Cryptocurrency markets are dealing with elevated volatility because the Financial institution of Japan (BOJ) prepares to boost rates of interest, a transfer that might have world impacts on Bitcoin, Ethereum, XRP and different digital property.

BOJ prepares historic price hike

Japan has maintained ultra-low rates of interest for many years to stimulate financial development by way of low cost loans. Nonetheless, rising inflation and a weakening yen have prompted the BOJ to announce a price hike. Economists predict a rise of 0.25% from the present 0.5%, and will probably attain 0.75%, the very best stage in many years.

The speed hike, whereas seemingly small, represents a serious shift in Japanese financial coverage and is anticipated to impression each native and world monetary markets.

Why crypto buyers ought to take discover

Cryptocurrency markets thrive on liquidity, with low cost cash driving funding in dangerous property. When central banks tighten financial coverage, borrowing prices rise and liquidity dries up. Traditionally, these circumstances have precipitated sell-offs in speculative markets, together with crypto.

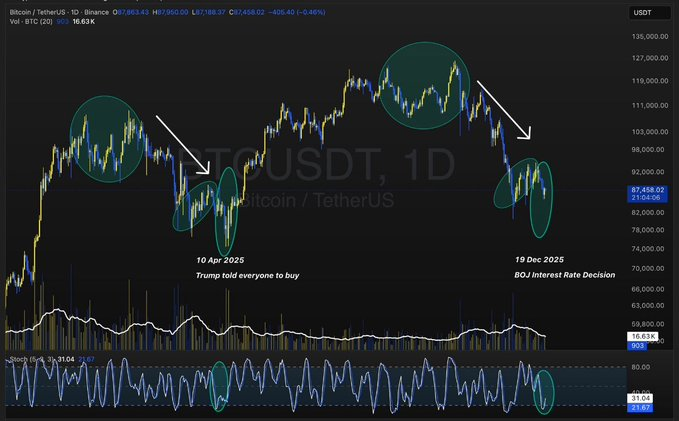

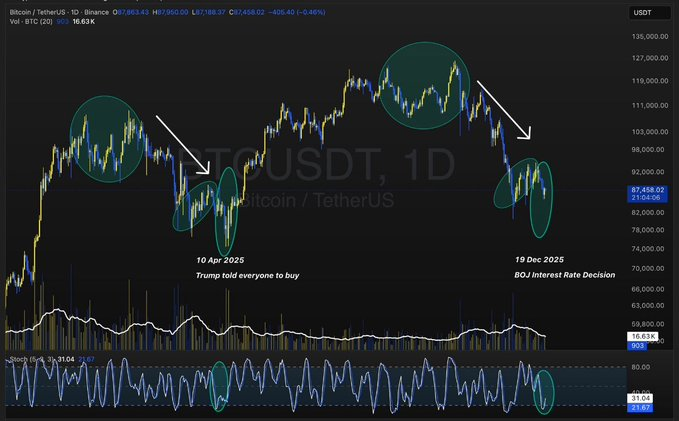

Bitcoin typically feels the primary impression. Throughout the US Federal Reserve’s 2022 rate of interest hikes, Bitcoin costs fell from over $60,000 to lower than $20,000 in just a few months. Analysts say a similar effect might be seen if the BOJ continues with the anticipated enhance.

The position of the yen and world carry trades

A stronger yen may additionally impression world carry trades. Buyers typically borrow yen at low charges to spend money on higher-yielding property equivalent to US shares or crypto. An rate of interest enhance may reverse these transactions, creating extra promoting stress on the crypto markets.

“This does not simply apply to Japan,” mentioned one market analyst. “Japan is the third largest economic system on this planet, so their strikes are inflicting ripples.”

Present market traits

As of December 17, the cryptocurrency markets are displaying the primary indicators of stress. Bitcoin is buying and selling round $86,589, down greater than 1% previously 24 hours. Ethereum has fallen to $2,834, dropping greater than 4% of its worth. XRP can be beneath stress, buying and selling at $1.86 with a decline of just about 4%. The whole market capitalization of cryptocurrencies is $2.92 trillion.