Policy & Regulation

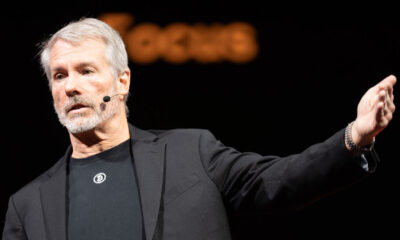

Mark Cuban Says FTX and Three Arrows Capital Would Still Be Operating if Gary Gensler Had Done the Right Thing

Credit : dailyhodl.com

Billionaire and Shark Tank star Mark Cuban is beaming Gary Gensler, Chairman of the US Securities and Trade Fee (SEC), for his strategy to regulating the crypto business.

In a brand new interview on the All-In Podcast, Cuban say that Gensler depends solely on the case of SEC v. WJ Howey Co. from 1946 in classifying crypto belongings as safety.

The Howey take a look at qualifies an asset as an funding contract topic to securities legal guidelines whether it is an funding in a three way partnership and there’s a cheap expectation {that a} revenue will probably be comprised of the efforts of others.

Says Cuban,

“You need to make it straightforward to comply with the foundations. And it means every thing is a certainty, Gensler says: “All the things applies to Howey.”

There is the Howey Rule, however the actuality is that there is additionally a ruling that got here after it known as Reves v. Ernst & Younger, which needed to do with curiosity…

Have you ever ever shorted shares or carried out inventory loans the place you can also make some cash with a inventory mortgage? You may make one in all your shares obtainable to the borrower and get a sticker. You might get 10% or 12%. Doing that’s precisely the identical as lending Bitcoin in order that another person can borrow it, they usually do not name that safety.

I requested Gary Gensler. If it isn’t a safety to lend some inventory, why is it a safety to lend Bitcoin to another person? He had no reply.”

Cuban says Gensler’s strategy is regulation by means of lawsuits.

“He will sue you first, ask questions later, and hope that the result of that lawsuit turns into a rule that everybody else has to comply with.”

Cuban says that as a substitute of building a transparent regulatory framework, Gensler is making it tough to register tokens with the SEC. He says bankrupt crypto corporations FTX and Three Arrows Capital would nonetheless be in enterprise if the US adopted Japan’s footsteps in regulating the business.

“If FTX desires to lend out all their Ethereum, it’s important to do what they did in Japan. It’s essential have 95% collateral and 95% of every thing must be in chilly storage. If he had adopted the identical guidelines for crypto as Japan, FTX would nonetheless be in enterprise. Sam Bankman-Fried should be in jail, however FTX and Three Arrows Capital should be in enterprise as a result of he did the flawed factor.

Do not miss a beat – Subscribe to obtain electronic mail alerts straight to your inbox

Test worth motion

Comply with us additional XFb and Telegram

Surf to the Day by day Hodl combine

Featured picture: Shutterstock/TadashiArt/Natalia Siiatovskaia

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024