Ethereum

Key Reasons Behind ETH’s 56% Monthly Surge

Credit : coinpedia.org

Ethereum now appears to be like bullish. Previously seven days, with a exceptional enhance of 24.1%, it has exceeded its most vital rivals, Bitcoin (-1.9%), XRP (19.7%), BNB (9.3%), Solana (11.6%) and Cardano (14.3%). Within the final 24 hours alone, it has risen by at the least 3.1%.

In a sensational publish on X, a crypto analyst, recognized as Titan van Crypto, means that Ethereum may very well be on its technique to a big outbreak.

That is what it’s worthwhile to know!

Ethereum -Market overview

Previously 30 days, Ethereum has seen a substantial bullish momentum. At the beginning of this month, the Ethereum value was $ 2,406.19. Since then, the value has risen by a minimum of 56.29% to $ 3,758.73.

The latest bullish rally is especially fed by substantial institutional influx into spot eth ETFs, rising whale exercise and constructive sentiment from giant buyers similar to Peter Thiel.

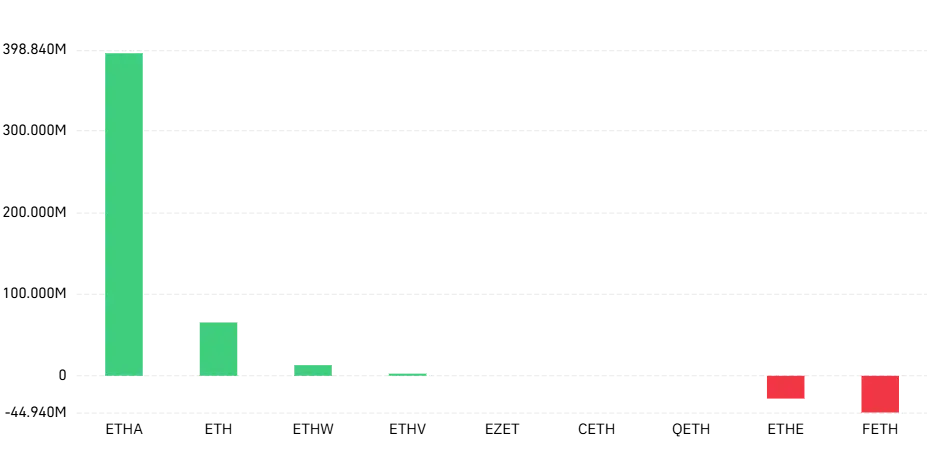

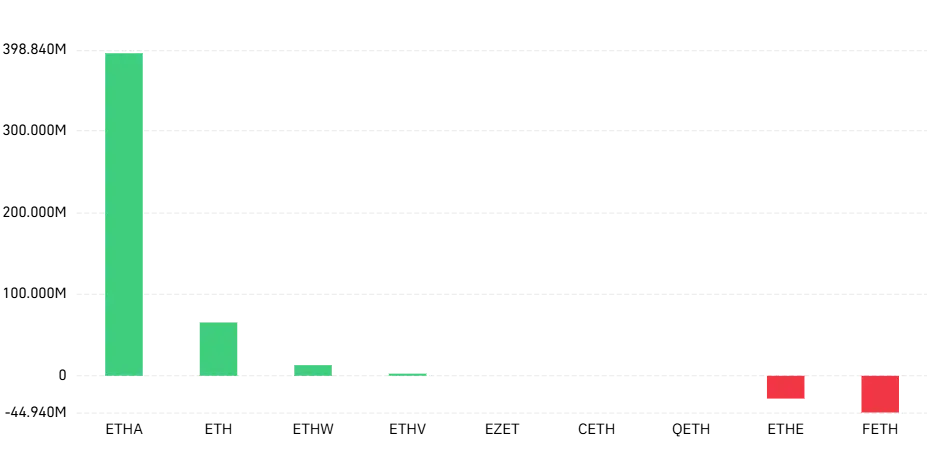

Between July 14 and 18, a minimum of 2,182.4 million flew to the Ethereum Spot ETF market. The 726.60 million influx, recorded on July 16, was the best each day influx final week. No less than 402.50 million entered the market on the final day of the week. No less than 394.90 million of this was launched by way of BlackRock’s Ethha.

Not too long ago one SEC -Document revealed that Peter Thiel, the previous CEO of PayPal, quietly acquired 9.1% of Bitmine Immersion Applied sciences shares – an organization that desires to develop into the Ethereum model of MicroSstratey.

The Ethereum community additionally noticed a rise within the restrict of layer 1, enhancing transaction capability and the continual progress of the usage of liquids, during which Binance ETH stopped and reached 20% of the market.

Does Ethereum put together for a big bullish rally?

The acclaimed crypto analyst Titan van Crypto states that Ethereum follows a technical card sample, referred to as an oblong reducing wider on the weekly graph.

An oblong peaking wedge is a bullish sample. It has a horizontal resistance line and a falling help line, with rising volatility and indecision. It suggests a possible uptrend after an outbreak above the resistance.

- Additionally learn:

- Rimple pricing whereas Trump Tweets about Crypto

- “

The graph, shared in his X publish by Titan van Crypto, exhibits that the Ethereum market launched the sample at first of 2024.

The analyst emphasizes the graph and proves that the market may initially attain $ 4,100 – the horizontal resistance line. He additionally predicts that if the outbreak is confirmed, the following most important value goal $ 6,700 is – calculated by including the peak of the triangle from the Breakout level.

In conclusion, the analyst advises that persistence is vital, as a result of the ETH value motion can take time to play out.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, professional evaluation and actual -time updates on the newest traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

Analysts predict that ETH will quickly be capable to attain $ 4,100 and presumably $ 6,700 within the medium time period. Longer -term predictions differ from $ 10,000 to $ 30,000, with some optimistic situations even above $ 50,000.

Ethereum is at present displaying a robust bullish momentum, fueled by ETF influx and whale exercise, which means that it’s usually thought of by many analysts, regardless of some overbough technical indicators.

Ethereum is mostly thought of funding in the long run due to the elemental function in Defi, NFTs and Web3, present scalability upgrades, rising institutional acceptance and potential for yield by deportation.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now