Ethereum

Is Solana the next Ethereum? A Swiss crypto bank says ‘Yes!’

Credit : ambcrypto.com

- Solana and Ethereum have each achieved main milestones whereas fostering a aggressive rivalry

- Nonetheless, a latest occasion might exacerbate tensions between the 2

In his month-to-month journal report, Swiss crypto financial institution Sygnum highlighted Solana [SOL] like that of Ethereum [ETH] largest challenger within the monetary sector and a viable different for numerous rollout and improvement breakthroughs.

Also known as a “Ethereum killer,” Solana has been steadily gaining floor by exploiting Ethereum’s weaknesses to create a aggressive benefit.

Nonetheless, there’s a vital market cap hole – roughly $218 billion – as Ether continues to outpace Solana. And but, Solana’s value ratio to Ether is up 300% 12 months over 12 months. What contributed to the rise?

Solana’s sturdy place within the monetary sector

Two years in the past, an identical rivalry emerged between SOL and ETH when Solana partnered with Visa. On the time, SOL was built-in for USD Coin settlements, touting its excessive throughput and low charges.

Just lately, the upside potential was additional strengthened by the announcement of asset supervisor Franklin Templeton launch an funding fund on Solana.

Solana’s rising ingenuity within the monetary sector has led the Swiss financial institution to acknowledge the blockchain as a “critical challenger” to Ethereum in the long run.

Whereas there is no clear timeline for when this shift would possibly occur, Solana undeniably does close the hole with Ethereum on a number of metrics.

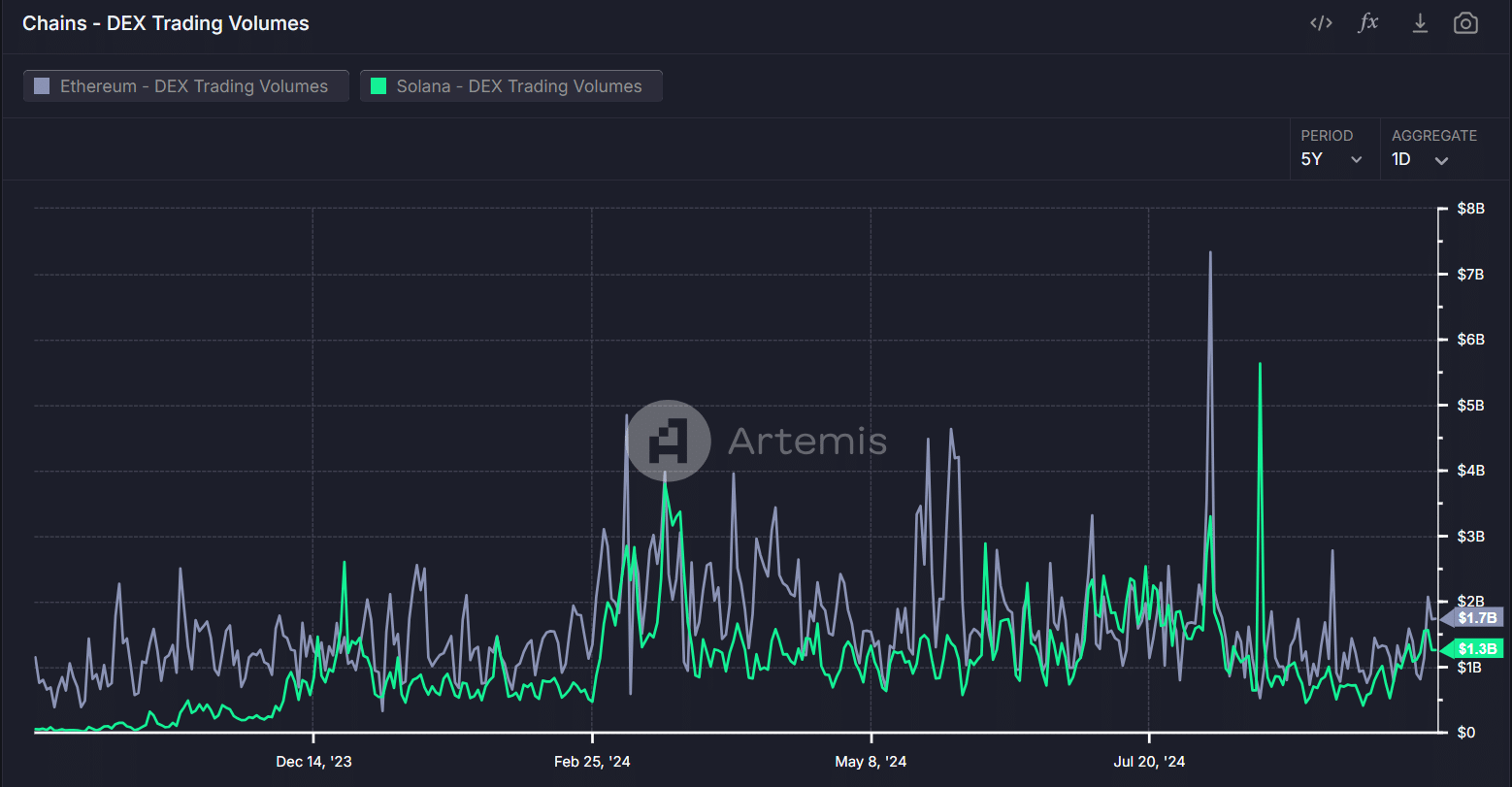

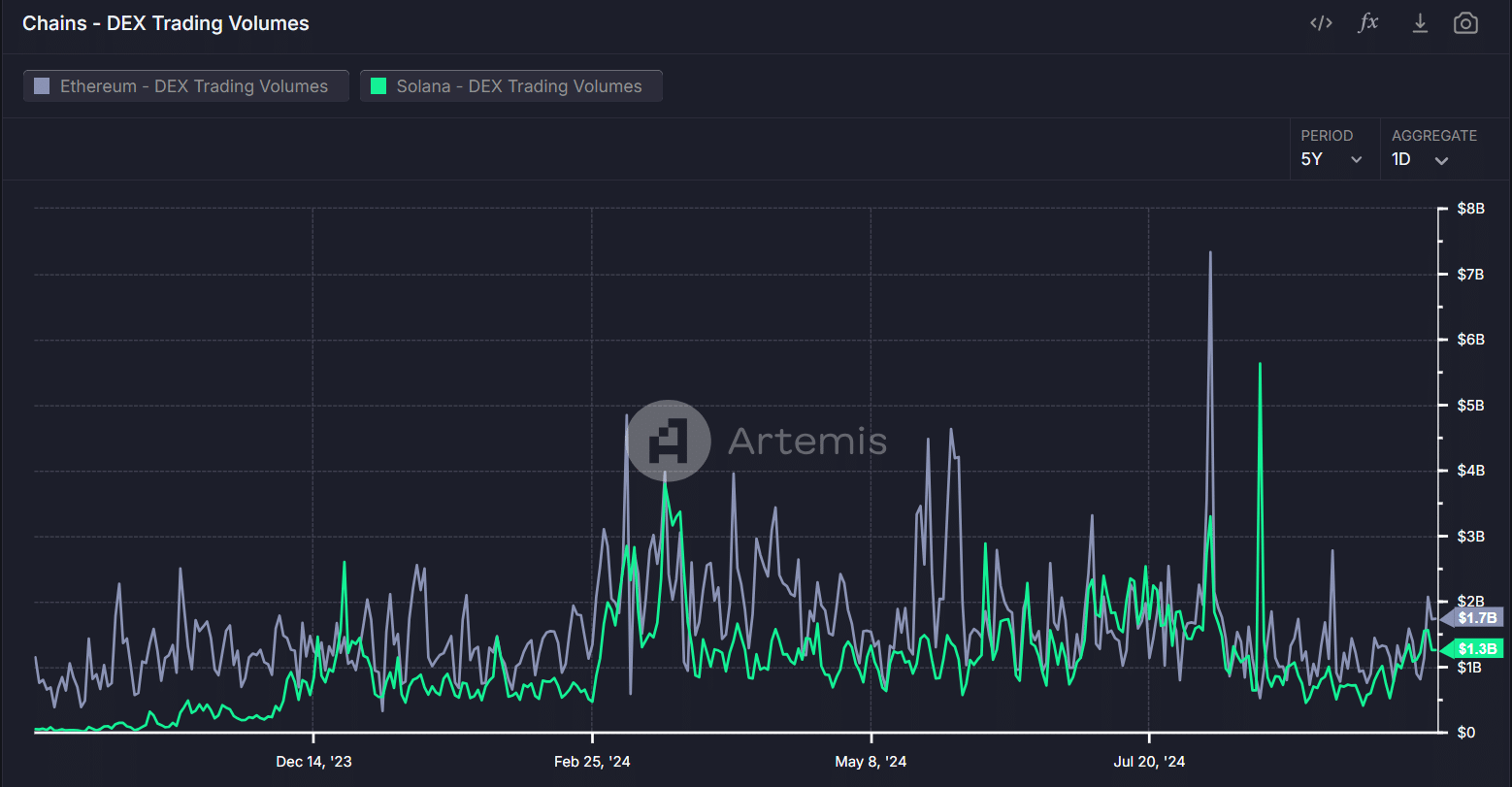

For starters, Ethereum’s DEX quantity had fallen from $2 billion in August to $1.7 billion on the time of writing. Quite the opposite, Solana’s DEX quantity has remained secure and even improved over the identical interval.

Supply: Artemis Terminal

Briefly, partnerships with main monetary establishments, resembling Visa, have elevated Solana’s visibility, probably attracting new buyers and difficult Ethereum’s dominance.

Along with these collaborations, the continued comparisons between Solana and Ethereum are supported by a well-thought-out technique. One which goals to overhaul the five-year older Ethereum blockchain.

Solana takes benefit of Ethereum’s shortcomings

Solana’s structure helps excessive throughput and low transaction prices, making it engaging to each customers and builders.

Ethereum, alternatively, faces challenges with excessive gasoline charges, which might deter customers from partaking with its community.

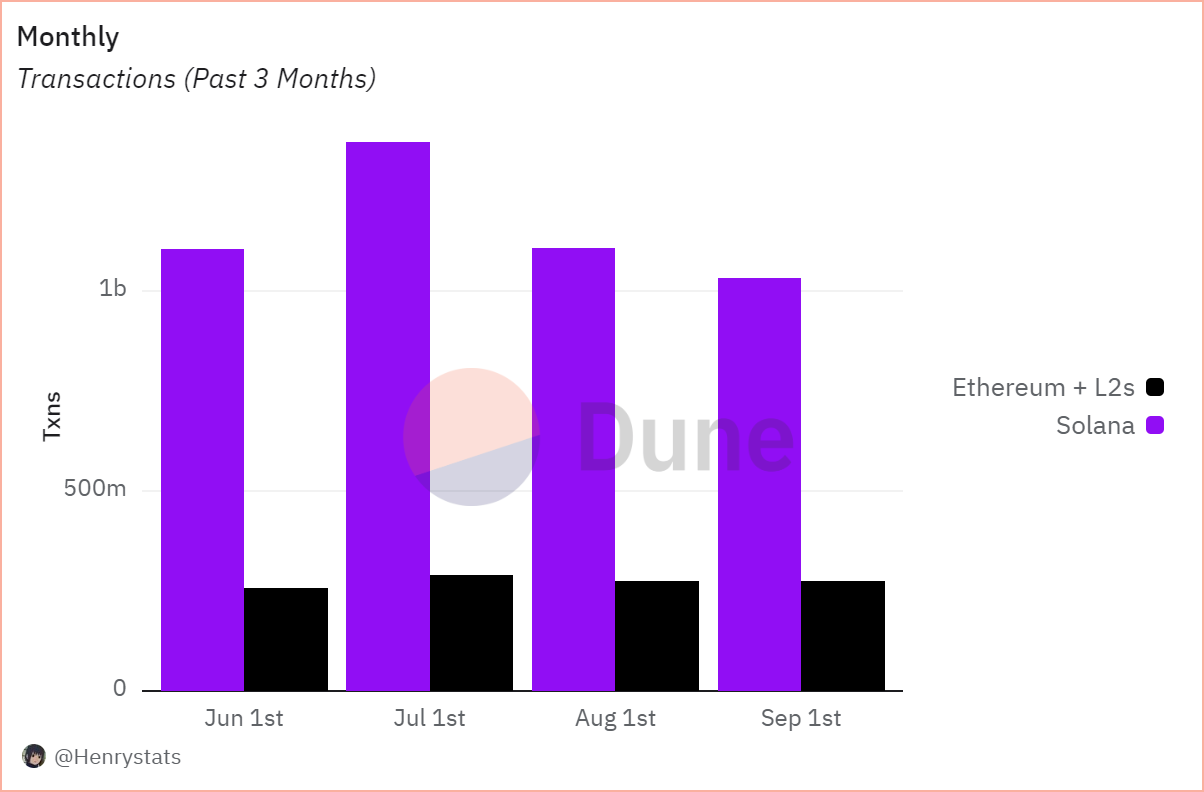

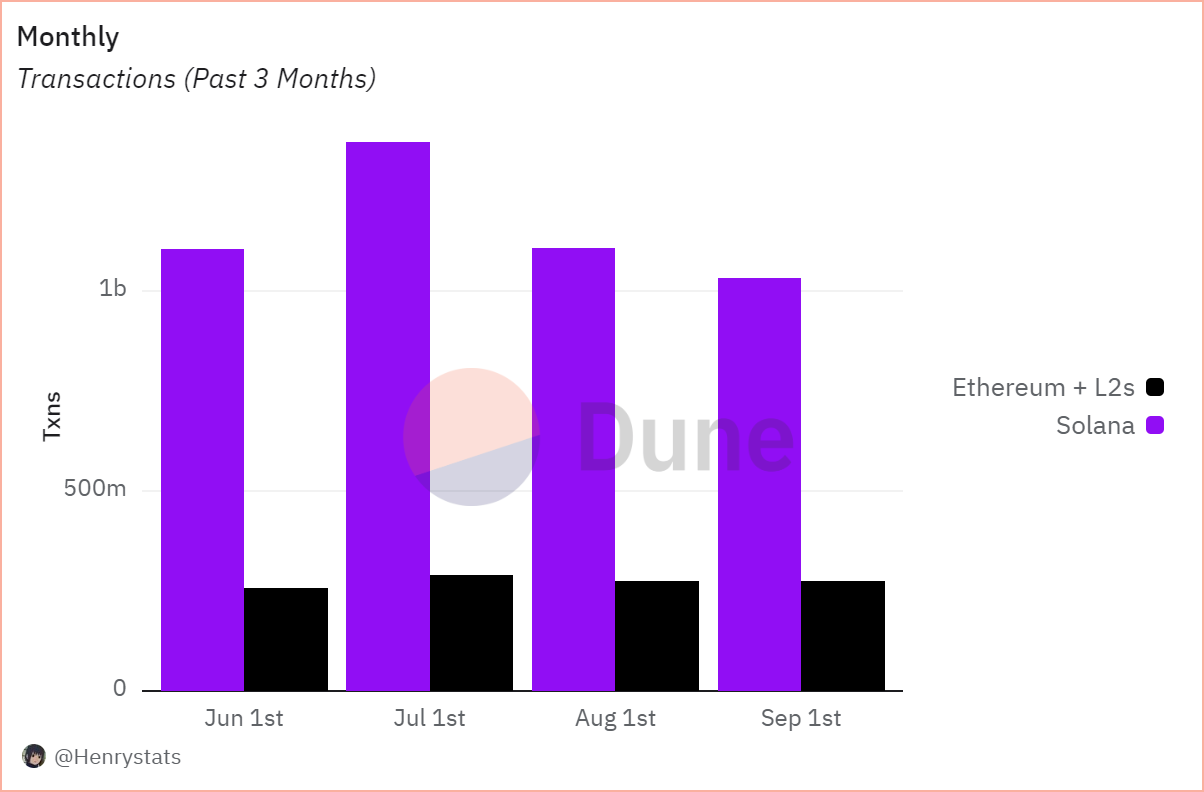

Supply: Dune

The influence of this disparity is clearly seen within the graph above. The variety of month-to-month transactions on Solana has crossed the 1 billion mark, whereas Ethereum is experiencing low community exercise with solely 200 million in transaction volumes.

Clearly, the excessive gasoline charges on Ethereum have pushed customers to Solana for quicker transactions at decrease charges.

Learn Solana’s [SOL] Value forecast 2024–2025

Basically, Solana has made vital progress in simply 4 years since its launch. Whereas there are areas the place SOL excels, Ethereum stays dominant others.

General, if Solana actually desires to rival Ethereum, it must develop modern decentralized functions that drive widespread adoption – an space the place Ethereum at present reigns.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now