Policy & Regulation

Japan introduces revised ‘crypto-friendly’ Payment Services Act

Credit : cryptonews.net

The nationwide food plan of Japan’s first dwelling on Friday accepted the Revised Cost Providers Act (PSA), which resulted in main modifications for firms that should do with crypto. The brand new class of ‘middleman firms’ relieves the necessity for intermediaries in Japan to register as exchanges, however the invoice has different implications, a few of which convey stricter guidelines and better centralization. Initially submitted to the Japanese food plan in March, the modifications to the Cost Providers Act are adopted on Friday and are praised as a pro-Crypto. Maybe it’s attracting essentially the most consideration from a brand new class ‘middleman firms’, which implies that firms that introduce or act as contacts between exchangers and customers. Such teams not should register as an change with the federal government regulator, the Monetary Providers Company (FSA). A separate registration, with relaxed guidelines, shall be launched for these intermediaries.

Picture: Chihiro Sakai.

What’s within the new legislation: stablecoins, middleman firms, emergency energy boundaries

Based on the FSA dialogue since November final yr, the modified Cost Providers Act is cited by regional media as most likely the removing of boundaries for gaming firms and others who wish to do enterprise with regard to cryptocurrency and digital belongings. Curiosity from Mercari, SBI Securities and Monex Securities has already been reported on registering as an ‘middleman firm’. Some essential modifications to the motion are as follows:

- Creation of “middleman” firms with relaxed registration guidelines.

- Creation of a separate registration system for commerce gala’s.

- New capacity to provide a authorized order that should hold established crypto firms in Japan as a way to stop outsourcing within the occasion of chapter.

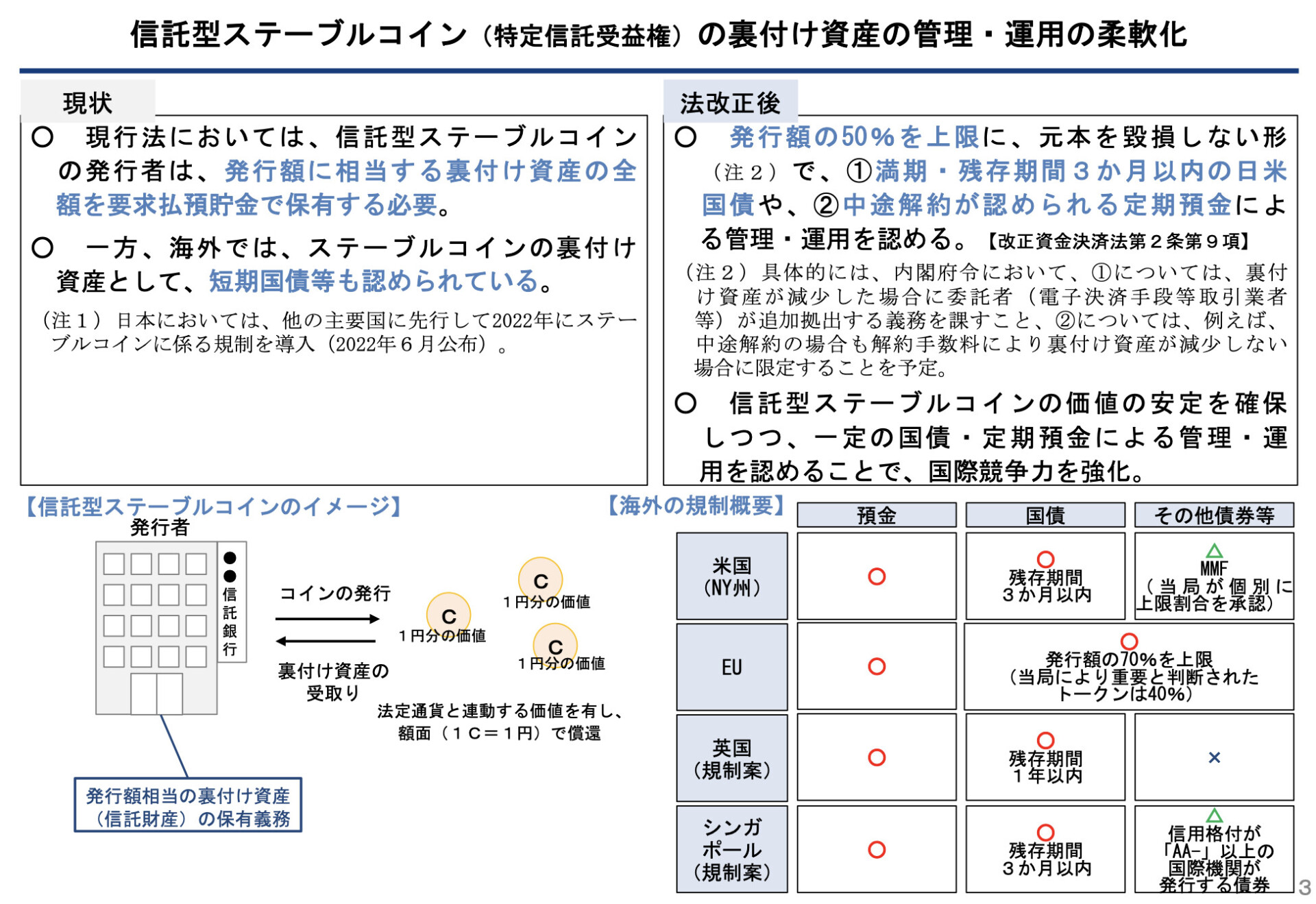

- “Belief-Sort” Stablecoin Backing Property can now be held partially (as much as 50%) in investments with a low danger corresponding to authorities bonds, reasonably than 100% supported by the problem.

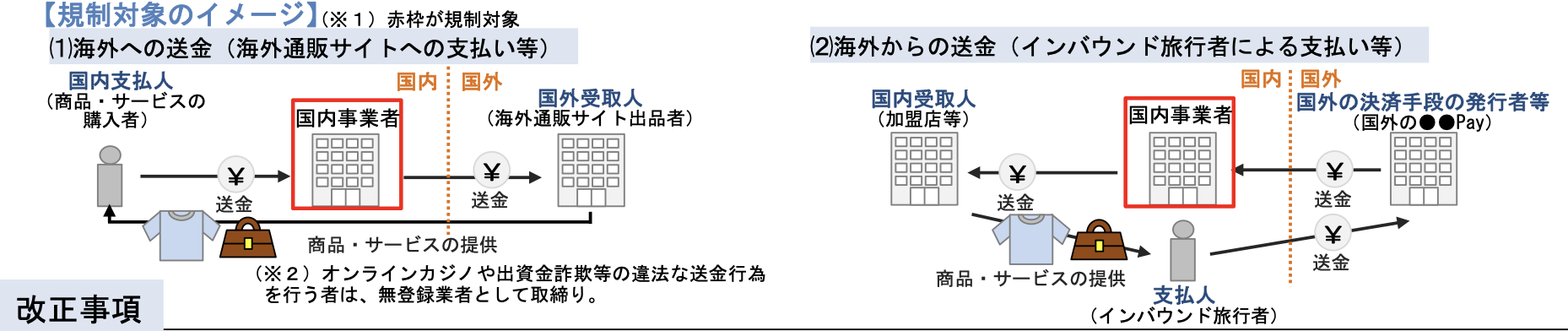

- Striker guidelines for firms which can be thought of overseas as ‘gathering companies’ that present e-commerce providers.

FSA graph with particulars about modifications within the Belief kind Stablecoin rules. Supply: FSA.

De gewijzigde moist, die binnen een jaar van kracht wordt, cementt in wezen strikte AML/CFT-vereisten en regels voor geregistreerde uitwisselingsexploitanten en e-commerce inzamelingsinstanties, verlicht de toegang tot het gereguleerde crypto-ecosysteem voor de liaisonbedrijven (die onder de toezicht van een geregistreerde operator moeten zijn, voorvallen met het runnen van het geld van de Japanse gebruikers en helpt banken die are simply recorded.

Centralization, stricter guidelines – Farther from Satoshi

Though it’s comprehensible that gaming firms and others are completely happy to listen to the information in regards to the success of the modification and the removing of entry thresholds, Tokyo and Japan will see Satoshi Nakamotas established authentic thought of separation of cash and stands as a Niets citizen. Or a poison apple, reasonably. Strong banks can now publish Stablecoins extra simply, the usage of state credit score, whereas abroad, permissionless markets and opponents are additional as threats. Comparable to coinpost in 2022 of a Mitsubishi UFJ working group was reported geared toward stablecoins: “The goal is to place an finish to the present scenario through which funds primarily streams in abroad stabilecoins, together with investments in abroad web3 (decentralized app) initiatives, and even Dektchoccre -Markt -Markt -Markt -Markt -Markt -Markt -Markt -Markt – -Alternate. “

Corporations that deal with cash thought of cross-border “assortment companies” which can be concerned in actions corresponding to e-commerce will also be regulated beneath the revised PSA. Supply: FSA.

Performing towards overseas fee brokers thought of cross-border “assortment companies”, corresponding to these concerned in e-commerce, is a easy slope. The FSA notes that it’s going to not go after actions with a low danger or registration requires intermediate intermediaries, whereas it threatens a efficiency towards on-line casinos and fraud, and noticing that “those that carry out unlawful transmissions, corresponding to on-line casinos and funding fraud, shall be topic to rules as non-registered firms”. As with all laws, random political interpretation makes countless abuse doable. Beforehand, cross -border collective companies didn’t should register as a enterprise switch firm on the State. Now they solely should depend on the FSA ensures, in a state of relative Limbo. Luckily for the proponents of peer-to-peer, permissionless transactions, whatever the new rules, the usage of precise crypto-not regulated, financial institution issued stabilecoins-stays a path to financial freedom and peace in Japan, in a time of a faltering yen, rice shortages and mainstream Malaise.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now