NFT

is there a silver lining for investors?

Credit : cryptonews.net

The NFT (non-fungible token) public sale market has cooled down considerably after the frenzy of 2021, characterised by fewer auctions and cheaper price ranges, however specialists liken the part to a wholesome consolidation that may usher in additional sustainable development over time.

Based on Artprice’s 2024 Up to date Artwork Market report, the NFT public sale raised simply $9.3 million final 12 months.

This was a far cry from the peak of hypothesis in 2021, when digital artist Beeple offered an NFT for an astonishing $69 million at Christie’s, thrusting him into the worldwide highlight.

Whereas the occasion despatched shockwaves via each the tech and artwork worlds and marked NFTs as a revolutionary new asset class, the NFT market raised a formidable $110.5 million via regulated auctions that 12 months, with items from rising artists like Fewocious and collections like CryptoPunks that made hundreds of thousands. .

2023 noticed the market transfer away from dizzying worth tags, with fewer auctions and extra reasonable worth ranges changing into the brand new norm.

The report says:

What was as soon as a chaotic and speculative bubble has now calmed down right into a extra steady market, giving collectors and traders house to evaluate the true affect of this digital artwork revolution.

Much less notable gross sales, however NFT collections see continued curiosity

Because the peak of the NFT increase, the market’s main artists have seen their costs drop to extra cheap ranges.

Fewocious, a 2021 teen sensation who offered a chunk for $2.8 million at Sotheby’s, has not had any work supplied at public sale this 12 months.

Likewise, Larva Labs’ CryptoPunks, as soon as a darling of the NFT house, are now not attracting the wild bids they as soon as did.

Even Beeple, whose work sparked the NFT increase, noticed rather more modest gross sales of $177,800 in 2023.

Regardless of this market correction, purchaser curiosity stays regular, particularly for established NFT collections, the report mentioned.

Yuga Labs, the maker of the Bored Ape Yacht Membership (BAYC), continues to see robust demand. Throughout a current Sotheby’s on-line sale, 100% of Yuga Labs’ NFTs have been offered, with essentially the most beneficial lot fetching $264,000.

This implies that whereas the broader NFT market has cooled, there’s nonetheless nice enthusiasm for high-end collections.

Cooling down in NFT auctions is in step with the broader cooling of the artwork market

The decline in NFT public sale values shouldn’t be considered in isolation.

Based on Artnet’s 2024 mid-year evaluate, a complete of $5.05 billion was spent on artwork at public sale within the first half of 2024, a decline of 29.5% from the identical interval final 12 months.

The Artprice report provides that the worldwide modern artwork market additionally did not set main public sale information final 12 months, even because the variety of transactions on reasonably priced works elevated.

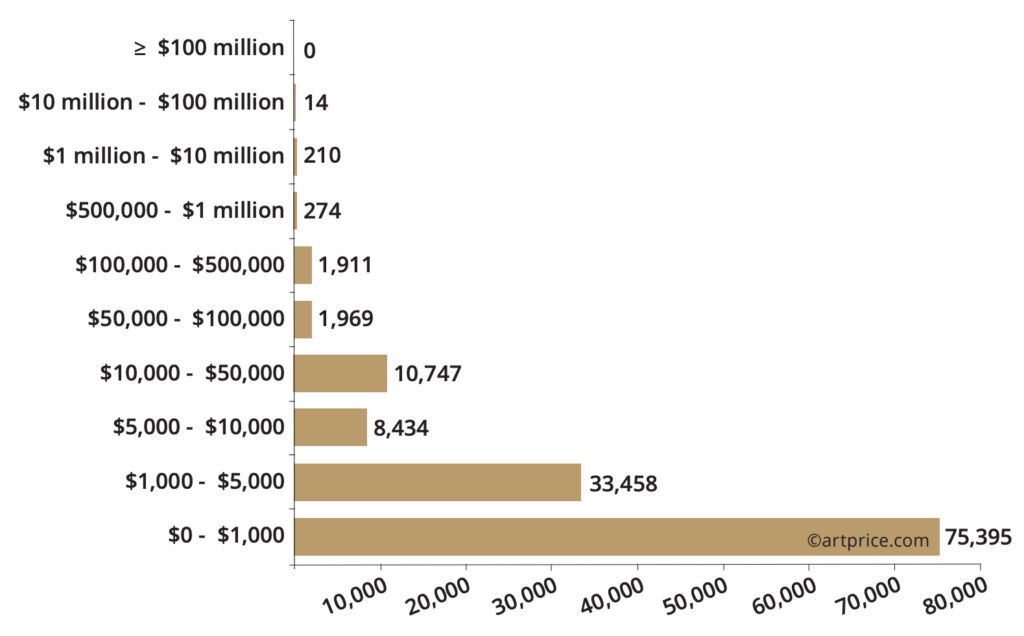

Up to date artwork public sale outcomes by worth vary 2023-24, Supply: Artprice

Based on the report, there was a notable contraction in modern artwork auctions within the 2023-2024 monetary 12 months, with almost a billion {dollars} much less in comparison with the historic peak two years in the past.

Nonetheless, with a complete of $1.888 billion, the market has returned to pre-pandemic ranges, exceeding the common of the 5 years previous the well being disaster by $200 million.

The worldwide context, with its persistent geopolitical and financial tensions, has slowed down the marketplace for status works. Persuade salespeople

Understandably, auctioning off their most useful possessions is a tough process in unsure occasions. In the meantime, main consumers are clearly in a cautious temper and are preserving an in depth eye on the long-term prospects.

What’s subsequent for the NFT public sale market?

Specialists see a silver lining within the hunch.

Artprice says collectors can now purchase works from main digital artists for a lot lower than 2021’s sky-high costs.

Famend artists akin to Refik Anadol, who lately exhibited on the Museum of Trendy Artwork (MoMA), and Dmitri Cherniak, a pioneer of generative artwork, have seen their NFTs out there at public sale for between $15,000 and $20,000.

Moreover, for underneath $10,000, consumers can discover almost 200 NFTs from artists like Moxarra Gonzalez, Matt Deslauriers, and Hideo, all chosen by main public sale homes up to now 12 months.

As NFTs enter their second decade of existence, however solely their third 12 months on the regulated public sale market, the speculative wave and FOMO phenomenon have subsided and the hype has subsided. We at the moment are a golden alternative to construct a stable and sustainable market, far-off from the thrill of the thrill.

This shift indicators that the NFT market is maturing and transferring from a speculative frenzy to a extra sustainable mannequin.

The market is now centered on constructing a stable basis fairly than chasing viral moments.

Whereas the spectacular worth will increase of the previous could now not dominate the headlines, the digital artwork world is working in the direction of a measured, extra resilient future.

With this newfound stability, there’s a golden alternative for collectors and artists alike to foster a sustainable market within the years to come back.

The post-NFT public sale market cools down considerably: is there a silver lining for traders? first appeared on Invezz

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024