Bitcoin

Maximizing Bitcoin Gains with ETF Data

Credit : bitcoinmagazine.com

Maximizing Bitcoin Income with ETF Information

For the reason that introduction of Bitcoin Alternate Traded Funds (ETFs) in early 2024, Bitcoin has reached new all-time highs, with a number of months of double-digit beneficial properties. As spectacular as this efficiency is, there’s a strategy to considerably outperform Bitcoin’s returns by utilizing ETF knowledge to information your buying and selling selections.

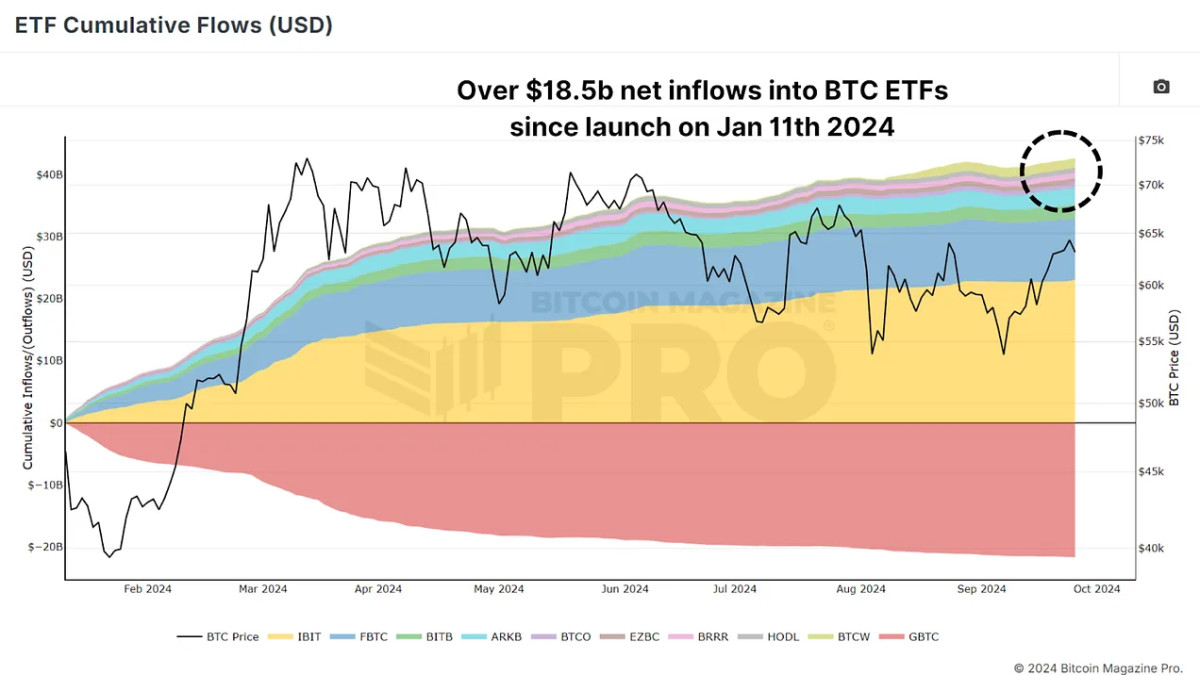

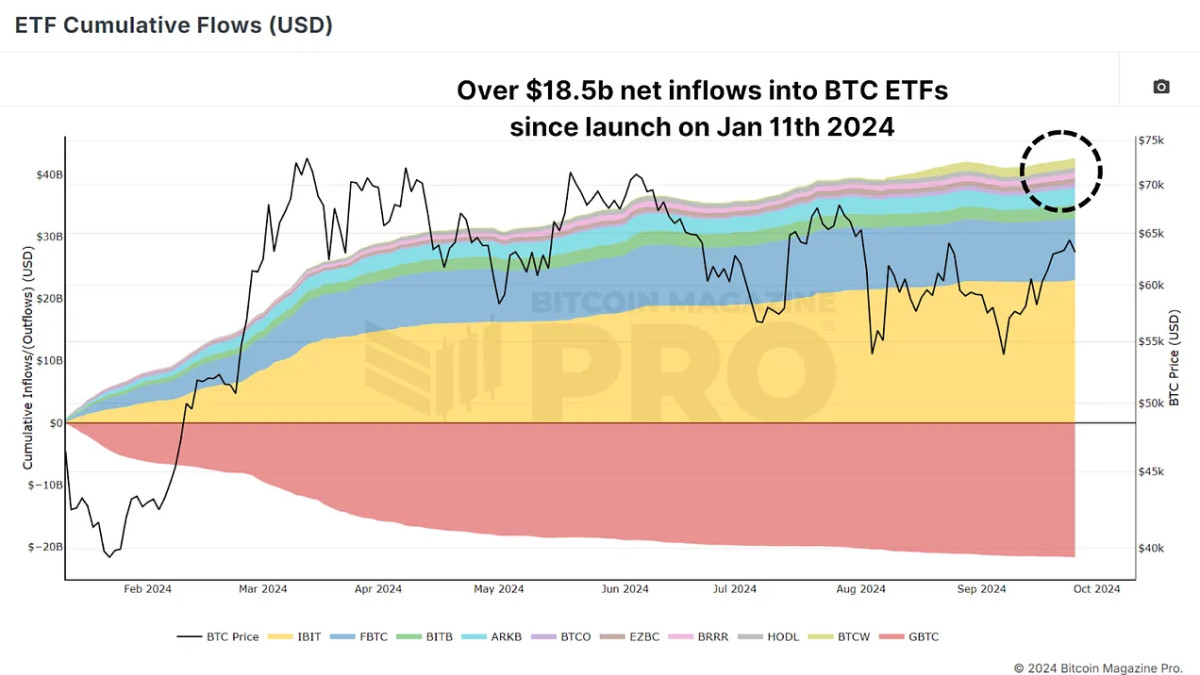

Bitcoin ETFs and their affect

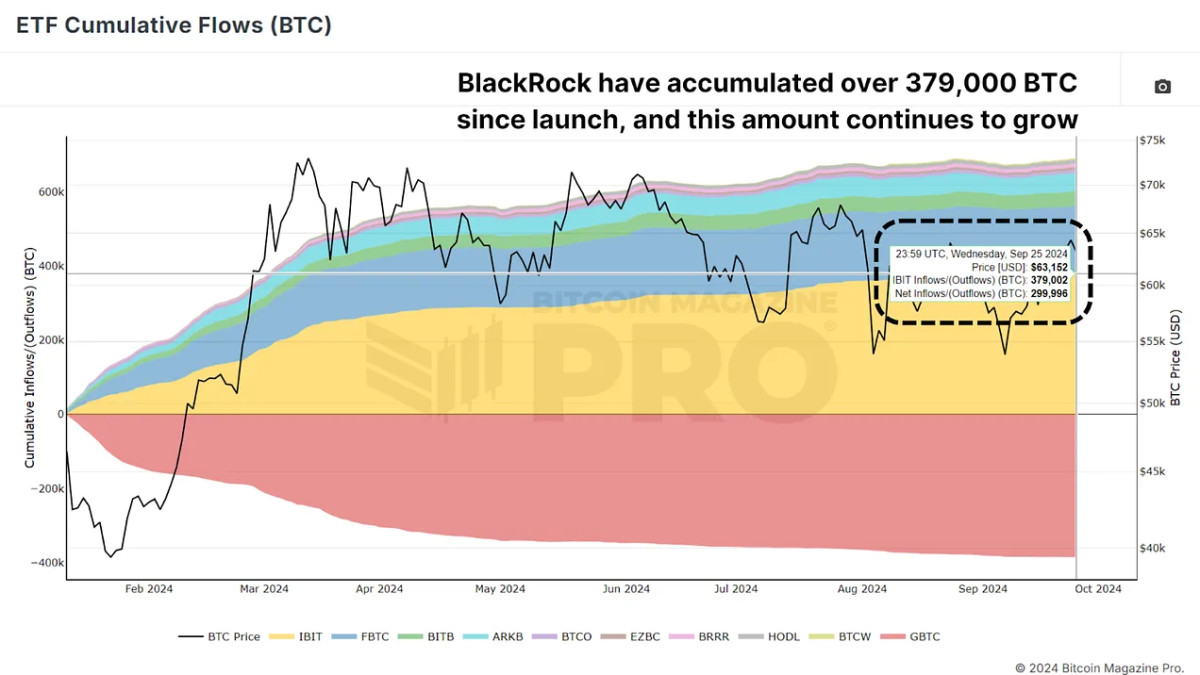

Launched in January 2024, Bitcoin ETFs have rapidly amassed massive quantities of Bitcoin. These ETFs, adopted by a number of funds, enable institutional and retail traders to realize publicity to Bitcoin with out proudly owning it instantly. This ETFs have accumulated billions of dollars in BTCand monitoring this cumulative circulation is crucial for monitoring institutional exercise within the Bitcoin markets, permitting us to estimate whether or not institutional gamers are shopping for or promoting.

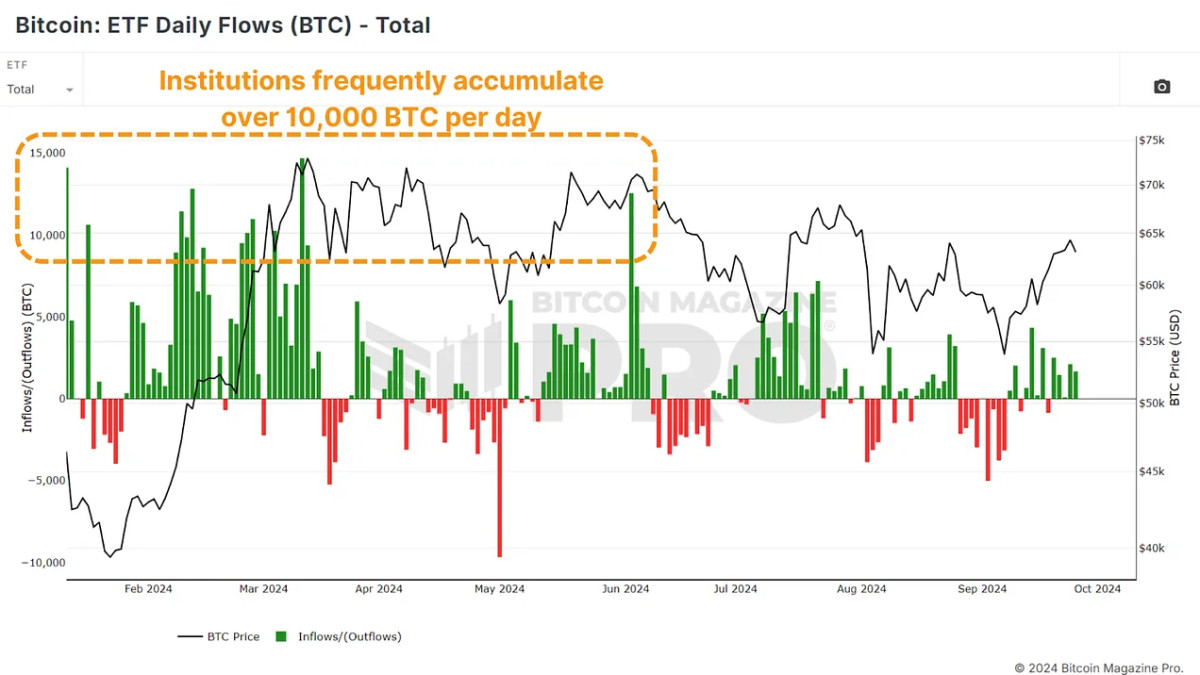

ETF daily inflow denominated in BTC point out that large-scale traders are accumulating Bitcoin, whereas the day by day outflows counsel that they’re exiting their positions throughout that buying and selling interval. For these seeking to surpass Bitcoin’s already sturdy efficiency in 2024, this ETF knowledge offers a strategic entry and exit level for Bitcoin trades.

A easy technique primarily based on ETF knowledge

The technique is comparatively easy: purchase Bitcoin when ETF inflows are optimistic (inexperienced bars) and promote when outflows happen (crimson bars). Surprisingly, this technique will help you outperform even throughout Bitcoin’s bullish durations.

This technique, whereas easy, has persistently outperformed the broader Bitcoin market by capturing worth momentum on the proper occasions and avoiding potential downturns by following institutional traits.

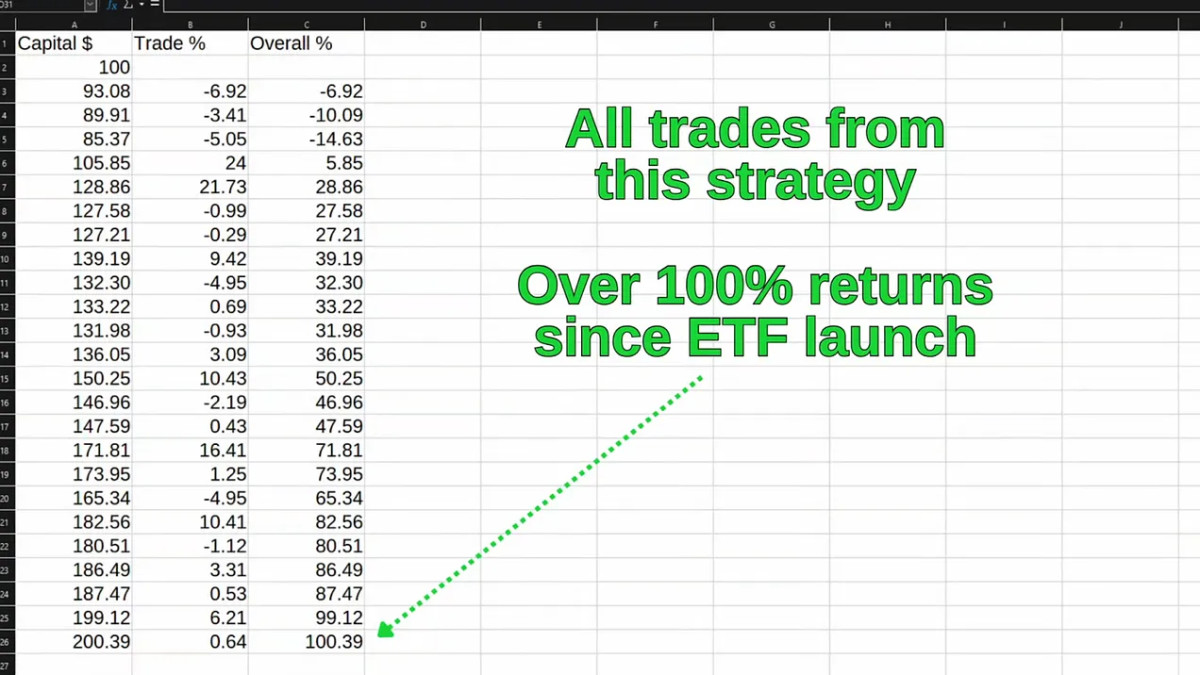

The ability of compounding

The actual secret of this technique lies in compounding. By compounding beneficial properties over time, you considerably improve your returns, even during times of consolidation or low volatility. Think about you begin with $100 in capital. In case your first commerce yields a ten% return, you now have $110. On the following commerce, one other 10% revenue on €110 brings your whole to €121. By combining these beneficial properties over time, even modest beneficial properties can accumulate into important beneficial properties. Losses are inevitable, however the compounding beneficial properties far outweigh the occasional dip.

For the reason that launch of the Bitcoin ETFs, this technique has delivered over 100% returns over a interval the place holding BTC has returned round 37%, and even in comparison with shopping for Bitcoin on the ETF’s launch day and promoting it on the precise highest level ever. , which might have yielded roughly 59%.

Can extra income be anticipated?

Lately we began seeing one continued trend of positive ETF inflowsindicating that establishments are once more closely accumulating Bitcoin. Since September 19, there was a optimistic influx daily, which, as we will see, typically preceded worth will increase. BlackRock and their IBIT ETF alone have amassed over 379,000 BTC since inception.

Conclusion

Market circumstances can change and there’ll inevitably be durations of volatility. Nonetheless, the constant historic correlation between ETF inflows and Bitcoin worth will increase makes this a beneficial device for these seeking to maximize their Bitcoin income. Should you’re in search of a low-effort, set-it-and-forget-it method, buy-and-hold should still be appropriate. Nonetheless, if you wish to attempt to actively improve your returns by utilizing institutional knowledge, monitoring Bitcoin ETF inflows and outflows is usually a game-changer.

For a extra in-depth have a look at this subject, watch a current YouTube video right here: Using ETF Data to Outperform Bitcoin [Must Watch]

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now