Bitcoin

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Credit : bitcoinmagazine.com

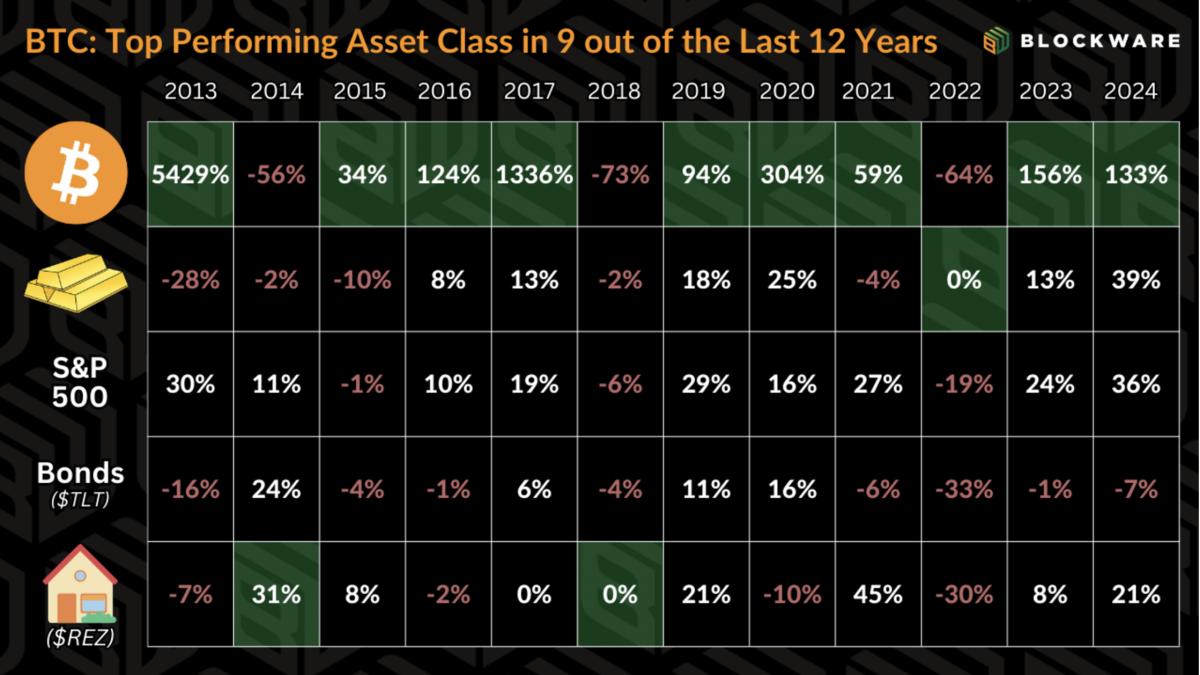

Bitcoin has persistently outperformed all main asset courses over the previous decade, cementing its function as a benchmark for digital asset buyers. For these dedicated to the long-term imaginative and prescient of Bitcoin, the final word monetary objective typically shifts from buying extra {dollars} to maximizing their Bitcoin holdings.

Bitcoin is the Hurdle Fee

Bitcoin is to digital property what authorities bonds are to the legacy monetary system: a basic benchmark. Whereas no funding is with out threat, Bitcoin self-managed eliminates counterparty threat, dilution threat, and different systemic dangers frequent in conventional finance.

The place BTC has outperformed each different asset class in 9 of the previous 12 years (in orders of magnitude)it’s no shock that it has usurped authorities bonds because the “risk-free charge” within the minds of many buyers – particularly these educated about financial historical past and thus the enchantment of Bitcoin’s verifiable shortage.

One other method to phrase that is that the monetary objective of digital asset buyers is to accumulate extra BTC as a substitute of buying extra {dollars}. All investments or bills are seen via the lens of BTC as a possibility value.

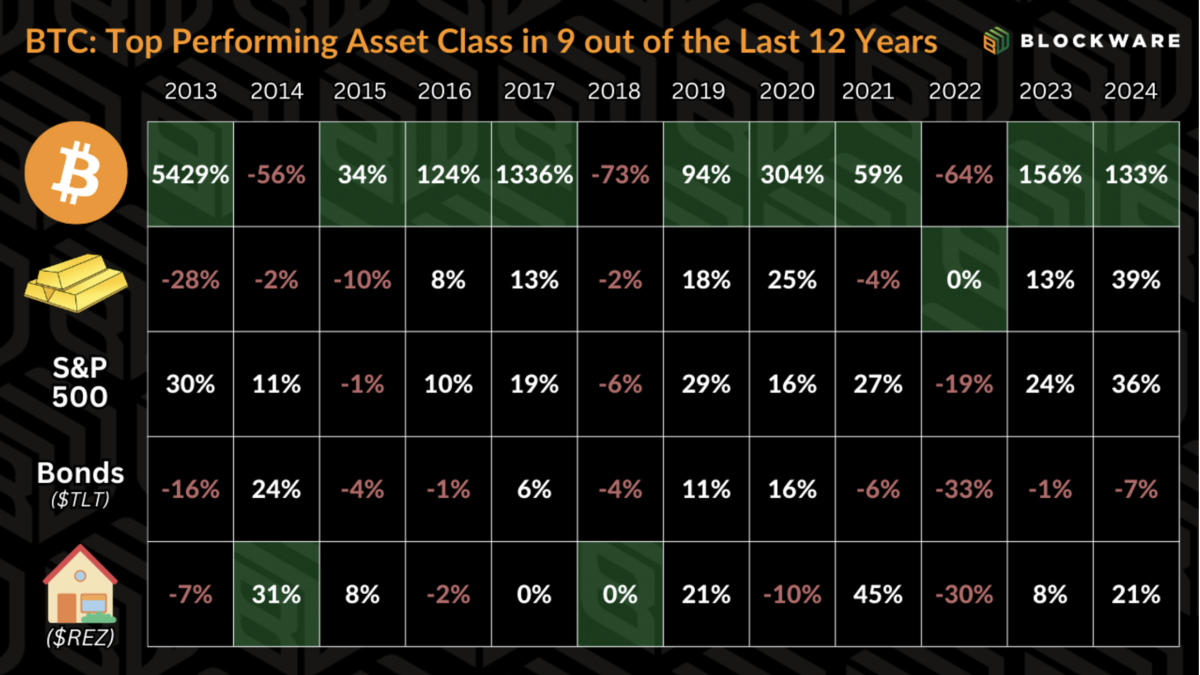

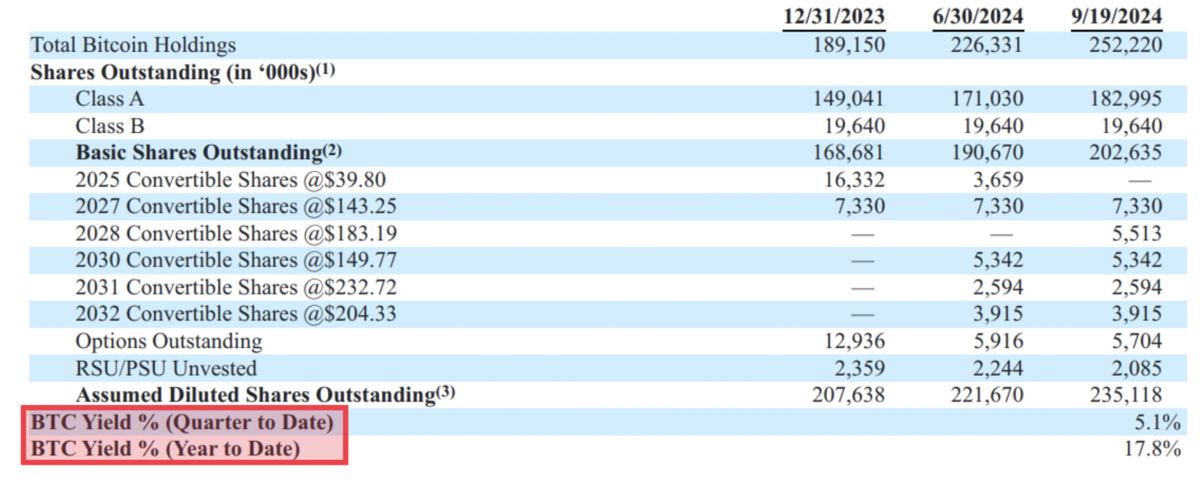

MicroStrategy has proven what this seems like within the enterprise world with their new KPI: BTC Yield. To cite from their September 20 publish: 8-K form: “The corporate makes use of BTC Yield as a KPI to evaluate the efficiency of its technique to accumulate bitcoin in a fashion that the corporate believes is helpful to shareholders.” MicroStrategy has taken full benefit of the instruments at its disposal as a multi-billion greenback publicly traded firm: entry to low-interest debt and the flexibility to concern new fairness. This KPI exhibits that they’re buying extra BTC per share excellent, regardless of participating within the historically dilutive exercise of issuing new shares.

Mission achieved: they purchase extra bitcoin.

However MicroStrategy has a bonus that the typical fund supervisor or non-public investor does not: It is a publicly traded firm with the flexibility to faucet capital markets at little to no relative value. Particular person holders are unable to concern shares on the general public market to boost capital and purchase BTC. Nor can we concern convertible bonds and borrow {dollars} at near-zero p.c rates of interest.

In order that begs the query: how can we accumulate extra bitcoin? How can we’ve a constructive ‘BTC Yield’?

Bitcoin mining

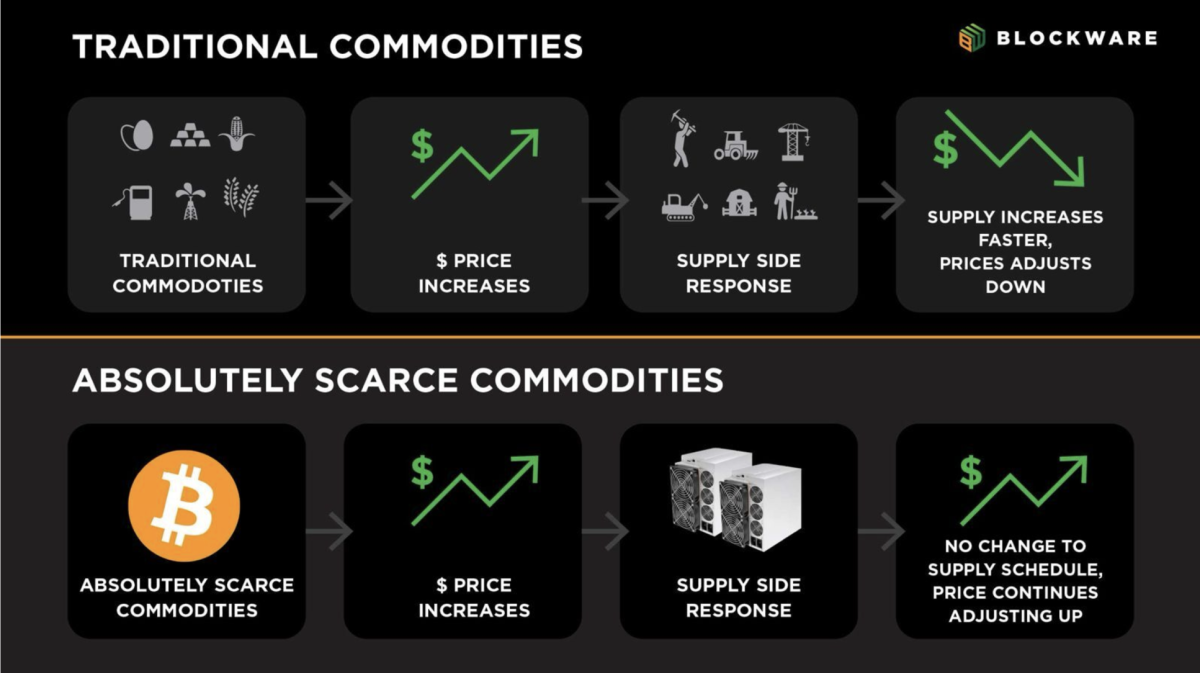

Bitcoin miners purchase BTC by contributing computing energy to the Bitcoin community and obtain a bigger quantity of BTC than what it prices in electrical energy to run their machine(s). Now that is simpler mentioned than performed. The Bitcoin protocol enforces a predetermined supply schedule utilizing ‘issue changes’ – which means that extra computing energy for Bitcoin mining leads to the finite block rewards being damaged down into smaller items.

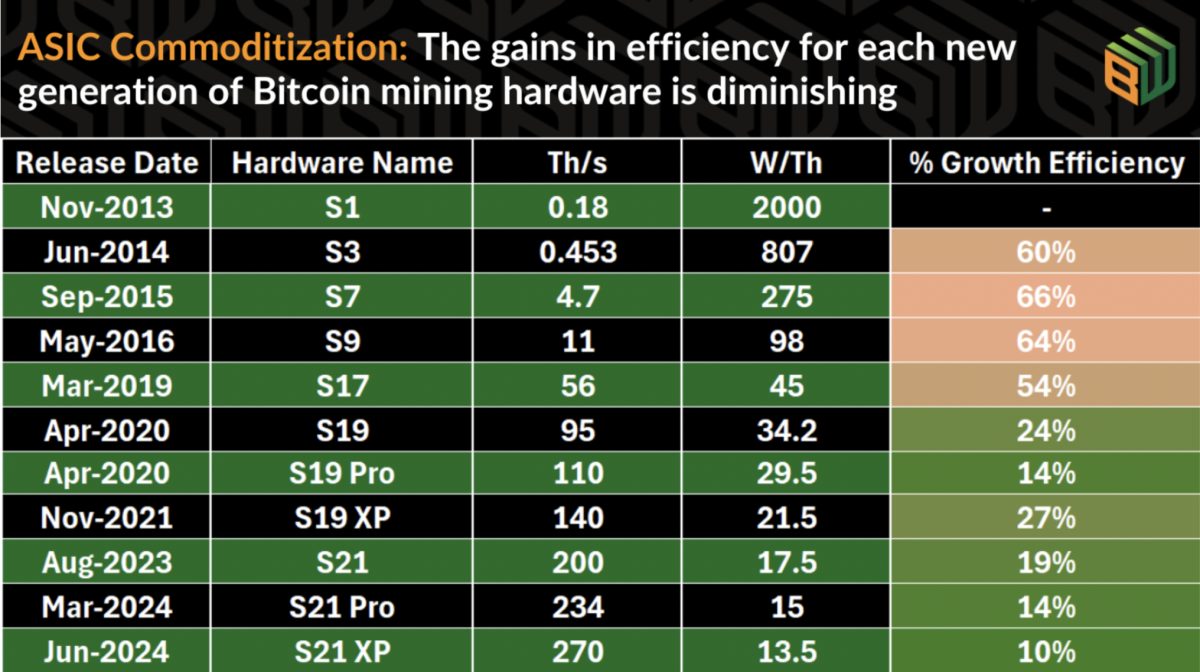

The simplest Bitcoin miners are those that maximize their computing energy whereas minimizing their working prices. That is achieved by buying the most recent, best Bitcoin mining {hardware} and working on the lowest doable electrical energy charge.

Beneath present market situations (from 21-11-2024), 1 bitcoin has a value of ~$98,000. Nevertheless, an Antminer S21 Professional mining with an electrical energy charge of $0.078/kWh can produce 1 BTC for ~$40,000 price of electrical energy. That is an working margin of virtually 145%. An organization is mostly thought of to have ‘wholesome revenue margins’ if they’re between 5 and 10% – mining simply beats this. That is even supposing from the Bitcoin halving in April 2024, they’ll earn half as a lot BTC per unit of account.

Value progress exceeds issue progress

The value of a monetary asset – particularly bitcoin – is ready on the margin. Which means the worth of the asset is decided by the latest transactions between patrons and sellers. In different phrases, the worth displays what the final purchaser is prepared to pay and what the final vendor is prepared to just accept.

That is partly what makes BTC’s notoriously risky value motion doable. An absence of sellers at value X signifies that patrons should bid the worth greater than X to seek out the subsequent marginal vendor. Conversely, a scarcity of patrons at value X signifies that a vendor should scale back demand to seek out the subsequent marginal purchaser. BTC can rise or fall rapidly primarily based on a scarcity of sellers or patrons in a selected vary.

Consequently, the pace at which the Bitcoin value can transfer is far quicker than that of community mining issues. Substantial progress in community mining issues is not going to be achieved via marginal bid/ask spreads, however can be achieved via the fruits of ASIC manufacturing, vitality manufacturing and mining infrastructure improvement. There can be no discount within the time and human capital required to extend the full computing energy on the Bitcoin community.

This dynamic creates alternatives for Bitcoin miners to build up large quantities of Bitcoin.

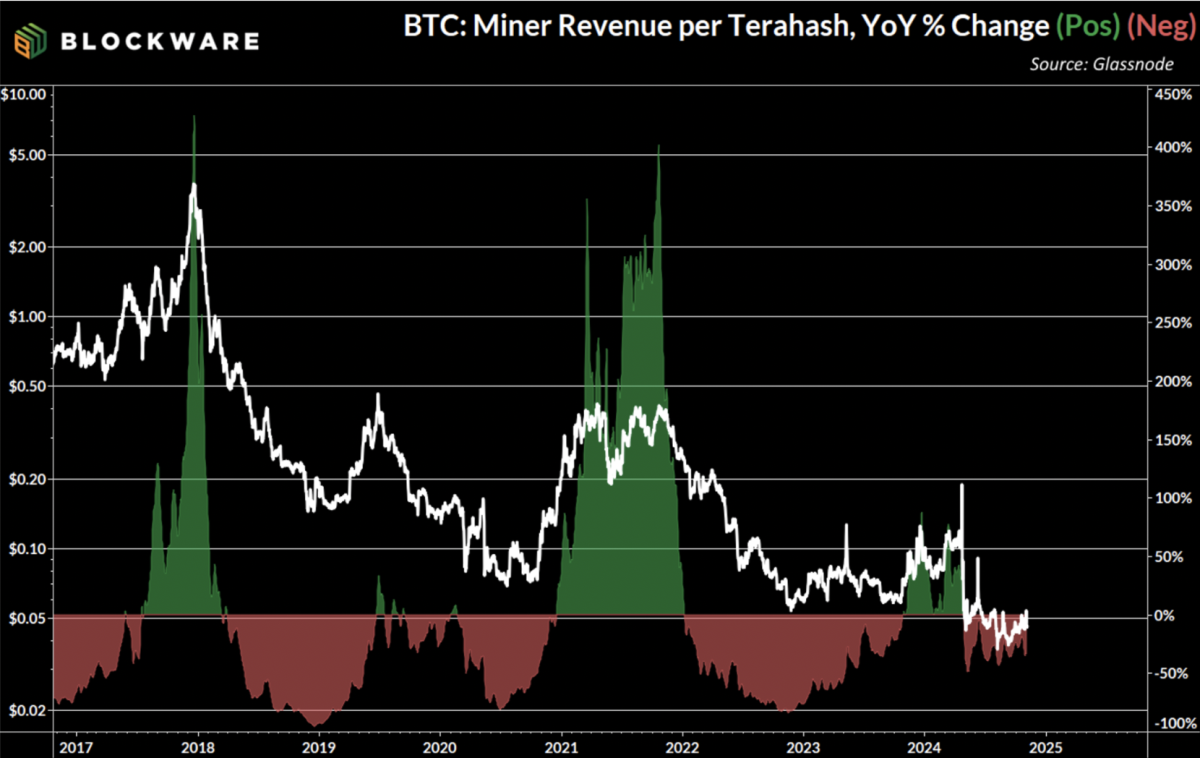

The chart right here illustrates the explosive progress in Bitcoin mining profitability that happens throughout bull markets. “Hashprice” measures the quantity of income Bitcoin miners earn per unit of account each day. On a year-over-year foundation, the hash value has elevated by greater than 300% on the peak of every Bitcoin mining cycle. Which means miners greater than tripled their revenue margins in a twelve-month interval.

In the long run, this statistic drops as extra entities begin mining bitcoin, miners improve to extra highly effective and environment friendly machines, and the block grant is halved each 4 years. Throughout bull markets, the mix of forces which are a constructive catalyst for mining issues (and due to this fact a internet detrimental for mining profitability) pales compared to the speedy progress of bitcoin’s value.

Value Volatility in Bitcoin Mining {Hardware}

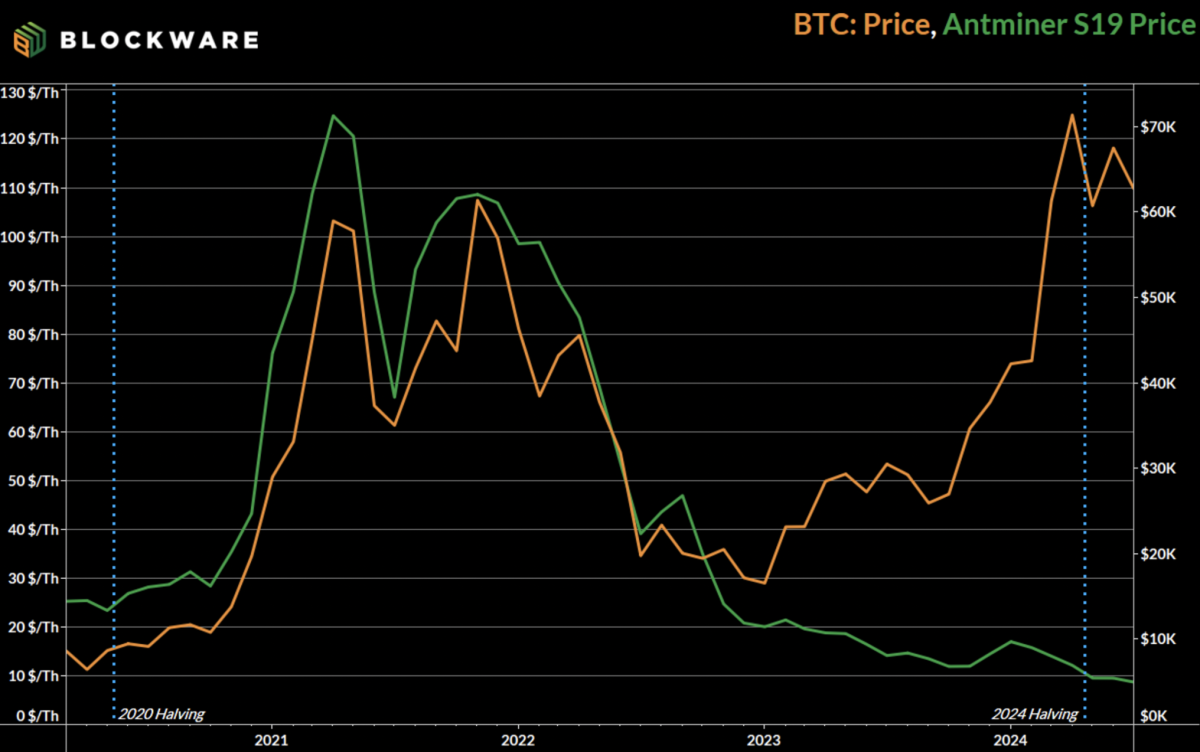

Along with wider revenue margins throughout bull markets, Bitcoin miners have the simultaneous benefit of the truth that ASIC costs have a tendency to maneuver in tandem with the Bitcoin value. In the course of the 2020 – 2024 cycle, the Antminer S19 (best ASIC at the moment) began buying and selling at ~$24/T. In November 2021 – when the BTC value peaked – they began buying and selling above $120/ton.

Bitcoin mining {hardware} that retains resale worth is turning into increasingly more the case with every new technology of {hardware}. Within the early days of Bitcoin mining, technological developments had been speedy and vigorous – to the purpose that new ASICs would make older fashions out of date in a single day. Nevertheless, the marginal beneficial properties of recent ASICs have declined to the purpose that older fashions can stay aggressive for a number of years after introduction.

Contemplating the S19 was launched in 2020 and has a non-zero market value in the present day, it is affordable to count on the S21 machine line to carry worth for even longer. This provides miners a big benefit in relation to accumulating bitcoin, because the preliminary value of buying machines is now not ‘sunk in’. Their machines have a value, a value that’s correlated with bitcoin, and there’s a supply obtainable to acquire it. liquidity.

Blockware Marketplace

Blockware developed this platform to offer any investor – institutional or non-public – with the chance to realize direct publicity to Bitcoin mining. Customers of {the marketplace} can buy Bitcoin mining rigs hosted in one in every of Blockware’s Tier 1 knowledge facilities and entry industrial vitality costs. These machines are already on-line, eliminating lengthy lead instances which have traditionally precipitated some miners to overlook these key months within the cycle when value exceeds community points.

Furthermore, this platform was constructed by Bitcoiners, for Bitcoiners. Which means machines are bought utilizing Bitcoin because the medium of trade, and mining rewards are by no means owned by Blockware; they’re despatched on to the person’s personal pockets.

Lastly, this provides miners the aforementioned alternative, however not the duty, to promote their machines at any time and at any value. This enables miners to make the most of the volatility in ASIC costs, recoup the prices of their machines, and accumulate extra BTC quicker than they’d with a standard ‘pure play’ strategy.

This innovation removes the obstacles which have made hosted mining tough prior to now, permitting miners to concentrate on the mission: amassing extra Bitcoin.

For institutional buyers on the lookout for bulk mining {hardware} costs, please contact the Blockware team directly.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now