Altcoin

Link prices rise 4% while analysts see $22

Credit : ambcrypto.com

- LINK costs are up 4.24% within the final 24 hours.

- Analysts are $22 if the altcoin has a resistance degree of $12.

Over the previous two months, the altcoin market has skilled excessive volatility. Nevertheless, the altcoin market seems to have began a restoration as of the time of writing.

As altcoins begin to recuperate, Chainlink [LINK] responded positively and recorded reasonable positive factors. As such, LINK was buying and selling at $10.23 on the time of writing after rising 4.24% in 24 hours.

Beforehand, LINK was experiencing a robust downward trajectory. After reaching $12.6 in August, the altcoin shaped a falling wedge sample. With the decline, it fell to a low of $9.2.

Regardless of the current positive factors, LINK stays comparatively low from the current native excessive of $15 in July. Furthermore, it’s nonetheless about 80.6% decrease than the ATH of $50.88.

Due to this fact, the current positive factors elevate questions on whether or not the altcoin is positioned for additional positive factors or whether it is only a market correction. Common crypto analyst Cryptojack recommended that LINK was prepared to make 4 occasions the revenue.

The prevailing market sentiment

Supply:

In his evaluation, Jack highlighted two key circumstances that LINK should meet to achieve $22. In line with the analysts, LINK’s falling wedge ought to stay above the $6 assist degree.

He famous that the altcoin’s falling wedge is approaching this crucial degree and {that a} additional decline will lead to a breakout.

Second, the analysts argue that LINK wants to interrupt out of the falling wedge to organize for a robust uptrend. He states {that a} break from the sample will strengthen the altcoin to realize 4x and attain $22.

Primarily based on this evaluation, breaking this sample is a recipe for additional positive factors. Trying on the charts, each time LINK breaks out of a falling wedge, it makes vital positive factors. For instance, the value beforehand rose from an area low of $8.0 to an area excessive of $12.6.

What LINK diagrams counsel

The circumstances highlighted by Jack undoubtedly present a constructive outlook. However what do different market indicators say?

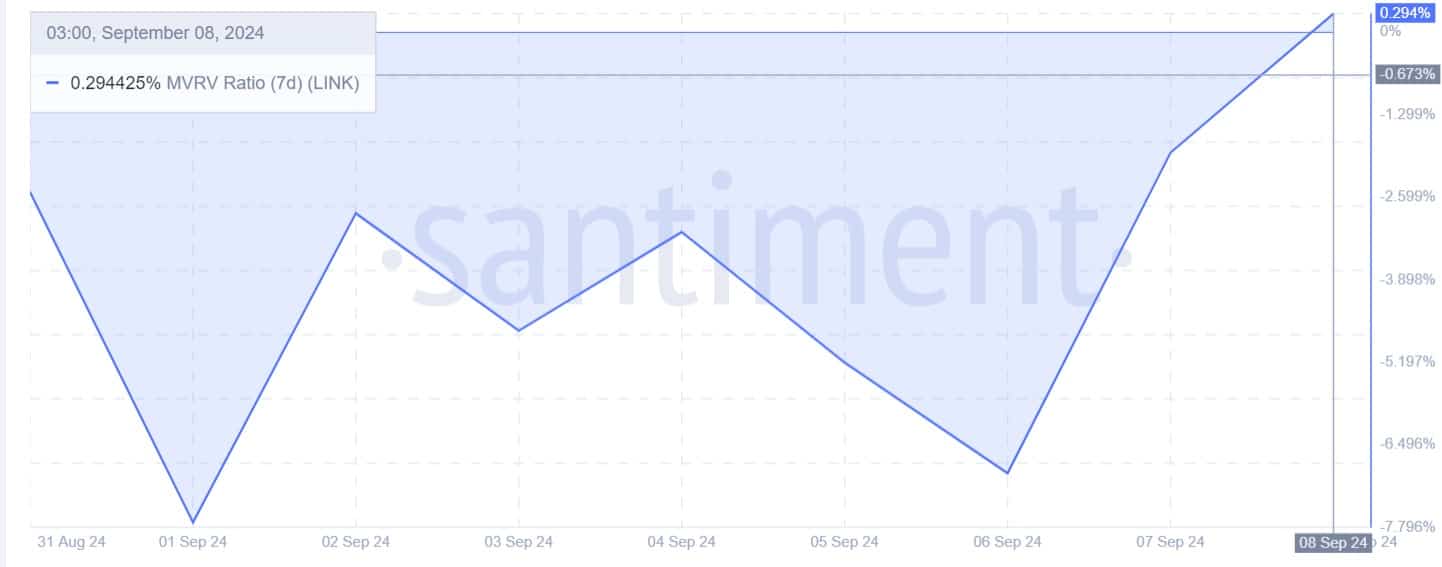

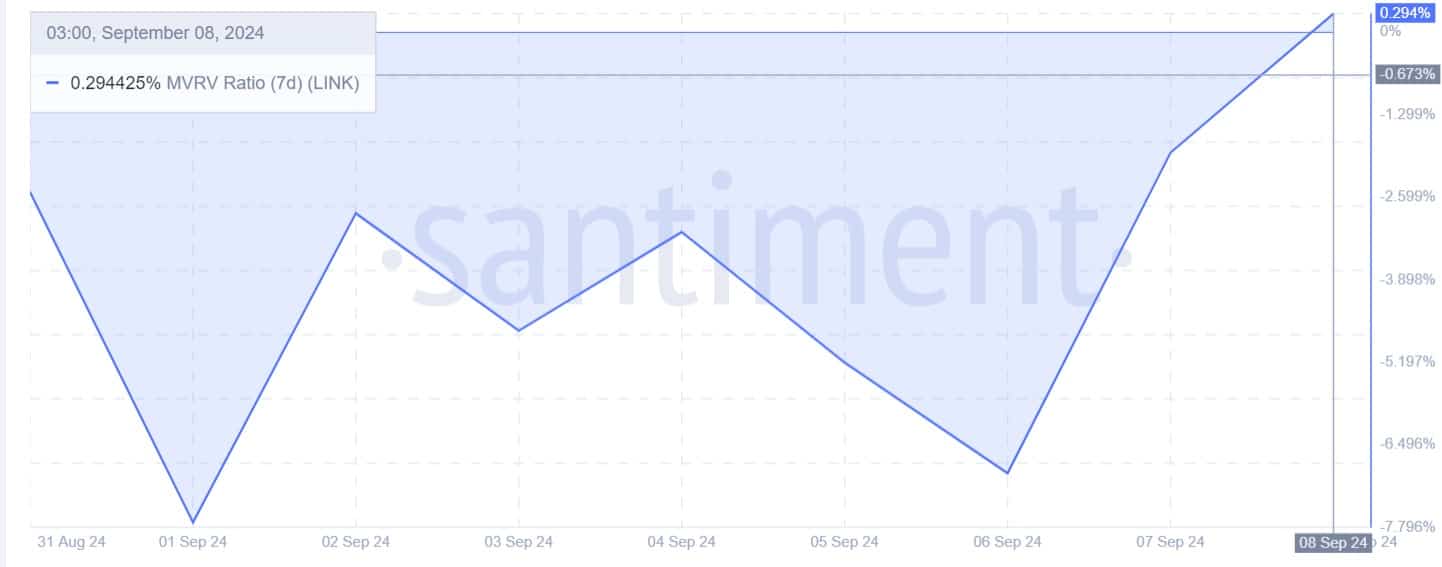

Supply: Santiment

First, Chainlink’s market worth to realized worth (MVRV ratio) has turned constructive after a sustained damaging studying. The MVRV was damaging for many of final week.

Nevertheless, on the time of writing, the MVRV ratio had turned constructive to 0.29. A shift from damaging to constructive signifies market restoration the place the market worth rises above the realized worth.

This means a restoration section or the market is experiencing bullish sentiment. Furthermore, such market conduct exhibits a shift in market sentiment in direction of elevated demand and optimism.

Supply: Santiment

Moreover, LINK’s open curiosity per change has elevated over the previous week. As such, open curiosity in inventory markets has seen motion over the previous week.

It has risen from a low of $36 million to $40 million. The rise in open curiosity per change exhibits that extra buyers are betting on additional worth will increase.

Is your portfolio inexperienced? View the LINK Revenue Calculator

This was a bullish sign as buyers open new positions whereas paying a premium to take care of their positions within the occasion of a downtrend.

If there’s between $10 and $12 within the worth, there could be an upward transfer. If the every day candle closes above $10.5, LINK is properly positioned to try a near-term $15 resistance degree.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024