Adoption

Italy’s largest bank Intesa Sanpaolo enters Bitcoin market with initial €1 million investment

Credit : cryptoslate.com

Intesa Sanpaolo, Italy’s largest financial institution, has reportedly entered the Bitcoin market by buying €1 million value of the important thing digital asset.

This quantities to round 11 BTC, in response to an inside e mail reportedly signed by Niccolo Bardoscia, the pinnacle of the financial institution’s digital asset buying and selling and funding division.

Though Intesa has but to verify the acquisition, a number of credible media shops together with Reutershave reported on it.

In the meantime, Intesa’s reported Bitcoin acquisition follows a sequence of strategic strikes within the digital asset area.

The financial institution’s crypto division was based final 12 months reportedly has obtained approval for spot cryptocurrency buying and selling, complementing its present providing of crypto choices, futures and exchange-traded funds (ETFs).

Nevertheless, it’s unclear whether or not this Bitcoin buy is an indication of a broader growth into the digital asset ecosystem.

However, Pierre Rochard, vice chairman of Bitcoin Miner Riot Platforms, emphasised the significance of this shift, noting that monetary establishments are more and more recognizing Bitcoin’s potential.

He said:

“All banks ought to begin accumulating BTC to recapitalize their stability sheets.”

Intesa is widely known as a pacesetter in digital asset adoption inside Italy’s conventional monetary sector. It additionally holds the primary place among the many Eurozone banks measured by market capitalization, valued at €69 billion, surpassing rivals reminiscent of Santander (€67 billion) and BNP Paribas (€66 billion).

Institutional Bitcoin Curiosity

Market observers famous that Intesa’s buy displays a broader development of elevated Bitcoin adoption amongst monetary establishments.

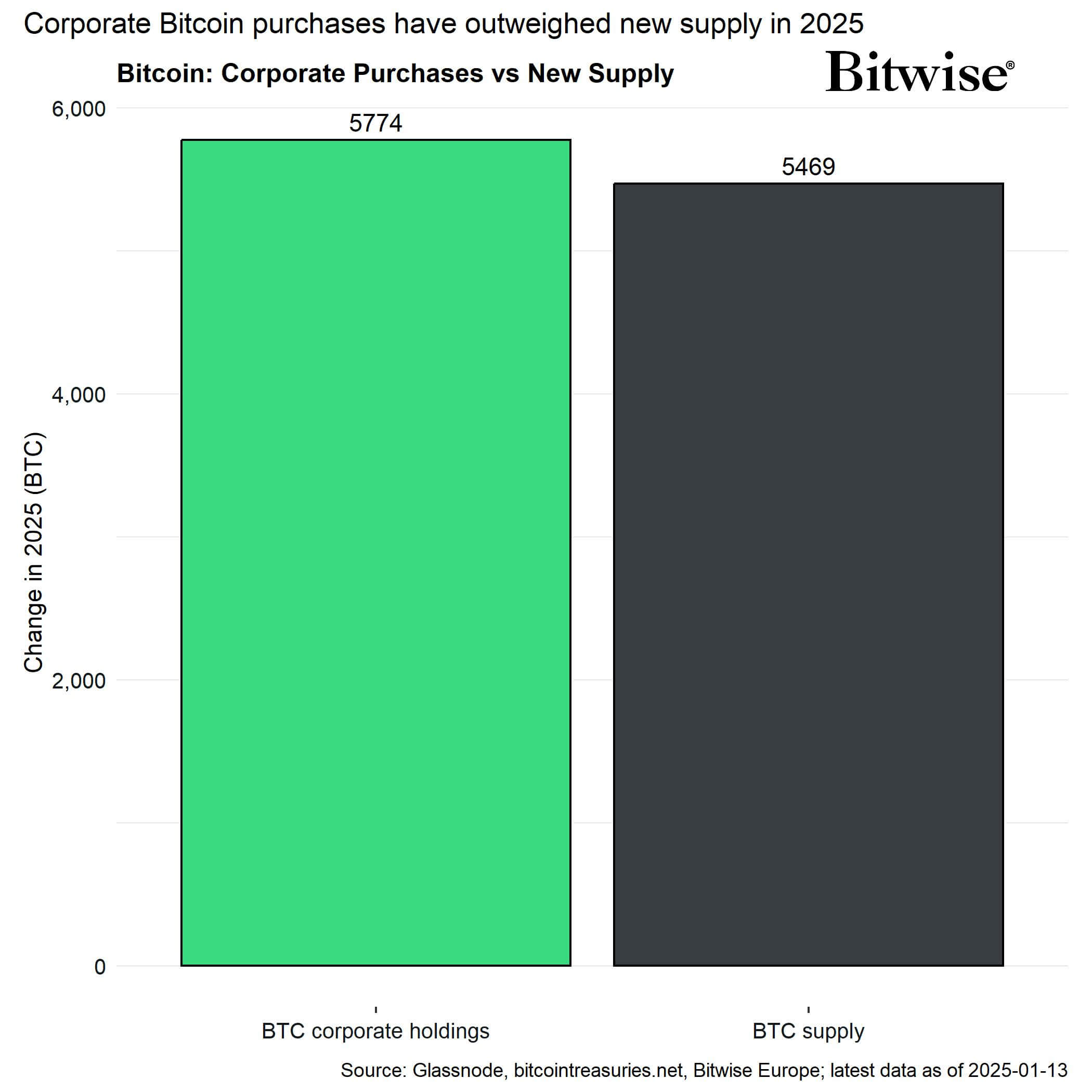

Facts from Bitwise emphasizes that company demand for Bitcoin will exceed the provision of newly mined cash by 2025. Firms have collectively bought 5,774 BTC for the reason that begin of the 12 months, whereas solely 5,469 BTC had been mined throughout the identical interval.

Among the many distinguished company consumers is MicroStrategy, which added about 3,600 BTC to its reserves this 12 months. Different corporations reminiscent of Semler Scientific and Ming Shing group have additionally turned to Bitcoin of their liquidity and reserve diversification methods.

Hunter Horsley, CEO of Bitwise, expects this development to proceed this 12 months, proverb:

“Firms shopping for Bitcoin can be a significant theme of 2025.”

Talked about on this article

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now