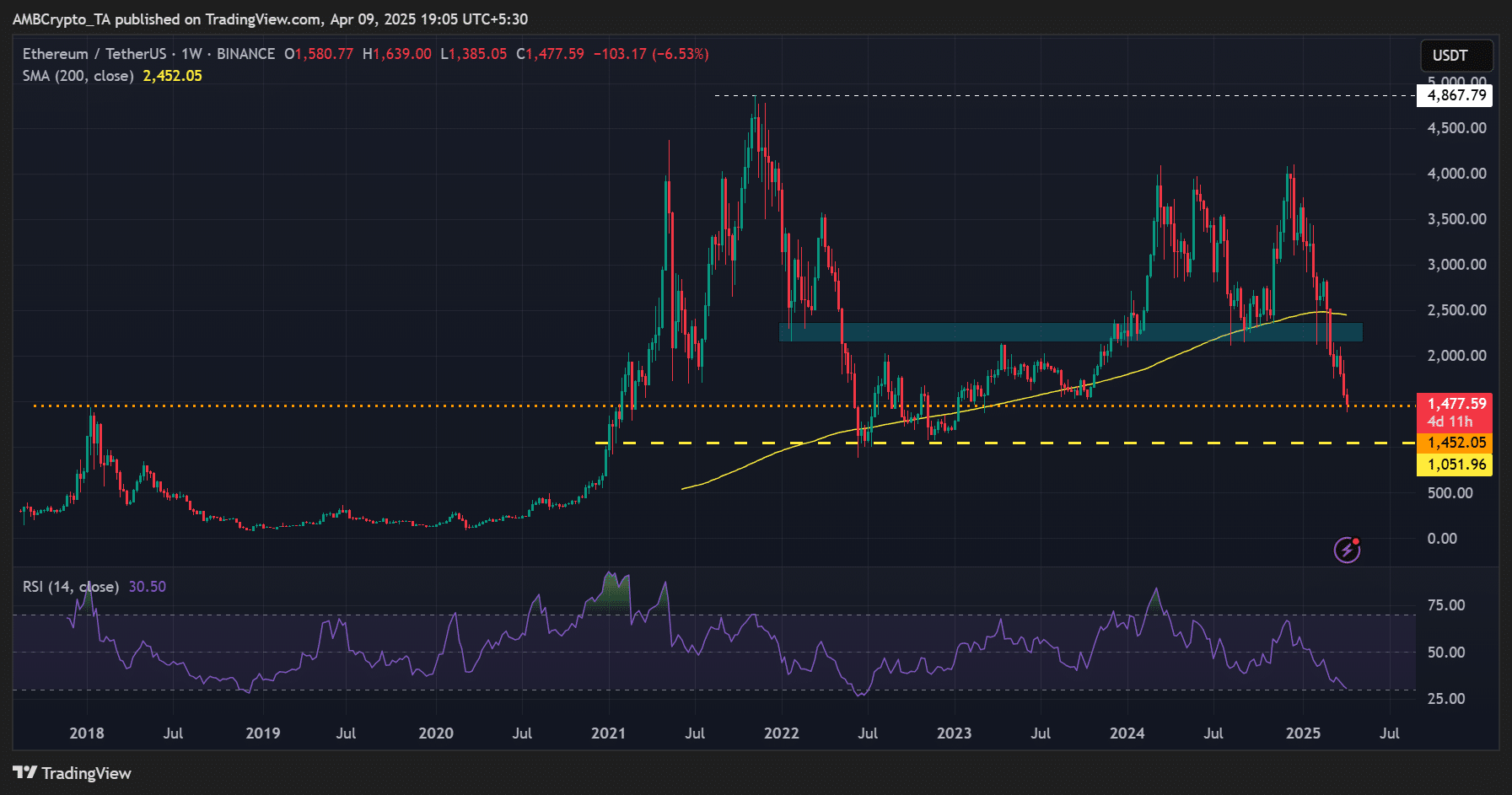

From the attitude of a value chart, ETH fell to a low layer of two years beneath $ 1.5k. In actual fact it was down 64% from the height of the $ 4K interval cycle.

With fixed macro uncertainty, a protracted -term lower as much as $ 1K can’t be overrun within the brief time period.

Supply: Eth/USDT, TradingView

Merely put, the Altcoin turned an important level, particularly when adopted from a realized value perspective.

Nonetheless, the Macro Entrance at present dominates the market characteristic and might decelerate a possible ETH Rebound if the uncertainty continues to exist within the brief time period. Furthermore, as revealed by a 7-week collection of ETF outflows, the weak query didn’t paint sturdy restoration.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024