Ethereum

Is the Santa Claus rally already over? Here’s what it means for your crypto investments

Credit : ambcrypto.com

- The market noticed important declines this previous week.

- There may be nonetheless time within the 12 months when the market can push for one final rally.

The Santa Claus rally, a seasonal market development the place costs traditionally rise within the final week of December, has grow to be a sizzling subject within the crypto world.

As we strategy the tip of 2024, crypto traders are questioning if this rally has fizzled out but or if it nonetheless has the potential to drive the markets larger.

Present market overview

Bitcoin [BTC]the market chief, is at the moment buying and selling at round $95.00, reflecting a rise of lower than 1% within the final 24 hours.

Ethereum [ETH] follows go well with with a rise of lower than 1%, with a value of roughly $3,291. Solana [SOL] and Binance Coin [BNB] are additionally exhibiting slight positive aspects, with the entire crypto market cap hovering round $3.5 trillion.

Regardless of the small decline, buying and selling volumes stay sturdy. Bitcoin’s dominance, now at 55.08%, underlines its essential function throughout this seasonal interval.

Supply: Coinglass

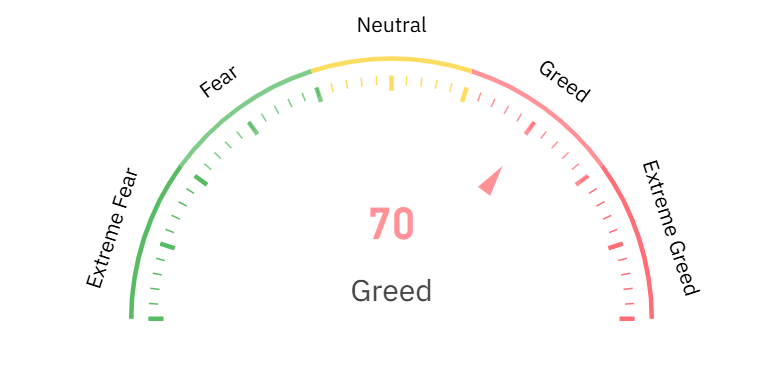

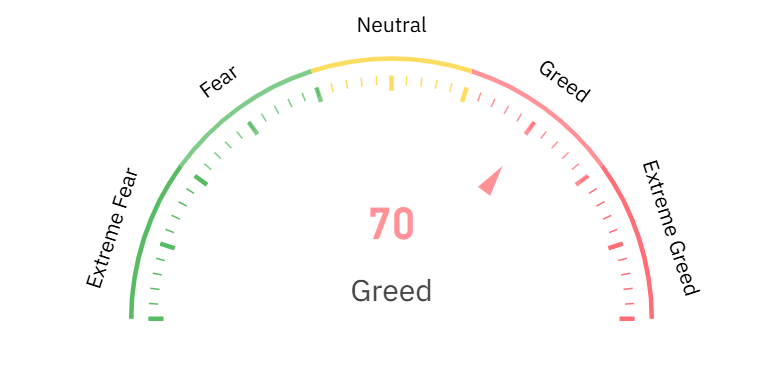

Moreover, the Concern & Greed Index, at the moment at 70 (Greed), means that market sentiment stays bullish, albeit cautiously.

Has the Santa Claus rally misplaced its momentum?

The Santa Claus rally has historically been linked to bullish sentiment, tax-driven buying and elevated retail participation. Nonetheless, current occasions have induced volatility, together with the expiration of greater than $2.6 billion value of Bitcoin and Ethereum choices.

This options expire usually causes value fluctuations as merchants regulate their positions.

Knowledge on the chain reveals blended indicators. Whale exercise has declined and fewer massive transactions have been recorded, whereas non-public traders proceed to build up.

In the meantime, technical indicators such because the Relative Power Index (RSI) for BTC and ETH are hovering round impartial ranges, indicating a scarcity of clear directional momentum.

What this implies for traders

The efficiency of the rally within the coming days will largely rely upon the important thing resistance ranges. Bitcoin faces a psychological barrier at $100,000, whereas Ethereum must regain $3,500 to regain bullish momentum.

Bollinger Bands point out decreased volatility, however any breakout will be important.

For these coming into immediately’s market, danger administration is crucial. Traders ought to take note of momentum shifts, particularly within the MACD and RSI, whereas maintaining a tally of macroeconomic tendencies and regulatory updates that would influence sentiment.

Though the Santa Claus rally has not produced explosive earnings, its potential has not been utterly diminished. The following week will probably be essential because the market transitions to 2025.

Staying knowledgeable and adapting to market situations will probably be essential for crypto traders seeking to benefit from the year-end alternatives.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024