Altcoin

LDO jumps 13% with an inflow of $ 40 million, so why sell bullish investors?

Credit : ambcrypto.com

Essential assortment eating places

77% of the LDO buyers voted to purchase, however as an alternative bought it actively, with the cumulative turnover of $ 3.5 million prior to now day. In the meantime the Derivaten market maintained its place.

Lido Dao [LDO] Led the market with a worth dump of 13% within the final 24 hours. Ambcrypto found that this liquidity influx is essentially powered by spinoff market financing.

Nevertheless, the gross sales stress of centralized exchanges continues to develop, in order that the upward potential of the belongings is stuffed in.

Traders promote bullish regardless of voting

Regardless of the bullish sentiment, promoting continues. In line with Coinmarketcaps Group sentiment, 77% of the 19,300 buyers voted for a bullish for LDO final day.

Supply: Coinmarketcap

Nevertheless, knowledge on the chain reveals a special story. Spot Alternate Netflows point out that buyers have bought to LDO for $ 3.5 million within the final 24 hours – regardless of the bullish votes.

Apparently, this divergence now continues to exist for 2 days, with a complete of round $ 4.2 million in sale throughout this section.

Supply: Coinglass

This means that bumpers can deal with the bullish sentiment as a possibility to depart or accumulate at essential ranges.

Liquidity influx stays robust

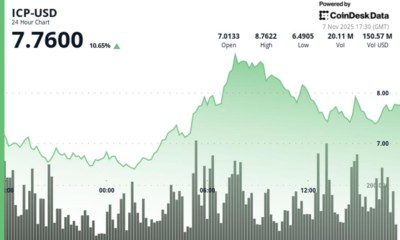

About $ 40 million has flowed in accordance with the derivatives market, in accordance with Coinglass’ Open curiosity knowledge.

Open curiosity measures the full worth of troubled contracts – each lengthy and brief – inside a sure interval. Within the final 24 hours, OI jumped greater than 15% to achieve $ 266 million, reflecting the $ 40 million inflow.

Supply: Coinglass

Ambcryptos Have a look at the liquidation knowledge means that this enhance was largely powered by lengthy positions.

Quick sellers have taken the largest hit on the previous day, which strengthens the concept merchants are more and more guess on an upward momentum.

This will encourage extra buyers to go for a very long time and add additional financing to the market. However, the present liquidity diversion leaves the course of LDO’s subsequent main motion unsure.

Will LDO change into a sinking ship?

A analysis Of the liquidation, the warmth of the LDO maybe suggests the value of LDO extra probably than Rally.

There are bigger clusters of stressed liquidity underneath the present worth than above. These clusters often work as magnets and draw the value in direction of them.

Supply: Coinglass

If LDO drops, it may possibly fall to as little as $ 1.05, the place there’s a massive cluster.

If the token meets as an alternative, the profit will be restricted. Liquidity clusters above the present worth solely prolong considerably – as much as round $ 1.27, a stage close to time.

A motion to $ 1.27 can rapidly activate a reversal of the value, in order that LDO will set a exceptional lower within the coming days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now