Policy & Regulation

John Deaton Calls for Federal Probe into ChokePoint 2.0

Credit : cryptonews.net

Legal professional John Deaton is looking for a federal investigation into Operation ChokePoint 2.0, which exposes the FDIC’s actions to limit cryptocurrency companies, together with Bitcoin and Ethereum transactions. The crypto business is backing Deaton, citing suppressed innovation and unfair remedy. Deaton emphasizes transparency and honest regulation for US crypto progress.

Legal professional John Deaton, a staunch supporter of actions in the USA.

John Deathon’s combat towards Operation ChokePoint 2.0

He’s keen to conduct the research at no cost as a result of, he claims, the American folks deserve extra oversight and openness amid rising authorities interference within the monetary world.

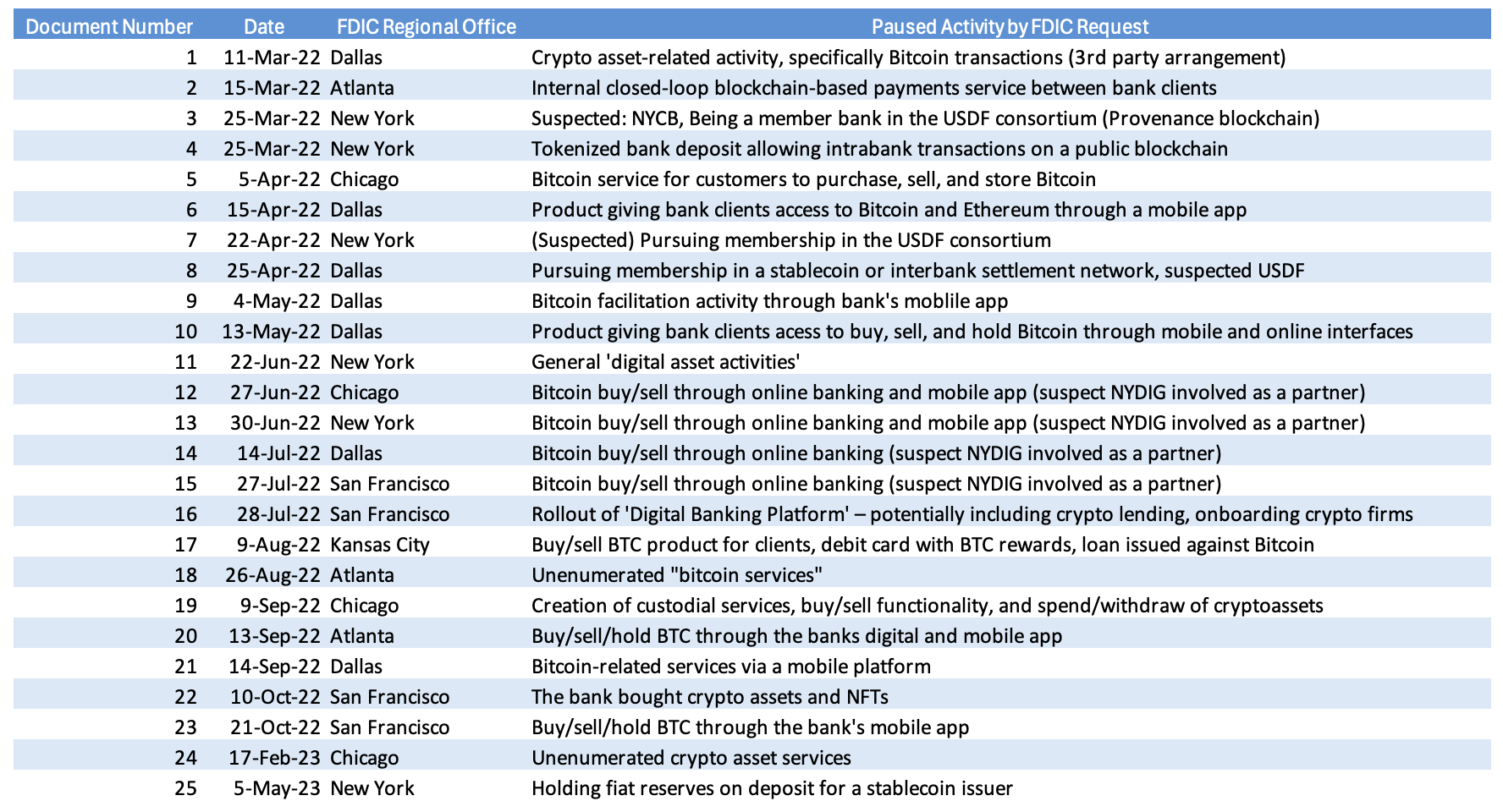

A discovery warrant revealed an enormous coordinated effort to limit cryptocurrency-related companies. Coinbase was efficiently in a position to acquire unredacted paperwork from the FDIC.

The trade claims that the FDIC despatched no less than 25 letters to varied banks between 2022 and 2023, demanding that they halt or reduce their companies associated to Bitcoin and Ethereum transactions, blockchain settlement networks, and tokenized deposit merchandise.

In line with one business professional, Nic Carter, the measures have stifled monetary innovation, precluding the emergence of merchandise equivalent to Bitcoin rewards debit playing cards and Bitcoin-backed loans.

He went on to say that the FDIC’s actions have been anti-consumer and anti-innovation as a result of they prevented the USA from gaining floor in monetary know-how.

Deaton provides his voice to the dialogue by claiming that he fears Operation ChokePoint 2.0 shall be extremely damaging. He argues that this isn’t only a cryptocurrency challenge, however a direct assault on the free market system in America. These kind of steps set a really dangerous precedent as a result of it limits the monetary infrastructure for official companies.

Deaton additional argued that unelected bureaucrats shouldn’t have the authority to find out who wins and who loses within the market. He mentioned such insurance policies really undermine America’s skill to stay a number one world energy in innovation and economics.

Custodia Financial institution was among the many hardest hit establishments. They’d no entry to the banking infrastructure. Nevertheless, the Custodia case was solely a part of the bigger points concerning firms trying to innovate within the crypto house.

Requires accountability and crypto-friendly regulation

As Deaton notes, the consequences of Operation ChokePoint 2.0 go far past the direct affect on firms and affect their skill to succeed and innovate inside the business. He described these actions as a direct assault on the basic ideas of free market capitalism and transparency.

The crypto business has welcomed Deaton’s name for an investigation. In his attraction to Congress, Coinbase Chief Authorized Officer Paul Grewal strongly urged that hearings be held on the FDIC’s actions.

Nic Carter praised Coinbase’s option to make the paperwork public and referred to as for swift motion to interrupt down the systematic limitations positioned towards the business. The change in administration that may now be staffed by President-elect Donald Trump has additionally led to a greater regulatory surroundings.

There may be additionally a brand new one “Crypto Czar” David Sacks who pledged to tackle the ChokePoint agenda, in addition to Rep. French Hill endorsing honest and balanced crypto regulatory reforms.

Many voters have expressed optimism in regards to the future prospects for the sector, but the sector nonetheless faces main challenges. Federal Reserve Chairman Jerome Powell has clearly said that the Fed has no intention of investing in Bitcoin or related initiatives.

Moreover, critics argue that regulatory readability should be achieved whereas making certain honest remedy of digital property earlier than extra limitations hinder innovation.

Certainly, Deaton himself recalled in a speech a name for accountability in investments, encouraging a balanced strategy between innovation and investor safety.

Whereas they await the brand new administration’s response, Deaton’s efforts shine a vibrant gentle on what’s urgently wanted concerning Operation ChokePoint 2.0. These business folks have been one who was taking important steps towards a long-held ambition: a steadfast transfer towards a good and clear system that might foster progress and innovation within the digital asset house.

Based mostly on the evaluation of the FDIC filings and the business’s response, it’s clear that it’s essential to deal with these points in a method that may hold the USA financially forward of the remainder of the world.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024