Policy & Regulation

Japan crypto-heads pin tax hopes on Trump, Tamaki, as P2P usage grows in Asia regardless

Credit : cryptonews.net

Politicians who make massive crypto guarantees – Donald Trump and Yuichiro Tamaki – are common in Japan because the financial system struggles and cryptocurrency holders are mercilessly taxed. Nonetheless, amid the cacophony of election buzz, a brand new motion of peer-to-peer (P2P) adoption and use has begun in Asia, based mostly on bitcoin money.

In a tweet posted on Halloween (JST), Japan’s self-regulatory and state-certified crypto asset group referred to as the JVCEA submitted a request for crypto tax reform to Folks’s Democratic Occasion (DPP) chief Yuichiro Tamaki.

“As consultant director of the JVCEA, a licensed self-regulatory group for crypto belongings, in the present day I submitted a request for tax reform associated to crypto belongings to Mr. Tamaki, the chief of the Democratic Occasion for the Folks,” writes Genki Oda . talked about on social media web site

Oda of the JVCEA complained: “In April 2017, greater than 50% of the world’s bitcoin transactions have been in Japanese yen. This has now dropped to round 1%,” indicating a troublesome setting for crypto fanatics within the nation.

Genki Oda, consultant director of the Japan Digital and Crypto belongings Trade Affiliation (JVCEA).

Tamaki and Trump are creating buzz on social media about crypto

Yuichiro Tamaki has beforehand brought on a stir in terms of making guarantees about crypto tax reforms within the nation, with holders doubtlessly being taxed as much as 55% on their winnings in probably the most excessive instances. The member of Japan’s Home of Representatives posted a 4-point crypto pledge to X on October 20, asking for votes for his social gathering.

Tamaki talked about a separate 20% tax on cryptocurrencies, the usage of NFT in authorities and the digitalization of the yen, that are elevating alarm bells amongst some concerning the doubtlessly harmful energy of a central financial institution digital foreign money.

Alternatively, the polarized political ambiance within the US appears to be pushing Republican presidential candidate Donald Trump to make daring claims about Bitcoin’s future as “MADE IN THE USA! VOTE FOR TRUMP!”

The previous Democrat (who by no means locked up Hillary Clinton as he promised in his first election, and actually showered her with excessive reward instantly after he received) will hopefully not less than observe by on introduced plans to kill Ross Ulbricht, the creator of the Silk Street market, to liberate.

Those that know the way politics inevitably work, nonetheless, have little selection however to hope for roughly a fortunate bureaucratic fluke in order that Ross would possibly get his life again. Japanese social media customers are equally hoping for a miracle in terms of Tamaki and Trump, however of their case it is the identical system that cruelly jailed Ulbricht for granting crypto tax breaks.

Along with the latest consideration from the founder and CEO of main Japanese trade Bitflyer, Yuzo Kano, on a regular basis

“Should not the Japanese authorities additionally purchase Bitcoin?” one account tweeted in response to Trump’s bitcoin guarantees.

However crypto was by no means about relying on political gusts. If the message encoded within the Bitcoin genesis block actually means something, Bitcoin has truly at all times been the precise reverse: used with out permission from banks and corrupt governments.

If there’s to be a crypto answer to the financial struggles Japan is presently experiencing, it should be discovered peer-to-peer.

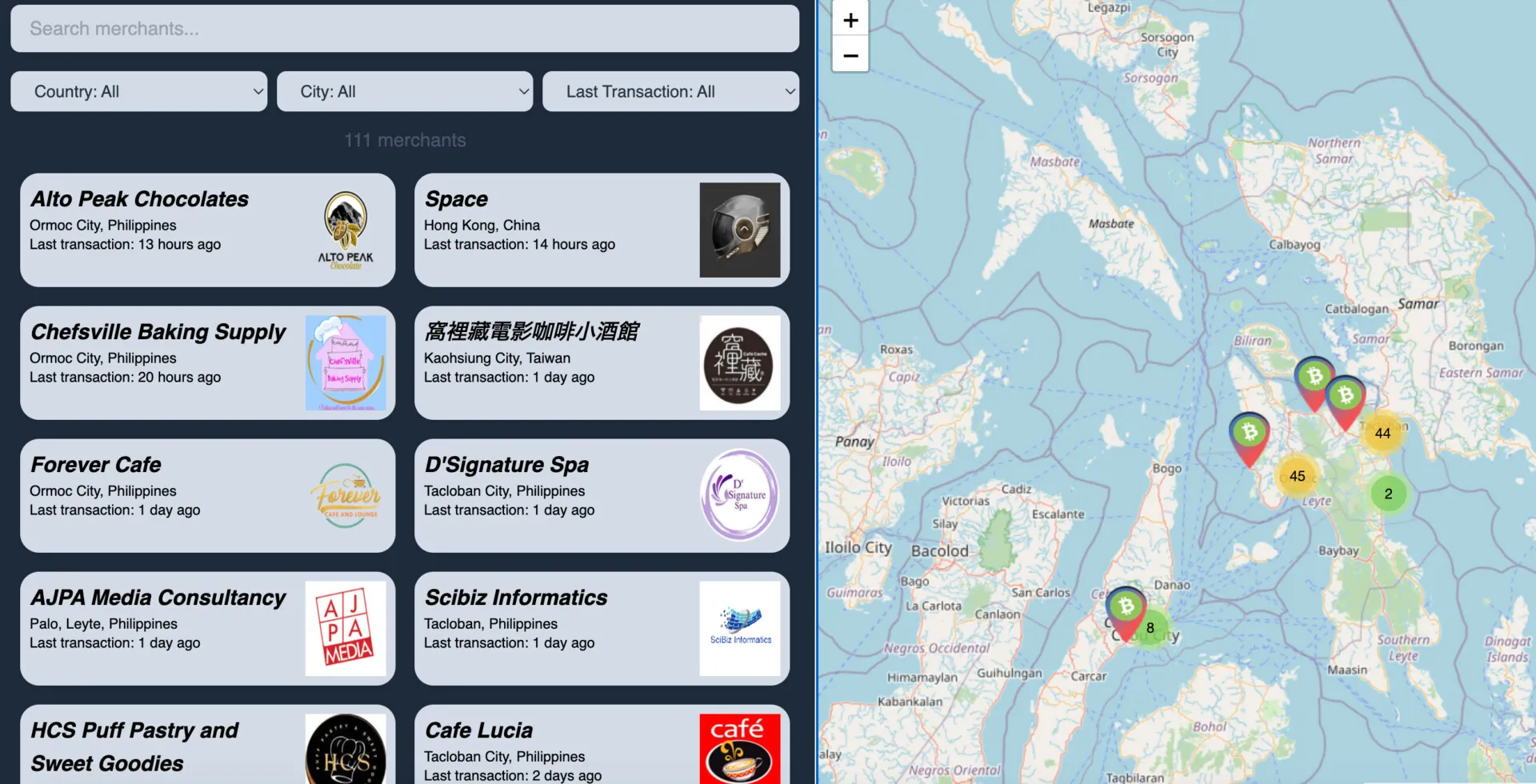

Paytaca pockets with corporations within the Philippines, Hong Kong and Taiwan that settle for bitcoin money.

Progress in the usage of P2P crypto in Asia

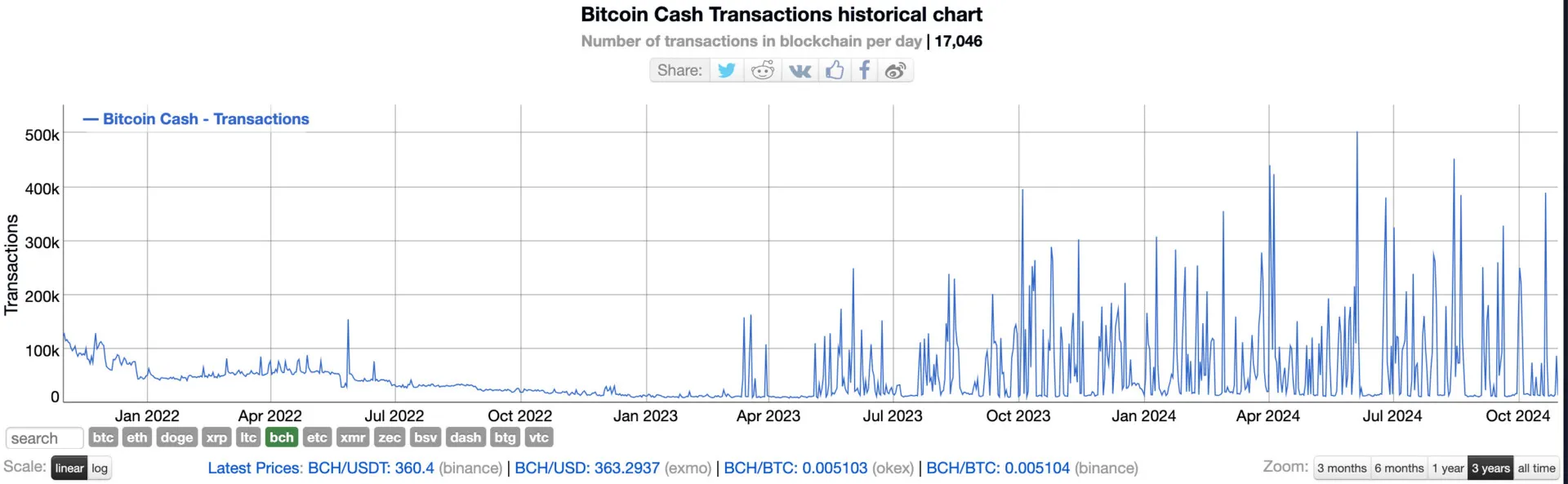

With the appearance of decentralized, permissionless and non-custodial buying and selling and hedging platforms corresponding to BCHBull, based mostly on the AnyHedge protocol, and UTXO (unspent transaction output) based mostly good contracts now enabled onchain on BCH, the oft-derided fork of BTC continues to make progress in direction of adoption with out having to hope to shady politicians.

Pockets makers like Paytaca are quickly bombarding brick-and-mortar companies within the Philippines and elsewhere within the area by specializing in quick transactions and practicality.

From left to proper: Aaron Almadro, Cindy Wang and Joemar Taganna.

Paytaca CEO Joemar Taganna instructed Cryptopolitan: “I imagine the important thing to driving crypto adoption within the Philippines – and Asia extra broadly – is to make it sensible and useful for on a regular basis funds, thereby surpassing the utility of fiat foreign money .” He famous that “This requires enabling direct, peer-to-peer crypto transactions fairly than simply embedding crypto into fiat fee methods.”

Taganna believes {that a} new breed of crypto corporations “should benefit from price financial savings and leverage the efficiencies of direct peer-to-peer funds to create sustainable margins.”

Statistically, transactions have additionally grown lately with the introduction of good contracts, on-chain NFT buying and selling and native adoption, as seen within the Philippines.

After all, there are a lot of different crypto belongings that may nonetheless be used P2P to guard themselves from monetary abuse, and BCH is only one of those choices, and none of them are with out their detractors.

Nonetheless, by specializing in uncensored cash and actually permissionless networks, as Taganna and others within the area are doing, it may finally make sure that irrespective of which political clown is vying for energy, the free market can nonetheless conduct transactions and initiatives , individuals and methods can select. that social governance is supported and valued voluntarily, and never by pressured elections.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now