Policy & Regulation

Japan Prepares Large Scale Amend of Crypto Policies

Credit : cryptonews.net

The Japanese Company for Monetary Providers (FSA) is making ready radical adjustments to its digital assetarader. The adjustments that mix tax reforms and authorized upgrades might introduce with exhibition -related funds (ETFs) which are linked to cryptocurrencies.

The initiative signifies the intention of Japan to combine crypto in common financing and to draw broader investments.

Tax burden in revision

The reform bundle, in your individual nation, contains two essential elements. Firstly, it consists of revising the tax code that will transfer Crypto from an intensive load to the identical class as shares. Secondly, it features a authorized change that Crypto refasses as a monetary product, permitting the FSA to use guidelines for insider-trade, disclosure requirements and investor safety below the Monetary Devices and Trade Act.

At the moment, Japan taxes comparable to “numerous earnings” win with progressive charges that may exceed greater than 50 % as soon as native taxes are included. As a substitute, shares and bonds are topic to a set tax of 20 %.

In response to Nikkei, the FSA has proposed to maneuver crypto to that 20 % system in tax 2026. Buyers might additionally undergo losses for 3 years. Officers imagine that parity with shares will scale back investor’s burden and enhance market exercise.

Regulatory shift to have interaction ETFs

The second pillar of the FSA contains altering the securities laws to categorise crypto as a monetary product. This is able to free the trail for crypto ETFs, together with spot Bitcoin funds, which aren’t out there in Japan. Observers declare that ETF’s accessible, regulated choices can provide for buyers and on the similar time stimulate market transparency.

In response to Beincrypto, the company can also be planning inside restructuring, which units up an company that focuses on digital financing and insurance coverage. This displays how crypto with broader monetary methods with broader monetary methods is interwoven, which requires constant supervision.

The historical past of Japan with crypto illustrates each danger and resilience. Mt. Gox in Tokyo as soon as greater than 70 % of the worldwide Bitcoin transactions earlier than he collapsed. Regulators have embedded classes from that disaster within the stricter frameworks of immediately.

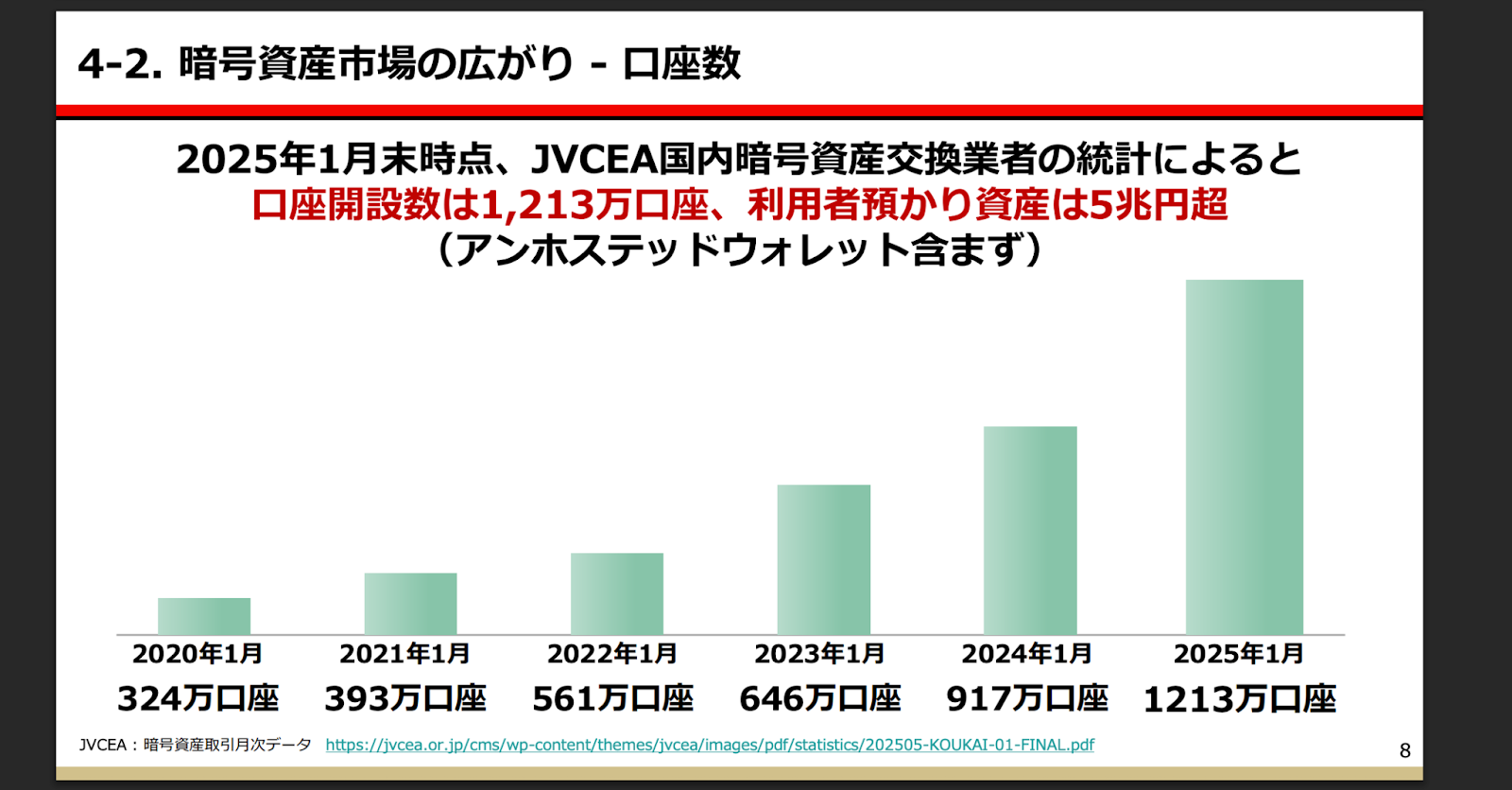

The variety of guardianship forfeilles in Japan. Supply: JVCEA

Momentum has since shifted to measured however regular development. Japan Crypto Enterprise Affiliation VICE chairman Shiraishi has documented the world market growth from $ 872 billion to $ 2.66 trillion. Japan’s home commerce quantity, alternatively, went ahead of $ 66.6 billion in 2022 and is anticipated to double to $ 133 billion. This underlines that whereas the acceptance of firms accelerates, the participation of the retail commerce stays modest.

88% nationals have by no means possessed Bitcoin

A survey by the Cornell Bitcoin Membership, quoted by DocumentingBTC, confirmed that 88 % of the Japanese inhabitants have by no means had Bitcoin. Analysts counsel that tax burden and regulatory uncertainty have discouraged a broader approval of households. The reforms of the FSA are supposed to sort out these obstacles by simplifying tax remedy and providing trusted ETF buildings.

Institutional curiosity, nevertheless, is rising. A joint examine by Nomura Holdings and Laser Digital confirmed that 54 % of Japanese institutional buyers intend to spend money on Crypto activa inside three years, with 62 % that quotes diversification advantages. The FSA additionally revealed the findings and famous that the popular allocations of 2-5 % of the management of the belongings are seen. The outcomes emphasize willingness amongst giant monetary gamers to embrace ETFs as quickly as regulatory circumstances permit it.

The reforms correspond to the “new capitalism” agenda of Japan and emphasize via investments led development. By clarifying the authorized framework and lowering tax burden, civil servants hope to encourage households to deal with digital belongings as a part of lengthy -term portfolios as an alternative of purely speculative bets.

The Submit Japan prepares giant -scale amendation of crypto coverage for first place on Beincrypto.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now