Altcoin

Map Dogwifhats [WIF] Road Ahead: Is it time for traders to sell at …

Credit : ambcrypto.com

- The vary of $ 0.55 was marked as a vital resistance on a number of fronts.

- For Dogwifhat, the buying stress in latest days was not robust sufficient to point a pattern elimination.

The Memecoin market noticed some lighting within the final 24 hours of commerce. On the time of the press, Mint market cap Information confirmed that the meme sector noticed a rise of just about 2% in market capitalization and a rise of 8.5% in every day commerce quantity.

This got here after a bitcoin [BTC] Buiter additional than the resistance of $ 82.5K on 11 April.

Dogwifhat [WIF] Sayed 9% in 24 hours, however it nonetheless had a bearish take a look at the upper timetables. The Solana [SOL] -Based mostly meme adopted the 18% of SOL’s 18% greater previously three days.

Ought to WIF merchants anticipate the momentum to be sustained within the coming week?

Merchants would most likely be extra worthwhile than shopping for Wif

Supply: Wif/USDT on TradingView

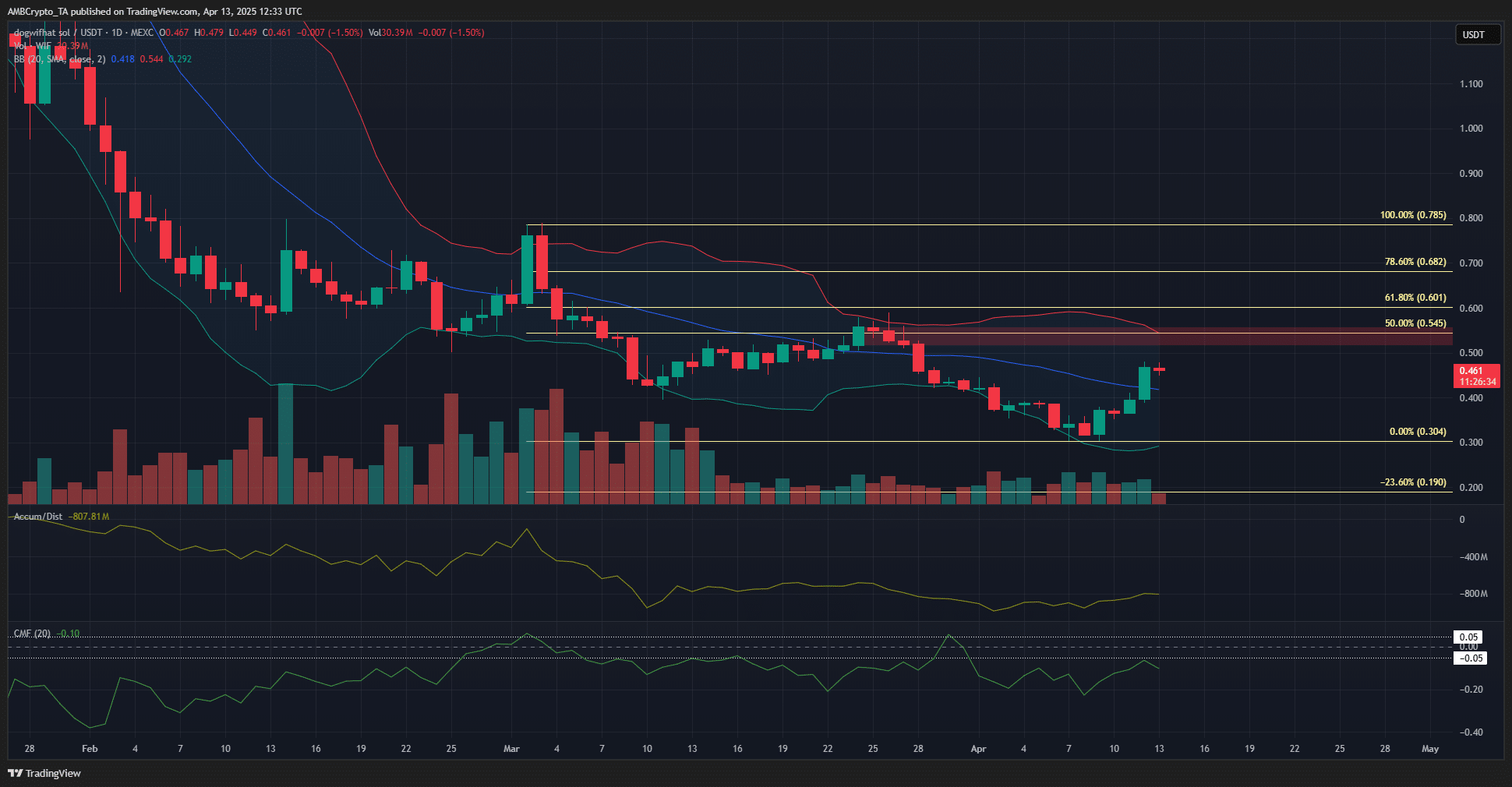

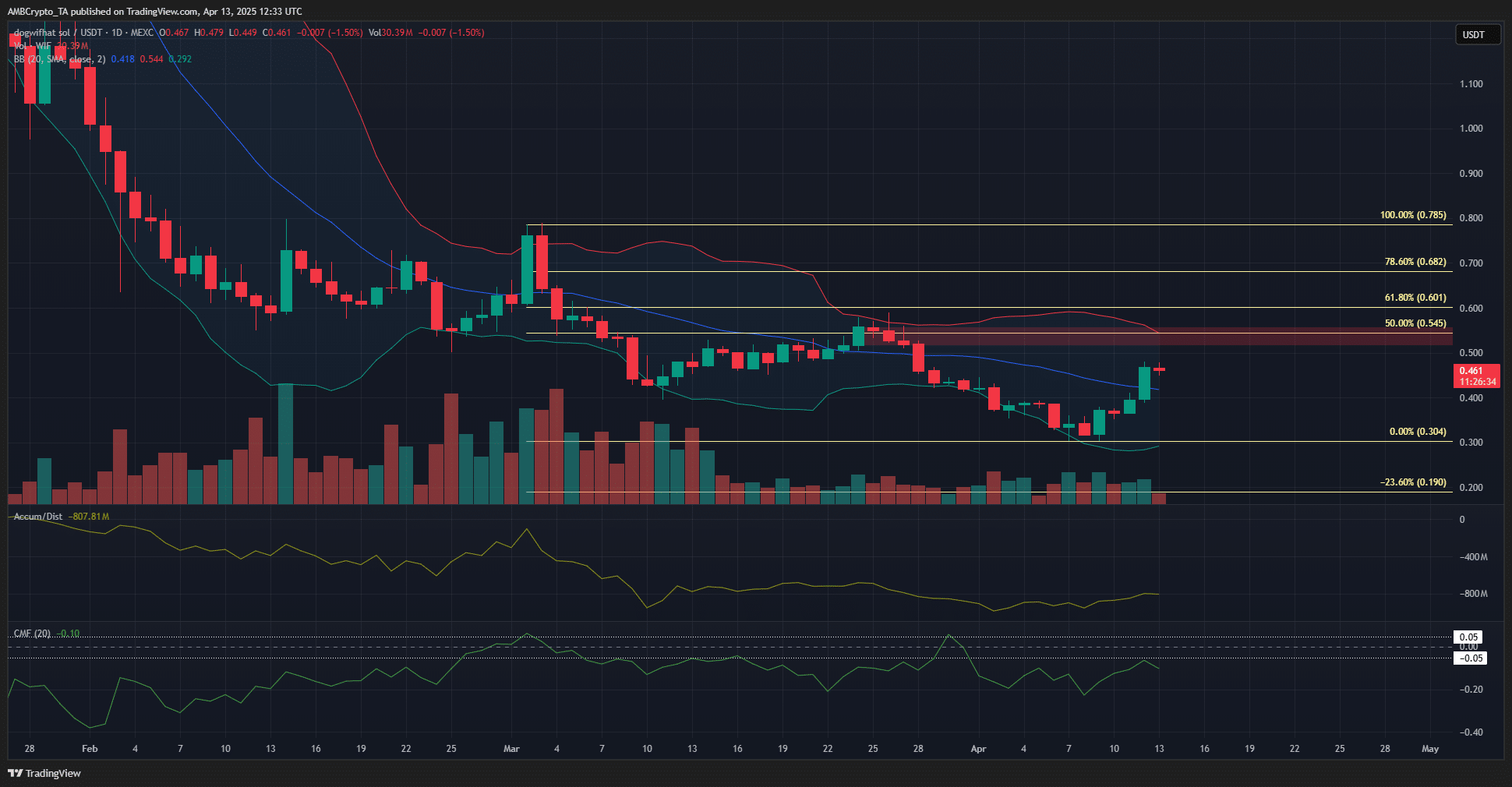

Regardless of the latest revenue, Dogwifhat labored below a bearish construction on the every day map, like many different altcoins. The losses in latest weeks had been too critical to recuperate, and merchants and buyers would higher abandon gross sales choices.

Technical evaluation helped to restrict the place these alternatives can happen.

The bearish order block marked, the bearish order block coincided with the 50% Fibonacci retracement degree, set out on the idea of the downward pattern of the previous six weeks. It additionally had confluence with the higher Bollinger band.

The A/D indicator noticed a bouncing in April, however couldn’t climb above the latest excessive set within the third week of March. This confirmed some buying stress, however no dominance of them.

The CMF was extra damaging. It has been the vast majority of the previous three months below -0.05. Collectively, the amount indicators underline the regular gross sales stress and the shortage of bullish pressure.

Merchants can use the area of $ 0.5- $ 0.55 to promote WIF.

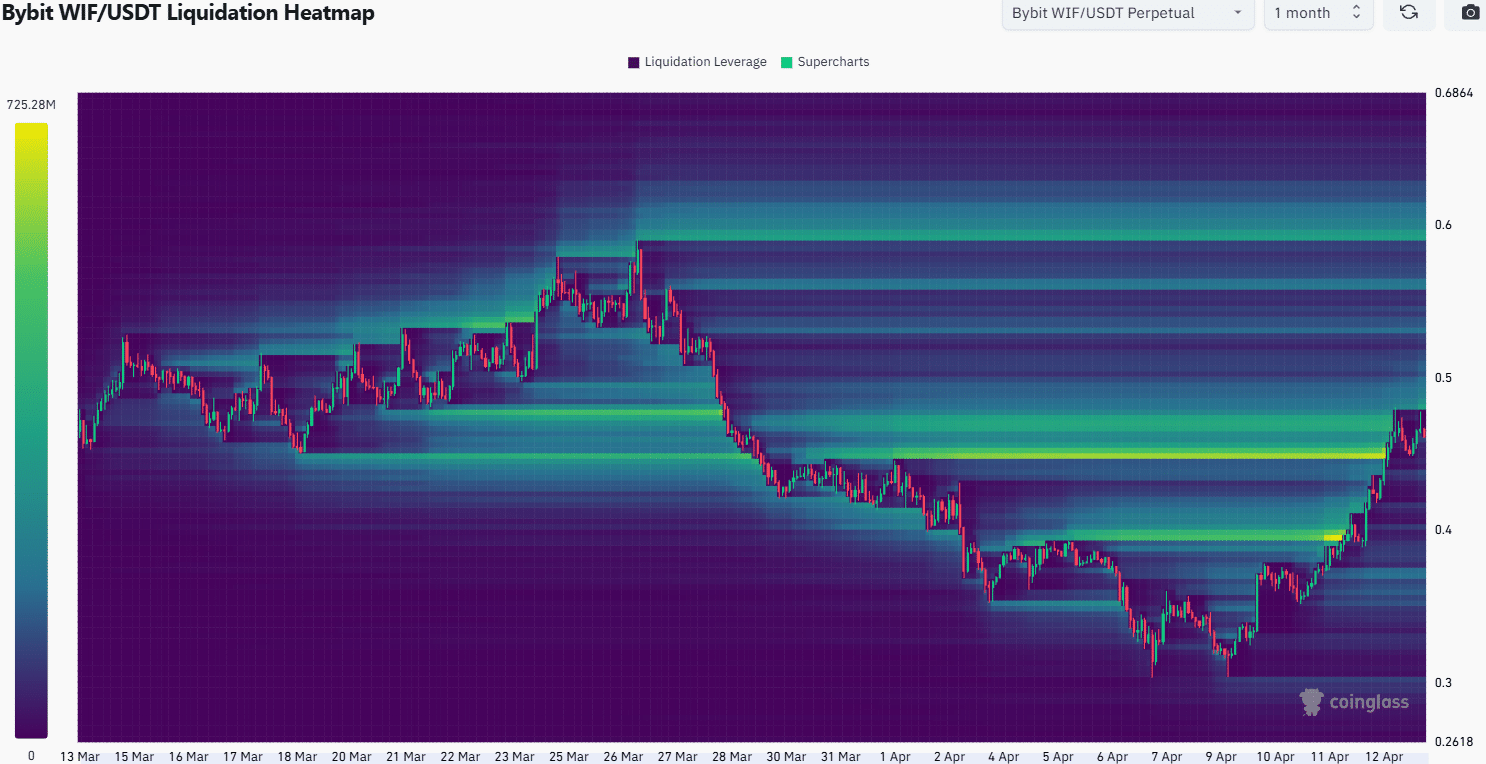

The 1-month liquidation heating confirmed that the realm of $ 0.45- $ 0.47 was full of brief liquidations. After sweeping this degree, WIF Bulls may keep the costs above $ 0.42, as a substitute of seeing their winnings shortly. The BTC value motion greater may affect the market sentiment.

The development of liquidity round $ 0.48- $ 0.5 marked it as a short-term goal. Additional north, the extent of $ 0.6 was the following outstanding liquidity pocket. Given the confluence of resistors round $ 0.55 and a weak query, an outbreak appeared unlikely.

If WIF can consolidate round $ 0.46 for the following 24-48 hours, the liquidity of round $ 0.5 would most likely get thicker. This situation of WIF consolidation within the subsequent day, adopted by a value bounce and a bearish reversal afterwards, the probably consequence appeared within the brief time period.

Merchants who need the memecoin need to fall in need of $ 0.5- $ 0.55, in addition to the BTC pattern to find out whether or not promoting can be a possible possibility or not.

Disclaimer: The introduced data doesn’t type monetary, investments, commerce or different sorts of recommendation and is barely the opinion of the author

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024