Altcoin

Maker focuses on $ 1,800: Will fresh buying pressure a rally of 41% spark?

Credit : ambcrypto.com

- Maker lately responded from an vital assist zone the place lots of of 1000’s of items had been bought.

- Nevertheless, some merchants take revenue – a motion that may affect the potential market motion of MKR.

Within the final 24 hours, consumers shifted the sentiment after they’d offered a big a part of the asset earlier prior to now month. This renewed buy exercise has led to a worth improve of 1.66%.

Giant shopping for orders could cause a rally

In response to Ambcrypto evaluation, this worth bounce can mark the beginning of an extra rally, with an extra advantage of 41% as a maker [MKR] strives to re -test a key resistance degree at $ 1,800.

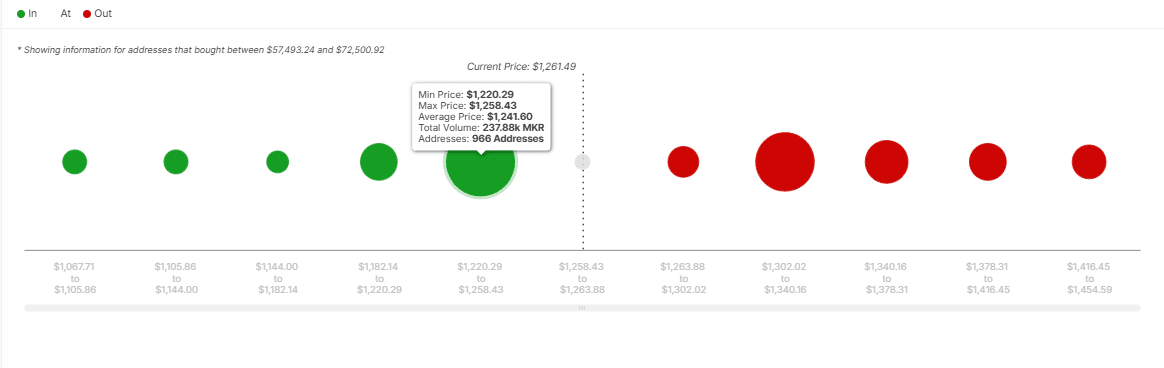

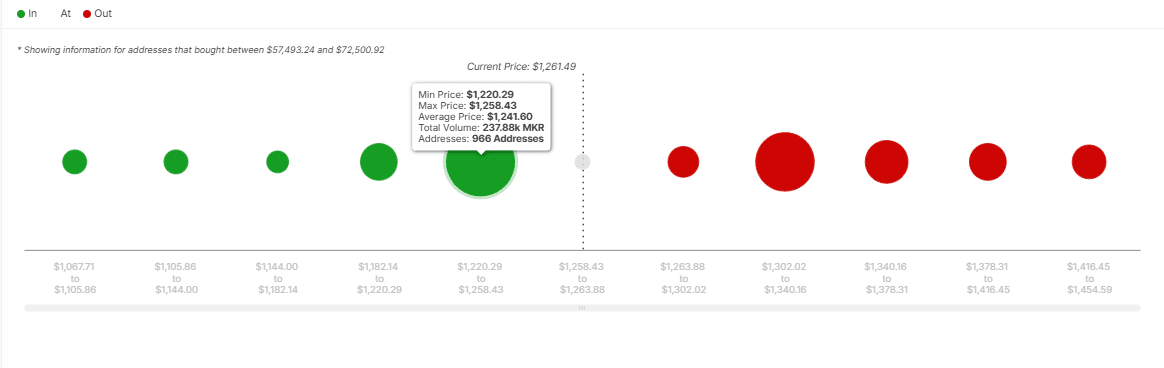

The in/out of the cash round worth (Iomap), which helps to determine potential demand and provide zones, reveals that MKR has responded to an vital demand space that would activate a big rally.

Supply: Intotheblock

This zone, positioned between $ 1,220.29 and $ 1,258.43, noticed a document traded 237,880 MKR, price round $ 299 million – a substantial quantity that fed the current uptrend.

When such an accumulation with a excessive quantity happens, a corresponding worth improve and quantity usually signifies an approaching market trally.

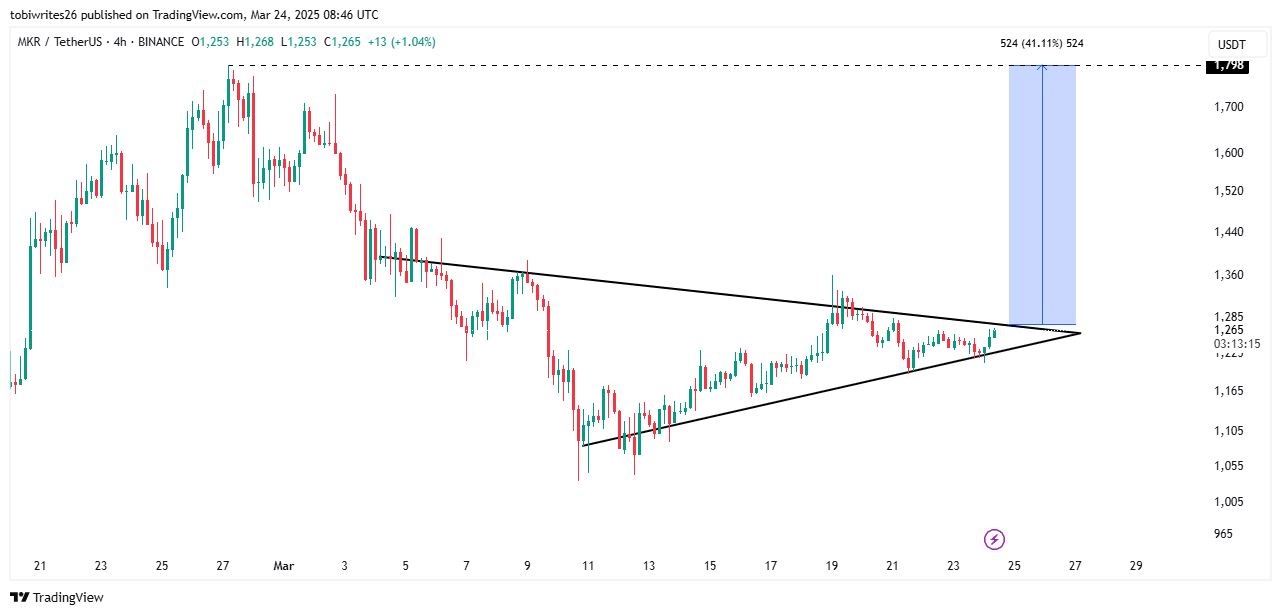

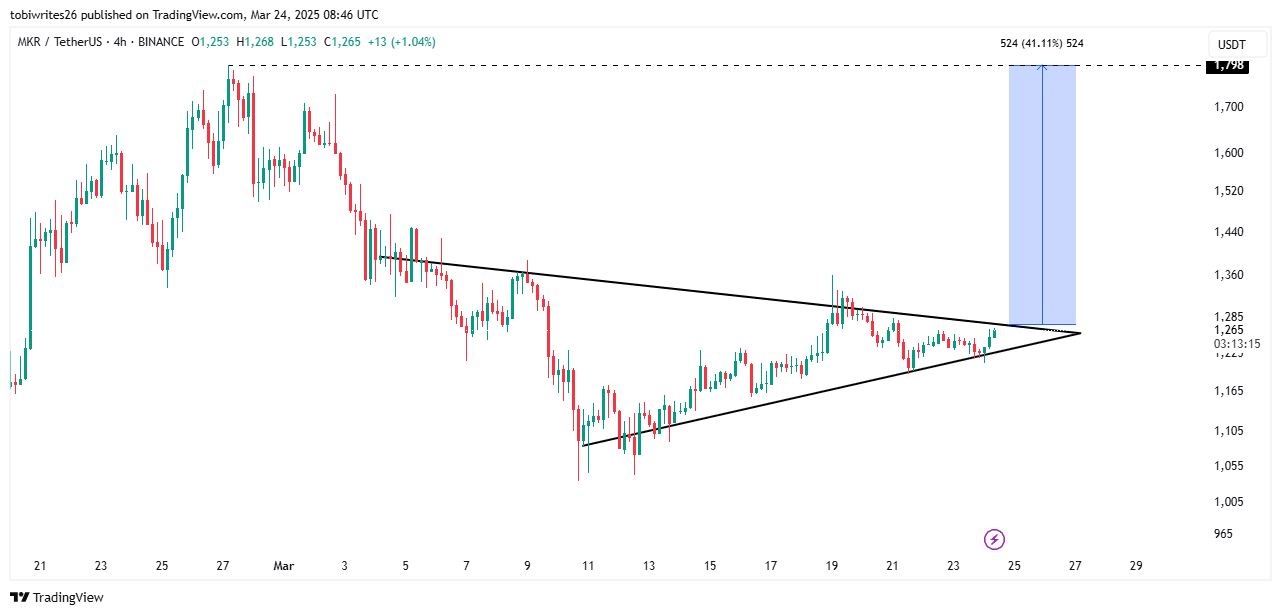

On the graph, MKR appears able to attempt a bullish breakout from a symmetrical triangle, based on the massive shopping for orders. Based mostly on the evaluation, if it actively breaks this resistance, it might rise 41% to succeed in $ 1,800.

Supply: TradingView

A symmetrical triangular sample arises when converging assist and resistance traces create a consolidation part. As quickly as the value motion breaks out, this normally results in a robust directional motion.

Derivatives merchants go lengthy earlier than the rally

Market sentiment stays Bullish, particularly within the derivatives market, the place merchants open extra lengthy positions pending an outbreak.

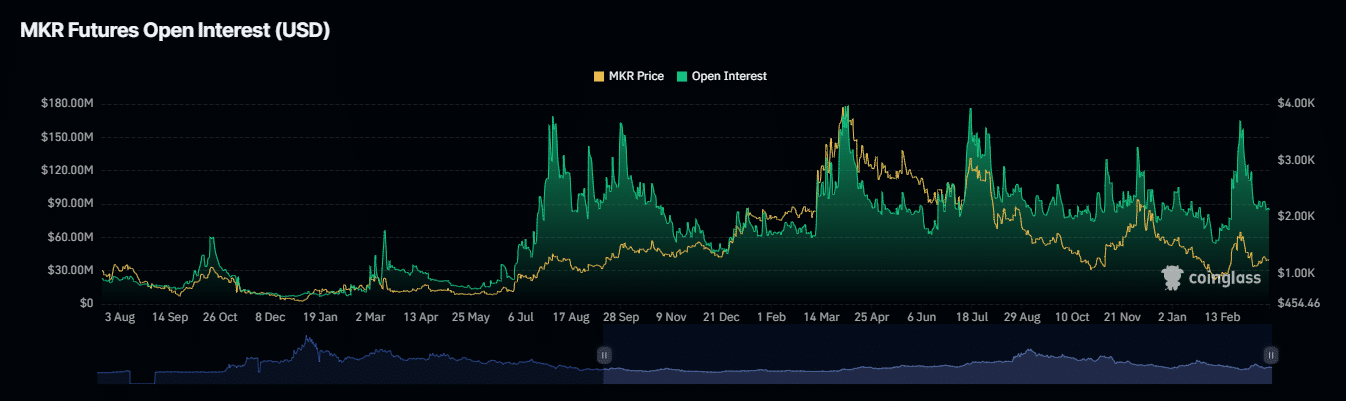

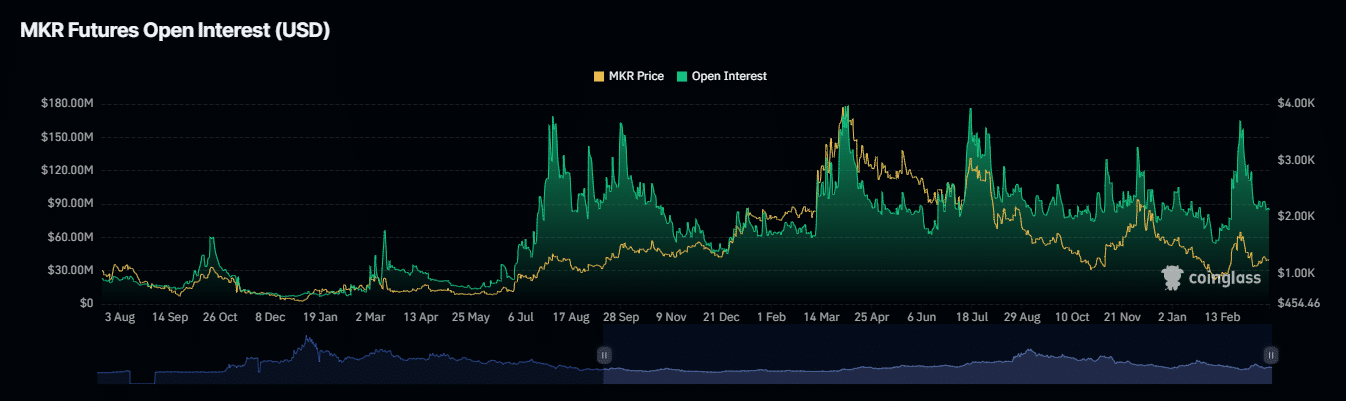

Information from Coinglass reveals that MKR’s Open Curiosity (OI) has risen steadily and has reached $ 87.80 million within the final 24 hours. This improve signifies extra stressed spinoff contracts out there.

Supply: Coinglass

A examine of the rising financing share means that these contracts want lengthy positions.

The aggregated financing share, which has risen to 0.0088%, implies that lengthy merchants pay a premium to quick sellers to keep up their positions – normally noticed in bullish market phases.

Making a revenue can gradual the expansion of MKR

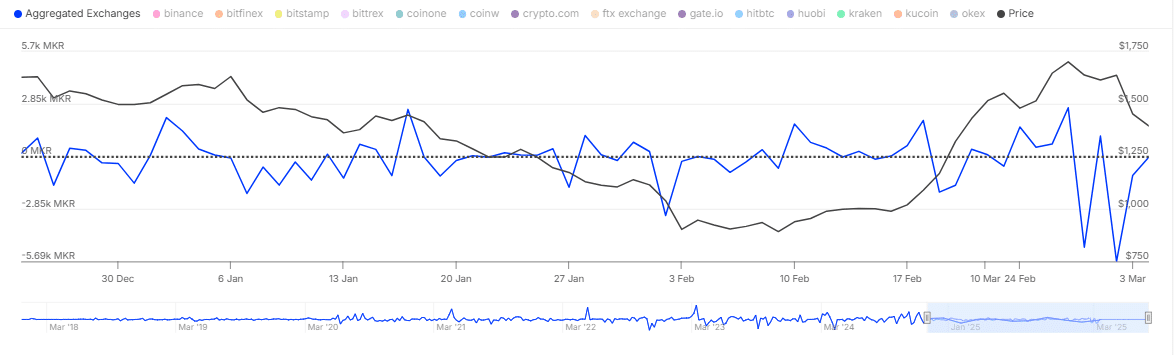

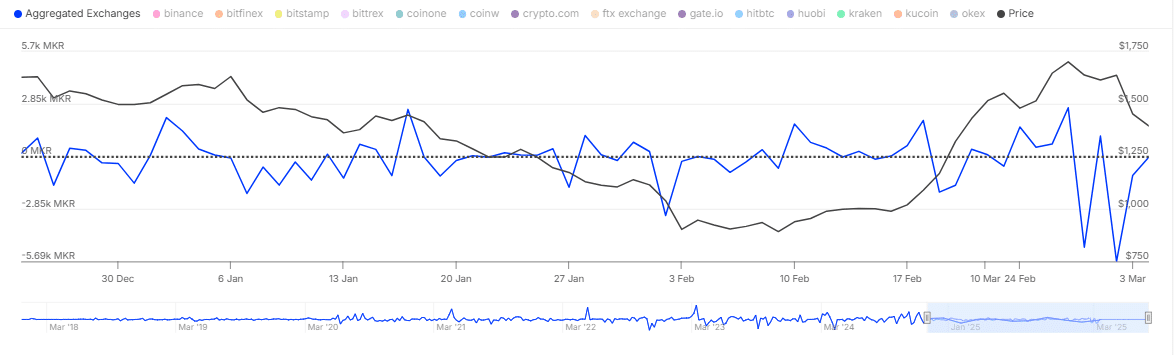

Though the broader market stays bullish, some spot merchants take revenue, as indicated by the Change Netflow that turns into optimistic.

Supply: Intotheblock

The Netflow -Metric, which follows the shopping for and promoting actions inside a sure interval, reveals that 989.63 MKR (price $ 1.2 million) has been offered.

Nevertheless, this gross sales strain is comparatively low in comparison with the acquisition exercise of the earlier days, which means that merchants obtain revenue and on the similar time preserve nearly all of their positions intact.

You will need to notice that if the gross sales actions proceed on the spot market and extra belongings are loaded, this will point out a shift to Bearish sentiment as an alternative of a easy revenue -making part.

For now, nonetheless, MKR stays largely bullish and focuses on $ 1,800.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024