Analysis

LINK Price Poised for 13% Decline, Here’s What’s Happening

Credit : coinpedia.org

Amid the continued unsure cryptocurrency market sentiment, Chainlink (LINK) is poised for a worth drop because it has shaped a bearish worth motion sample on its every day timeframe. Including to LINK’s bearish outlook, its worth, like different main cryptocurrencies, has began to say no.

LINK Value Momentum

On the time of writing, LINK is buying and selling across the $10.52 stage and has skilled a worth drop of over 2.7% within the final 24 hours. Throughout this era, buying and selling quantity has fallen by 19%, indicating decrease participation from merchants and buyers, presumably because of the bearish worth motion sample.

LINK Technical evaluation and upcoming stage

In accordance with skilled technical evaluation, LINK has shaped a bearish head-and-shoulders worth motion sample on the every day timeframe. Moreover, with the latest worth drop, it has damaged the essential descending trendline assist that has existed since August 2024.

Based mostly on the latest worth momentum, if LINK breaks the neckline of this bearish sample and closes a every day candle beneath the $10.30 stage, there’s a sturdy chance that the asset might expertise a 13% worth drop, and presumably within the coming time to achieve the $9 stage. to daybreak.

As of now, LINK is buying and selling beneath the 200 Exponential Transferring Common (EMA), indicating a downtrend. Merchants and buyers usually control the 200 EMA when constructing positions, each on the lengthy and brief facet.

Bearish on-chain metrics

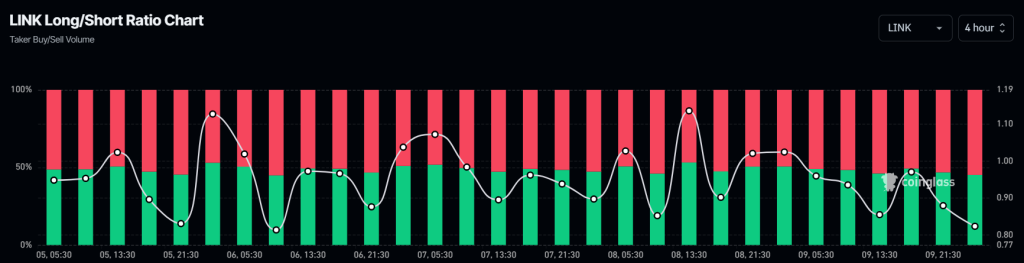

LINK’s bearish outlook is additional supported by on-chain metrics. In accordance with the on-chain analytics firm Mint glassLINK’s Lengthy/Brief ratio at present stands on the stage of 0.82, indicating sturdy bearish market sentiment amongst merchants. Moreover, future open curiosity has risen 5.2% over the previous 24 hours, which is at present a bearish signal for LINK holders.

When the lengthy/brief ratio is beneath 1 and open curiosity is rising, it signifies that merchants have began shorting.

At the moment, 54.84% of prime merchants have brief positions, whereas 45.16% have lengthy positions. It seems that merchants have began betting on the brief facet as a result of they suppose the value will fall.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024