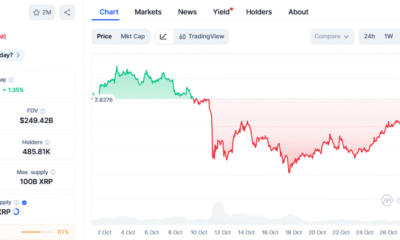

Bitgo, a number one crypto guardianship and buying and selling firm, has entered right into a strategic partnership with Vivopower. As a part of this deal, Vivopower will use the unique freely obtainable (OTC) commerce companies from Bitgo to purchase $ 100 million in XRP tokens. This step is a part of the brand new treasury technique from Vivopower, after the profitable fundraising of $ 121 million.

An indication of rising curiosity in Altcoin Treasury Holdings

This step from Vivopower marks one of many first main allocations of the corporate chips in XRP – a motion that displays what corporations reminiscent of MicroSstrategy did with Bitcoin. By protecting crypto belongings as a part of their enterprise reserves, corporations wish to diversify and probably profit from the rising marketplace for digital belongings.

John Deaton’s take a look at the larger image

Responding to the information, linked Professional-XRP lawyer and knowledgeable John Deaton this improvement with a broader development. He remembered how, after the lengthy -awaited approval of Bitcoin Spot ETFs, he had predicted that ETFs would ultimately comply with for different altcoins reminiscent of ETH, XRP and Sol.

Though some folks doubted him on the time, the reasoning of Deaton was based mostly on a easy remark: as quickly as Bitcoin ETFs proved to be enormously successful-even among the finest performing ETFs in historical past will after all wish to replicate that success with different digital belongings.

Corporations that replicate the Bitcoin Treasury mannequin

Deaton additionally defined what Michael Saylor and MicroSstratey did with Bitcoin – making an organization of a enterprise portray – finally encourage different corporations to do the identical with chosen Altcoins reminiscent of XRP. The Motion of Vivopower appears to be the primary public instance of this development kind.

Greed stimulates innovation

Deaton was clear that he doesn’t endorse or have a good time these actions, however fairly reveals how monetary incentives and the urge for food of Wall Avenue typically predict market shifts for revenue earlier than rules or public sentiment.