Policy & Regulation

Korea’s Pivotal Crypto Shift in 2025

Credit : cryptonews.net

The Cryptocurrency market of South Korea undergoes an important shift in 2025 and goes from a flowering pushed by the retail to a extra institutionalized and controlled framework.

4 coverage pillars decide this transformation. Firstly, the federal government plans phased enterprise participation. Secondly, regulators design frameworks for spot Bitcoin ETFs and received stablecoins. Thirdly, authorities keep strict measures towards non -registered operators and infringements of KYC. Fourth, the Central Financial institution pauses CBDC growth. As an alternative, the proponent of banks guided stablecoin pilots is in favor.

Nationwide digital belongings agenda and legislative challenges

Beincrypto beforehand reported necessary coverage developments below President Lee Jae-Myung. The Presidential Coverage Planning Committee has “constructed a digital belongings ecosystem” as a nationwide coverage agenda. This agenda falls below the banner “modern economic system that leads the world”. The Monetary Companies Fee (FSC) supervises this coverage job.

Nevertheless, particular implementation information won’t be introduced. At the moment, solely faucet titles are public. The trade refers to Lee’s marketing campaign guarantees for directions on future plans. These commitments embody approval of spot ETFs, legalization of safety sticks, introduction of home won-backed stablecoins.

Nevertheless, the plan is confronted with uncertainties. The initiative isn’t one of many 12 -emphasized strategic priorities. The function of the FSC is confronted with uncertainty within the midst of potential restructuring of the federal government. Implementation requires the revision or dedication of 951 legal guidelines and rules. The federal government focuses on 87% of the adjustments for submitting the Nationwide Meeting by subsequent 12 months. Though the ruling get together has a considerable majority and likewise help the leaders of oppositions within the growth of crypto, speedy legislative progress is unlikely.

Regional competitors provides urgency. The US Genius Act has accelerated the worldwide acceptance of dollar-based stablecoins, which expresses concern in Korea about financial sovereignty. Neighboring hubs are advancing rapidly: Japanese companies are constructing digital asset reserves, Hong Kong has enacted complete stablecoin guidelines, and Singapore doubled crypto alternate licenses in 2024. BeInCrypto famous these strikes will possible intensify Korea’s legislative debates on Stablecoin Regulation, Alongside the Gradual Growth of Company Accounts, ETFS, and Leverage Merchandise on Home Exchanges.

Revision of the rules

On February 13, the FSC unveiled a route map to raise the 2017 ban on Company Crypto Buying and selling. In H1 2025, non -profit organizations and public authorities can promote present corporations; In H2, listed corporations and certified institutional buyers can act on trial. That is consistent with world traits and makes use of the Digital Asset Consumer Safety Act (with impact from July 2024) to guard customers and to ensure honest markets.

In June, the FSC submitted an implementation plan for the home location Bitcoin ETFs and a KRW Stablecoin on the Presidential Committee. The route map covers custody, costs, investor safety and reimbursement discount. Though the present legislation doesn’t enable spot ETFs, President Lee’s pro-crypto authorities helps the reforms.

The Financial institution of Korea (BOK) has delayed its CBDC challenge and stops a deliberate pilot on the finish of 2025 on the finish of 2025. As an alternative, it helps a “bank-first” stablecoin mannequin and strengthens its cautious perspective over time.

“It’s first fascinating to allow banks, that are beneath a excessive degree of rules, to problem based mostly on won-based stablecoins and progressively lengthen them to the non-banking sector with the expertise,” mentioned Yu Sang-Dae, Bok Senior Deputy Governor.

4 massive Korean banks are actively making ready for the difficulty of KW-Pegged Stablecoin previous to anticipated laws. All 4 banks – KB Kookmin, Shinhan, Hana and Woori – are deliberate to satisfy Circle Heath Tarbert throughout his go to to Korea subsequent week.

The Ministry of SMEs and Startups proposed to alter the Dedication Act to allow crypto corporations to register as enterprise corporations, unlocking subsidies, tax stimuli, mortgage ensures and funds supported by the federal government.

Enforcement actions

Enforcement actions underline the choice of regulators. In February, the Monetary Intelligence Unit (FIU) OPBIT ordered to cease new buyer transactions about AML -Upholstes, together with dealing with of non -registered international gala’s and Lax KYC. A judicial order of 27 March allowed Boarding to renew pending the ultimate determination.

In Might, the Digital Asset Change Alliance (Daxa) Wemix eliminated for the second time, as regards to disclosure errors and a theft of $ 6.6 million, inflicting a worth drop of 60%.

Authorities additionally pressed on Google and Apple to take away non -registered alternate apps.

Crypto tax stays politically delicate. A capital acquire tax of 20%, postponed to January 2027, may be additional postponed as a result of incomplete methods and the native election local weather 2026.

Market dynamics and development meter

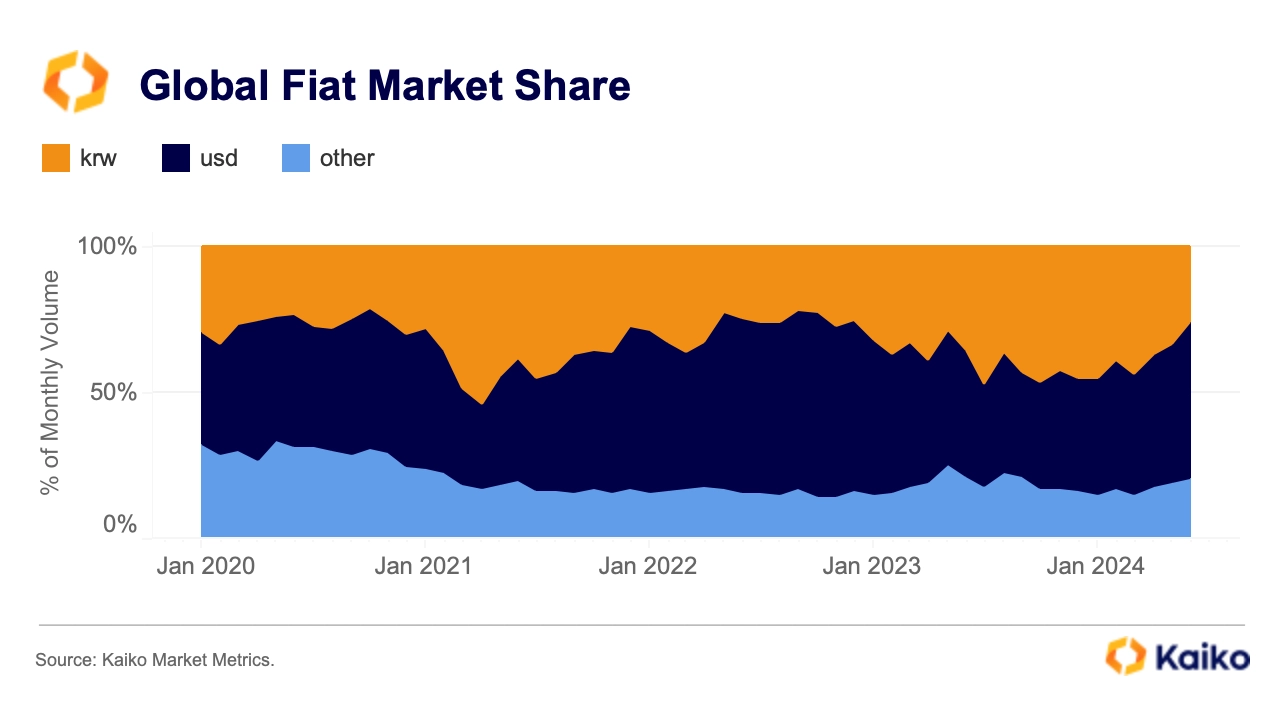

KRW’s function in crypto. Supply: Kaiko.

KRW is the second most traded Fiat in Crypto and reaches $ 663 billion year-to-date volume-on-the-one 30% of worldwide Fiat-Crypto exercise. Nearly a 3rd of the Korean adults have digital belongings, double the American adoption share.

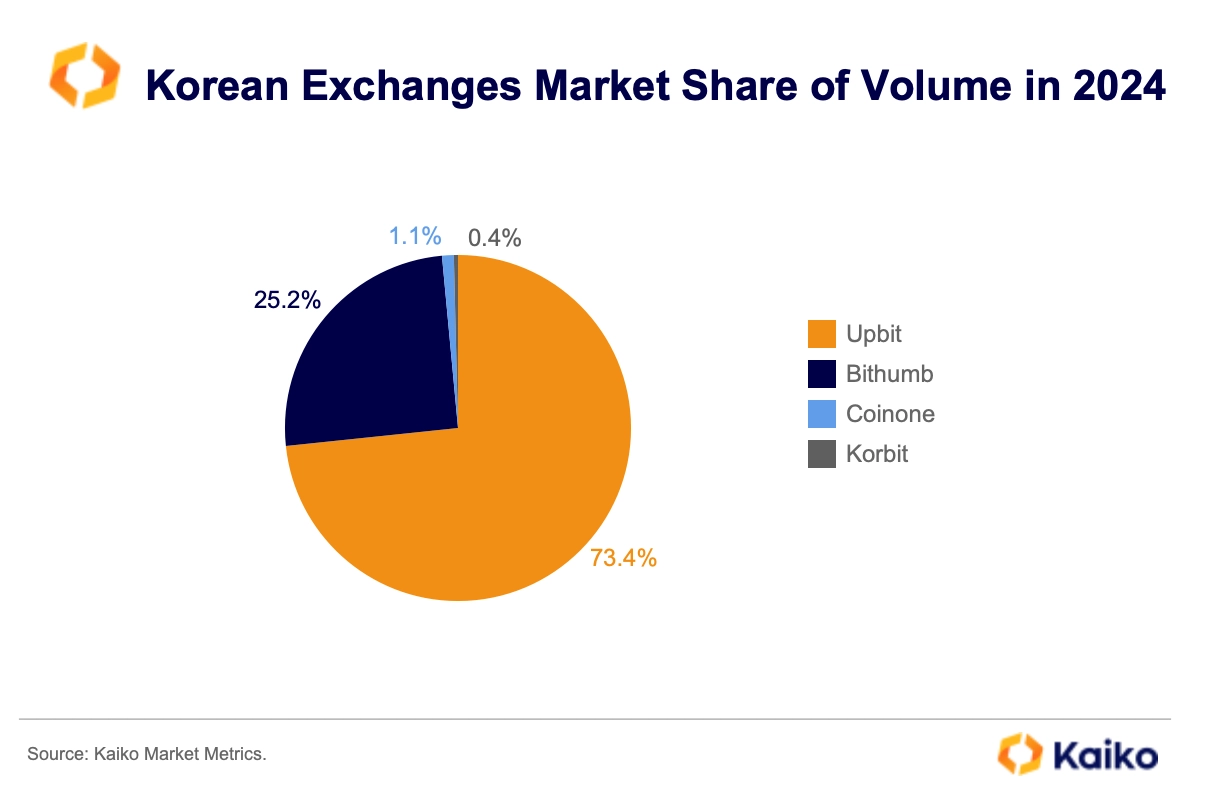

UPBIT owns 69% of the home market from February, whereas Bithumb is mirrored in 25% for his plan to say at Kosdaq on the finish of 2025. Bithumb’s personal shares have risen by 131% this 12 months to 238,000, whereas Upbit operator Dunamu’s Rose received 33% to 240,000, appreciated at 8.26 trillion. Each peaks in July earlier than moderating.

Smaller competing coinon, with 3% share, offered 10% of the belongings to finance actions – the primary sale below new Might pointers for regulated liquidation. Coinone has positioned operational losses for 3 years and reduces workers, in order that the acquisition hypothesis is fueled.

Essential gamers within the Korea Crypto market. Supply: Kaiko

The Kimchi Premium – the worth hole of Korea versus worldwide markets – waved sharp: over 10% in February, adverse by the tip of July after which stabilized at 2-3% in August. Analysts bind this to liquidity shifts below stricter compliance.

Infrastructure and abroad enlargement are progressing. Kaia, a merged firm of Klaytn and Finschia, every began by the perfect technical giants within the nation, Kakao and Naver, desires to be the primary suitable layer-1 blockchain from Asia. Dunamu is spreading to Vietnam and stimulates the worldwide attain of Korea.

Geopolitically South Korea performs a key function in combating the North Korean crypto -theft. On January 14 it joined the US and Japan in a joint assertion that warned that DVK actors stole greater than $ 600 million in 2024 to finance weapons applications.

“The flexibility of South Korea to hyperlink strict compliance with market innovation makes it a singular take a look at case for world regulators,” mentioned Park Ji-Hoon, established fintech coverage analyst established in Seoul.

Prospect

The fundamental situation includes the completion of the ETF framework, the launch of the bank-guided Stablecoin pilot and the enlargement of enterprise commerce. These can repatriate capital, deepen liquidity and enhance the activa high quality via stricter affords. Dangers embody over regulation, lengthy -term authorized disputes (eg UPBIT), offshore migration of heavy FX guidelines and contamination by token removals.

Essential efficiency -Indicators for 2026: ETF -Legalization, Stablecoin -Growth, Fiu’s Upbit -Pronunciation, Bithumb IPO outcomes and acceptance of KAIA and Blockchain -Gaming tasks.

The technique of South Korea ornament of compliance whereas selling innovation-zou can strengthen its function as a crypto-financial hub. By channeling home capital to regulated markets and supporting the expansion of the infrastructure, it’s meant to stability the safety of buyers with market enlargement. The next 12 months will probably be essential to find out whether or not this stability applies and the worldwide affect of Korea is rising.

The publish is nationwide and institutional: the essential crypto shift from Korea in 2025 first appeared on Beincrypto.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024