Altcoin

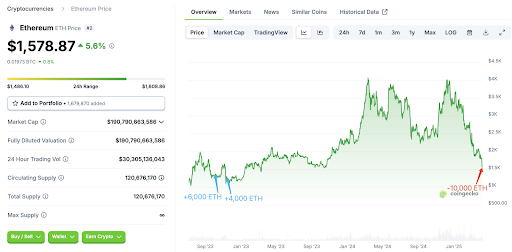

Major Ethereum Whale dumps 10,000 ETH after 2 years, is it time to get out?

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

A Ethereum Walvis Has dumped its ETH firms after having held them for greater than two years, even by way of a bull market. This capitulation of the ETH -walvis means that it could be a great time to discharge the main Altcoin, with an extra crash a chance within the coming weeks.

Ethereum Whale dumps 10,000 ETH after 900 days

In a single XOn-Chain Analytics Platform Lookonchain revealed {that a} Ethereum Walvis Lastly capitulated after holding greater than 900 days, all their 10,000 ETH bought for $ 15.71 million. This whale initially purchased 10,000 ETH for $ 12.95 million for a mean value of $ 1,295 on October 4 and November 14, 2022.

Associated lecture

The Ethereum -Walvis bought none of their ETH firms, even when the main Altcoin broke $ 4,000 twice in 2024. Nevertheless, the whale has now capitulated with the Ethereum -Price Beneath $ 1,500, nearly their common admission value of $ 1,295. The investor bought the cash for a revenue of $ 2.75 million, whereas their non -realized revenue was at its peak $ 27.6 million.

This Ethereum walvis isn’t the one one to capitulate. As bitcoinist reported, Eth whales have been dumped Greater than 500,000 cash within the area of 48 hours. This improvement is because of the big crash of Ethereum, with the main altcoin that runs the chance of falling decrease. This decline is a part of a broader crypto market crash, which happened due to the charges of Donald Trump.

Trump’s charges have led to a big commerce struggle with China, which has promised not to not withdraw, which additional causes concern amongst traders. As such, the Ethereum value within the meantime appears to undergo an extra crash, which explains why these Ethereum whales capitulate to scale back their losses.

Donald Trump’s World Liberty Monetary additionally capitulating?

Donald Trump’s World Liberty Monetary (WLFI)An Ethereum walf, appears to really feel the warmth and should have already began with capitulation. Just about the info from Arkham Intelligence, look monchain revealed {that a} pockets that will have been linked to WLFI 5.471 ETH bought for $ 8.01 million for the worth of $ 1,465, which represents a loss for the whale in query.

Associated lecture

World Liberty Monetary had beforehand bought 67,498 ETH for $ 210 million for a mean value of $ 3,259. The crypto firm is now on a non -realized lack of $ 125 million, for the reason that Ethereum value has fallen by greater than 50% since their purchases.

Crypto analyst Ali Martinez Predicts that the Ethereum value will proceed to crash within the quick time period, indicating that Ethereum whales similar to WLFI can not see -realized loss on their ETH firms. Martinez acknowledged that $ 1,200 may very well be the place the main Altcoin finds its foot.

On the time of writing, the Ethereum value acts at round $ 1,400, a lower of greater than 8% within the final 24 hours, in keeping with facts Van Coinmarketcap.

Featured picture of Unsplash, graph of TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now