Altcoin

Litecoin’s short squeeze – a rally or just temporary hype?

Credit : ambcrypto.com

- Litecoin carried out higher than Bitcoin, powered by liquidations, however dangers stay attributable to market volatility

- Analysts insist on warning, as a result of LTC is confronted with essential help challenges and steady worth fluctuations

Litecoin [LTC] lately confirmed a slight lead over Bitcoin [BTC] Within the quick time period, with some Bearish positions which might be liquidated throughout the course of. This improve within the worth of LTC has led to optimism amongst merchants, however analysts insist on warning.

Regardless of the rally, the market stays risky, making threat administration important.

LTC’s short-term efficiency liquidations of gas De Rally, however warning is required

Litecoin has seen a lower of 5.54% within the final 24 hours and traded at $ 119.74 within the charts after a excessive level of $ 127.30. Regardless of this withdrawal, nonetheless, LTC performed better than Bitcoin within the quick time period. The liquidation of Beerarish positions in all probability contributed to a brief worth improve earlier than the retracement.

Supply: TradingView

Information indicated that though LTC registered a powerful assembly in mid-February, rejection within the occasion of essential resistance hinted to revenue and market uncertainty.

Within the meantime, BTC noticed a lower of 20.51percentbefore he recovered, which displays a wider market weak point. Analysts have subsequently emphasised the significance of Cease-Loss ranges, as a result of the volatility stays excessive with essential LTC help for $ 114 and $ 110.

Litecoin Market Evaluation

Current evaluation additionally emphasised a dynamic market panorama.

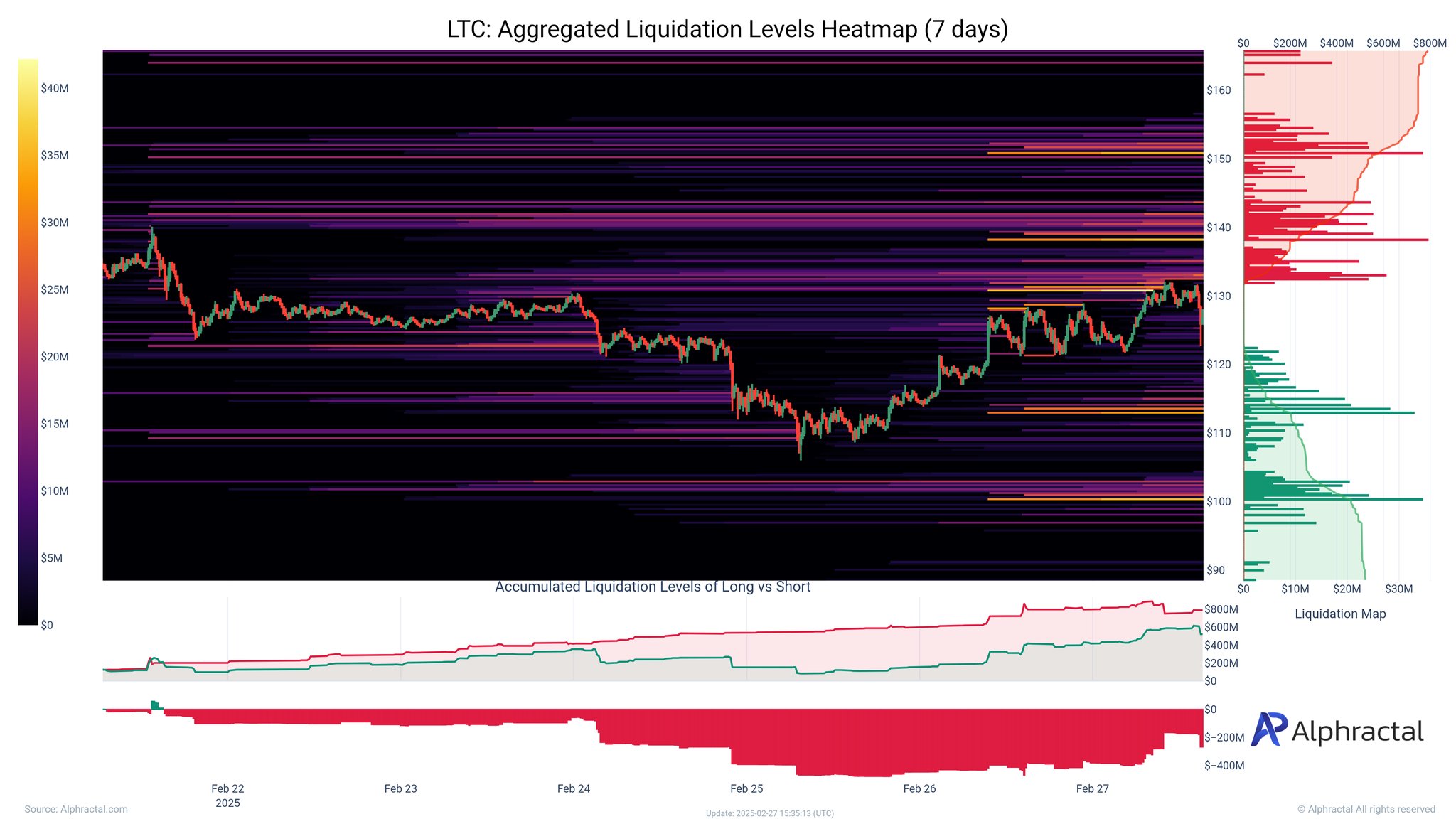

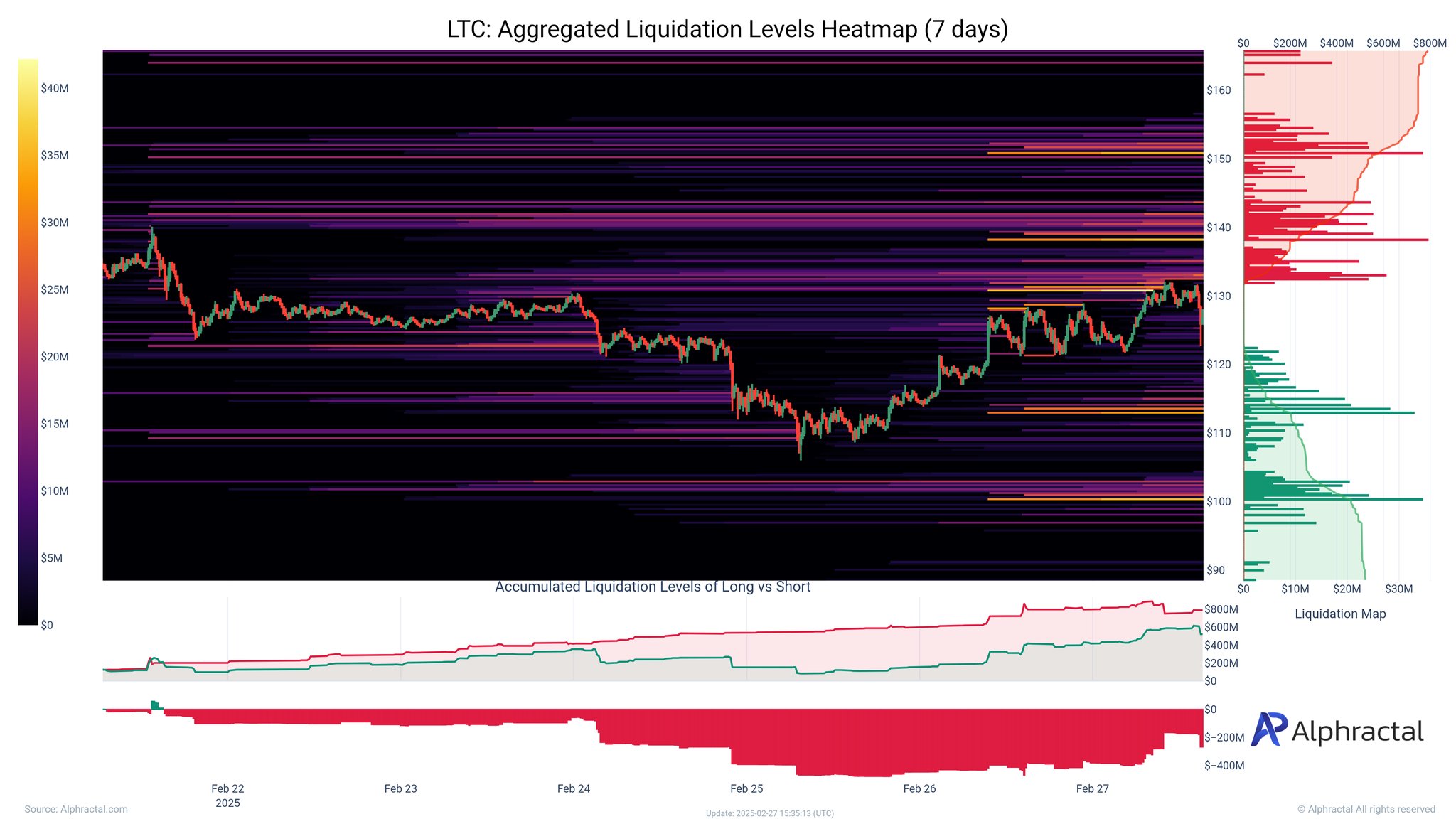

A seven-day liquidation warmth revealed a major exercise on key levels-strong liquidations close to $ 130 resistance and lengthy liquidations close to $ 110 help. The cluster of quick liquidations above $ 130 urged that Beerarish positions have been pressed when LTC tried to assemble within the charts.

Supply: Alfractaal

This rally was largely powered by quick liquidations.

Nonetheless, as LTC approaches the $ 110 degree, lengthy liquidations will probably be pronounced extra, in order that probably downward threat is demonstrated if the gross sales strain will increase. The general development additionally emphasised extra quick liquidations than longs – reinforcement that bears have been compelled throughout the upward motion.

Supply: Alfractaal

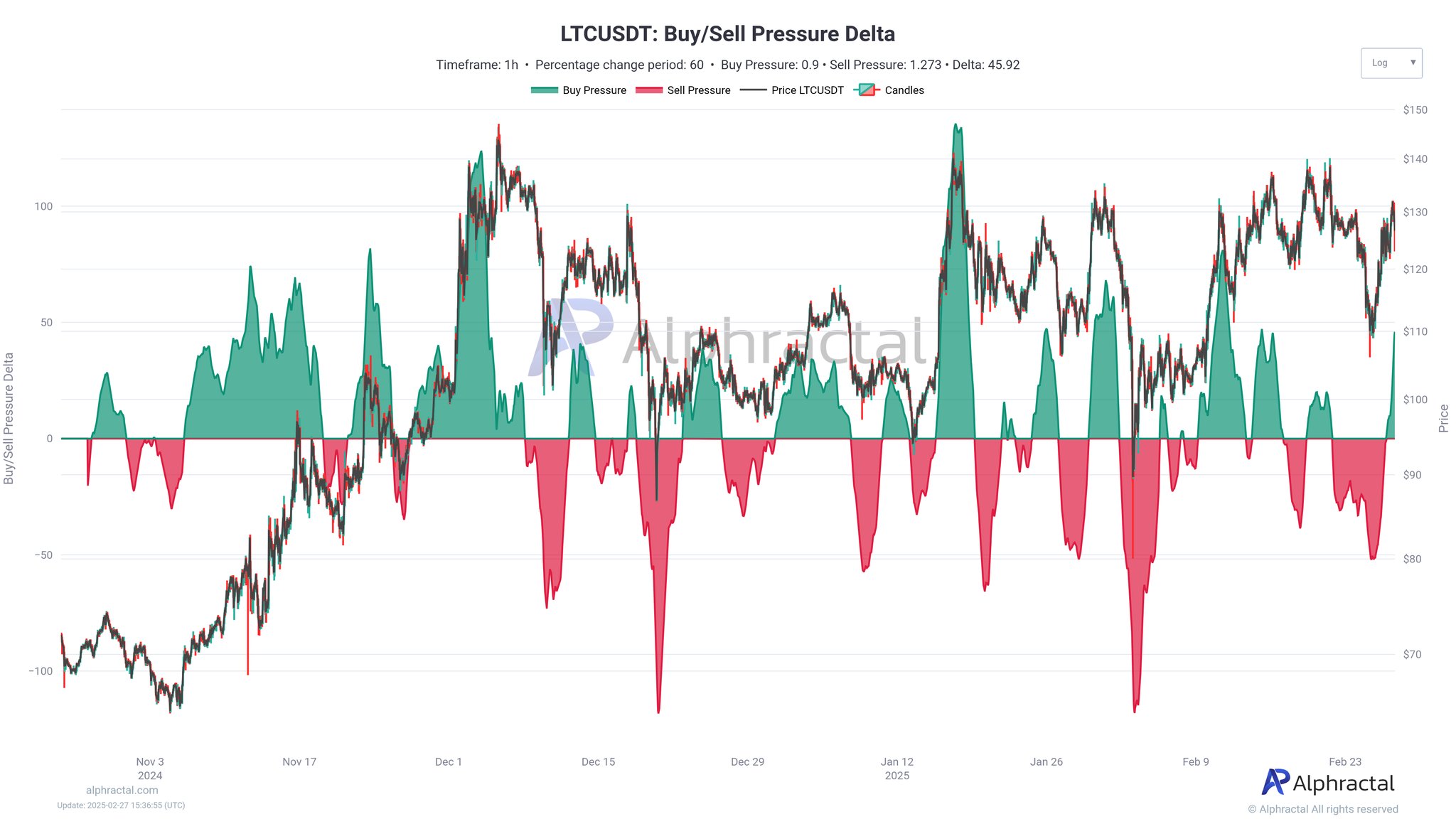

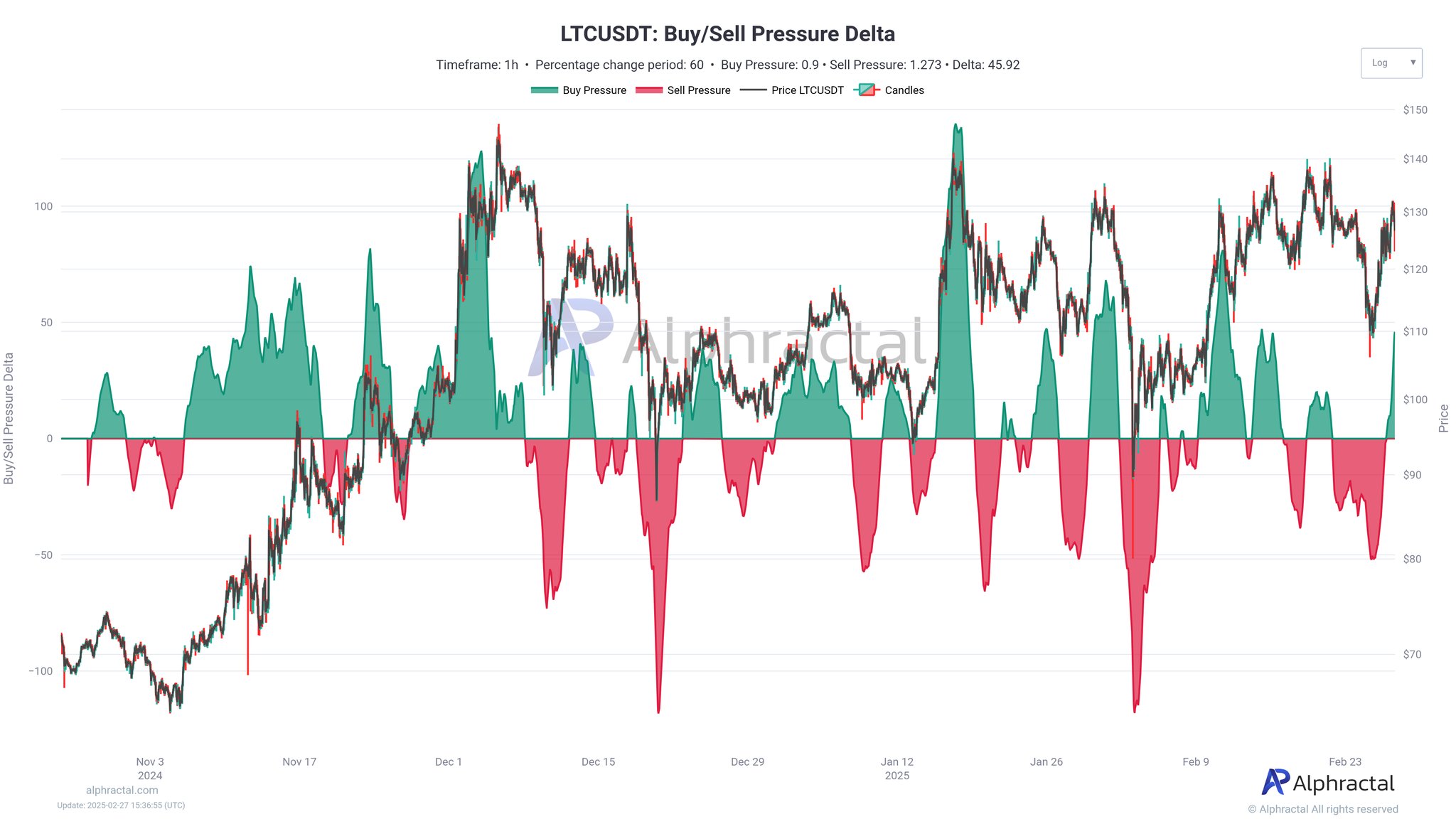

The Purchase and Promote strain graph underlined essential moments of accumulation and distribution.

Through the Rally of LTC, the dominance of the buy-side pushed the value increased. Because the momentum delayed, the gross sales strain elevated, which signifies taking a revenue or a shift in sentiment. Nonetheless, the demand has remained sturdy within the neighborhood of the help, by pointing a possible rebound when LTC stabilizes.

Supply: Alfractaal

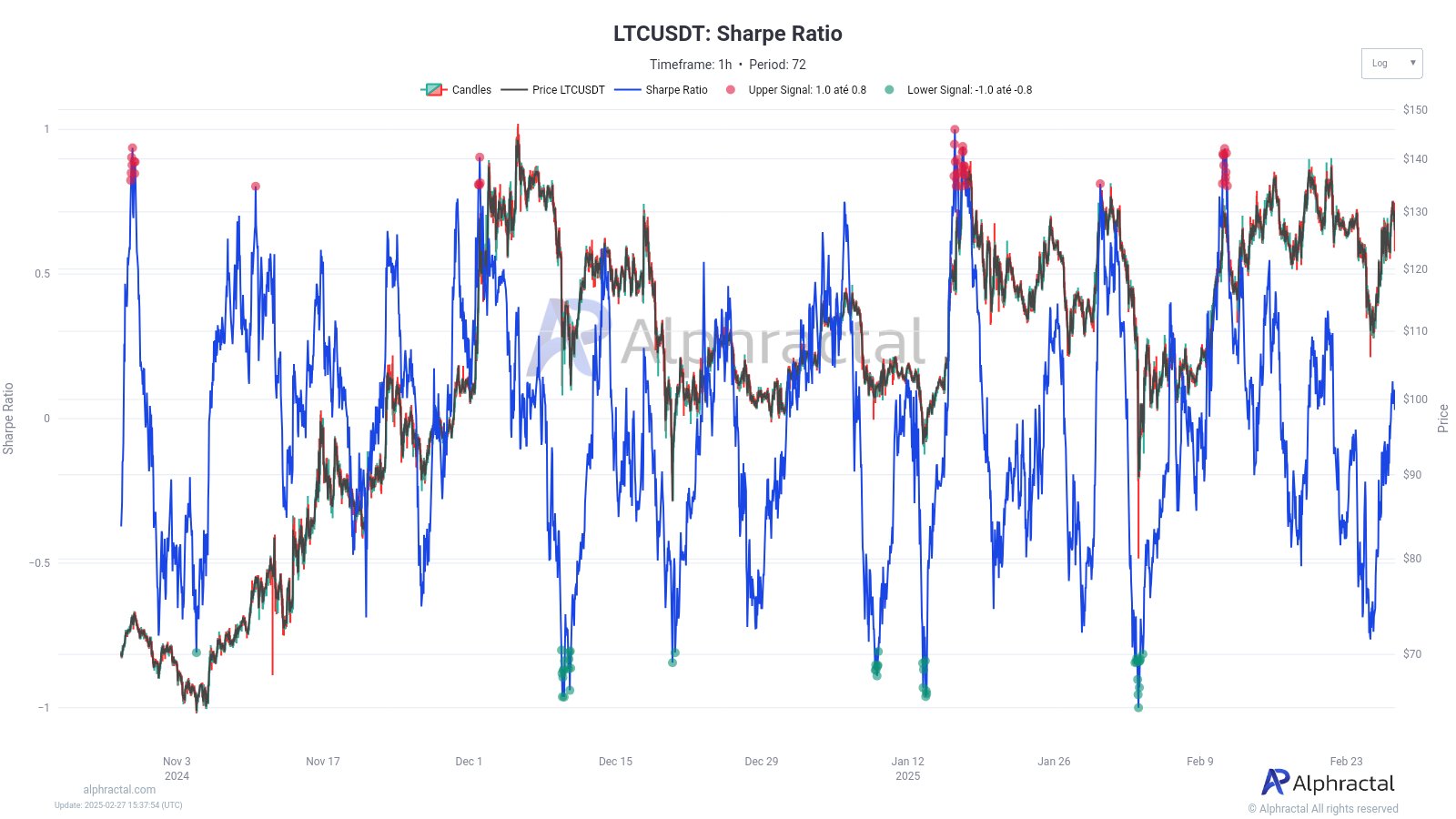

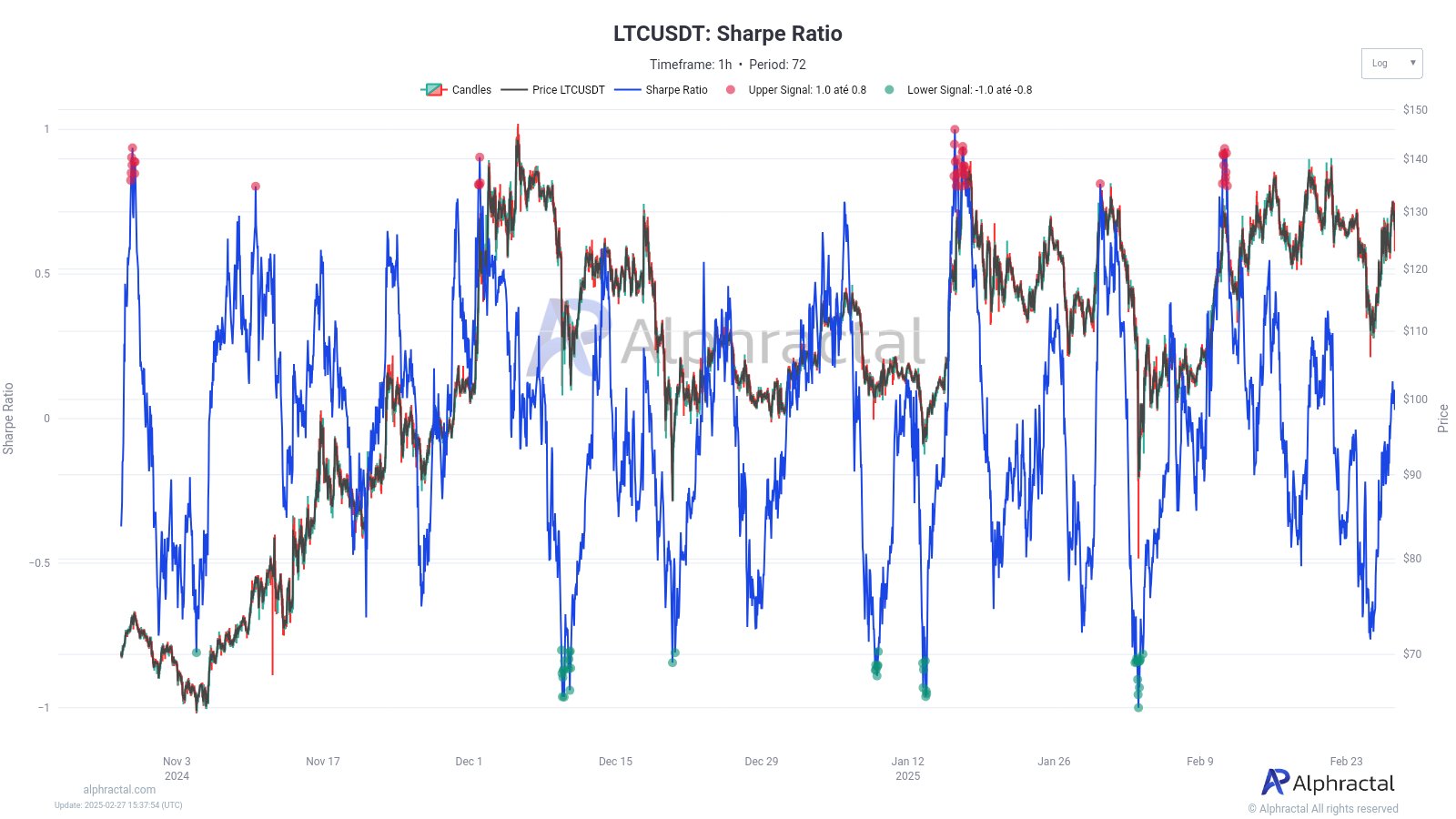

Lastly, the Sharpe ratio, with spikes above 0.8, signifies situations during which the return threat, usually results in corrections. Conversely, dips under -0.8 point out undervaluation, with the chance outweighing the potential return.

On the time of writing, the Sharpe ratio of LTC appeared to return from a latest low level and an indication that though volatility persists, risk-corrected returns can enhance within the close to future.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024