Bitcoin

Making PPLNS Work For Demand Response

Credit : bitcoinmagazine.com

Bitcoin -Mybouw has taken a good distance because the days of GPUs and basement setup. At the moment, miners have improved in numerous methods. For instance, ASICs are actually the usual, not GPUs. Furthermore, gamers from firm members entered the sphere, open new boundaries and entail the dimensions and institutional recognition that opens the doorways for different unattainable locations for smaller miners. These days there’s a true grid companies, restriction methods and vitality market participation not are peripheral containers, however core methods. Because the world round it has moved, there’s one query that we proceed to listen to from miners: can PPLNs adapt?

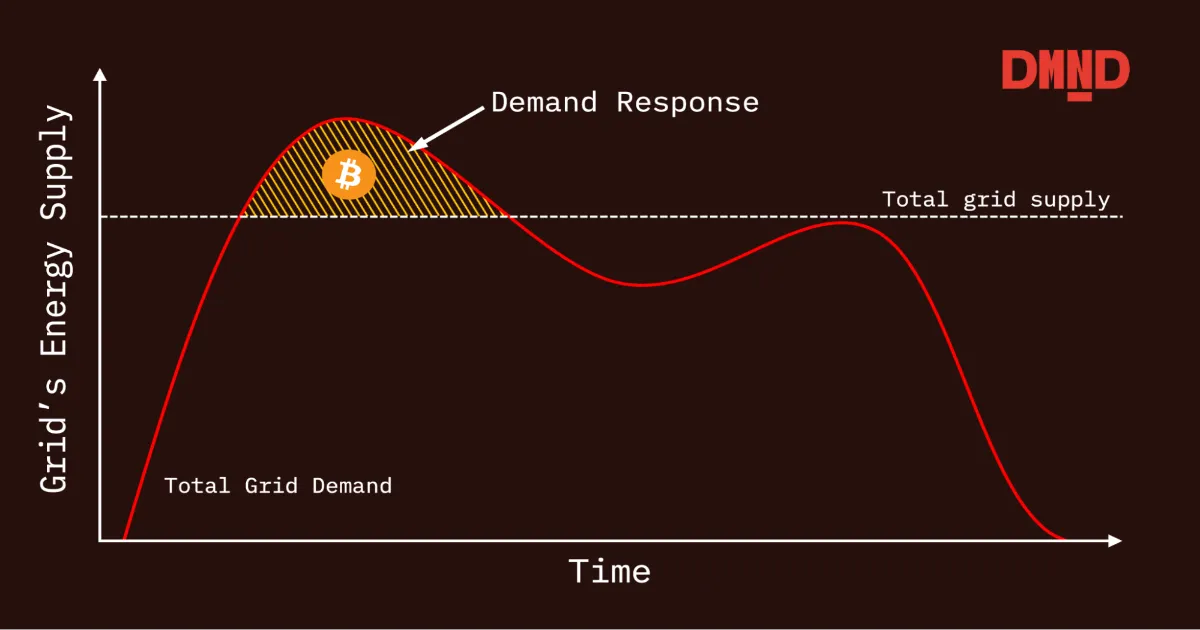

Many miners, particularly those that work carefully with vitality suppliers or integrating demand mechanisms, have suspected PPLNs. They’re involved that downtime punishes and solely rewards uninterrupted hashrate – a nasty deal for individuals who restrict routine machines to help the grid or supply different companies.

This worry is just not unfounded. It follows again to an important second within the latest previous of the mining business, a second when the deal has apparently sealed for a lot of on PPLNS model profit: the autumn -out between Riot and Braiin Pool.

On the time, Braiins used the rating -proceeding system. Designed in 2011 by Slush itself, rating was designed to unravel the issue of polar hopping – when miners would soar between Polish to take advantage of reward programs. There has additionally been a false impression that rating is a PPLNS model fee system, however as Rosenfeld Bible on Pool -Expenditure systems Describes, rating and PPLNs are clearly totally different fee strategies. A very powerful distinction is how they’re chargeable for shares, particularly, rating applied a rolling window with exponential decay perform, this made the lookback window successfully very quick. Alternatively, PPLNS is a household of payout programs with various kinds of leasers with a set size.

As proven on This archived website From how rating labored, you possibly can see that your hashrate was not current on the pool after 90 minutes. Because of this the second a miner begins to mine, their share within the rewards rapidly reaches the actual worth of the trouble. Alternatively, when a miner stops with mining, it drops simply as rapidly, as proven on the GIF under.

This may occasionally have labored properly within the period of cowboys and hackers, however it’s by no means designed with the present advanced mining environments in thoughts. Actually not with the demand response, during which miners take intentional and worthwhile machines offline to stabilize vitality networks or to supply it in supporting markets. To attain, that sort of conduct appears to be no totally different than a polar hopper – somebody attempting to cheat the system.

So when Riot left Braiins, just about concern in regards to the fee mechanics, it despatched a shock wave by means of the mine world. Because of the aforementioned false impression, the errors of the scoring system had been unfairly projected on a broader class of funds, PPLNs had been trapped within the battle, the place he captured a misplaced bullet within the course of, and the business threw the infant away with the tub water.

However the mine world has modified, and it is time for the Phoenix to rise from its axis.

Slice: A fee mechanism for the twenty first -century schedule

Enter SlabA contemporary, open-source stratum-V2-ready fee system made by the DMND crew. It’s an enchancment and evolution of PPLNs that rethink how miners are paid, rewards are calculated and – most significantly – how downtime is handled with respect

to attain. Whereas the appropriate to maintain a miner to construct their very own block templates with SV2.

Within the core, Slice is about honesty and transparency. It retains the elemental concept of PPLNs – paying miners in relation to their precise contribution to fixing blocks – whereas modernizing for the present decentralized mining panorama.

A very powerful innovation lies in how the calculation of the disk buildings the calculation of the buildings rewards and about how the assessment window works. As a substitute of treating all the swimming pool as a monolith, stick the time in smaller, dynamic “slices” work to accurately distribute the element of the payment. These slices symbolize batches of shares which were submitted for a selected interval, whereby we verify for the quantity of the reimbursements within the mempool, and examine and rating numerous process templates for the monetary worth they symbolize. When a block is discovered, Slice divides the block subsidy and transaction prices individually. The subsidy is allotted proportionally by Hashraat, whereas the prices are distributed on the premise of trouble and monetary worth.

That is notably related in a world the place miners can select their very own transaction units. Some miners can provide precedence to bundles with a excessive fairy-style; Others can exclude sure sorts of transactions for ideological, political or technical causes. Slice ensures that, inside every slice, miners are rewarded in line with each the amount and the standard of their work – with out punishing them for downtime or strategic vitality selections. For many who are curious to be taught extra, this article can show to be helpful.

Ask a response with out punishment

What makes Slice notably enticing for miners who take part in demand response or limitation packages is that it isn’t punished since you are offline.

That is as a result of Slice doesn’t expire your fee simply because you might have taken a break. Your shares stay within the PPLNS window – the rolling window of latest work that’s eligible for payouts – so long as they’re just lately sufficient. On this method, every share is handled independently and it’s anticipated to obtain 8 payouts, as a result of Slice makes use of an 8-block roll window, every legitimate share stays eligible for fee over the next 8 blocks on common. Because of this, irrespective of how massive or small the pool is, you’ll by no means have the horrible happiness of consuming out of breakdown days and not using a block, disconnecting the swimming pool and never being paid.

That signifies that miners may be eradicated throughout peak hours, help their regional grid and nonetheless gather their sincere discount from blocks which might be discovered after they resume the actions, particularly when they’re offline when their shares are nonetheless within the window. In different phrases, if the swimming pool has a sequence of unhealthy luck, after which the miner is named to carry out a requirement response and is closed, even when the swimming pool finds a block throughout their down -time, that miner will get their sincere share for on a regular basis they had been on-line. That’s as a result of each share that’s generated at the moment will probably be energetic and paid for 8 blocks on common.

This isn’t an answer. That is the perform. It makes plaque totally suitable with trendy vitality methods that require flexibility, whether or not you take part in frequency regulation markets, reduce by means of throughout schedule conditions or just optimize for greenback costs.

For instance, for instance {that a} miner is created by a swimming pool and that the swimming pool has not but discovered that day block. Because of this the swimming pool has not but discovered Het Blok, and so the miners haven’t been paid that day. Now the miner is switched off to supply supporting companies for a number of hours throughout peak summer time tax, throughout that point the swimming pool finds Het Blok. In a rating -based pole, the miner wouldn’t see any Saturday after 90 minutes if the decay had had a full impact. However even when the swimming pool discovered a block half-hour later, due to the exponential decay, the miner would hardly see something. Alternatively, the miner would obtain all of the shares they’ve mined in the course of the day, as a result of every share receives a mean of 8 funds. The miner would subsequently profit within the good occasions and never be punished within the unhealthy occasions.

Cost of transparency and auditability

Furthermore, Slice not solely modernizes the equity of the fee – it does this in a method that minimizes confidence within the polar operator. Every slice is totally auditable. Every share is adopted, listed and publicly verifiable by each miner, in order that miners can independently confirm their share within the block remuneration. There is no such thing as a black field, no “consider me, bro.”

And if the polar operator tries to cheat – says, by injecting faux shares to dilute the payouts, the extra integrity of the plaque can dispute. The extension of the duty assertion to Stratum V2, on which Slice trusts, consists of mechanisms for publishing share information, verifying model roots and guaranteeing that every share corresponds to actual computational work.

For miners who take care of decentralization, Slice is just not solely a fee schedule – it’s a device for accountability.

From defensive to strategic

The shift from rating to Plak represents greater than a technical improve. It’s a psychological shift. Mining swimming pools not should defend themselves in opposition to unhealthy actors by punishing everybody. As a substitute, they’ll construction payouts in a method that displays actuality: these miners are superior contributors who not solely work within the bitcoin -blockchain, but in addition within the vitality ecosystem.

With Slice, PPLNS stops legal responsibility and turns into a strategic benefit. It makes higher revenue, extra transparency and auditability and smoother integration with Grid Providers potential.

And in a world the place uptime is elective, however equity is non-consumable, that’s precisely what miners want from Enterprise-Grade, a strategic polar associate who’s making forward and innovates, brings the longer term right this moment and allows miners to earn more cash with the identical {hardware}.

This can be a visitor submit from Basic Kenobi. The expression of opinions are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now