Altcoin

LTC’s 78% have owned their assets for over a year

Credit : ambcrypto.com

- 78% of Litecoin addresses have held their LTC for greater than a 12 months.

- The LTC has fallen by 11.09% previously 24 hours.

Since reaching a current excessive of $147 two weeks in the past, Litecoin [LTC] is struggling to take care of upward momentum.

Particularly within the final 24 hours, we’ve seen the best decline for the altcoin, reaching an area of $94. On the time of writing, Litecoin was even buying and selling at $96. This marked a decline of 11.09% on the day by day charts. Likewise, the altcoin has fallen 20.12% over the previous week.

Regardless of the current dip within the value charts, long-term holders of LTC stay optimistic and anticipate extra positive aspects.

78% of Litecoin long-term addresses stay bullish

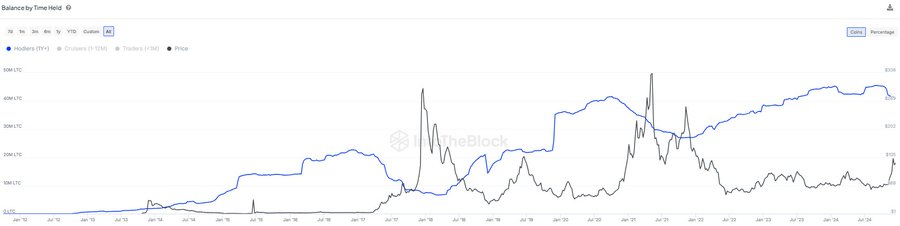

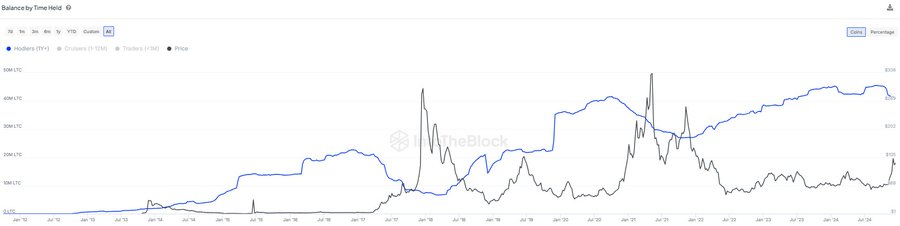

In keeping with InTheBlok78% of Litecoin addresses have held their LTC for greater than a 12 months. These addresses have collected throughout bear markets and offered round peak costs.

Supply: IntoTheBlock

Whereas earlier cycles have seen a rise in promoting of long-term positions, this cycle was completely different.

On this cycle, LTC has seen a slight decline in long-term investments. Nevertheless, this decline is much less pronounced than in earlier cycles. This means that fewer long-term holders are promoting their LTC in comparison with earlier bull markets.

Due to this fact, many holders are anticipating additional value progress as they’re nonetheless ready for the height within the present cycle. This means optimism amongst long-term homeowners.

What LTC charts counsel

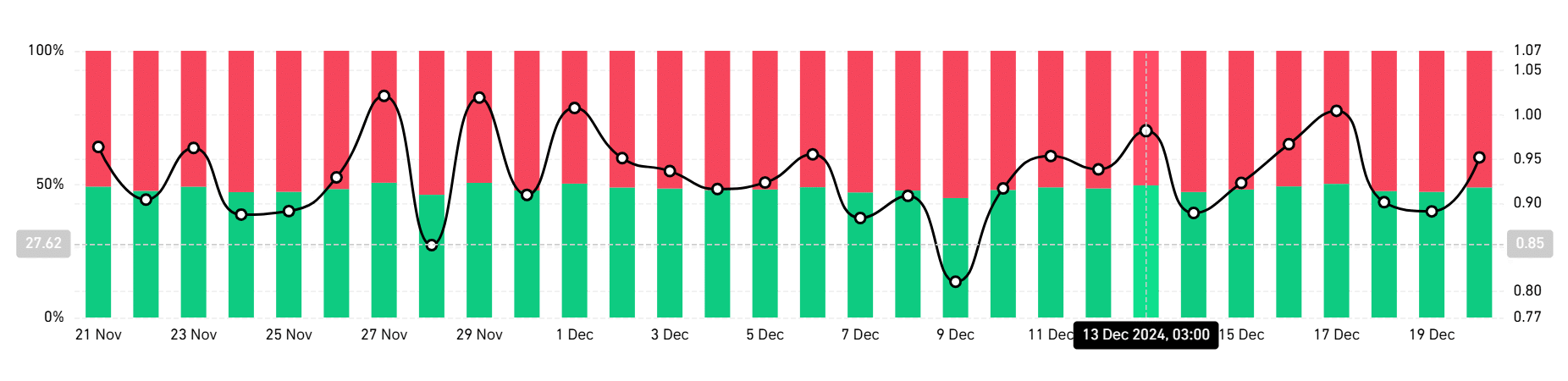

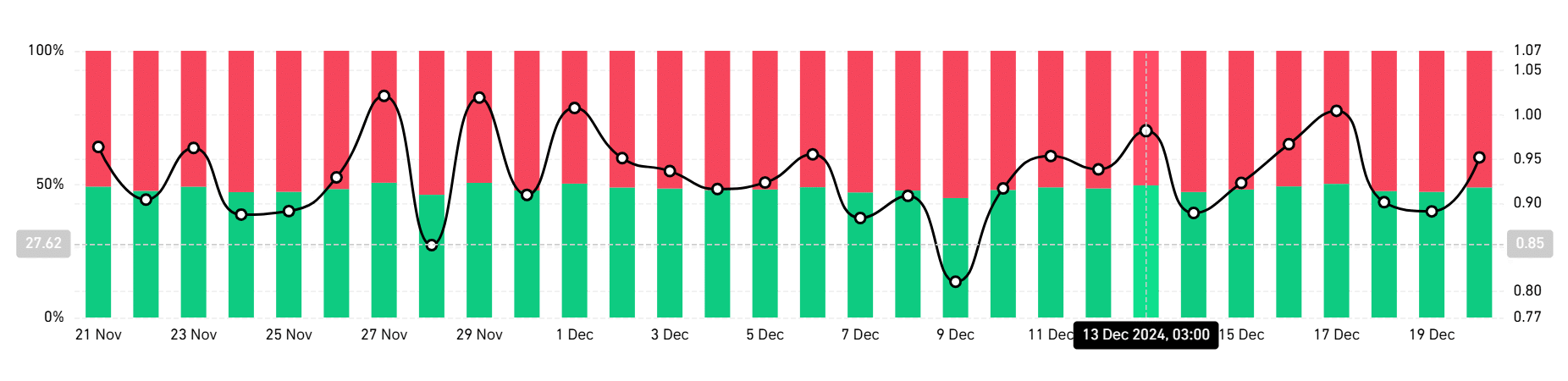

Whereas long-term buyers have offered much less in comparison with different cycles and stay bullish, the market as an entire stays bearish.

Supply: Coinglass

As such, we will see this bearishness as most buyers are taking quick positions. In keeping with Coinglass, the lengthy/quick ratio exhibits that those that go quick dominate the market. This means that the majority merchants anticipate costs to fall.

Supply: IntoTheBlock

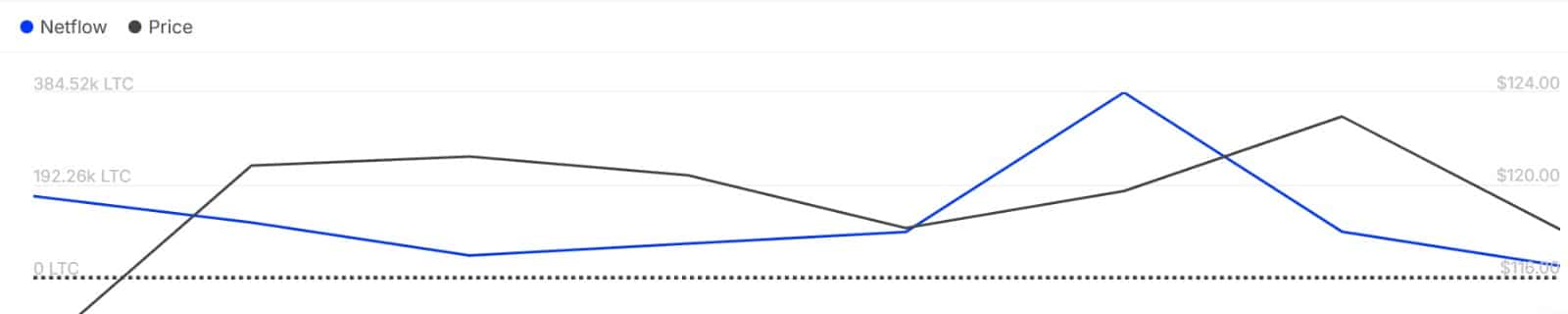

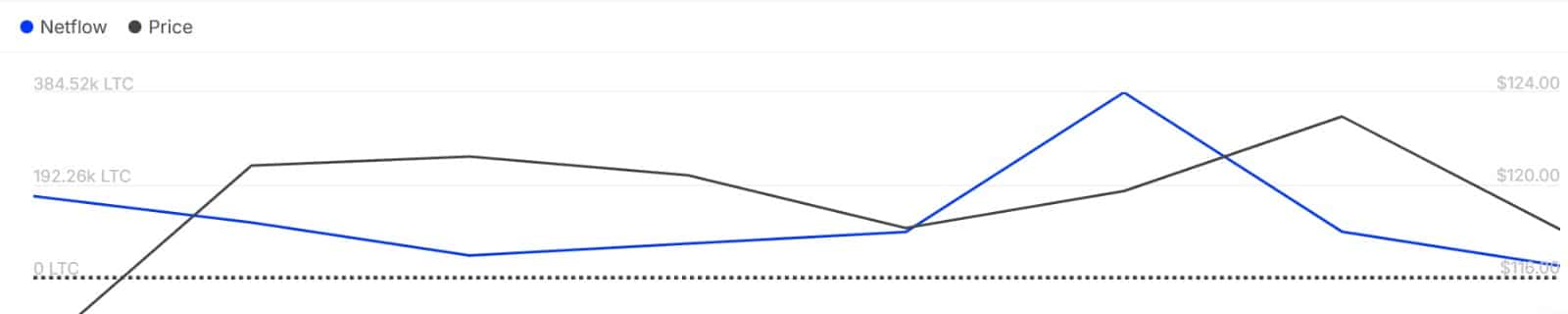

Furthermore, massive buyers are additionally bearish and have continued to scale back their capital inflows into LTC. As such, the online circulate of Litecoin’s massive holders has fallen from 384.52k to 21.89k.

Which means that the outflow has exceeded the influx for 4 consecutive days.

Supply: Tradingview

Lastly, sellers have dominated the market over the previous twelve days. This dominance is evidenced by a continued decline within the Relative Power Index. The RSI has fallen from 71 to 40 and is approaching oversold territory.

Learn Litecoins [LTC] Value forecast 2024–2025

In conclusion, whereas long-term buyers are optimistic, retail merchants are usually not. The market subsequently experiences adverse sentiment within the quick time period. If this sentiment holds, LTC may fall to $91.47.

Nevertheless, if the bullishness of long-term holders spreads throughout the market, LTC will regain the $100 degree.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024