Analysis

Is the Crypto Bear Market Here? Whales Go Short, Fears Spike Big

Credit : coinpedia.org

The crypto market is sending out warning indicators immediately, with the whole market cap falling to $3.83 trillion, down 0.62%. Vital indexes by CoinMarketCap Watch out: the CMC 20 index is nearly flat at $243.75, and the Concern & Greed index has plunged straight into concern at 37. Moreover, altcoin season is cooling off at 38/100. Even the typical crypto RSI is just 47.93, indicating declining momentum.

With market-moving information just like the NY FED Manufacturing Index, Philly FED Manufacturing Report, and NAHB Housing Manufacturing all down this week, volatility is looming. The present panorama feels tense, and rightly so, the US authorities simply moved 667 BTC, value about $75 million, to a brand new pockets. Examine this to the latest motion of an ‘insider whale’ who has scaled his shorts to over $500 million, anticipating a good deeper collapse.

Whale actions and authorities actions

When whales take motion, the market listens. In accordance with SwanDeskthe so-called “insider whale” answerable for final week’s sudden crash has aggressively doubled down, pushing his brief place previous $500 million. The whale is betting closely available on the market in anticipation of additional declines.

This stage of conviction hardly ever occurs with no seismic shift behind the scenes. On the identical time, the US authorities’s shifting of 667 BTC will not be one thing to disregard. Traditionally, such transfers typically precede gross sales that exert heavy promoting stress, and buyers are understandably nervous a few sudden dump that would speed up bearish momentum.

Inventory market outflows and liquidations

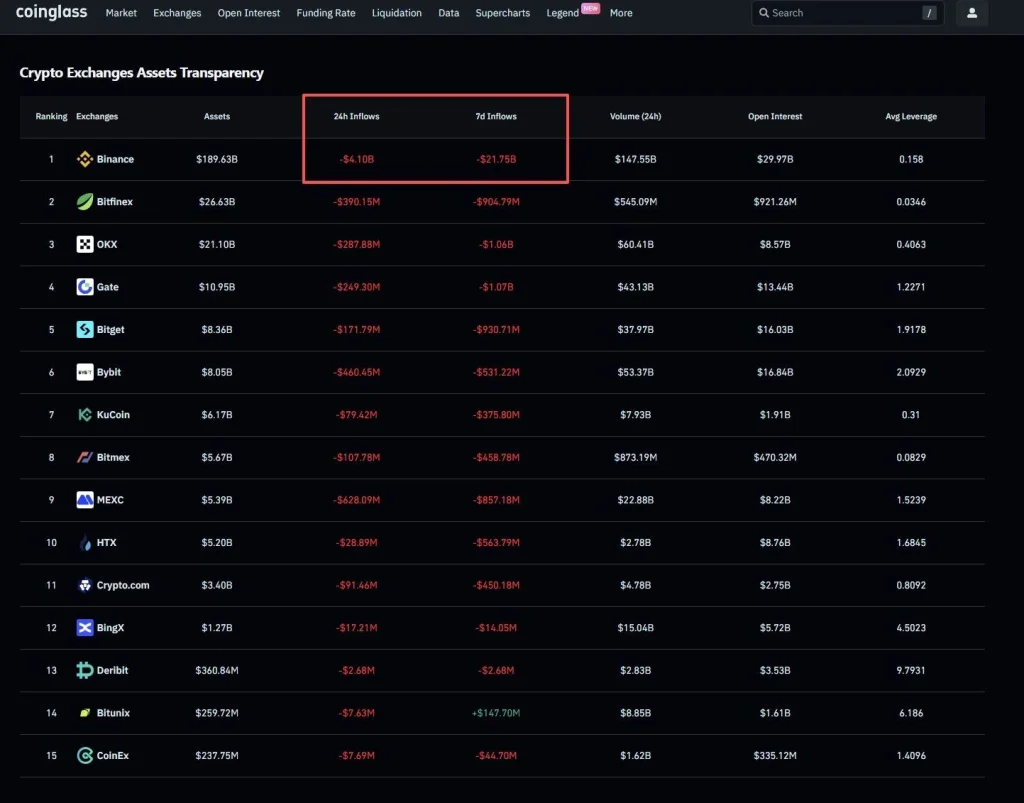

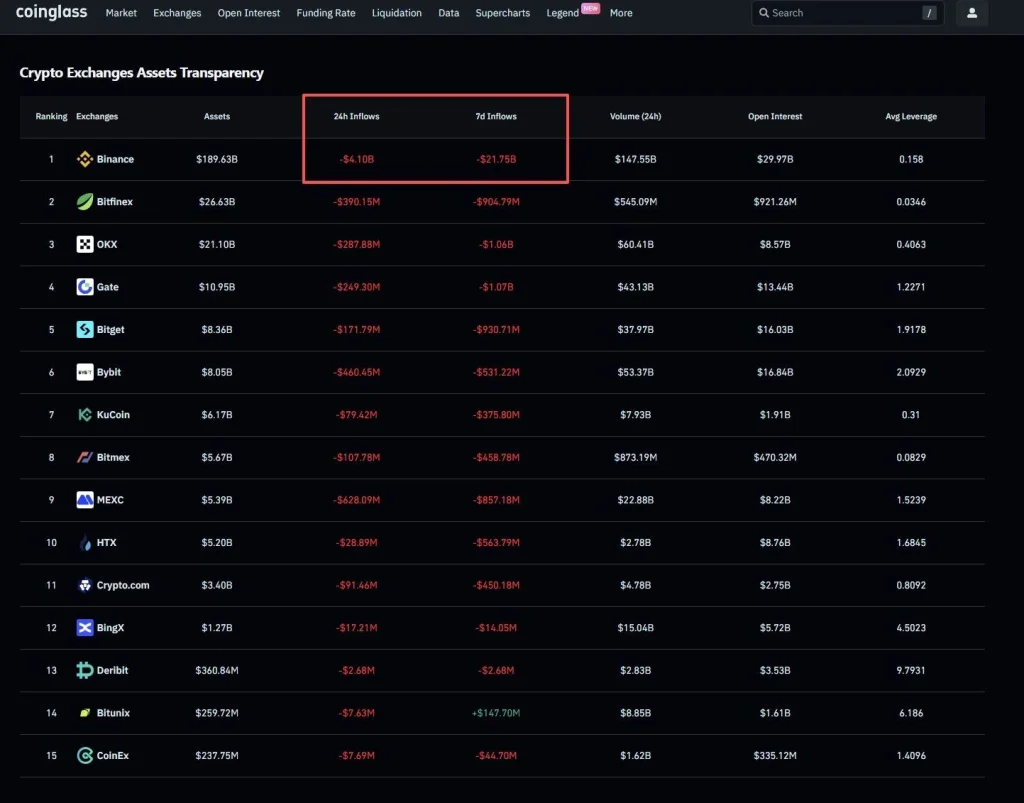

In accordance with MintGlassCentralized crypto exchanges are recording vital outflows, a basic signal of uncertainty and lack of belief. Binance noticed a staggering internet outflow of $4.1 billion in 24 hours, with many main platforms displaying comparable patterns. This knowledge helps the narrative that main gamers are both leaving to keep away from additional losses or making ready to promote their companies elsewhere.

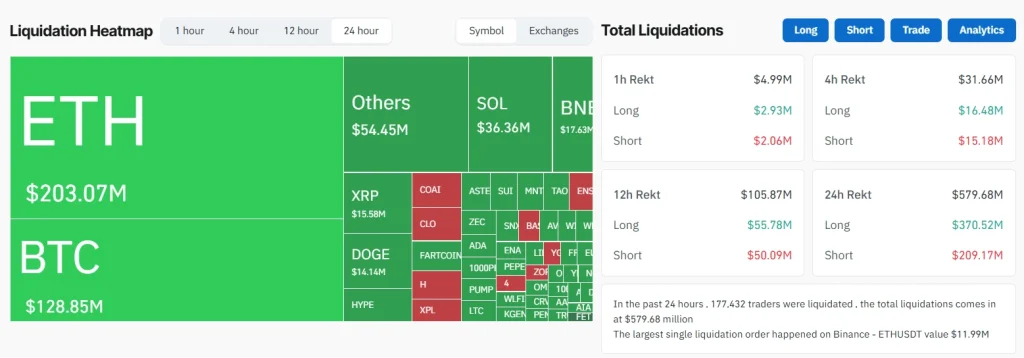

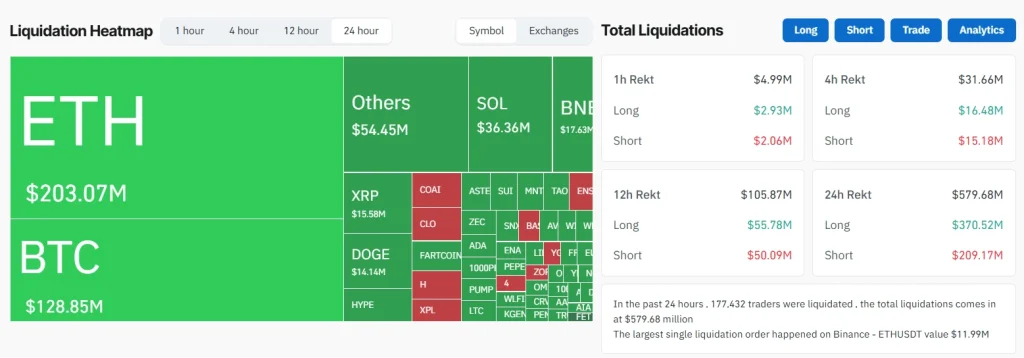

Sequentially, the liquidation chart reveals almost $580 million in positions worn out prior to now day, with ETH and BTC main the way in which ($203 million and $129 million, respectively). Most of those liquidations are on lengthy positions, which suggests to me that bullish merchants are being caught out, fueling much more cautious sentiment.

Bearish indicators and market sentiment

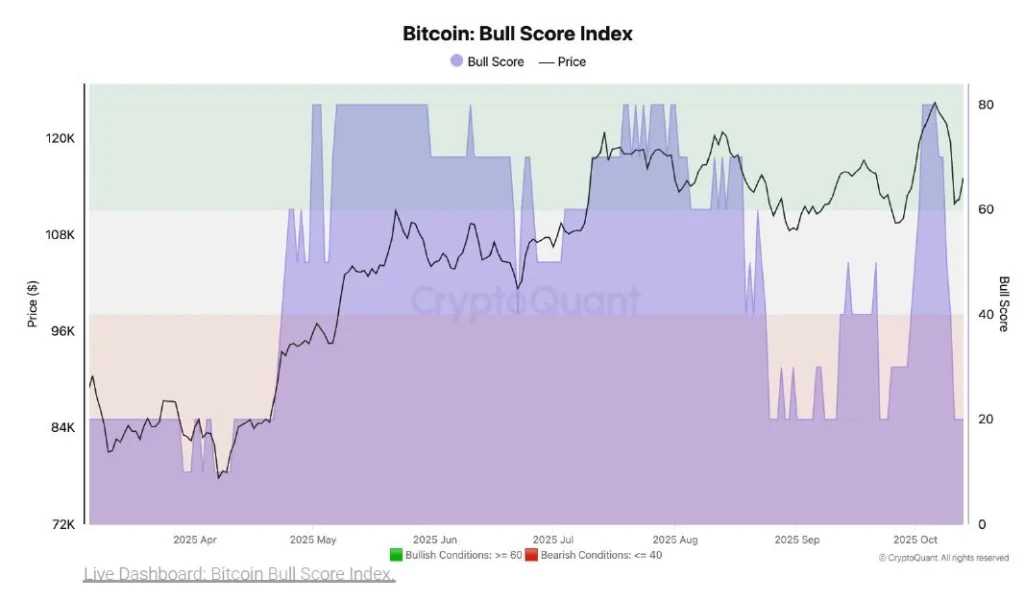

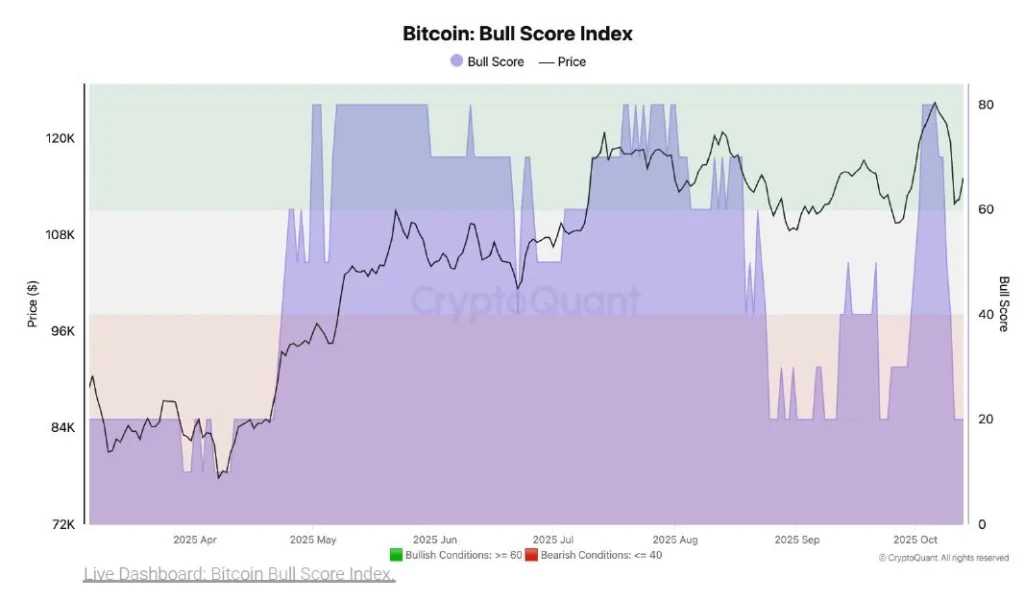

CryptoQuant’s The Bull Rating Index has not solely cooled, however collapsed. From a sturdy 80 final week, it’s now languishing in direction of 20. Traditionally, readings under 40 corresponded to bearish market phases. At sentiment ranges, concern has the higher hand: the Concern & Greed Index is studying 37 and altcoin momentum has fallen sharply. The latest worth motion is not only a blip, there’s a sense of continued danger aversion in all corners of the crypto world.

Macro occasions and future dangers

It isn’t simply inner crypto components which have merchants on edge. With the whales and the federal government in a down place, and liquidations piling up, any aggressive occasion might ship this shaky market right into a bear part.

Often requested questions

The actions of presidency wallets are sometimes a harbinger of institutional promoting. Such dumps can set off an accelerated market decline, particularly if sentiment is already fragile

No sign is ever “assured”. Nonetheless, when a whale invests over $500 million in shorts, it’s normally based mostly on data or perception about an impending recession, which provides weight to bearish indicators.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We goal to supply well timed updates on every little thing crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts duty in your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks could seem on our web site. Advertisements are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now