Analysis

LINK Price Eyes Recovery as Reserves Grow and ETF Speculation Builds

Credit : coinpedia.org

Hyperlink Worth stayed below stress till September, slipping right into a bear market and has been briefly touching the bottom level since August.

But the indicators of a change are on the rise. With a cup and hand formation of the sample, the strategic reserves of Hyperlink are increasing, and even the institutional momentum is constructing firmly, Hyperlink Crypto can put together for a vital rebound.

Hyperlink worth supported by strategic reserves

An necessary growth of the event The hyperlink worth is the strategic hyperlink reserves. Because the starting of August, it has collected greater than 371,000 connection cash, with a price of round $ 8 million at a median price foundation of $ 22.49.

This reserves are created by redirecting on-chain and off-chain prices to direct purchases of hyperlink token.

This technique is necessary as a result of the demand for hyperlink crypto is intently linked to acceptance. As Chainlink’s community grows, the prices are anticipated to rise, rising the reserve accumulation.

The regular construction not solely helps the tales of the hyperlink prize forecast, but in addition signifies their everlasting confidence in making worth in the long run.

ETF -Antification provides gasoline to the story

The left worth graph may also put together for Momentum as Altcoin ETF hypothesis more and more intensifies. Suggest for Gay values And Bitwise Hyperlink ETFs are investigated by regulators, a growth that American buyers might appeal to and the demand for Chainlink -Crypto can proceed to institutionalize.

Latest information verify an elevated curiosity in Altcoin ETFs, wherein merchandise similar to Ethereum, XRP, Solana and Dogecoin already expertise robust influx.

If the USD left worth receives a comparable regulatory traction, this will unlock a brand new section of market participation. That is consistent with broader expectations of the rising demand for actual asset-tokenization, an space the place Chainlink has positioned itself as a frontrunner.

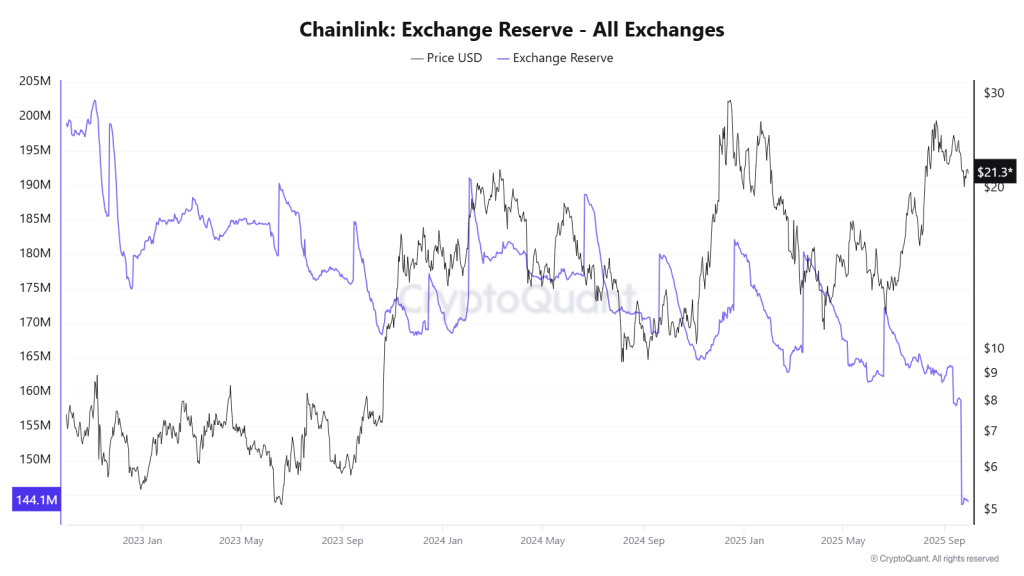

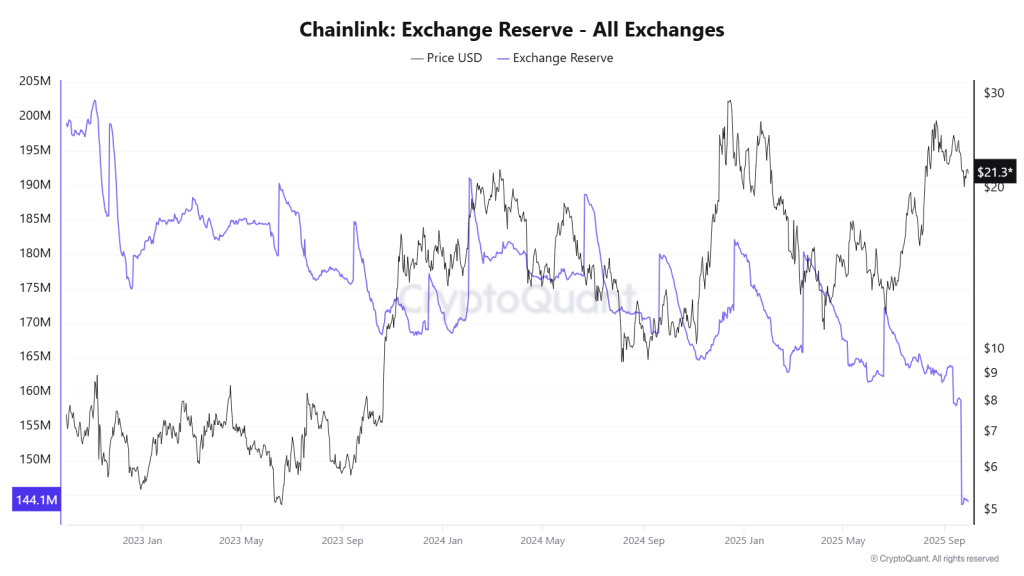

Provide shock and accumulation of buyers

One other issue that might probably stimulate the prediction of the hyperlink worth is the speedy lower in stock exchange reserves. In simply 30 days, buyers portfolios have absorbed practically 20 million hyperlink tokens.

Such a structural shift, usually seen as a precursor to a provide shock, signifies rising confidence from bigger gamers.

The discount within the obtainable supply coincides with broader institutional headlines. This convergence means that at present the hyperlink worth might begin a interval wherein the demand can significantly exceed a major provide, creating favorable situations for upward motion.

Swift ledger and institutional partnerships

Likewise, one other optimistic information momentum for hyperlink Crypto turned enhanced on the SIBOS 2025 convention when Swift revealed his plans for a based mostly ledger based mostly on consensys and greater than 30 massive banks, together with JPMorgan and HSBC.

The announcement was such a daring transfer that it rapidly revived the curiosity in chain hyperlink, given his position in bridging conventional funds with blockchain infrastructure.

Even the chain hyperlink itself marked The enterprise motion initiative on X confirms the information that they’ve actually carried out to 24 international monetary establishments, together with Swift, Anz, Schroders and Zürcher Kantonalbank. These partnerships add credibility to hyperlink the expectations of the value prediction by demonstrating the acceptance of actual world and institutional confidence.

Technical prospects: Pairing the Worth forecast

On the technical stage, LINK Worth has fashioned a cup and deal with sample, a construction that’s usually related to bullish reversations.

If the ground of $ 20 retains holding, the following potential goal is round $ 28, in order that the resistance within the center vary marks.

Moreover, the broader rising channel, based since 2023, remains to be framing the development in the long term.

Beneath this construction, the hyperlink worth in USD might stretch to greater resistance close to $ 47 if the momentum persists, suggesting the house for appreciable benefit within the coming months.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September