Policy & Regulation

Lawmakers stumble on stablecoin terms as US Congress grills Fed’s Bowman

Credit : cryptonews.net

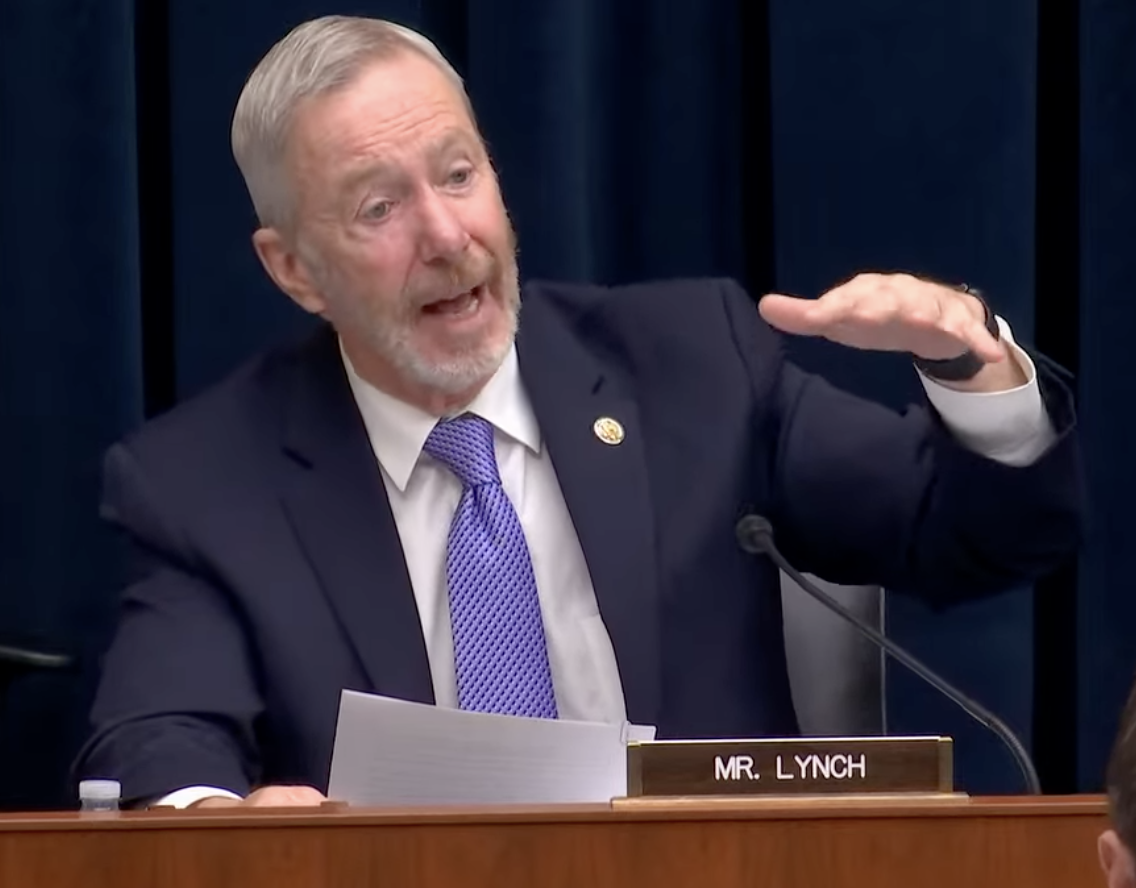

U.S. Rep. Stephen Lynch on Tuesday pressed Federal Reserve Vice Chair Michelle Bowman over her previous feedback encouraging banks to “go all in” on digital property, questioning the Fed’s function in advancing crypto frameworks whereas displaying confusion over the definition of stablecoins.

Throughout an oversight listening to on Tuesday, Lynch requested Bowman, the Fed’s vice chair for supervision, about feedback she made on the Santander Worldwide Banking Convention in November. In accordance with the congresswoman, Bowman mentioned she supported banks “[engaging] fully” with regard to digital property.

Nevertheless, based on Bowman’s feedback on the convention, she referred to “digital property” quite than particularly cryptocurrencies. The questioning led to Lynch asking Bowman in regards to the distinction between digital property and stablecoins.

The Fed official mentioned the central financial institution had been approved by Congress — particularly the GENIUS Act, a invoice aimed toward regulating stablecoins for funds — to discover a digital asset framework.

“The GENIUS Act requires that we enact laws to permit some of these actions,” Bowman mentioned.

Rep. Stephen Lynch throughout Tuesday’s oversight listening to. Supply: Home Monetary Providers Committee

Whereas the value of many cryptocurrencies might be risky, stablecoins, resembling these pegged to the US greenback, are typically “steady,” because the identify suggests. Whereas there have been situations the place some cash have de-pegged from their respective currencies, such because the crash of Terra’s algorithmic stablecoin in 2022, the overwhelming majority of stablecoins not often fluctuate past 1% of their peg.

Associated: Atkins says SEC has ‘sufficient authority’ to advance crypto guidelines in 2026

Bowman mentioned in August that Fed employees ought to be allowed to carry small “quantities of crypto or different forms of digital property” to grasp the know-how.

Appearing chairman of the FDIC says stablecoin framework might be obtainable quickly

Travis Hill, appearing chairman of the Federal Deposit Insurance coverage Company, additionally testified throughout Tuesday’s listening to. The federal government company is one among a number of answerable for implementing the GENIUS Act, which US President Donald Trump signed into regulation in July.

In accordance with Hill, the FDIC will suggest a stablecoin framework “later this month,” which can embrace necessities for overseeing issuers.

Journal: When Privateness and AML Legal guidelines Battle: The Unattainable Alternative of Crypto Tasks

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now