Ethereum

Is It Time To Give Up On Ethereum Below $4,000? Analyst Weighs The Facts

Credit : www.newsbtc.com

This text is accessible in Spanish.

Crypto analyst Ali Martinez has mentioned Ethereum’s present worth motion because the second-largest cryptocurrency by market cap stays under $4,000. The analyst outlined some info to offer a clearer image of whether or not or not that is the correct time to surrender ETH.

Analyst Discusses Whether or not It is Time to Give Up on Ethereum

In a single X messageAli Martinez outlined sure info to find out whether or not it’s time to surrender on Ethereum. First, the analyst famous that ETH has been one of many weakest performers of late, a growth that seems to have led to Vitalik Buterine to shake issues up by altering the Ethereum Basis’s management crew.

Associated studying

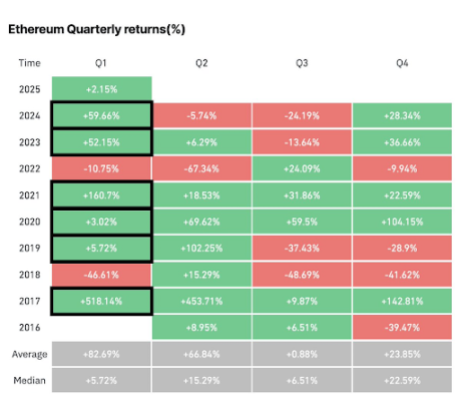

Martinez then alluded to it historic knowledge exhibiting that Ethereum performs properly within the first quarter of yearly. The analyst beforehand hinted that this may in all probability be no totally different this yr. On the time, he famous that ETH has its strongest efficiency within the first quarter, particularly in odd years, and 2025 is one such yr.

Given Ethereum’s constructive efficiency within the first quarter, Martinez famous that this might clarify why crypto whales have amassed over $1 billion price of ETH up to now week alone. He beforehand revealed that these whales had bought over 330,000 ETH, price over $1 billion.

Moreover, the crypto analyst famous that the shopping for stress can also be clearly seen within the outflow of exchangeswith practically $2 billion price of Ethereum withdrawn from crypto platforms final month. Particularly, 540,000 ETH, price $1.84 billion, had been withdrawn from the exchanges final month. This accumulation development is constructive because it signifies that buyers are nonetheless bullish on ETH.

Nevertheless, for Ethereum to interrupt out bullish, Martinez stated it should overcome a number of key resistance ranges. From an on-chain perspective, the crypto analyst highlighted the $3,360 to $3,450 zone because the large supply wall. This vary is probably the most vital resistance degree for ETH, whereas the important thing help zone is between $3,066 and $3,160.

From a technical evaluation perspective

Martinez additionally supplied perception into Ethereum’s worth motion from a technical evaluation perspective. He said that ETH seems to type the correct shoulder of a head and shoulders patternwith a $4,000 neckline. He added {that a} decisive breakout above this degree may gas a rally in the direction of $7,000.

Associated studying

The crypto analyst additionally revealed that this upside goal aligns with Ethereum 3.2 Market value to realized value (MVRV) Worth vary, presently hovering round $7,000. Amid this bullish outlook, Martinez stated one worrying signal is Ethereum’s community development, which has slowed. The variety of new ETH addresses is claimed to have decreased by 9.32%, indicating decreased adoption.

Regardless of this, Martinez believes the outlook for Ethereum continues to be bullish. He informed market individuals to control the help zone of $2,700 to $3,000. Based on him, this demand zone should maintain to keep up ETH’s bullish outlook.

On the time of writing, Ethereum is buying and selling round $3,200, down 4% up to now 24 hours, based on facts from CoinMarketCap.

Featured picture from Adobe Inventory, chart from Tradingview.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now